Written by: Nancy, PANews

Historically, in the financial competition for customers, "giving users a share of the profits" has always been the simplest and most effective weapon.

More than a decade ago, products like Yu'ebao opened up ordinary people's understanding of financial products with visible and calculable returns, launching a direct impact on traditional finance.

A similar game is being replayed across the ocean. Recently, Wall Street elites and native crypto giants have been fiercely debating a market structure bill concerning stablecoin yields. One side attempts to maintain the high walls of traditional finance through regulation, while the other side tries to seize the market with real money.

Looking back domestically, the digital yuan is undergoing a critical upgrade. As is well known, over the years of pilot programs, red envelope incentives, scenario promotions, and policy pushes have been deployed, but the digital yuan has struggled to reach the average person.

With the launch of digital yuan 2.0 this year, it has begun to generate interest, providing users with an intuitive real-world need: earning interest on holdings. At the same time, the digital yuan has transitioned from M0 to M1, planning a longer-term path with smart contracts, becoming the underlying digital payment infrastructure.

Entering the Era of Earning Interest, Upgrading to "Yield-bearing Stablecoin"

If we only look at the scale, the promotion of the digital yuan is not slow.

After ten years of research, exploration, and pilot promotion, the digital yuan has formed a certain scale. By the end of November 2025, it had processed a total of 3.48 billion transactions, with a transaction amount of 16.7 trillion yuan; it had opened 230 million personal wallets and 18.84 million corporate wallets, with pilot programs covering 17 provinces (regions, municipalities) and 26 areas.

From building infrastructure, validating technology, to landing payment scenarios, the digital yuan has completed the phased goal of being usable. This progress is attributed to the continuous improvement of underlying technology and strong policy support, continuously creating opportunities for the use of the digital yuan through red envelope subsidies, cashback, and other means.

But in daily life, is the digital yuan really common? The answer is not optimistic.

When placed in a larger payment system, the contrast is particularly stark. In the third quarter of 2025 alone, the amount of online payment business processed by non-bank payment institutions in China reached 85.28 trillion yuan, with 33.8019 billion transactions. Not to mention, commercial payment networks formed by Alipay and WeChat Pay have long been deeply integrated into high-frequency scenarios such as clothing, food, housing, and transportation, far surpassing the current capabilities of the digital yuan in terms of transaction scale, user stickiness, and capital retention.

For most ordinary users and businesses, the digital yuan is merely a rebranded version of the renminbi, essentially still funds lying in accounts without earning interest, showing no difference from the balances in WeChat or Alipay wallets, leading users to lack the motivation to change their long-standing habits.

This situation finally reached a turning point on January 1, 2026, when the digital yuan officially upgraded to a "yield-bearing stablecoin."

According to the latest policy, users can download the digital yuan app from the official app store and earn interest on funds in type I, II, and III real-name wallets at the rate of demand deposits. The current annual interest rate is 0.05%, with interest payment dates on March 20, June 20, September 20, and December 20 each year; it is important to note that anonymous wallets (type IV wallets) verified only by phone number do not earn interest.

This means that users now have a channel for their short-term idle funds to appreciate, with automatic interest calculation and zero operational costs. Although this interest rate is not high, it provides users with a reason to retain funds and gives the digital yuan a competitive advantage compared to traditional financial products.

In the crypto world, earning yields on stablecoins is not new, typically achieved through DeFi, staking, or shadow rates. However, these mechanisms also come with challenges such as smart contract vulnerabilities, de-pegging risks, and regulatory uncertainties.

In contrast, the yield from the digital yuan is established within a safe and controllable framework under central bank regulation, ensuring the stability and security of funds. The digital yuan is included in the deposit insurance category, enjoying the same safety guarantees as ordinary deposits, with a maximum compensation limit of 500,000 yuan. This safety structure backed by national credit is fundamentally different from the reliance on code and consensus mechanisms in the crypto world.

With the further upgrade of the digital yuan, China has become the first economy in the world to offer interest on central bank digital currency.

Saying Goodbye to 100% Reserve Requirement, Banks Finally Have Motivation

In addition to the lack of enthusiasm from users, the participation and motivation of banks have also been a significant challenge in promoting the digital yuan.

Initially, the digital yuan was positioned as M0 (digital cash). This design limited its application scenarios and could not provide users with returns. More importantly, it adopted a 100% reserve requirement system. This means that commercial banks cannot utilize the digital yuan deposited by users for fund operations or lending; every digital yuan received by banks must be fully remitted to the central bank and frozen in the central bank's account.

As a result, banks not only cannot generate income from these funds but also bear substantial operational costs related to wallet opening, scenario expansion, anti-money laundering, and customer service. Therefore, banks lack sufficient motivation to actively promote the digital yuan.

"The traditional account system has little room for innovation. With the digital yuan positioned as M1, it is becoming a financial infrastructure, giving market institutions more space for exploration," a banking insider revealed to Caixin.

As the digital yuan gradually transitions to the M1 form, the situation has changed.

In the new M1 model, the digital yuan balance in customers' real-name wallets at banks becomes a liability for commercial banks. Banks only need to deposit a portion of the funds with the central bank according to the statutory reserve requirement, while the remaining funds can be used to develop value-added services independently, such as launching exclusive wealth management products for the digital yuan.

This institutional adjustment provides banks with more profit space, incentivizing them to actively participate in the construction of the digital yuan ecosystem, and allowing banks to gradually transform from cost centers to profit centers, thereby enhancing their motivation to promote the digital yuan.

Currently, banks such as Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, China Postal Savings Bank, and China Merchants Bank all offer digital wallet services.

It is important to note that non-bank payment institutions (such as Alipay and WeChat Pay) still need to maintain a 100% reserve requirement and cannot enjoy the more flexible fund operation space that banks have.

Removing the Payment Label, Smart Contracts Become New Financial Infrastructure

The digital yuan is gradually shedding the label of "payment alternative" and transforming into a more sticky digital financial infrastructure.

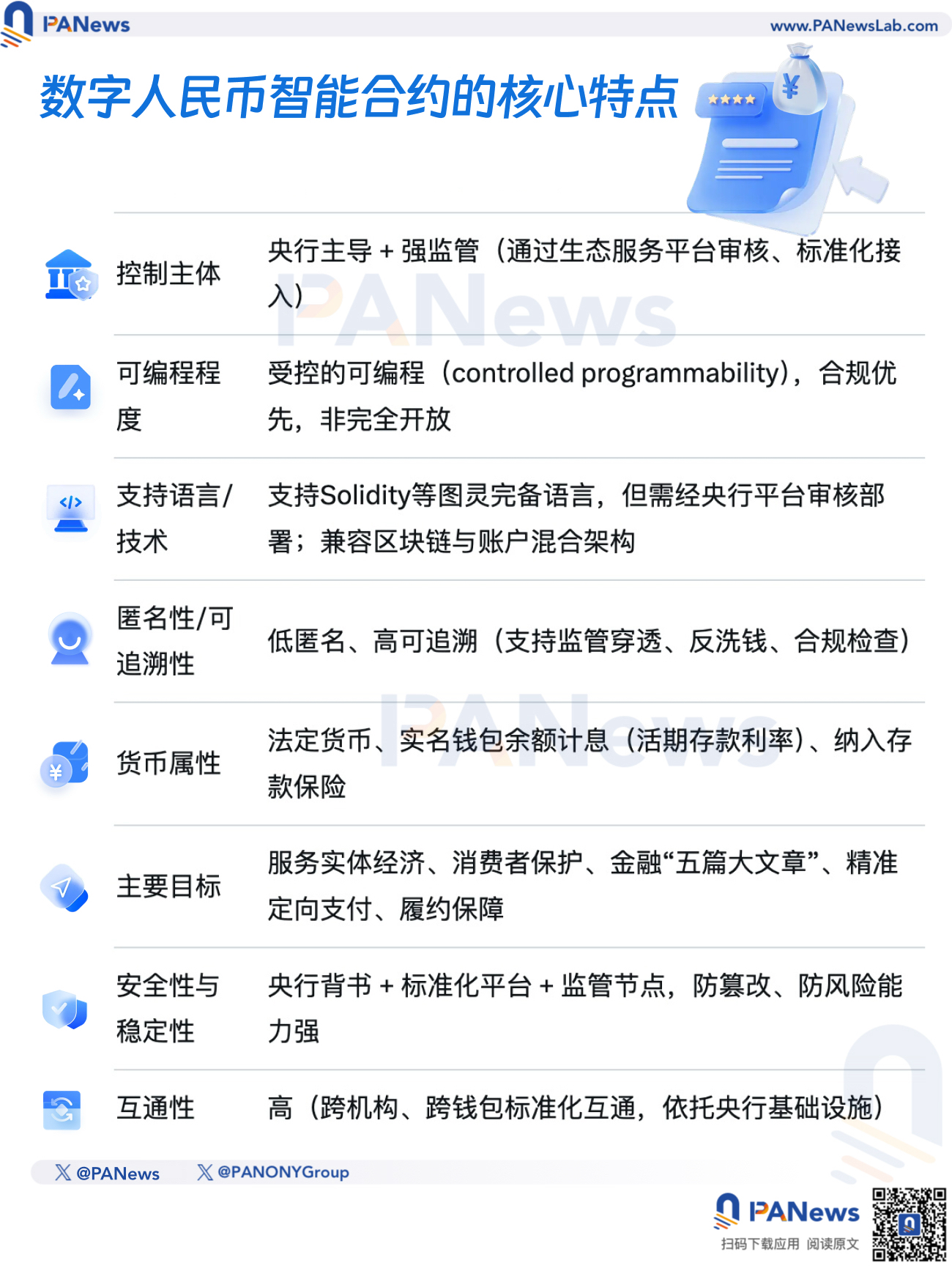

Unlike WeChat and Alipay, which essentially serve as payment tools for storing traditional currency, the digital yuan itself is a form of currency, functioning like electronic cash during transactions. Additionally, the digital yuan is not built on blockchain technology but is based on a newly designed account system. However, the programmability based on smart contracts is its core competitive advantage, allowing it to be embedded in more complex performance and regulatory scenarios.

For example, in the prepaid field, the digital yuan can implement a "partial unfreezing, per transaction payment" fund management model; in family and campus scenarios, parents can limit their children's accounts to specific spending ranges; in the area of government subsidies, the use of funds can also be precisely controlled.

In terms of this technological implementation, according to disclosures from Caixin, the digital yuan employs a restricted Turing-complete design, only supporting templated scripts permitted by the central bank. While this design limits certain functionalities, it effectively ensures the system's security and controllability. Compared to the fully Turing-complete smart contracts in the crypto world, this design of the digital yuan avoids common risks such as smart contract vulnerabilities, attacks, and governance failures. Notably, the development of smart contracts for the digital yuan supports multiple programming languages, including fully Turing-complete languages like Solidity that are compatible with Ethereum, thus not limiting development potential.

Moreover, the digital yuan has also demonstrated payment resilience. Its dual offline payment feature allows both parties to complete transactions via mobile NFC in a no-network environment. This capability is irreplaceable in emergency scenarios and special environments, while in the crypto system, whether for Bitcoin or stablecoin payments, continuous connectivity is almost always required for ledger synchronization and final settlement.

To bridge the "digital divide" and adapt to the usage habits of different groups such as the elderly, students, and foreign visitors to China, the digital yuan has also launched various forms of hard wallets, including IC cards, wearable devices (such as watches), SIM cards, and mobile terminals. This is in stark contrast to the defensive positioning of crypto hard wallets, which are primarily used for "cold storage" of private keys to prevent hacking attacks; digital yuan hard wallets focus more on the inclusivity of high-frequency payments. However, at this stage, due to the cost of merchant acceptance terminals and the willingness to upgrade, the actual usage range of digital yuan hard wallets remains limited, and its actual popularization effect still needs further observation.

Currently, the digital yuan is accelerating its evolution towards a full-scenario currency, with applications breaking through the retail category, forming replicable promotion models covering wholesale payments, public services, social governance, and even cross-border settlements, and is expected to become an indispensable infrastructure in the digital economy.

Especially in cross-border payments, its upgraded important direction supports three-level transfers between countries, merchants, and individuals. With the rapid penetration of stablecoins in the global cross-border payment field, the digital yuan is accelerating its "going global," becoming an important driving force for the internationalization of the renminbi. Through cross-border payments, the digital yuan can not only improve payment efficiency and reduce costs but also occupy a place in the global payment system. For instance, foreign tourists can make purchases in China without exchanging foreign currency, simply using the digital yuan app to scan a code for payment at real-time exchange rates. Currently, cross-border transfers conducted through mBridge have exceeded 55 billion USD, with 95% settled in digital yuan.

In summary, for the digital yuan to truly complete the leap from a policy tool to a mass product, the real test may just be beginning. However, its path and potential are clearer than ever before.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。