In the first article, we explained why the Digital Asset Market Clarity Act has become one of the most discussed pieces of cryptocurrency legislation in recent years. We detailed the core structure of the bill, the classification of digital assets, the importance of this classification for institutions, and the current legislative progress of the bill. In short, the Clarity Act aims to reduce regulatory uncertainty, has passed in the House of Representatives, and is currently at a critical stage in the Senate committee.

The second article shifts the perspective from policy design to probability. The question is no longer whether the Clarity Act is important, but whether it can ultimately become law—and whether the market is correctly pricing this outcome. Today, prediction markets are actively trading on this question, forcing participants to translate complex legislation into a binary outcome: yes or no.

From Policy Framework to Market Game

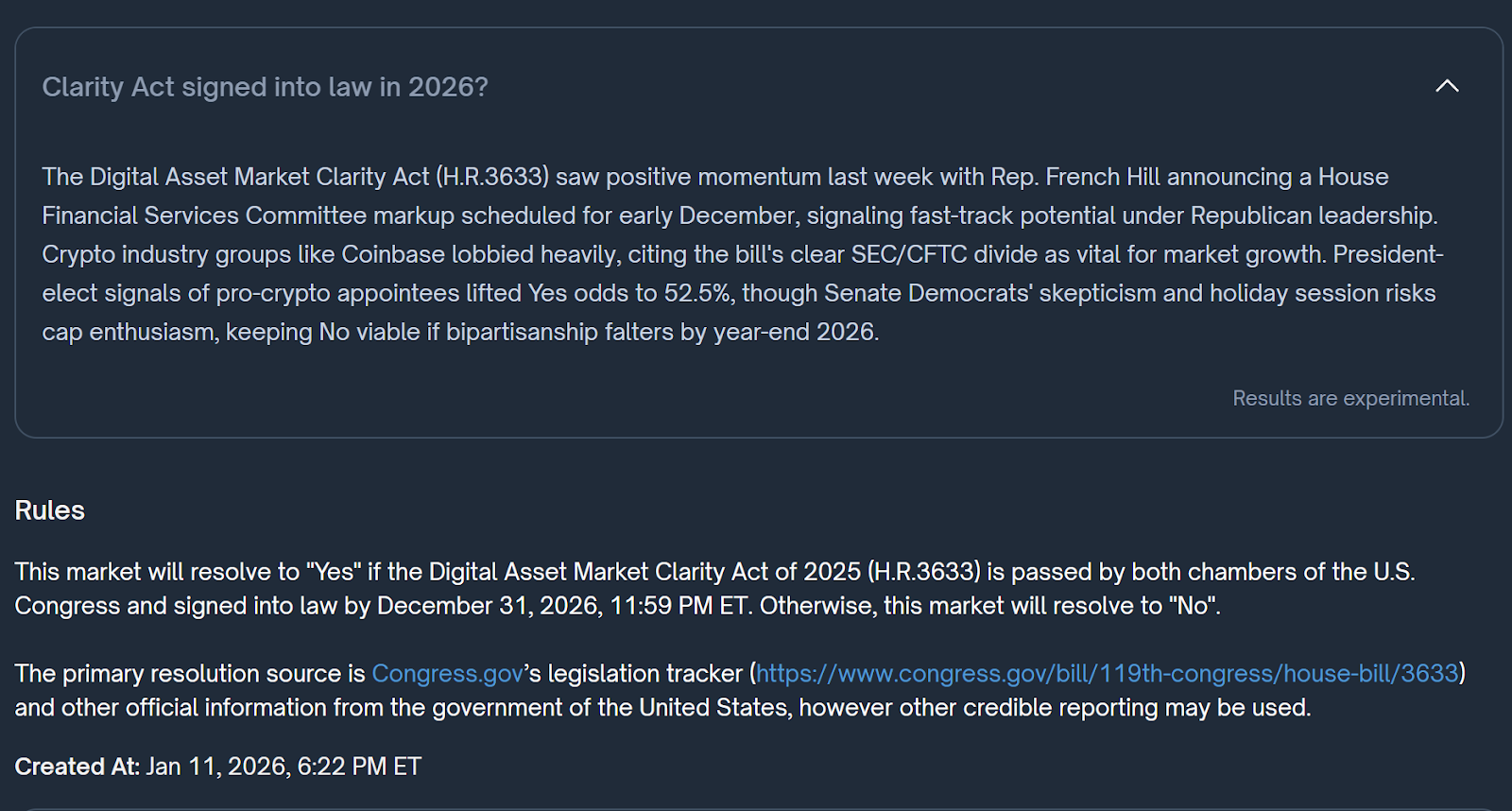

Prediction markets rely on specificity. In this case, the contract does not ask whether U.S. cryptocurrency regulation will improve, or whether lawmakers will be more supportive of digital assets. The question posed is much narrower and more stringent: Will the Digital Asset Market Clarity Act (specifically numbered H.R.3633) be passed by both houses of Congress and signed into law by December 31, 2026?

This framework is crucial. It means that merely achieving broad regulatory progress is not enough. Similar bills, amended proposals, or Senate-led alternatives, even if they ultimately take effect under different bill numbers, would still result in a "no" for this market. Participants are betting not on direction, but on procedural success.

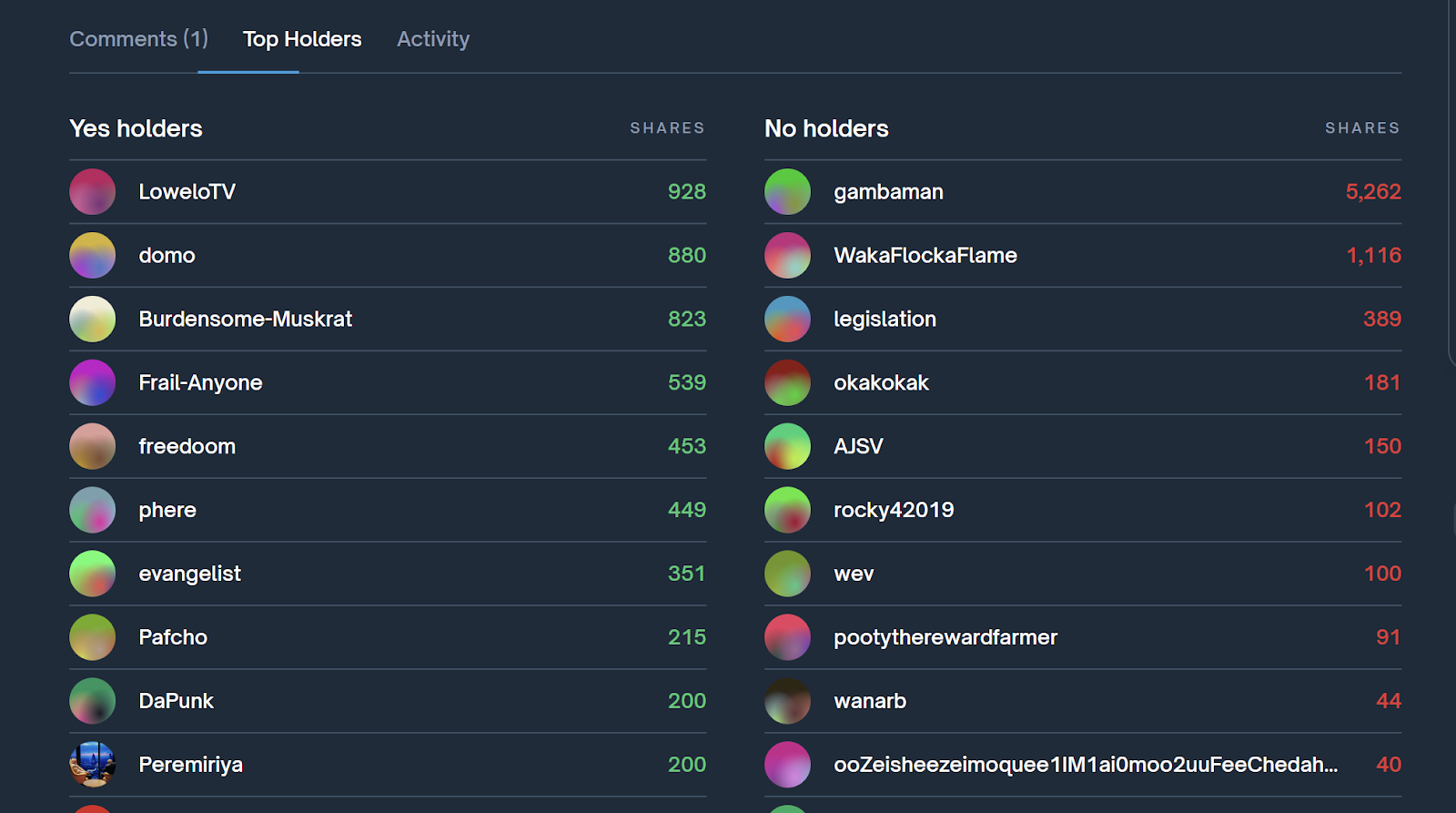

In this context, the current pricing—approximately 53 cents for a yes vote and 48 cents for a no vote—indicates that the market believes the likelihood of the bill passing is slightly higher than that of it being rejected, but far from certain. Such a small price difference reflects the degree of risk balance.

Reasons Supporting the Bill: Why Supporters Believe It Can Pass

Those leaning towards a yes vote typically articulate their views from three angles: political stance, industry pressure, and strategic timing.

First, Republican lawmakers have been the most steadfast supporters of legislation regarding the structure of the digital asset market. Their support is not purely ideological but aligns with their broader ideals of innovation, competitiveness, and limiting what they see as regulatory overreach. From this perspective, the Clarity Act aims to replace the uncertainty brought by enforcement with legal boundaries. Clear rules, even if strict, are preferable to unfettered discretion.

Second, industry lobbying efforts are unusually coordinated. Major exchanges, asset management firms, and infrastructure providers have long claimed that the primary reason institutional capital remains cautious is market uncertainty, not volatility. The Clarity Act directly addresses this pain point by clarifying whether assets fall under the jurisdiction of the U.S. Securities and Exchange Commission (SEC) or the U.S. Commodity Futures Trading Commission (CFTC). For many market participants, this alone is enough to make compromises elsewhere.

Third, supporters point to the strong momentum of the bill. Its passage in the House is significant. The House's approval indicates that a considerable number of lawmakers are willing to support a framework for the cryptocurrency market. From a legislative perspective, this means the Clarity Act has passed the stage where most bills quietly die. If Senate leadership can reach a consensus on amendments that retain the core of the bill while addressing key objections, supporters believe the bill is still likely to pass in 2026.

From this perspective, the current price supporting "yes" seems reasonable. It reflects an optimistic belief that once the cost of sustained uncertainty becomes too high, bipartisan pragmatism will ultimately prevail.

Reasons for Opposition: Why Skepticism Remains Strong

At the same time, many traders and lawmakers remain cautious, and there are equally compelling reasons for this.

First is procedural risk. The Clarity Act is currently stuck at the Senate committee level, where complex financial legislation often tends to stall. Delays in the committee are not merely a scheduling issue; they often indicate unresolved disagreements regarding scope, authority, or political influence. Each delay compresses the remaining time and increases the likelihood that the bill will be obstructed by unrelated matters.

The second point is the asymmetry of partisan positions. While Republicans largely position the bill as supportive of innovation, many Senate Democrats hold a different view. Their skepticism is not rooted in opposition to cryptocurrency but in concerns about risk. Issues such as investor protection, systemic stability, and anti-money laundering enforcement are critical. For legislators prioritizing these issues, any framework perceived to weaken the SEC's role or accelerate financialization without sufficient safeguards will raise their alarms.

The handling of stablecoins, DeFi regulation, and tokenized securities has become a focal point of concern. Even subtle differences in wording can alter the power dynamics between agencies, and the implications of these changes may extend far beyond the cryptocurrency realm. Therefore, hesitation is rational rather than obstructive.

The third risk is influenced by scheduling. Legislative time is not continuous. Congressional recesses, holidays, and election cycles can interrupt the legislative process. As 2026 approaches, attention will increasingly shift to year-end politics and midterm elections. In this context, controversial financial legislation will be harder to prioritize rather than easier. A bill that fails to pass committee review early on is likely to face the risk of indefinite postponement.

Finally, and most importantly for traders, the contract directly incorporates resolution risk. Even if Congress passes the cryptocurrency market structure bill in 2026, unless it is H.R.3633, the final outcome will still be a rejection. If Senate negotiators choose to advance a revised version under a different bill number or merge it into a broader legislative package, the policy outcome may be positive, but traders' bets will still lose.

This single condition is enough to significantly discount the probability of "yes."

How Politics and Timing Affect the Odds

The coming months are less about making headlines and more about sending signals. Rescheduling committee reviews, public bipartisan proposals, or explicit support from Senate leadership will significantly alter public expectations. Conversely, silence, repeated delays, or public disagreements among industry supporters will reinforce the opposition's voice.

Holiday recesses further complicate the issue. They shorten the legislative calendar and distract lawmakers. Even highly popular bills may lose momentum if they cannot keep pace with Congress's rhythm. By the time lawmakers reconvene, their focus may have shifted.

Elections add another layer of uncertainty. As political motivations change, legislative trade-offs will also shift. A goal that seems feasible in early 2026 may become fraught with risk by the end of the year, especially if cryptocurrency regulation devolves into a campaign issue rather than a technical policy discussion.

Interpreting Prices: I Currently Lean Towards Not Buying

At the current prices—53 cents for a yes vote and 48 cents for a no vote—I personally lean towards a no. But this does not mean I believe the Clarity Act is destined to fail. Rather, I think the probability of H.R.3633 completing all legislative procedures by the end of 2026 is lower than the market expects.

The opposition benefits from various interwoven failure modes: procedural delays, partisan gridlock, compressed schedules, and the possibility that another bill number may ultimately become law. Each risk may be manageable on its own, but together they raise questions about feasibility.

From a probabilistic perspective, I need stronger confirmation before I would be willing to pay a premium for "yes."

What Would Change My Mind to Choose "Yes"?

That said, this is not a fixed viewpoint. I would quickly reassess if certain conditions are met.

Most importantly, the Senate committee successfully reviews and passes H.R.3633. This event would eliminate the largest bottleneck and indicate that a compromise has been reached on the most contentious issues.

The second catalyst would be clear bipartisan cooperation, especially public support from influential Senate Democrats. This would reduce the risk of the bill getting caught in partisan negotiation gridlock.

Finally, a clear confirmation that H.R.3633 will continue as a legislative vehicle rather than being replaced by a new Senate bill would significantly reduce resolution risk.

If these signals emerge, the price for "yes" may rise, but its potential probability would also increase. At that point, the risk balance might be enough to prompt investors to switch positions.

Currently, prediction markets are playing their maximum role: forcing participants to confront the difference between the importance of policy and procedural success. The Clarity Act is likely to determine the future of U.S. cryptocurrency regulation. But whether it will ultimately take effect under this specific bill number and timeline remains the question the market is trying to answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。