Holding an Ethereum ETF allows you to receive interest periodically, just like holding bonds?

At the beginning of this month, Grayscale announced that its Grayscale Ethereum Staking ETF (ETHE) has distributed earnings obtained through staking to existing shareholders for the period from October 6, 2025, to December 31, 2025. This also marks the first time a spot crypto asset trading product in the U.S. has distributed staking rewards to its holders.

While this move may seem ordinary to Web3 native players as a typical on-chain operation, in the context of crypto finance history, it signifies that Ethereum's native yield has been packaged into the standard shell of traditional finance for the first time, which is undoubtedly a milestone.

What’s even more noteworthy is that this is not an isolated event. On the on-chain data level, Ethereum's staking rate continues to rise, the validator exit queue is gradually being digested, and the entry queue is accumulating again. A series of changes are happening simultaneously.

These seemingly scattered signals are pointing towards a deeper question: Is Ethereum gradually evolving from an asset primarily focused on price volatility to a type of "yield-bearing asset" that is accepted by long-term capital and possesses stable income attributes?

1. ETF Earnings Distribution: Traditional Investors' First Experience with Staking

Objectively speaking, for a long time, Ethereum staking resembled a technical experiment with a bit of a geeky quality, limited to the "on-chain world."

It not only requires users to have basic knowledge of crypto, such as wallets and private keys, but also to understand the validator mechanism, consensus rules, lock-up periods, and penalty logic. Although liquid staking (LSD) protocols represented by Lido Finance have significantly lowered the participation threshold, staking rewards themselves still primarily exist within the crypto-native context (such as wrapped tokens like stETH).

Ultimately, for most Web2 investors, this system is neither intuitive nor easily accessible, creating an insurmountable gap.

Now, this gap is being bridged by ETFs. According to Grayscale's distribution plan, ETHE holders will receive $0.083178 for each share they hold, reflecting the earnings obtained and sold through staking during the corresponding period. The distribution will occur on January 6, 2026 (the ex-dividend date), and the recipients will be investors holding ETHE shares as of January 5, 2026 (the record date).

In short, this income does not come from business operations but from network security and participation in consensus itself. In the past, such earnings existed almost exclusively within the crypto industry, but now they are starting to be packaged into the familiar financial shell of ETFs. Through U.S. stock accounts, traditional 401(k) or mutual fund investors can obtain native earnings generated by Ethereum network consensus (in dollar form) without needing to interact with private keys.

It is important to emphasize that this does not mean that Ethereum staking has achieved full compliance, nor does it represent a unified stance from regulators on ETF staking services. However, economically speaking, a key change has occurred: non-crypto-native users have, for the first time, indirectly obtained native earnings generated by Ethereum network consensus without needing to understand nodes, private keys, or on-chain operations.

From this perspective, the ETF earnings distribution is not an isolated event but the first step for Ethereum staking to enter a broader capital vision.

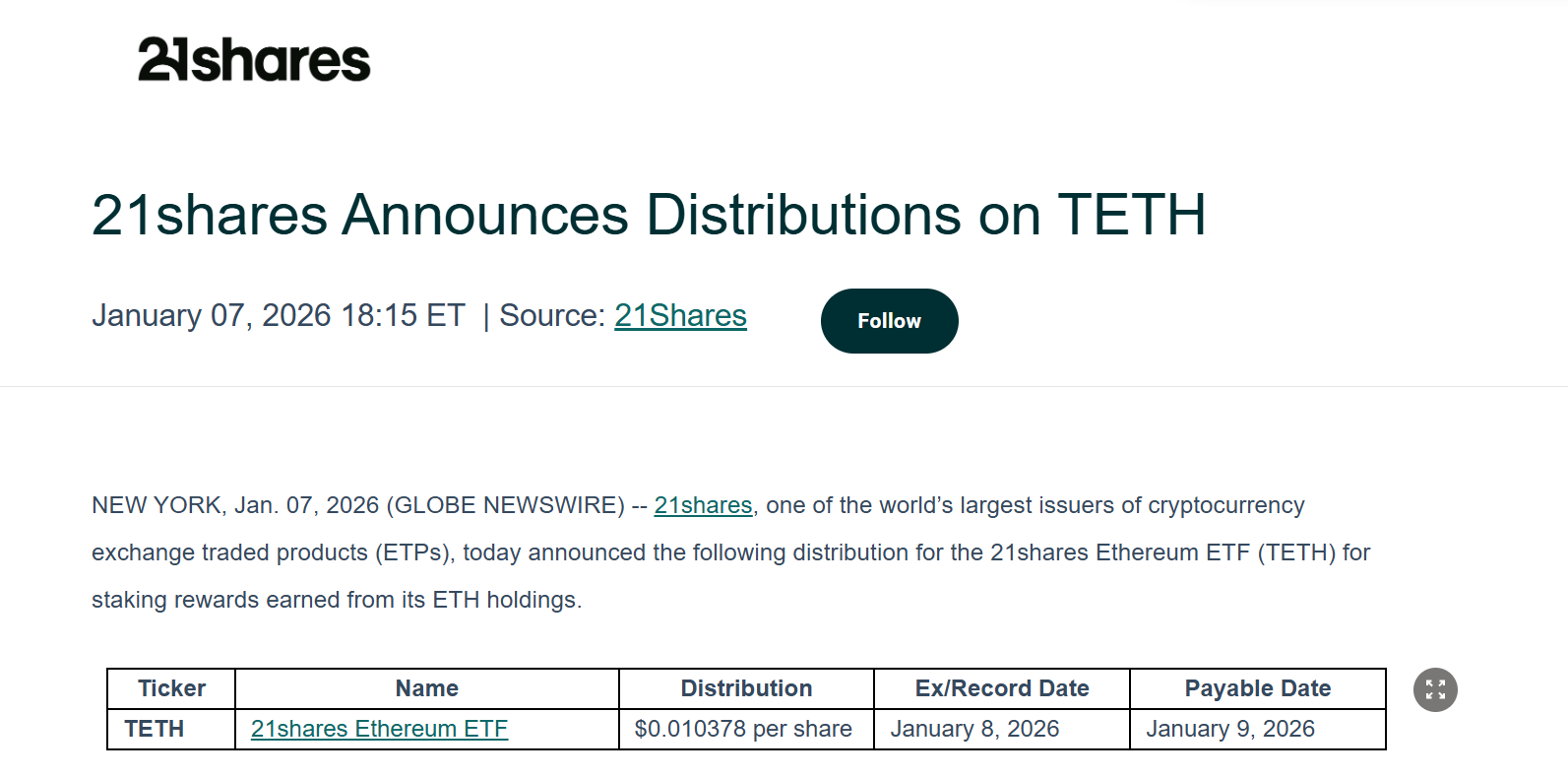

Grayscale is quickly becoming not the only player; 21Shares' Ethereum ETF has also announced that it will distribute earnings obtained through staking ETH to existing shareholders. The distribution amount is $0.010378 per share, and the relevant ex-dividend and payment processes have been disclosed.

This undoubtedly sets a good precedent, especially for institutions like Grayscale and 21Shares, which have influence in both TradFi and Web3. The demonstration effect goes far beyond just a single dividend; it will undoubtedly drive the effective implementation and popularization of Ethereum staking and earnings distribution in the factual realm, marking that Ethereum ETFs are no longer just shadow assets following price fluctuations but are truly financial products capable of generating cash flow.

Looking at a longer time frame, as this model is validated, it is not impossible for traditional asset management giants like BlackRock and Fidelity to follow suit, potentially injecting hundreds of billions in long-term allocation funds into Ethereum.

2. Record High Staking Rates and the Disappearance of the "Exit Queue"

If the ETF earnings are more of a narrative breakthrough, then the changes in total staking rates and the staking queue more directly reflect the behavior of funds themselves.

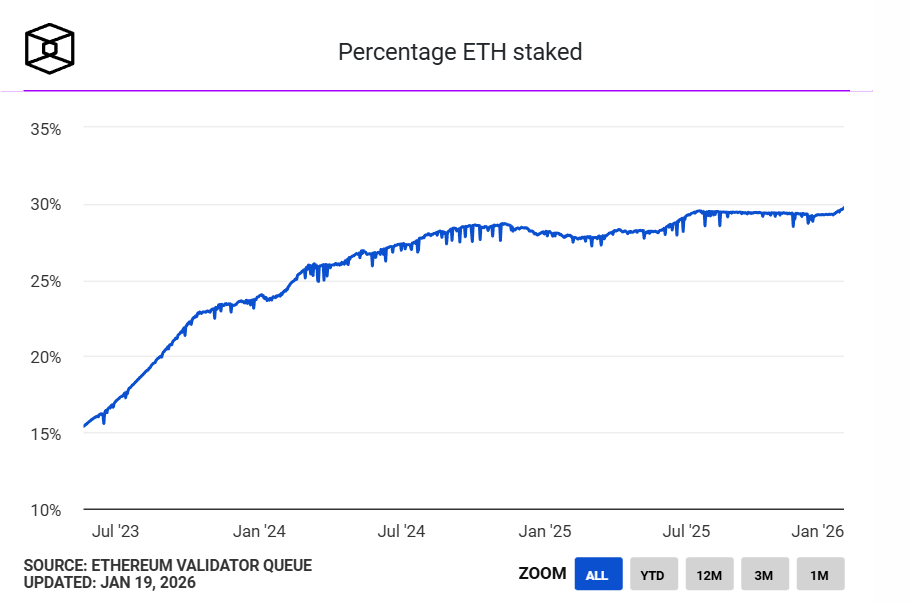

First, the Ethereum staking rate has reached an all-time high. According to data from The Block, over 36 million ETH are currently staked on the Ethereum Beacon Chain, accounting for nearly 30% of the network's circulating supply, with a staking market value exceeding $118 billion, setting a new historical high. The previous record for the highest proportion of circulating supply was 29.54%, which occurred in July 2025.

Source: The Block

From a supply and demand perspective, a large amount of ETH being staked means that it has temporarily exited the freely circulating market, indicating that a significant portion of circulating ETH is transitioning from a high-frequency trading asset to a long-term allocation asset that assumes functional roles.

In other words, ETH is no longer just a gas, a medium of exchange, or a speculative tool; it is beginning to assume the role of "productive material"—it participates in network operations through staking and continuously generates income.

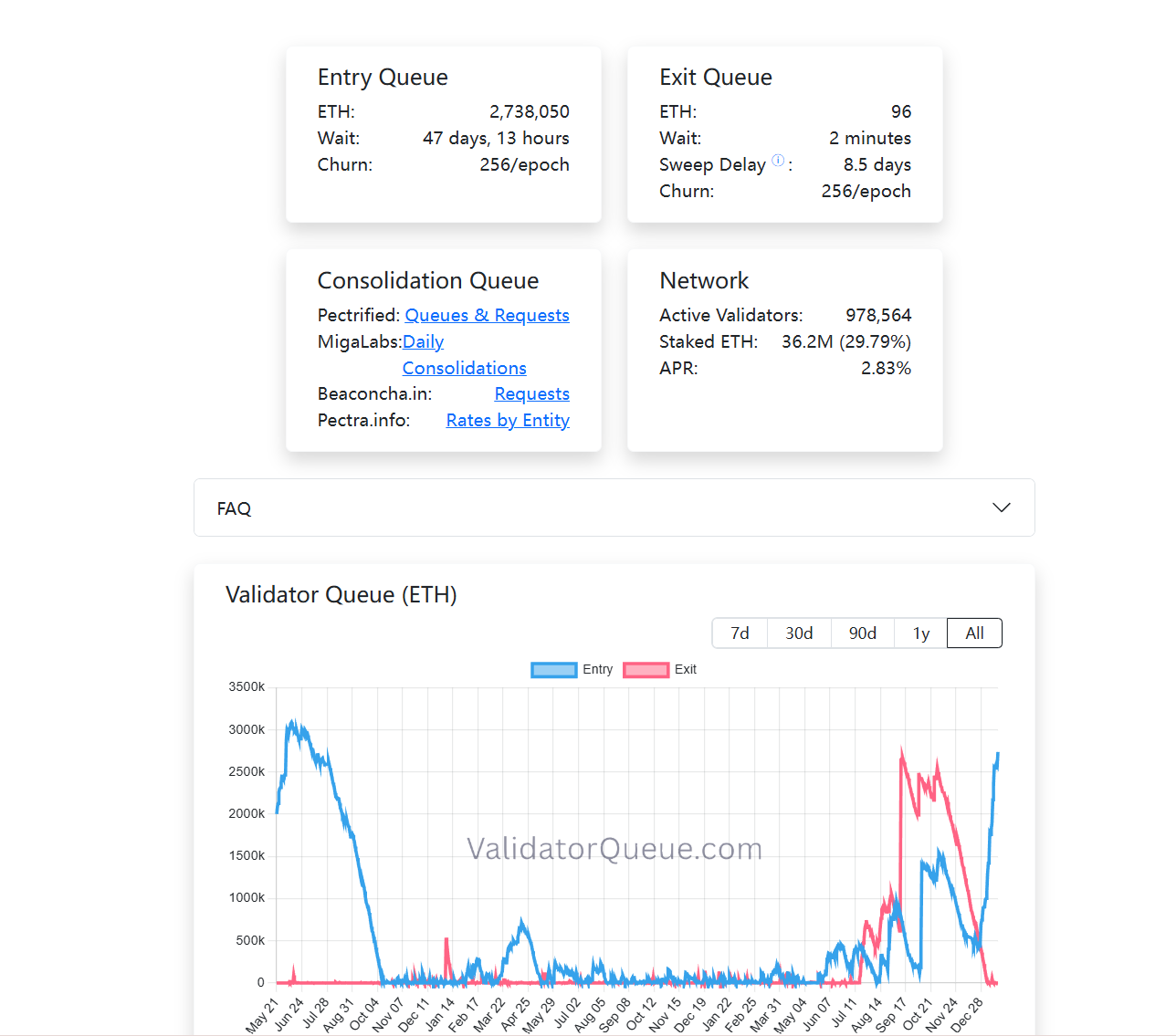

At the same time, the validator queue has also shown intriguing changes. As of the time of writing, the Ethereum PoS staking exit queue is nearly empty, while the entry queue for staking continues to grow (over 2.73 million ETH). In short, a large amount of ETH is currently choosing to be locked into this system for the long term (see further reading: “Penetrating the 'Degradation' Clamor of Ethereum: Why the 'Ethereum Values' is the Broadest Moat?”).

Unlike trading behavior, staking itself is a low-liquidity, long-cycle, and stability-return-focused allocation method. The willingness of funds to re-enter the staking queue at least indicates one thing: at this stage, an increasing number of participants are willing to accept the opportunity cost for this long-term lock-up.

When we put together the institutional ETF earnings distribution, record high staking rates, and changes in queue structure, a relatively clear trend emerges: Ethereum staking is evolving from early on-chain participant dividends into a structurally yield-bearing layer that is gradually accepted by the traditional financial system and reassessed by long-term capital.

Looking at any one of these factors alone is insufficient to form a trend judgment, but together, they are outlining the gradual maturation of the Ethereum staking economy.

3. The Future of an Accelerating Maturation of the Staking Market

However, this does not mean that staking has turned ETH into a "risk-free asset." On the contrary, as the participant structure changes, the types of risks faced by staking are shifting. Technical risks are gradually being digested, while structural risks, liquidity risks, and the costs of understanding mechanisms are becoming more important.

As is well known, during the last regulatory cycle, the U.S. Securities and Exchange Commission (SEC) frequently wielded its regulatory power, taking enforcement actions against several liquid staking-related projects, including unregistered securities charges against MetaMask/Consensys, Lido/stETH, and Rocket Pool/rETH, which brought uncertainty to the long-term development of Ethereum ETFs.

From a practical perspective, whether and how ETFs participate in staking is essentially more of a product process and compliance structure design issue rather than a denial of the Ethereum network itself. As more institutions explore boundaries in practice, the market is voting with real funds.

For example, BitMine has staked over 1 million ETH in Ethereum PoS, reaching 1.032 million ETH, valued at approximately $3.215 billion, which accounts for a quarter of its total ETH holdings (4.143 million ETH).

In summary, Ethereum staking has come to a point where it is no longer a niche game for the geek community.

As ETFs begin to stably distribute earnings, as long-term funds are willing to queue for 45 days to enter the consensus layer, and as 30% of ETH transforms into a safety barrier, we are witnessing Ethereum officially building a native income system accepted by the global capital market.

Understanding this change itself may be just as important as whether to participate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。