Original Title: "Why Do the Memes You Buy Only Drop? — Deconstructing the Growth Spiral and Volume of Memes Using First Principles"

Original Author: danny, Crypto Analyst

In the eyes of most people, meme coins are irrational revelry, a casino for fools. But from a mathematical perspective, the birth of every myth of a ten-thousand-fold increase is not accidental; it is actually a middle school spatial geometry evolution application problem.

This article presents a disruptive perspective: the market value of meme coins is not "gained" but "stretched" out. The value of memes can be calculated!

We are accustomed to focusing on the fluctuations of the Z-axis (price height), while neglecting that what determines life and death is the base radius constructed by X (narrative density) and Y (propagation nodes). A meme with only height and no base is merely a thin "needle" that can fall with a gust of wind; only a continuously expanding consensus radius can support a stable, geometrically growing wealth cone under the gravity of capital.

Note: This article is a popular science piece on "financial physics," not a rigorous econometric paper, and aims to provide a brand new perspective on memes.

1. The Beginning of Theory: The Three-Dimensional Coordinate System of Memes

In the current cryptocurrency market, meme coins are often seen as irrational revelry. But is that really the case?

If we strip away emotional noise, KOL endorsements, and community hype, we will find that the birth and demise of every phenomenal meme follows a strict mathematical logic.

The essence of meme coins is the tokenization of attention economy, and their market value is not determined by traditional discounted cash flow (DCF) but is constructed by the breadth of narrative, community resonance, and the explosive power of funds.

For better discussion, we define these factors as the XYZ three-dimensional growth spiral model.

These three axes are not merely independent variables; they exhibit strong reflexivity—meaning that a change in one variable reinforces another, forming a positive feedback loop.

Let’s explain these parameters:

X Axis: Narrative Density and Cultural Memes

Definition: The "genes" of memes. This includes core memes (like Doge), origin stories (like CZ's pet name), cultural symbols (like Pepe's sad frog), and the richness of community-generated content.

Key Indicators: Originality of narrative, replicability, emotional resonance.

Y Axis: Propagation Potential and Node Network

Definition: The transmission pipeline of information. From top nodes (CZ, Elon Musk) to secondary nodes (Alpha Callers, KOLs), and down to end nodes (ordinary retail investors).

Key Indicators: Node weight, propagation coverage, frequency of endorsements.

Z Axis: Fund Flow and Liquidity Vehicles

Definition: The monetization result of attention. This includes on-chain fund inflows, liquidity depth—i.e., the value that is settled or the total amount of sell orders that can be absorbed.

Key Indicators: Market cap, trading volume, turnover rate, and liquidity (the most important indicator).

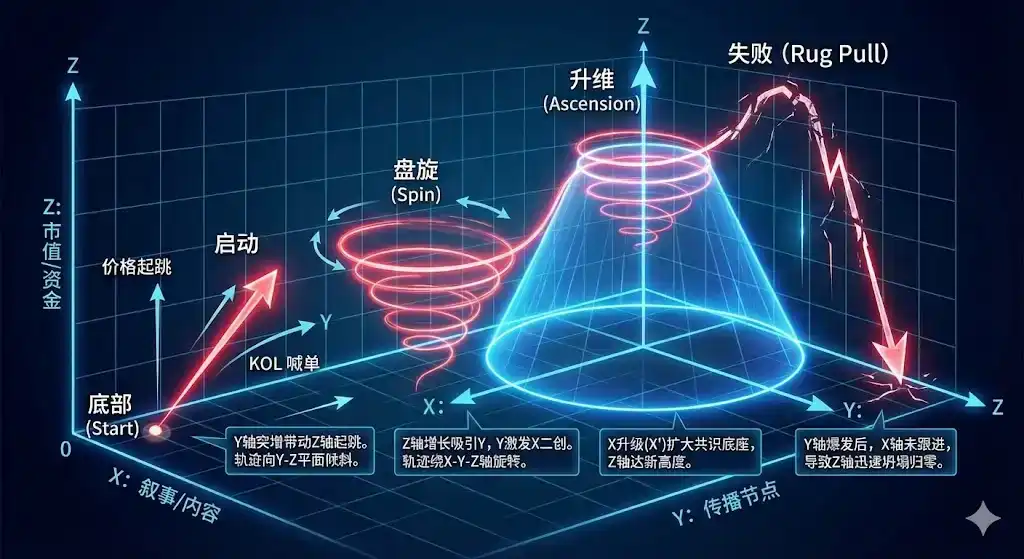

2. Growth Curve Diagram of XYZ Axis Interaction

If we plot these three axes in three-dimensional space, a successful meme growth trajectory generally presents a spiral upward trend (as shown below):

- Bottom (Start): X, Y, Z are all close to zero.

- Ignition: The Y-axis surges (KOL endorsements), driving the Z-axis (price) to jump. The trajectory line tilts towards the Y-Z plane.

- Spin: The growth of the Z-axis attracts more Y (more people discussing), and Y stimulates X's secondary creation (enriching content). The trajectory line begins to rotate around the X-Y-Z axes.

- Ascension: As X upgrades (X'), the base area of the cone expands (the consensus range widens), and the Z-axis (market cap) reaches a new height.

- Failed Meme (Rug Pull): Typically manifests as a surge in the Y-axis followed by a brief rise in the Z-axis, but the X-axis fails to upgrade (narrative scarcity), leading to a rapid collapse of the Z-axis back to zero, with the trajectory line falling in an inverted V shape.

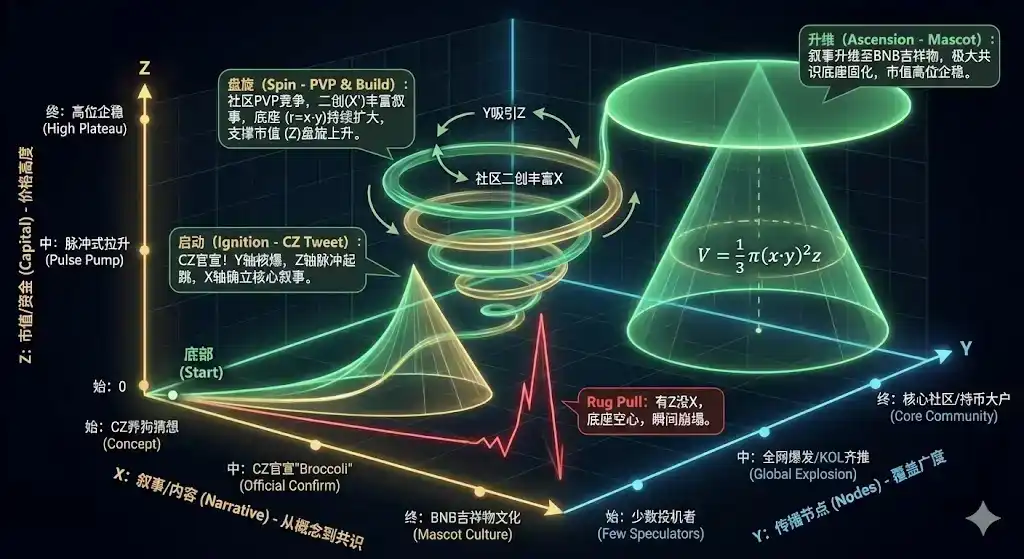

3. Evolution of Growth Curves: Four Stages of Spiral Ascension

From the previous section, we know that the lifecycle of a meme is not linear but a vortex that continuously expands around the Z-axis (fund flow). In this section, we will analyze based on the four developmental stages of memes.

The following diagram shows its standard evolutionary path:

First Stage: Ignition (The Ignition) — X + Y → ΔZ

A powerful narrative (X) combined with a high-weight propagation node (Y) instantly ignites funds (Z).

For example, Broccoli:

- X (Narrative): On February 13, 2025, CZ announced that his pet dog's name is "Broccoli." This is not just a simple pet name; it carries deep metaphors of "CZ's comeback" and "BNB ecosystem return," and "Broccoli" itself has a unique sound symbol and visual image (green = rise).

- Y (Node): CZ himself is a top traffic node in the industry (Y-Max), and the propagation potential of a single tweet from him even surpasses that of a Super Bowl ad.

- Z (Result): Funds respond instantly. Hundreds of tokens with the same name quickly emerged on Solana and BNB Chain, with the leading tokens' market cap surpassing $1.5 billion within hours, and early speculators making millions in just 20 minutes.

The growth of the Z-axis in this stage is pulsed, entirely relying on a single point explosion on the Y-axis.

Second Stage: Establishment of Reflexivity (The Reflexivity Loop) — Z↑→ Y↑

The price (Z) itself becomes the best advertisement and propagation channel (Y). When the Z-axis (market cap) rapidly rises, creating a wealth effect of "hundred-fold golden dogs," it will have a reverse effect on the Y-axis.

- Passive Propagation: KOLs who originally did not pay attention to the meme start to actively mention it to capture the heat (traffic capture).

- FOMO Spread: The top gainers list itself is the strongest propagation node. Media reports (like "a certain address made a profit of $6 million") further expand the propagation radius.

- BNB Chain's Strategy: The BNB Chain officially injects energy into the Z-axis through the "Meme Innovation Contest" and "Daily Airdrop" plan (airdropping golden dogs to the community for those who buy 33 BNB daily) to maintain the activity of the Y-axis.

Third Stage: Narrative Upgrade and Solidification (Narrative Upgrade) — Y_expansion → X'

The expanded propagation network (Y) forces the narrative (X) to undergo a secondary iteration (X'). Simply relying on the meme of "CZ's dog" (X) cannot sustain long-term market value. When the Y-axis expands to hundreds of thousands of holding addresses, the community begins to spontaneously create new narratives (X').

From "Meme" to "Culture": The community starts creating memes, establishing the "Broccoli Church," and endowing the token with a certain spiritual connotation (like "resisting VC coins," "symbol of BNB Chain's revival").

Tooling the Narrative: For example, FLOKI evolves from a simple meme into an ecosystem with Valhalla games and DeFi protocols. This is also an upgrade from X to X'.

Fourth Stage: Value Black Hole (The Value Black Hole) — X'→ Z_max

The upgraded narrative (X') can carry a larger scale of funds (Z).

When the X-axis completes the upgrade from "local dog" to "totem," the upper limit of the Z-axis is opened.

Change in Fund Nature: From early "quick in and out" smart money to "diamond hands" community funds and institutional funds attempting to allocate.

Infrastructure Bloodsucking: At this point, memes are no longer just a customer acquisition tool; they begin to feed back into on-chain infrastructure. Huge trading volumes bring a large amount of BNB burn and fee income to the BNB Chain, while also providing liquidity entry for other applications within the ecosystem (like Aster derivatives trading, Pancake's trading volume).

4. A Conical Formula Sparks a Hypothesis?

If you are observant, you might notice that the three-dimensional diagram above resembles a cone. Is it possible that we can apply the volume formula of this cone

V = ⅓ * Base Area * Height to the growth model of meme coins?

4.1. Variable Mapping: Constructing the Growth Model

We will correspond the various geometric elements of the cone to the variables x, y, z you proposed:

Base Radius r = x * y: The boundary of social consensus

- x (Content/Narrative): This is the "gene" of the meme. Good content determines the infectiousness of consensus.

- y (Propagation Nodes): This is the community, KOLs, and holding addresses. Nodes determine the coverage of the narrative.

- r (Radius): Represents the physical boundary of consensus. The larger the radius, the more people know and are willing to believe this story, making the base more stable.

- Height h = z (Funds/Emotional Leverage): The speed and density of fund inflow determine the vertical height of price increase.

- Volume V = Market Cap: The final market cap scale presented.

4.1.1 Why is the radius x * y a square relationship?

In the world of memes, the combination of narrative and nodes has a network effect.

If content x is merely a mediocre imitation, even if there are many nodes y, it is difficult for the radius r to expand.

When a highly penetrating narrative (x) meets high-frequency interactive propagation nodes (y), the area of consensus expands exponentially. The square term in the formula means that a slight expansion of the underlying community consensus will lead to a squared increase in the supported volume (market cap) potential.

4.1.2 Why is fund z a linear height?

The funds z determine how high the price can go. However, in the meme model, a height of funds without a base area (x and y) is unstable. If there is only z (whales entering to pump) without r (broad retail consensus), the cone will turn into a very thin "needle" that will collapse with the slightest disturbance.

True blue-chip memes (like DOGE, PEPE) have a large base diameter, which means that even if the height h of funds fluctuates, the overall volume remains substantial.

4.1.3 The Charm of the Coefficient ⅓: Meme Loss and Attention Decay

Scientists have found that the volume of a cone is only one-third that of a cylinder with the same base and height. In the meme market, this represents the friction loss of attention, but ⅓ is just a hypothetical value; it could actually be 1 / 300.

Not everyone who hears the narrative will buy in. Not every fund that enters can be converted into long-term held market value. This coefficient reminds us that the market value of a meme can never fully cover the attention traffic it reaches, as there is a significant amount of bubble evaporation and attention transfer.

4.2 Trajectory Analysis: From "Point" to "Cone"

The upward trajectory of meme coins typically follows the process of cone generation:

Budding: The narrative x has just been born, with very few nodes y, and funds z are just beginning to flow in. At this point, the volume is negligible.

Taking Root: As more nodes y join, the narrative x begins to bifurcate. In this stage, the most important factor is not the price (height) but the increase in the number of holding addresses and community activity (expanding radius r).

Vertical Eruption: When the consensus base is large enough, the inflow of funds z will produce an astonishing leverage effect. Since the base radius has already solidified, adding the same z will cause the volume V to expand rapidly.

A successful meme coin trajectory essentially expands the base first and then increases the height.

5. Boundaries and Limitations of the Cone Volume Formula

5.1 Defining "Healthy" and "Deformed" Growth States

This model sets r (narrative × nodes) as a square term, while z (funds) is set as a linear term. There are two obvious effects:

Captures the network effect: In the meme field, a tenfold narrative spread (r) can often support a hundredfold market value (V) growth. This explains why some coins can have their funding amount (h) not yet reach the explosion point, but as long as the community foundation (r) is solid enough, their valuation potential will leap geometrically.

Explains the physical structure of "collapse": If a project's radius r (consensus) is shrinking, even if you invest more funds z to pump it, the volume of the cone will quickly shrink due to the collapse of the base.

Additionally, through this geometric model, we can easily identify two typical failure models:

"Telephone Pole" Model (high z, extremely low r): Only large holders are trading or pumping funds, lacking community discussion and narrative resonance. This cone is extremely unstable; once the funds z are withdrawn, the volume instantly returns to zero.

"Big Pancake" Model (large r, extremely low z): The community is very lively, and the narrative is good, but there is simply no funding entering. This cone has area but no volume, representing a "well-received but not profitable" poor community.

5.2 Limitations

In real secondary market applications, there are several "physical deformations" to note:

Coupling relationships between variables: In the formula, r and h are independent variables, but in the meme market, the rise of z (funds) will, in turn, strengthen x (narrative) and y (propagation nodes). This is the famous "the rise has been served" effect. The higher the price, the more the narrative resembles truth, and the faster the nodes spread.

The dynamics of the ⅓ coefficient: In an extremely crazy bull market, this coefficient may approach 1 (turning into a cylinder) because emotions smooth out all losses; while in a bear market, this coefficient may become 1/1000, meaning that the vast majority of attention cannot be converted into purchasing power.

The absence of a time dimension: The cone is a static geometric body, but memes are time-sensitive. If we introduce a "decay rate," this model would be more perfect, as the narrative x of memes will naturally shrink with aesthetic fatigue.

6. Case Analysis of Broccoli

6.1. Elements of Broccoli

x (Content/Narrative): "CZ's personal certification" — this is top-tier narrative and influence.

y (Propagation Nodes): CZ's millions of followers, the official BNB Chain account, the Four.Meme platform, and the "scientists" and PVP players lurking across the internet.

z (Funds/Market Value): The existing funds on the BNB chain, as well as "hot money" coming from other chains.

6.2. Four-Stage Trajectory Restoration

First Stage: Bottom (Start) — Fog Period

Before February 13, 2025, when CZ made the announcement. x, y, z were almost zero, but the market was full of "static electricity." The entire network began to speculate on the name, resulting in many small cones in the wrong direction, such as BNBDog, CZDoge, etc.

Second Stage: Ignition (Ignition) — Narrative Nuclear Explosion

CZ tweeted, officially announcing that the dog's name is Broccoli, accompanied by an image. The y-axis (nodes) instantly exploded. Twitter and Telegram channels almost synchronized in seconds.

Since x (narrative) was directly provided by CZ, its authenticity was confirmed. Funds z poured in crazily, and hundreds to thousands of tokens with the same name instantly emerged on platforms like Four.Meme. The trajectory line at this moment presented an almost vertical tilt in the y-z plane.

Third Stage: Spin (Spin) — Jungle Brawl (PVP)

In the 2-12 hours after the name was revealed, thousands of Broccoli appeared in the market. To compete for the "real body," various communities began to create content frantically (competition for x). At this point, the model was in a rotating state. Some tokens increased z through spontaneous community buying, while others enriched x with more interesting meme images.

Only those Broccoli that could continuously stimulate y (more node discussions) and enrich x (narrative upgrades, such as doing charity, creating games) could maintain rotation; the rest, due to a lack of x, lost their rotational force and directly entered a collapse program.

Fourth Stage: Ascension (Ascension) — Consensus Sedimentation

Ultimately, only 1-2 "true heirs" emerged, gaining the attention of the BNB Foundation or recognition from mainstream trading platforms.

At this point, the base area r = x * y had solidified due to long-term community building. The narrative upgraded from "CZ's dog" to "the mascot of BNB Chain." Even if funds z occasionally fluctuated, due to the extremely stable base, the market value cone still stood tall.

6.3 Warning: The Sublimated Broccolis

In the chaos of 2025, 99.99% of Broccoli fell into the "inverted V-shaped" drop.

They relied on fake or internal market pumps to achieve a very high z-axis during the ignition phase. The developers purely aimed to harvest, with no intention of managing x (content) and y (real community nodes). Therefore, this cone was a very thin "needle," and after reaching the peak on the z-axis, due to the base radius r approaching zero, it instantly lost balance, and the trajectory line directly fell vertically, leaving a mess behind.

CZ's Broccoli case proves that the ultimate battle of meme coins is not about who launches the coin first (z), but about who can turn the point of "CZ's pet" (x) into the largest circle (r) through the power of the community (y).

Broccoli should be the largest-scale "speed competition of cones with the same base area" in the meme world of 2025. Under the same x narrative, tens of thousands of projects competed for y and z, ultimately proving that only "narrative upgrades + node stickiness" can lead to breakthroughs in market value.

7. Case Analysis of Pnut

Dissection of Pnut's Three-Dimensional Coordinates

X Axis (Narrative Density - Emotion and Justice): This is not just a squirrel meme; it carries the narrative of "resisting the excessive expansion of public power" and "avenging innocent lives." From "a cute squirrel → a hero harmed by the system → a political totem of the MAGA movement." Its narrative density has rarely reached a cross-border, cross-class resonance in meme history.

Y Axis (Propagation Nodes - Dimensional Attack): Top node Y_max: Elon Musk's continuous tweets, followed by top influencers like Joe Rogan. These nodes are not merely "shouting KOLs," but giant nodes with the ability to set social agendas.

Z Axis (Funds Vehicle - Emotional Leverage): The rapid liquidity on the Solana chain, combined with the lightning-fast listing on top CEXs like Binance, allows funds z to flow in quickly.

Stage 1. Ignition Phase: Gene Injection of Tragic Narrative

x (justice/revenge) forms instantly, and y (local community) begins to spread. The trajectory jumps vertically from the origin. The actions of the New York Environmental Protection Agency injected a highly penetrating x gene into Pnut. At this point, z (funds) was still sluggish on-chain, but the energy of the base had begun to accumulate.

Stage 2. Spin Phase: "Gravitational Pull" of Top Nodes

The Y-axis experiences a magnitude jump due to Musk's (Elon Musk) involvement (Y → Y_max).

The explosive rise in price z attracts the attention of the entire network. Due to the strong reflexivity of Elon’s tweets, every time the price doubles, it attracts more traditional media and political KOLs (new nodes) to join the discussion. The trajectory line begins to rotate violently in three-dimensional space, and the radius r expands rapidly.

Stage 3. Ascension Phase: From "Squirrel" to "Political Totem"

The X-axis completes its ascension (upgrading from "animal protection" to "U.S. election/resisting the system"). This is the most stable step for Pnut. Due to the upgrade of narrative x, the base area of the cone r = x * y is no longer limited to the crypto circle. At this stage, Pnut is no longer just a local dog but a cultural asset. Even if funds z experience periodic pullbacks, the massive consensus base can absorb the selling pressure.

Stage 4. Value Black Hole: Collapse and Reconstruction of Blue-Chip Consensus

Listing on top trading platforms like Binance, funds z reach their peak. A massive V (market value) has formed. It begins to absorb liquidity within the Solana ecosystem like a black hole. At this point, Pnut's cone has completely hardened, becoming the object that all subsequent animal memes attempt to imitate.

In Conclusion

After all this theoretical analysis, you may ask me, as an ordinary user, how should I identify, participate in, and embrace the opportunities of memes on BNB Chain, Solana, Base, and Xlayer? How can I seize the big opportunities and achieve significant results?

To know what happens next, please stay tuned for the next breakdown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。