The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

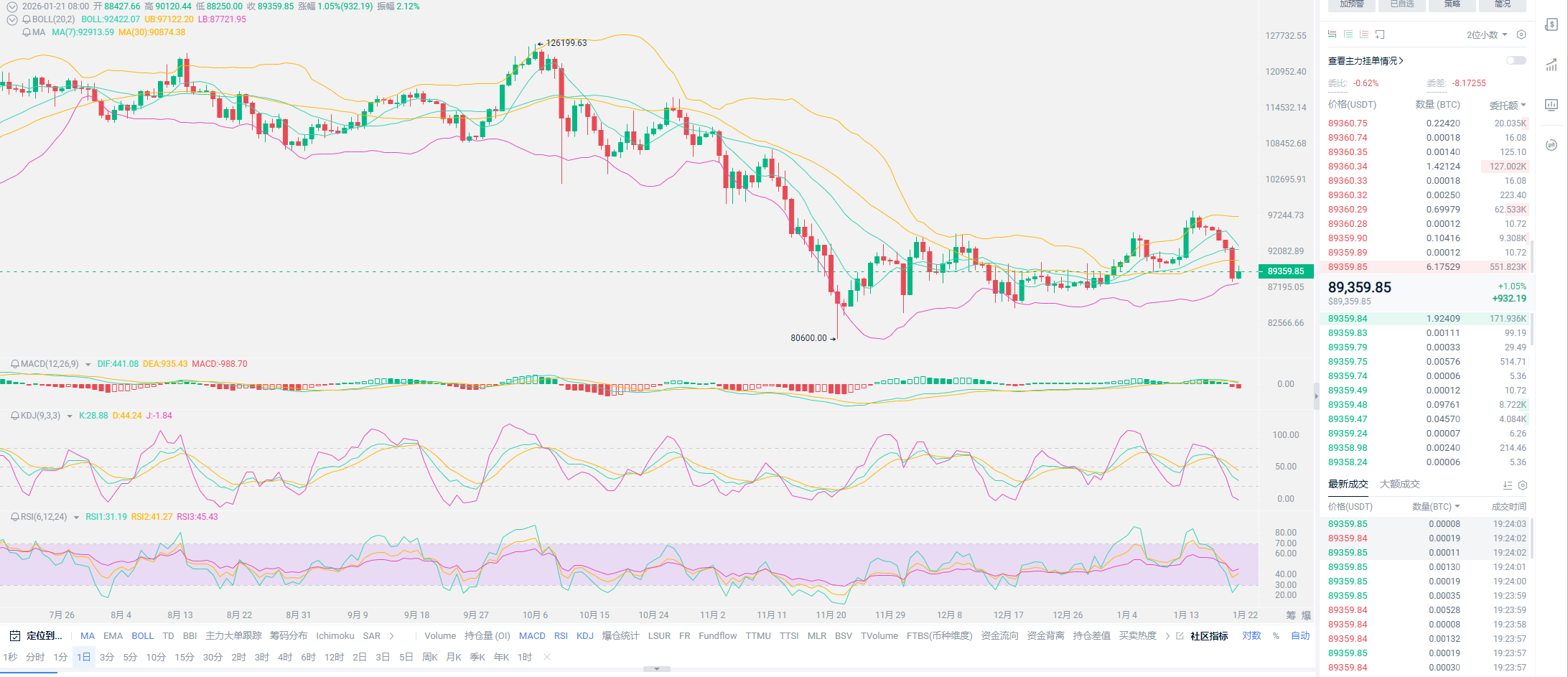

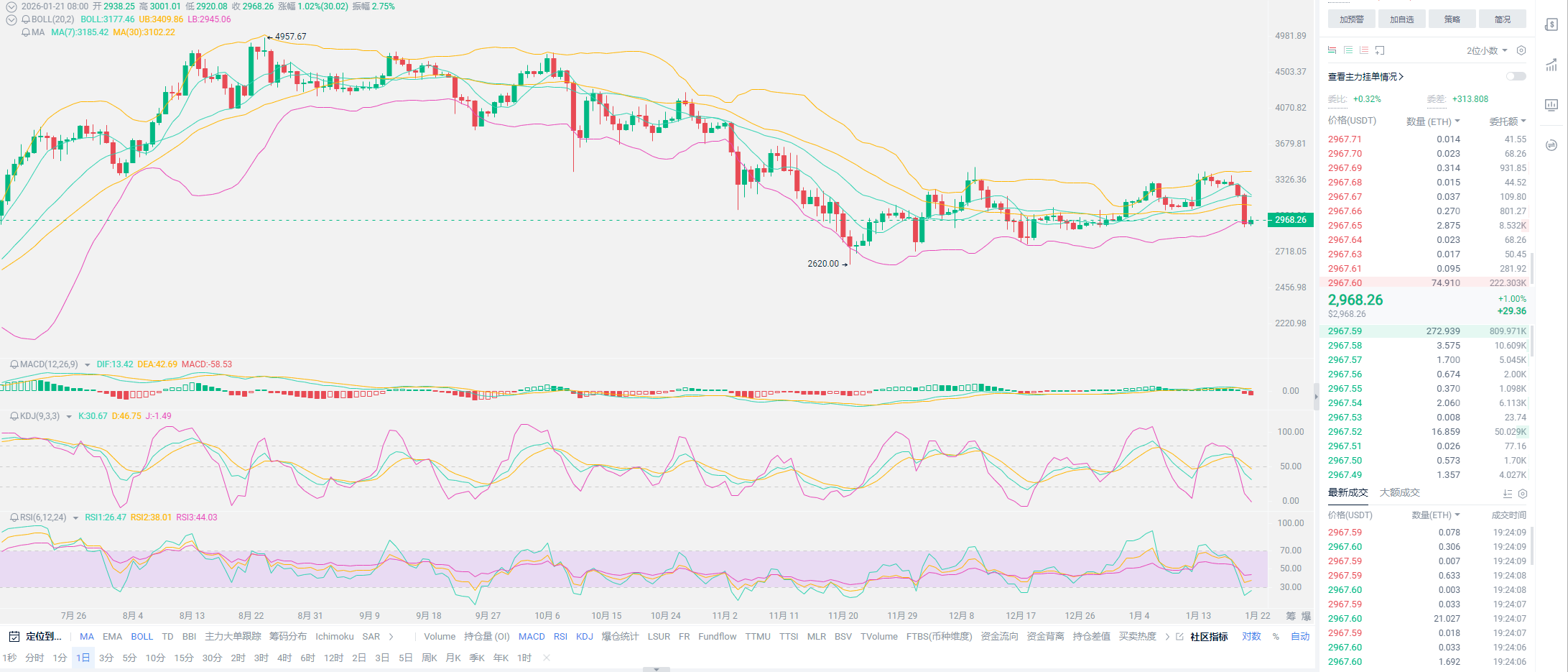

With a wave of decline, it has almost shattered several of Lao Cui's friends. Although I gave everyone a warning before the drop, whether in articles or in private circles, I had mentioned the downward trend at the end of January. This time, however, the drop has led many friends to start questioning whether the future still exists. Standing in the downward space, looking at the rebound of the bull market, it is indeed somewhat difficult. My personal feeling is that the cryptocurrency circle seems to be somewhat pathological, and this pathology is something we all contributed to. Everyone can think about the previous logic; did the bubble caused by Trump's rise to power really become clear at this stage? Or has the 126,000 high already become an insurmountable mountain for Bitcoin? No matter how you put it, defining the current stage is somewhat forced. Moreover, I mainly hold SOL in spot trading; even if Bitcoin breaks through, SOL may not necessarily continue to rise. Of course, you need not worry; I am not saying that SOL's value is gone.

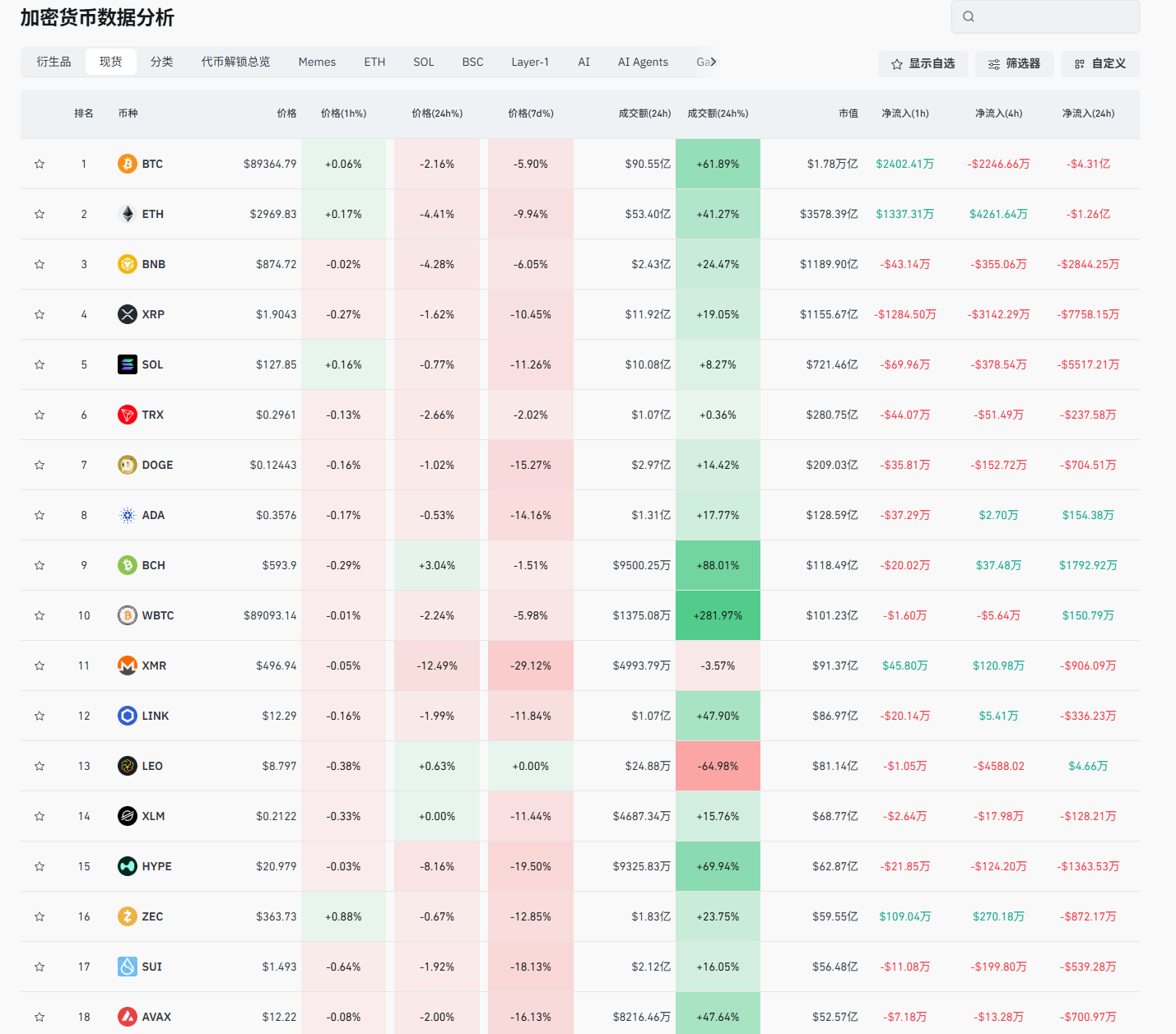

From the trend after the 126,000 high, I won't say that careful users can't observe it themselves; the sell-off seems easy, while the rebound is quite difficult. You all are very clear that after the high, there have been favorable news; since the second half of last year, there have been two consecutive interest rate cuts, which have not reversed the downward trend for Bitcoin. Why are capital investors unwilling to re-enter the cryptocurrency circle? Since 2026, cryptocurrency giants have frequently spoken out, and even Trump has continuously supported the cryptocurrency circle. CZ, Musk, and our star comrade's updated OKX link in 2025 have all been strong pushes for the cryptocurrency circle. This is not just a slogan; the latest data shows that Trump's own asset allocation is 20% in cryptocurrencies, and X's entry into the cryptocurrency market is real money starting to fight. Earlier, there was also the DOGE upgrade; why have these capitals started to shy away from the cryptocurrency circle? If this series of news had been released before 2021, it would have at least triggered a wave of bull market.

Not to mention, there are other small coins being listed, which are almost without any waves. This series of problems has kept Lao Cui awake for a long time. After all, Lao Cui is also fighting with real money, not just talking. You have all heard about the losses in spot trading; to put it bluntly, if there hadn't been a recovery from contracts last year, I might have already exited the cryptocurrency circle, with returns not even matching the gold market, which is indeed distressing. Many measures implemented have not met our expectations, but that does not mean that the trend will change. During the loss period, it indeed requires a strong heart to look to the future. Everyone needs to see whether the giants in the cryptocurrency circle are still fighting for their ideal goals. I am still on the bullish side, but in the short term, there will definitely be continued sell-offs, and the range has not changed, which is almost the same as our previous predictions. I will provide you with forecasts based on actual events.

There are too many markets with opposite trends to the cryptocurrency circle, especially gold frequently hitting new highs, while Japanese bonds are also continuously reaching new highs. The performance of these two stable markets has indeed attracted too much capital. Looking at the average price since 2008, it broke through $1,000 per ounce, and it took until 2020 to double to $2,000. In just five years, it has doubled again to break through $4,000, and as of today in 2026, it has already surpassed $4,750. From the perspective of gold prices, it is more about global consensus driving price growth, along with Trump's instability and geopolitical conflicts; the price is likely to maintain its state in 2026. Do not underestimate the gold market; it is after all the largest financial market globally, exceeding $30 trillion, which is ten times that of the entire cryptocurrency circle. This means that every slight increase requires ten times the capital of the cryptocurrency circle to drive it, and it is a globalized market backed by the two superpowers, China and the United States.

Secondly, the explosive growth of the U.S. stock market is something Lao Cui is not overly worried about, as the later trends in the cryptocurrency circle may be linked to dollar assets. The emergence of X is to allow cryptocurrency funds to flow more easily into the U.S. stock market, which also cuts off X's desire to enter the domestic market. As long as the integration of the cryptocurrency circle and the U.S. stock market is completed in 2026, the performance of the entire cryptocurrency circle will be completely different. Among the entire U.S. stock market, what worries me the most is the application of AI. Although at the beginning of the year, Musk's several speeches raised everyone's recognition of AI again, even the so-called breakthroughs in brain-machine interfaces and the future of robotic surgeries are very impressive, making more investors favor the AI sector. After everyone calms down, one thing to consider is, if AI is really that powerful, why is the U.S. so stingy with electricity for the AI sector, even making these so-called AI companies pay to build their own power systems? This is completely contrary to our attitude.

Lao Cui's concern is merely about the application of AI. Many friends believe that the center of AI is in the U.S. market. I do not think so; only we are actively building the power system, while the U.S. has enough attention on AI, but the actual construction will take at least 5-10 years. This reminds me of a famous saying: "Ten thousand years is too long; we only strive for the present." The establishment of a computing power center is the core support for AI development, and electricity is the blood; they do not have the possibility to achieve this in the short term. Therefore, within these 5-10 years, there must be a market capable of accommodating U.S. stock market funds. Although I estimate that it is Musk's aerospace company, can the emergence of 2026 really rely on one company to drive it? If it cannot bear the load, do not think that the funds will flow into the cryptocurrency market; the cryptocurrency market is more linked to AI. Once AI collapses, the cryptocurrency circle will only be affected. The occurrence of such events has a high probability, and everyone needs to have a clear understanding that no financial market can maintain a high-speed growth state indefinitely. Can the AI bubble continue?

Lao Cui summarizes: The current trend in the cryptocurrency circle indeed makes most users start to question; I also hold a bearish attitude in the short term, which will at least last until the end of January. Whether it can rise in February remains to be seen (currently leaning towards a rebound). This year will definitely be a growth year for Bitcoin, and I am more inclined to believe that there is still a possibility of new highs, reaching 130,000 is not a big deal. The problems facing the cryptocurrency circle at this stage have already been given to everyone. On the contrary, from my perspective, this price decline also provides an opportunity for retail investors to enter; the Bitcoin market currently lacks the entry of retail investors. The price is somewhat too high, making it increasingly difficult for capital to profit, and I will definitely keep a good amount of assets waiting to buy after the decline. Do not think that the current explosive growth of gold means you should invest in gold; I bought in at around 1500-2500 and exited at around 3000. Although it may seem a bit off, it has indeed exceeded personal understanding, and this growth pattern will definitely encounter problems, limited to a specific time period. For contract users, you can short at this stage; if you do not understand, just ask Lao Cui.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。