Original Translation: Nicky

Solana's 2026 roadmap may represent the most radical upgrade cycle in the network's history, overhauling everything from the consensus mechanism to infrastructure to become a decentralized Nasdaq.

The roadmap aims to transform Solana into an environment that reaches exchange-level capabilities, allowing its native on-chain centralized limit order book (CLOB) to compete with centralized exchanges (CEX) in terms of latency, liquidity depth, and fairness. Here are all the upgrades to achieve this goal.

Alpenglow: Comprehensive Overhaul of the Consensus Mechanism

Alpenglow is the most significant protocol layer change in Solana's history. It introduces a brand new consensus architecture built around two core components: Votor and Rotor.

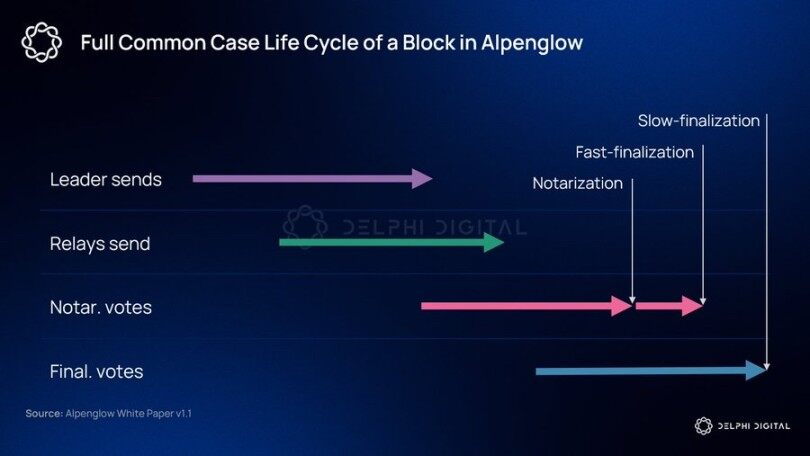

Votor has fundamentally transformed how the network reaches consensus. It no longer chains multiple voting rounds together but allows validators to aggregate votes off-chain and submit final confirmations within one to two rounds. As a result, the theoretical final confirmation time has been reduced from the original 12.8 seconds to 100-150 milliseconds.

Votor runs two final confirmation paths in parallel. If a block receives overwhelming support (over 80% of staked tokens) in the first round, it is immediately finalized. If the support rate is between 60%-80%, a second round of voting is initiated. If the support rate in the second round also exceeds 60%, the block is finalized. This design ensures that final confirmation can still be achieved even if some nodes in the network are unresponsive.

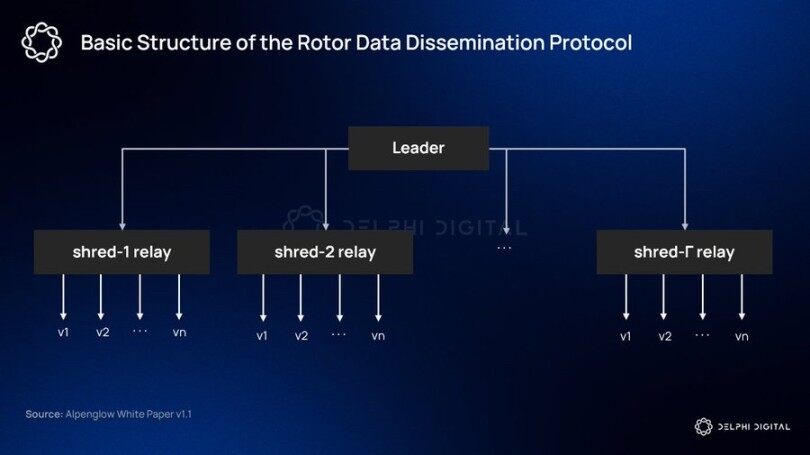

Rotor innovates the block propagation mechanism by routing messages directly through validators with high stakes and stable bandwidth.

Alpenglow also introduces a "20+20" resilience model: as long as the total staked tokens of malicious actors do not exceed 20%, security is guaranteed; even if an additional 20% goes offline, the system's liveness can still be maintained. This means that Alpenglow can still achieve final confirmation even if up to 40% of nodes in the network are malicious or offline.

Under Alpenglow, the Proof of History mechanism has effectively been abandoned, replaced by deterministic time slot scheduling and local timers. This upgrade is expected to be launched in early to mid-2026.

Firedancer: Runtime Performance Improvements

Since its inception, Solana has relied on a single validator client (now known as Agave). This singularity has long been one of the network's core weaknesses. Any vulnerabilities or failures at the client level could lead to a complete network shutdown.

Firedancer is a second independent validator client developed by Jump, written in C++. Its design goal is to transform Solana's validators into a deterministic, high-throughput engine capable of processing millions of TPS with minimal latency differences.

Frankendancer is its transitional version, combining Firedancer's networking and block production modules with Agave's runtime and consensus components. As Firedancer gradually reaches mainnet readiness, the diversity of validators is expected to significantly increase.

In this competitive context, both teams have undergone extensive iterations.

DoubleZero: High-Performance Fiber Infrastructure

DoubleZero is a private network overlay that connects validators via dedicated fiber optics, using the same infrastructure as traditional exchanges (like Nasdaq and CME) for microsecond-level transmission.

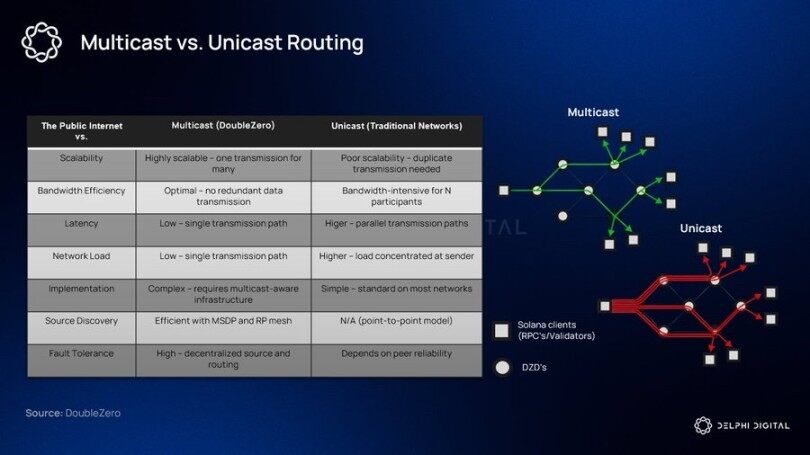

As the validator set expands, information propagation becomes more challenging. More nodes mean more destinations, which introduces timing inconsistencies in the network. DoubleZero eliminates this discrepancy by routing messages along optimal paths rather than bouncing back and forth over the public internet.

Alpenglow's final confirmation model relies on validators receiving and responding to messages within strict time windows. If propagation is inconsistent, votes will be delayed, quorum formation slows down, and the time required for final confirmation increases. By narrowing the latency gap between validators, DoubleZero enables Votor to achieve final confirmation faster and allows for more uniform propagation by Rotor.

DoubleZero also supports multicast, replicating data within the network and simultaneously delivering it to all validators.

Block Building: BAM and Harmonic

Two complementary trends are reshaping Solana's block building layer:

BAM (Block Assembly Marketplace) is Jito's reimagining of Solana's transaction pipeline. It is no longer solely determined by slot leaders deciding transaction ordering; instead, a market and privacy layer is inserted between ordering and execution. Transactions are imported into a Trusted Execution Environment (TEE), meaning that neither validators nor builders can see the original transaction content before ordering takes effect. This prevents opportunistic pre-execution behaviors like front-running.

Harmonic addresses another aspect of the pipeline — who builds the blocks. It introduces an open block builder aggregation layer, allowing validators to receive block proposals in real-time from multiple competing builders. Harmonic can be seen as a meta-market, while BAM is a micro-market.

Raiku: Ensuring Deterministic Execution

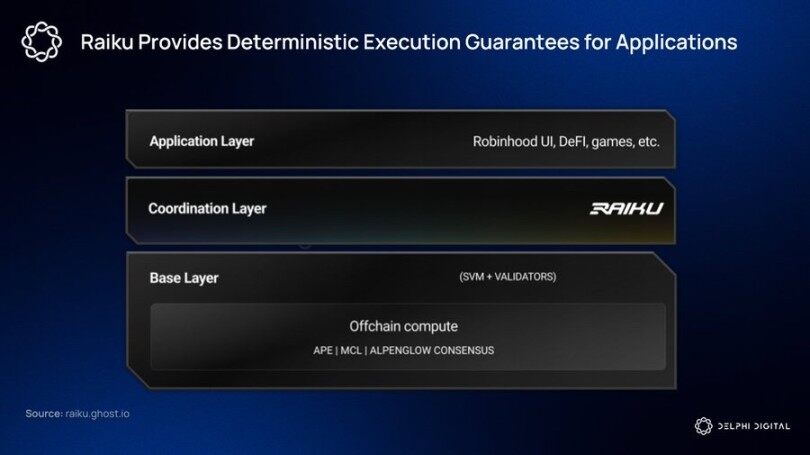

Raiku fills the remaining gaps. Solana has largely addressed most throughput bottlenecks, but it has not natively provided deterministic latency or programmable execution guarantees for specific applications. The granularity control required for high-frequency trading (HFT) style matching and on-chain centralized limit order books (CLOB) far exceeds what a layer 1 network (L1) can reasonably provide.

Raiku offers a scheduling/auction layer that runs in parallel with Solana's validator set, providing applications with a programmable, deterministic pre-execution environment without modifying the L1 consensus mechanism. It achieves guaranteed execution for pre-submitted workflows through Ahead-of-Time (AOT) transactions and meets real-time execution needs through Just-in-Time (JIT) transactions.

Bringing Capital Markets On-Chain

In the high-performance public blockchain space, Solana remains a leader, but this dominance is meaningless without users and efficient on-chain markets. While the vast majority of meme coins still trade on Solana, the on-chain perpetual contract market is rapidly consolidating on a few platforms.

To compete with centralized players, performance must reach comparable levels. We believe the Solana ecosystem has recognized this issue and is optimistic about closing the gap. Upcoming upgrades are highly anticipated, and new Solana-native perpetual contract exchanges like BULK will launch early in the year.

Retail users still have a huge demand for trading spot assets on Solana. While Hyperliquid currently dominates the perpetual contract market, Solana has established itself as the preferred L1 for trading any spot trading pair. Centralized exchanges still lead significantly, but Solana is currently the preferred solution for on-chain trading.

Products like xStocks are directly bringing on-chain stocks to Solana. Liquidity, price discovery, and speculative interest are concentrating on this single chain, which can provide faster settlement, better user experience, and denser capital.

This is why Solana is bringing capital markets on-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。