The yield on Japan's 10-year government bonds soared to 2.330% on January 20, reaching a historic high since February 1999, while the U.S. bond market is experiencing its longest period of low volatility since 2020.

This Friday, the Bank of Japan is set to announce its latest interest rate agreement, with the market widely expecting rates to remain unchanged. However, the backdrop of rising Japanese bond yields is marked by a rapid increase, as long-term Japanese government bonds continue to be sold off.

Market analysis indicates that with the yen continuing to depreciate and a positive outlook for wage growth, policymakers remain vigilant about inflationary pressures, although the specific timing for further rate hikes remains unclear.

I. Japan's Historic Rate Hike Cycle

The Bank of Japan's monetary policy stands at a historic crossroads.

● According to a report by the Nikkei, the market widely expects the Bank of Japan to maintain its recently raised 0.75% interest rate level as of December 2025, which is the highest rate in nearly 30 years. This decision comes amid rising bond yields and the upcoming elections scheduled for February, complicating the policy path.

● Governor Kazuo Ueda has previously hinted at the possibility of further rate hikes. Nomura Securities foreign exchange strategist Yusuke Miyairi noted that the Bank of Japan is currently confident that wage growth and potential inflation will remain solid, thus it is prepared to adjust rates.

● The Bank of Japan's policy adjustments reflect its efforts to curb the rising trend of inflation. Recent surveys show that Japanese companies expect wages to continue rising next year, providing a strong rationale for the central bank to consider further rate hikes. However, the policy-making process is complicated by the differing fiscal outcomes brought about by political uncertainties.

II. Turbulence in the Japanese Bond Market

The Japanese government bond market is undergoing a historic sell-off. On January 20, the yield on the 10-year government bonds, a key indicator of long-term rates in Japan, rose to 2.330%, the highest level since February 1999.

● This surge is not an isolated event. As early as January 13, the yield on newly issued 10-year government bonds had briefly risen to 2.160%, marking a 26-year and 11-month high since February 1999. Market analysis points out that this is mainly related to Prime Minister Fumio Kishida's consideration of dissolving the House of Representatives, with increasing views that if a House election is held, the ruling party would win due to high approval ratings.

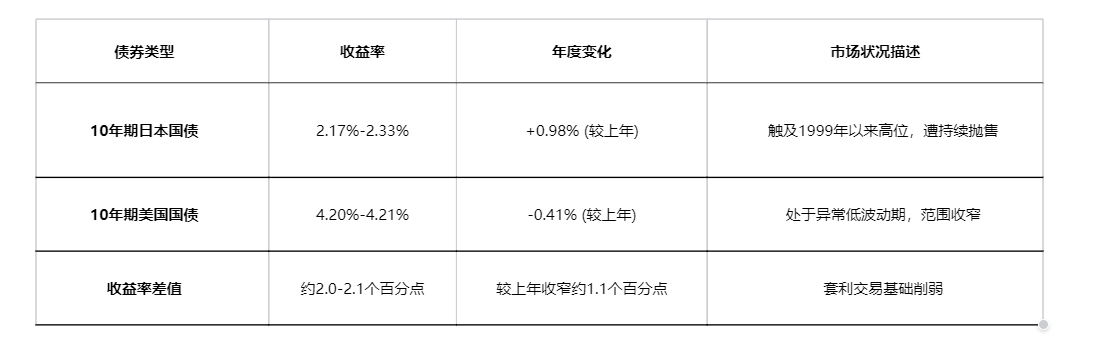

● Concerns over fiscal deterioration caused by Kishida's proposed expansionary fiscal policies have led to a sell-off of government bonds, resulting in rising yields. Additionally, data from January 16 showed that the yield on 10-year Japanese government bonds had reached 2.17%, soaring 98 basis points compared to the same period last year.

● The continued rise in bond yields indicates that market concerns over Japan's fiscal policy are intensifying. This sell-off trend reflects not only domestic political factors but also the overall tension in the global bond market, especially against the backdrop of diverging monetary policies among major economies.

III. U.S. Bond Market

● In stark contrast to the volatility in the Japanese bond market, the U.S. Treasury market is experiencing an unusual period of calm. As of January 16, the benchmark Treasury yield is on track for its fifth consecutive week of minimal fluctuations, potentially marking one of the longest periods of low volatility in the past two decades.

● Since 2006, the median weekly trading range for the 10-year Treasury yield has been about 16 basis points. However, since early December, this range has narrowed to less than 10 basis points, marking the longest relative calm since 2020. This stability is surprising given that the market has faced a series of significant risk events.

● Notably, despite these risk events, the 10-year U.S. Treasury yield has been tightly constrained within the range of 4.1% to 4.2% since mid-December. As of January 16, the 10-year U.S. Treasury yield stood at 4.20%, while the 30-year yield was at 4.83%.

● This unusual calm is seen by some analysts as a harbinger of significant market changes. The last time Treasury yields remained at such low levels for an extended period was in the fall of 2020, when the 10-year yield traded between 0.64% and 0.80% for about six weeks. This calm was ultimately replaced by a sharp rise in yields as the rollout of COVID-19 vaccines signaled economic recovery and large-scale fiscal spending began to take shape.

IV. Narrowing U.S.-Japan Yield Spread and Changes in Global Capital Flows

The divergence in U.S. and Japanese monetary policies is profoundly affecting the global capital flow landscape. Currently, the yield spread between 10-year U.S. Treasuries and 10-year Japanese government bonds is 2.2 percentage points, down from 3.3 percentage points a year ago.

● The continued narrowing of this spread directly threatens the long-standing "carry trade" model that has supported the U.S. Treasury market. This trading strategy involves investors borrowing low-interest yen to invest in higher-yielding U.S. Treasuries or other assets to earn the interest differential.

● As the Bank of Japan may further raise interest rates, the cost of borrowing yen will increase, significantly reducing or even collapsing the attractiveness of this arbitrage strategy. Ed Yardeni of Yardeni Research stated, "The Bank of Japan is no longer providing funding support for risk investments in the rest of the world."

Comparison of Key U.S. and Japanese Bond Yields (as of January 16-20, 2026)

Historically, the last time U.S. Treasury yields were so stable for an extended period was in the fall of 2020. Although the current environment is markedly different, this history reminds us that prolonged periods of low volatility may signal meaningful market changes.

V. Global Market Interconnection

The global impact of the Bank of Japan's policy shift is gradually becoming apparent. Larry McDonald of Bear Trap Report warns that the narrowing U.S.-Japan yield spread has put carry trades on shaky ground.

● The collapse of these carry trades could trigger a chain reaction in the U.S. market. Japanese investors have been the primary overseas buyers of U.S. Treasuries in recent years, pouring hundreds of billions of dollars into the U.S. bond market. If a rate hike in Japan prompts them to withdraw funds from the U.S. bond market, it would undoubtedly exacerbate concerns among global investors already worried about the expanding U.S. deficit and overvalued assets.

● McDonald further points out that the continued narrowing of the yield spread will significantly increase borrowing costs for the U.S. government and the general public. This poses a potential threat to the sustainability of U.S. finances and the consumer credit environment, especially against the backdrop of the current complex domestic political landscape in the U.S.

● In addition to its impact on U.S. Treasuries, Friday's decision may also put pressure on the Japanese stock market. Although Tokyo's benchmark Nikkei 225 index has performed strongly this year, easily surpassing the U.S. S&P 500 index, the yen's exchange rate against the dollar has already risen in anticipation of the policy shift.

VI. The Fed's Dilemma: Political Pressure vs. Policy Independence

● In the U.S., the Federal Reserve is facing unprecedented political pressure. On January 16, Fed Chair Jerome Powell released a video statement in response to the Justice Department's investigation into his testimony regarding the reconstruction of three Federal Reserve buildings.

● Powell described this investigation as "another attempt by the government to pressure the Federal Reserve to lower interest rates more aggressively than the Federal Open Market Committee deems appropriate." President Trump told reporters that he was unaware of the investigation until the media inquired about it.

● This investigation adds uncertainty surrounding Powell's eventual departure. Powell's term does not end until a successor is confirmed by the Senate. However, North Carolina Republican Senator and member of the Senate Banking Committee Thom Tillis stated that he would oppose all Federal Reserve nominees until the investigation is dropped.

● Given the committee's narrow Republican majority (13-11), as long as the Democrats remain united, his opposition would effectively block new appointments. This political interference comes at a critical moment for global monetary policy coordination, further complicating the Fed's ability to respond to domestic inflation and global market changes.

The yield on Japanese government bonds reaching 2.330%, a 25-year high, stands in stark contrast to the unusual calm in the U.S. bond market. The yield spread between the two countries' 10-year government bonds has narrowed from 3.3 percentage points a year ago to about 2.1 percentage points, putting the long-standing carry trade model supporting U.S. Treasuries on shaky ground.

At this crossroads of diverging global monetary policies, the market is holding its breath for the Bank of Japan's decision on Friday and whether the Fed, under Powell's leadership, can withstand political pressure and maintain policy independence. Regardless of the outcome, the interaction between the two countries' bond markets will set the tone for global capital flows in the coming years.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。