Netflix (NFLX.M) Q4 2025 financial report presents a highly fragmented narrative.

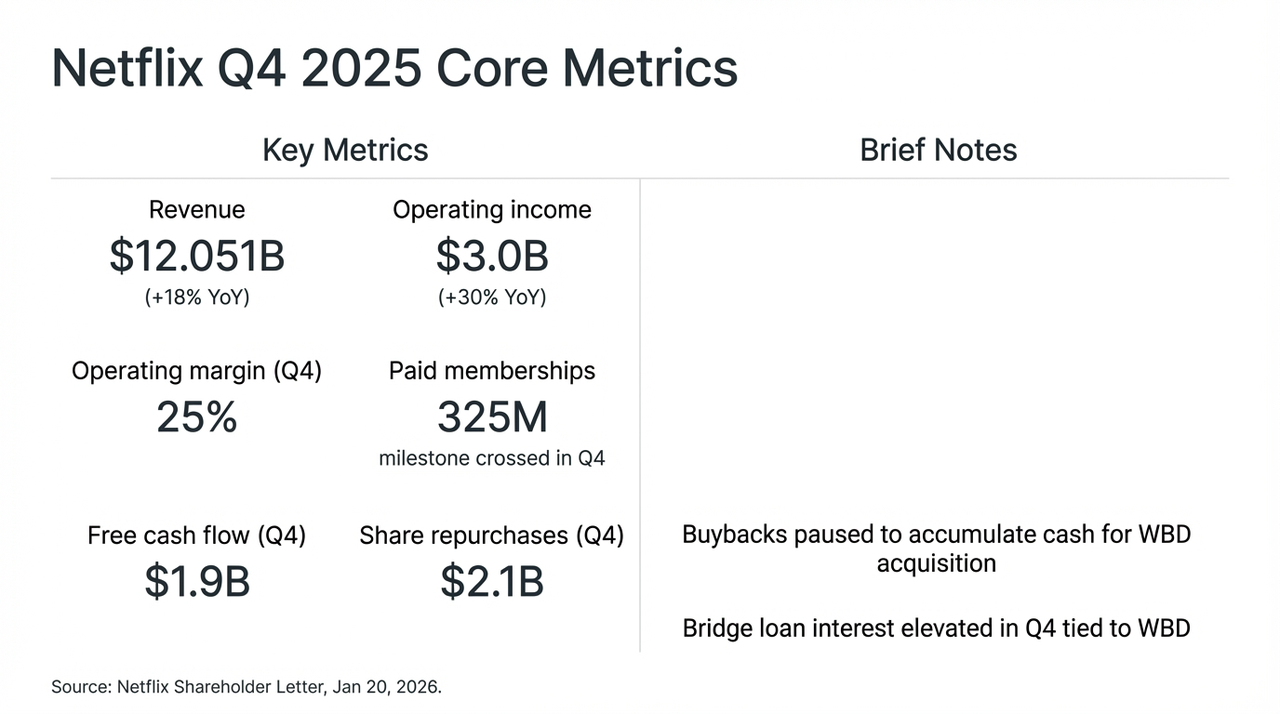

Undoubtedly, driven by the phenomenal series "Stranger Things" in its final season, Netflix delivered an almost impeccable report this quarter: revenue increased by 18% year-on-year to $12 billion, global paid memberships surpassed 325 million, and free cash flow (FCF) reached $1.9 billion.

However, the market did not respond positively. After the earnings report was released, investors quickly shifted their focus from the impressive growth data to a controversial decision—suspending stock buybacks to reserve liquidity for the acquisition of Warner Bros. Discovery (WBD).

This radical strategy adjustment of "exchanging growth for space" directly led to a sharp fluctuation in Netflix's stock price after hours. We also attempted to dissect this $72 billion acquisition plan (of which $59 billion is financed through bridge loans), analyzing this gamble aimed at "crowning the king of streaming" and the transformative identity it entails.

Netflix Q4 Core Financial Metrics and WBD Acquisition Impact

1. The Underlying Financial Report: Price Increases and Advertising as "Dual Engines"

To be fair, the Q4 financial report, viewed in isolation, is nearly "flawless," once again strongly demonstrating Netflix's unshakeable dominance in the global streaming market.

However, the capital market's restrained reaction is primarily due to the suspension of buybacks and the all-cash acquisition of WBD, prompting the market to reassess Netflix's growth trajectory and capital structure risks. In simple terms, in the prolonged tug-of-war between Silicon Valley and Hollywood, Netflix seems to have chosen the most aggressive path: sacrificing free cash flow to make a final push to "crown the king of streaming."

This is also the real shift beneath the surface of the financial report, as Netflix's core issue has long since shifted from whether growth exists to "how growth continues."

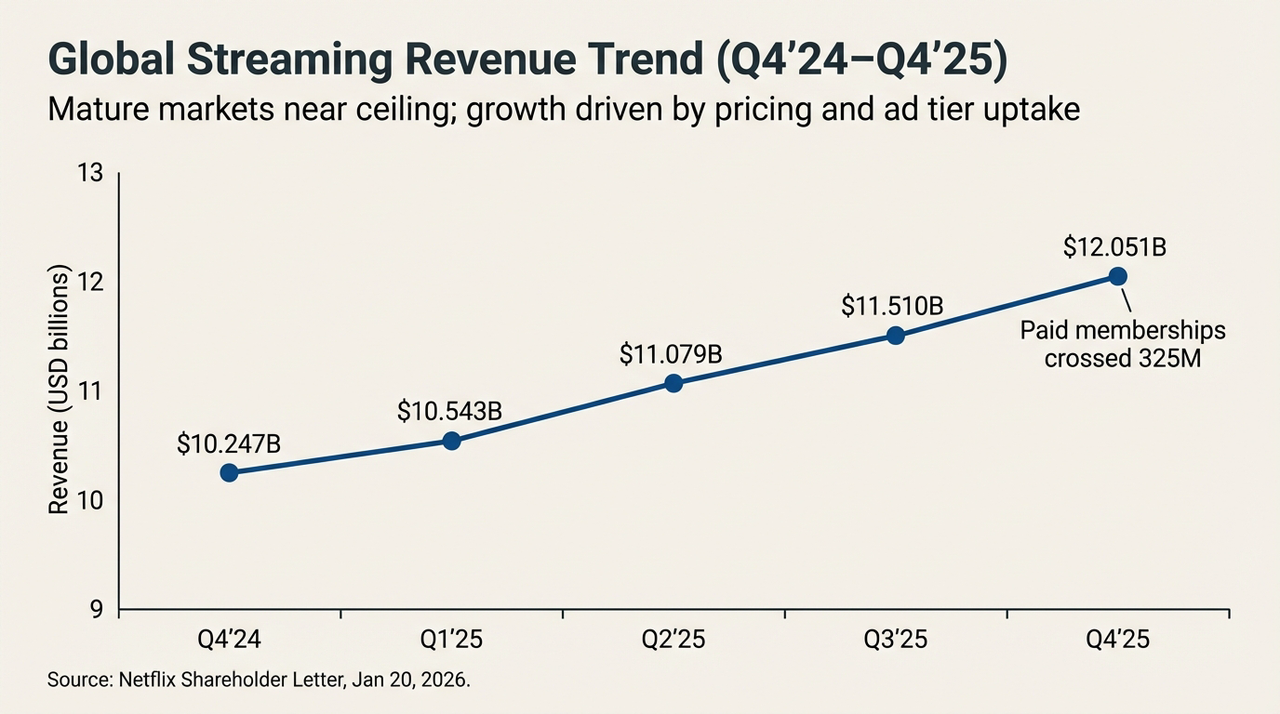

Reflecting on the various statements made by Netflix's management during the earnings call, this shift has become evident—stripping away the noise of the acquisition, Netflix's growth logic is actually at a critical juncture, transitioning from "user scale-driven" to "ARM (Average Revenue per User)-driven."

For instance, while its annual advertising revenue has surpassed $1.5 billion (growing over 2.5 times year-on-year), the user ceiling effect in mature markets has emerged, leading to actual business performance significantly below some institutions' previous aggressive expectations ($2-3 billion). More importantly, this growth primarily stems from price increases in North America and Western Europe, as well as the temporary tailwind from combating password sharing.

Management also admitted that the programmatic advertising system is still in the testing and ramp-up phase, and in the short term, the advertising layer primarily serves as a low-cost customer acquisition tool rather than a true profit engine.

Against this backdrop, Netflix's revenue growth guidance for 2026 is set at 12%-14%, significantly lower than the pace of previous years, which many analysts view as Netflix entering a "low-growth era" that relies more on refined operations rather than extensive expansion.

Global Streaming Revenue Trends (Q4'24-Q4'25)

From another perspective, as maintaining double-digit "growth myths" through refined ARM management becomes increasingly challenging, the marginal returns from achieving valuation breakthroughs through internal forces are diminishing. Since the internal engine can no longer support greater ambitions, seeking an "external driving force" that can reshape the competitive landscape is no longer optional but necessary.

This may be the deep catalyst behind Netflix's decision to gamble on WBD at this time.

2. Acquiring WBD: A Turning Point in the Growth Story

Despite strong fundamentals, what truly shifted market sentiment to caution was Netflix's acquisition arrangement with WBD, which is heavily laden with "heavy industrial characteristics."

"Could this be a poisoned candy?" This is likely the core suspense swirling in the minds of all investors regarding Netflix's acquisition of WBD.

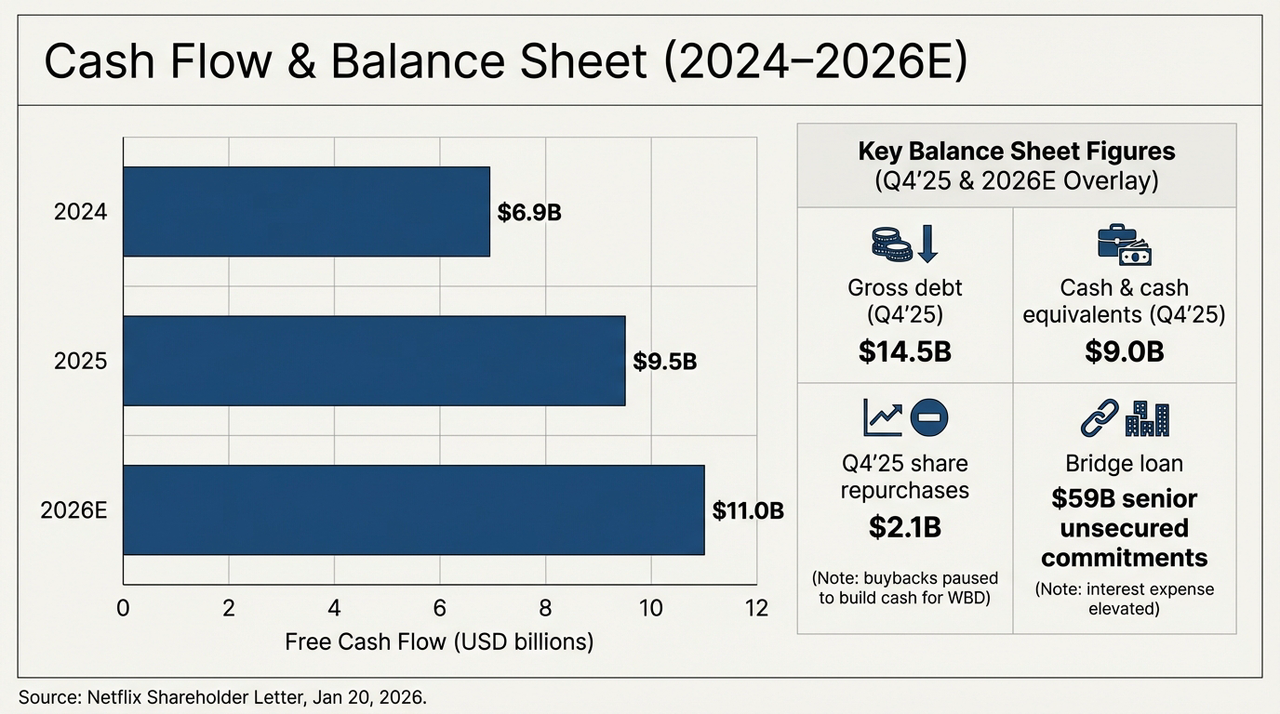

Objectively speaking, the WBD acquisition pulls Netflix from being a light-asset tech company back into the heavy-asset quagmire of traditional media. To complete this all-cash transaction at $27.75 per share, Netflix has taken on a staggering $59 billion in senior unsecured bridge loan commitments, and the direct consequence of this decision is a dramatic "stress test" reflected on the balance sheet.

The following chart clearly shows the evolution of the company's cash flow and debt structure over the next two years. By Q4 2025, Netflix's confirmed gross debt will be $14.5 billion, while cash and cash equivalents will only be $9 billion, meaning that before officially merging with WBD, the company's net debt will reach $5.5 billion. With the bridge loan in place, Netflix's debt scale will directly jump to over four times its original size.

Cash Flow and Balance Sheet Outlook (2024-2026E)

Meanwhile, Netflix's free cash flow is actually on a steady upward trajectory: approximately $6.9 billion in 2024, increasing to about $9.5 billion in 2025, and potentially reaching around $11 billion in 2026 (guidance). Looking at this curve alone, Netflix remains one of the few streaming platforms globally capable of continuously and significantly generating cash.

But the problem is, even if Netflix uses all of its projected $11 billion FCF for 2026 solely for debt repayment, it would take over five years to clear the bridge loan. More concerning is that the content amortization ratio currently stands at about 1.1x, but with the integration of HBO and Warner Bros.' vast film library, future amortization pressure will significantly increase.

This "cash flow sacrifice" essentially bets on the marginal ARM increments that top assets under WBD, such as HBO and the DC Universe, can generate to cover interest expenses and depreciation costs.

This also means that before WBD's assets are fully integrated and begin to enhance content supply and user retention, Netflix must endure a relatively long transition period of "cash flow prioritizing debt service." If the integration efficiency falls short of expectations, this massive loan could shift from being a "booster" driving growth to a "black hole" dragging down valuation.

3. IP Alchemy: Can Copyright Magic Overcome Debt Gravity?

So why is Netflix willing to bear the criticism and go all in?

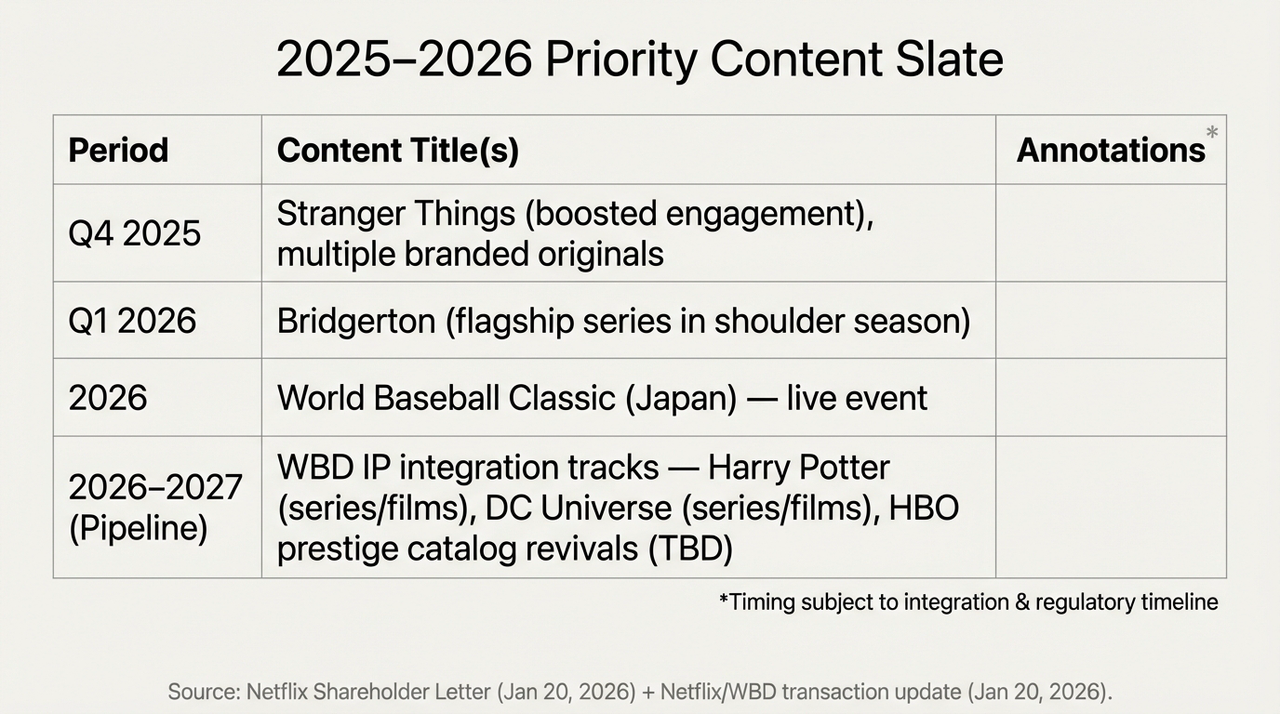

The answer lies in WBD's "dusty" assets. It is well-known that from the Burbank studios to the London production facilities, WBD possesses the "ammunition" that streaming dreams of, such as the magical world of Harry Potter, the superhero capes of the DC Universe, and HBO's irreplaceable premium library.

These are the "content moats" that Netflix has long been relatively weak in but is extremely eager for, so for Netflix, this is the final piece in building its "omni-streaming empire" and the trump card for its second-half gamble. Ultimately, the true significance of this acquisition lies not in short-term financial performance but in the long-term change in competitive structure:

- On one hand, WBD's IP can significantly enhance Netflix's ability to provide stable content supply, reducing reliance on single blockbusters;

- On the other hand, the global distribution network and mature recommendation system also provide unprecedented commercialization space for these IPs;

The issue, however, is that the realization of this path will clearly take longer than the pace currently favored by the capital market. After all, at around a 26x price-to-earnings ratio, Netflix is in a delicate position:

For optimists, the stock price fluctuations offer a "discount ticket," and once WBD's IP successfully integrates into Netflix's content system, a new growth flywheel may restart; for the cautious, the hundreds of billions in acquisition financing, the suspension of buybacks, and the downward revision of growth guidance all indicate that this company is entering a new phase where both risks and returns are amplified.

This is also the root of the market's divergence.

2025-2026 Key Content Schedule and WBD IP Integration Plan

In other words, this has turned into a repricing of Netflix's future positioning. The largest-scale "IP alchemy" in human history that Netflix is currently undertaking comes at a significant cost—before the completion of the FCF ramp-up in 2026, every dollar of revenue will be prioritized for interest repayment in the "abyss."

And the final answer, clearly, will take time to reveal.

In Conclusion

Ultimately, the stock price drop following the Q4 earnings report feels more like a fierce turnover of "faith in the king of streaming."

Regardless, Netflix is no longer just the app that helps you pass a boring weekend; it is becoming a financial behemoth burdened with weight.

Perhaps in 2026, when Harry Potter emerges from the fog of debt on Netflix's homepage, we will know whether this alchemy has succeeded or turned against its creator.

Disclaimer: The content of this article is a macro analysis and market commentary based on publicly available information and does not constitute any specific investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。