Introduction

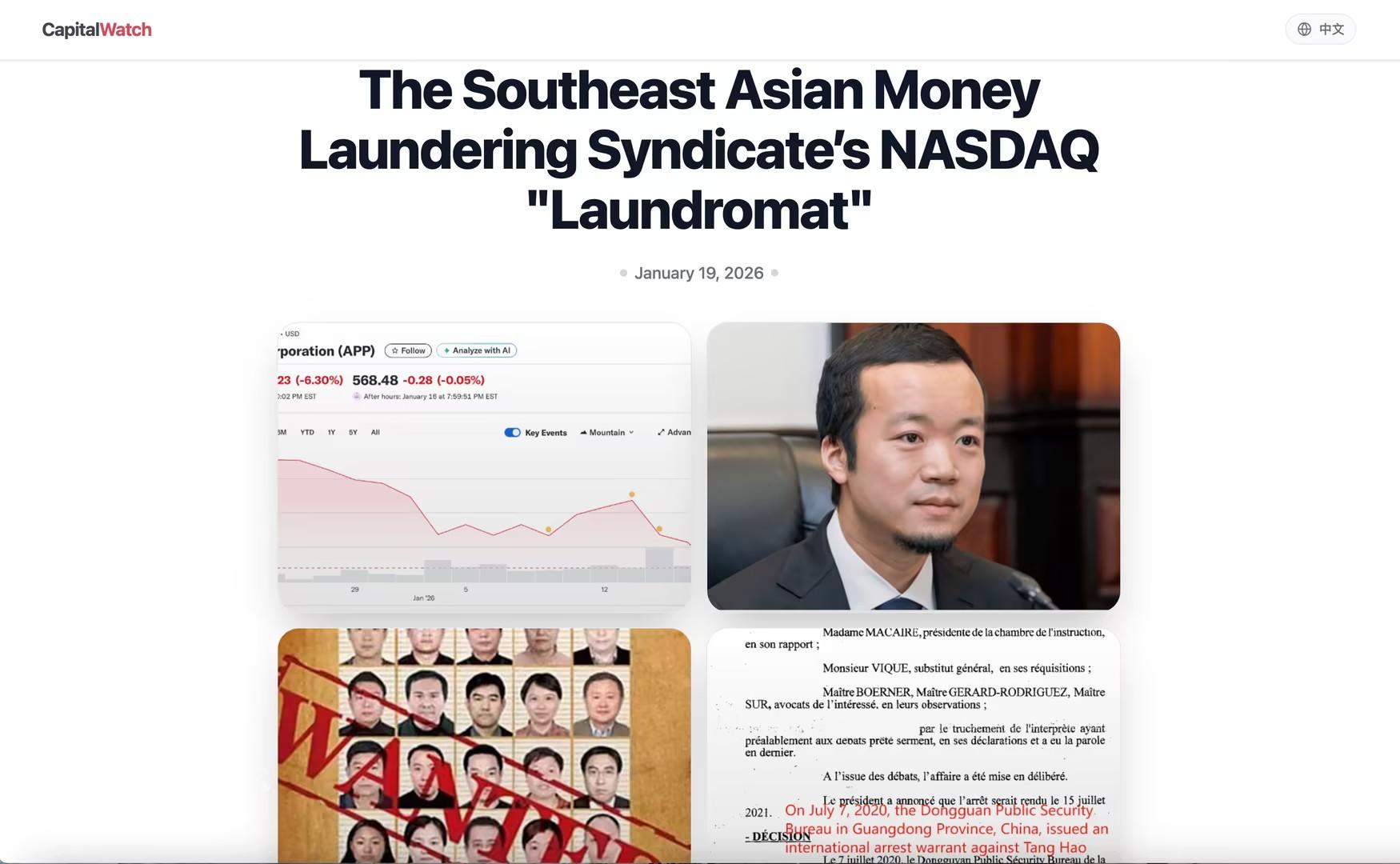

A recent short-selling report targeting the US-listed company AppLovin (APP) has thrust this mobile advertising and monetization platform into the spotlight. Unlike typical short-sell reports that focus on valuation or growth expectations, this report directly points to funding pathways and compliance risks.

Before understanding this report, it is necessary to introduce who Capitalwatch is. Capitalwatch is a short-selling institution focused on in-depth investigations and systematic problem digging, having previously released several lengthy studies revealing potential fundamental issues in corporate operations. It has pointed out systemic financial fraud or incomplete information disclosure in multiple international financial market cases, effectively forcing the market to re-evaluate the risks associated with relevant targets.

The existence of short-selling institutions is essentially that of risk revealers in market logic, historically prompting regulatory investigations or triggering stock price re-evaluations through detailed reports. Capitalwatch is an active player among such institutions.

Figure 1: Short-selling report released on Capitalwatch's official website

1. The Target of the Short Sell: What Kind of Company is AppLovin?

AppLovin is not a traditional advertising company. Its main business includes:

Providing advertising display and user monetization tools for mobile games and entertainment applications

Operating a real-time bidding advertising system

Helping developers increase the revenue generated each time a user opens the app

It serves as the infrastructure for the flow of traffic and funds behind the app economy, emphasizing performance advertising, user acquisition efficiency, and high-frequency traffic distribution, unlike ordinary brand advertisers. This platform-based, technology-driven, and highly abstracted cash flow business model makes it inherently suitable for hiding the true sources and uses of funds. One of the focuses of the short-selling report revolves around these mechanisms.

Figure 2: The short-sold company AppLovin

2. CapitalWatch's Core Accusation: This is Not Advertising, It's Money Laundering

In the short-selling report, CapitalWatch provided an extremely complete and logically closed accusation pathway:

1. Source of Funds: Telecom Fraud, Gambling, and Funds from the Collapse of Chinese P2P Platforms

Hao Tang, the main shareholder of AppLovin, and his associated network are accused of injecting huge amounts of illegal funds into the company, primarily sourced from two channels:

First, funds transferred from victims after the collapse of the Chinese P2P platform Tuandai.com, involving approximately $36 billion;

Figure 3: Tuandai.com founder Tang Jun, who has been imprisoned since 2019

Second, dirty money generated from telecom fraud groups, illegal gambling, and "pig-butchering" cryptocurrency scams in Southeast Asia (especially Cambodia).

The report emphasizes that AppLovin is not an isolated target but rather "a link" in a larger-scale cross-border money laundering chain—these "dirty money" funds are gradually injected and "cleaned" into multiple US-listed companies after being split by underground banks, forming systemic capital pollution. Currently, these accusations remain unverified, and the company has not officially responded; investors should pay attention to the subsequent actions of regulatory agencies (such as the SEC and CFIUS).

Figure 4: Recently extradited Chen Zhi from the Prince Group

2. Money Laundering Pathway: Advertising Spending Becomes a "Legal Shell"

According to CapitalWatch's report, transnational criminal organizations like the Prince Group open accounts on AppLovin's advertising platform through shell companies they control, ostensibly purchasing advertising services to promote gambling apps, but in reality, they are converting illegal proceeds into "advertising expenses." Subsequently, AppLovin recognizes these funds as legitimate advertising revenue, recording them in the company's financial statements, thus achieving "cleaning" of the funds. Finally, AppLovin settles part of the funds "cleanly" back to overseas accounts controlled by the Prince Group in the form of developer revenue sharing or advertising publishing fees, forming a complete "advertising equals money laundering" closed loop.

CapitalWatch characterizes this very directly: AppLovin is described as the final laundering exit for transnational criminal organizations, and its advertising technology platform has essentially become the "Nasdaq laundromat" for Southeast Asian money laundering groups to inject into the US capital market, allegedly assisting in legalizing huge amounts of dirty money from illegal fundraising in China and "pig-butchering" scams in Southeast Asia.

Figure 5: The money laundering process of pig-butchering funds

Figure 5: The money laundering process of pig-butchering funds

3. More Shocking Details: Pre-installed Software + Forced Installation of Gambling Apps

One of the most shocking and horrifying details is that AppLovin is accused of obtaining system-level permissions on user devices through commercial cooperation with mobile manufacturers and telecom operators, utilizing pre-installed software mechanisms. This allows AppLovin's Array platform and AXON algorithm to achieve a so-called "silent installation" function: users only need to click an advertisement once, without further confirmation, and the system can automatically download and complete the installation of gambling apps in the background, often occurring without the user's knowledge or under misleading circumstances.

3. Market Reaction: What Happened After the Release of the Short-Selling Report?

After the release of the short-selling report, AppLovin's stock price experienced a significant decline:

In pre-market trading following the report's release, APP's stock price fell by about 5%, with a market value evaporating by nearly $10 billion, and a cumulative decline of over 14% in five days.

These fluctuations reflect the market's sensitivity to potential compliance risks, regulatory investigations, and possible legal consequences.

Figure 6: Recent stock price trend of AppLovin

Conclusion

If some of CapitalWatch's accusations are ultimately confirmed, the impact of this matter will far exceed that of a single advertising company:

Advertising technology platforms may be becoming the "ideal interface" for transnational dirty money

Connections between cryptocurrency scams, telecom fraud, illegal gambling, and traditional capital markets are closer than imagined

The "compliance facade" of US-listed companies does not inherently equate to clean funds

AppLovin may just be the first company to be named.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group Chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。