Introduction

Recently, the parent company of the New York Stock Exchange (NYSE), Intercontinental Exchange (ICE), disclosed that it is advancing a tokenized securities platform that supports 24/7 trading. On the surface, this is merely an extension of trading hours; but at a deeper level, it marks the first systematic challenge from traditional finance to the "core institutional advantages" of the crypto market—around-the-clock trading and instant settlement.

For over a decade, 24/7 trading has been almost an exclusive feature of the crypto market. Now, the NYSE's decision to actively absorb and transform this system indicates that traditional finance is no longer content with "trading during the day and watching at night," but is attempting to confront the crypto market directly in terms of time.

This change may be closer to a structural shock than the approval of any ETF.

Figure 1: New York Stock Exchange

1. 24/7 Trading is More Than Just "Extended Hours"

In the context of traditional markets, trading hours have never been a neutral issue.

Fixed trading periods mean concentrated liquidity, unified pricing, and controllable risk; while 24/7 trading implies decentralized liquidity, continuous pricing, and higher frequency risk management requirements. For this reason, U.S. stocks have long maintained a compromise structure of "limited time + extended trading."

What ICE is promoting is not simply an extension of pre-market and after-hours trading, but an attempt to build a trading system that natively supports around-the-clock operation through tokenized securities and on-chain settlement architecture.

This means that stocks and ETFs will, for the first time at the institutional level, have a trading rhythm similar to that of crypto assets.

In other words, the NYSE is not "working overtime," but is rewriting the rules of market timing.

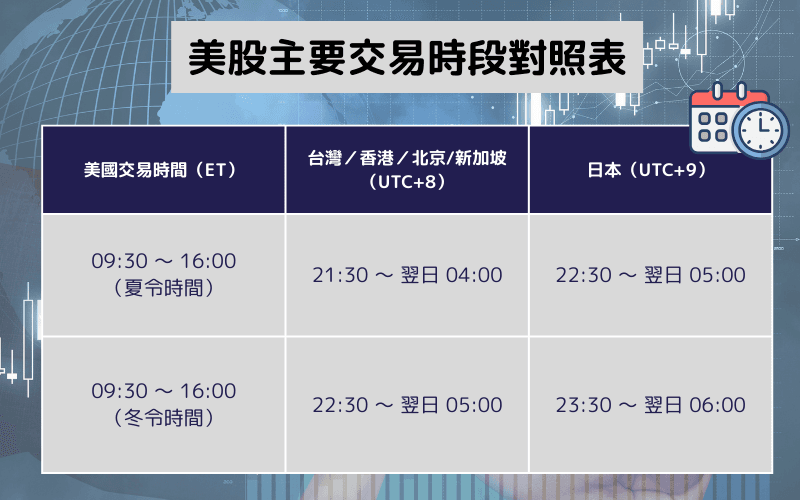

Figure 2: Structure of traditional U.S. stock trading hours

2. The Real Competitor is Not Other Exchanges

From a competitive perspective, the direct competitors of this change are not Nasdaq or other traditional exchanges.

What is truly being challenged is the "non-time advantage" that the crypto market has long occupied.

In the past, when U.S. stock markets were closed, global funds often naturally flowed into the crypto market:

- Trading demand during Asian and European time zones

- Speculative and hedging demand on weekends

- Instant pricing needs following macro events

These demands collectively form the liquidity foundation that persists in the crypto space.

Once core U.S. stock assets begin to have 24/7 trading capabilities, some funds will no longer be "forced" to enter the crypto market to express risk. Especially for institutions, trading familiar stocks or ETFs in a compliant environment is inherently attractive.

From this perspective, the NYSE's 24/7 trading is not "learning from crypto," but is directly competing with the crypto space for global liquidity pricing power.

Figure 3: Illustration of global fund cross-market flow

3. Not Built on ETH is a Signal in Itself

When the news first broke, the market speculated:

Would this platform be built on the Ethereum mainnet, or at least on some ETH Layer 2?

However, the information currently disclosed indicates that this expectation has not been realized.

ICE is more likely to adopt:

- A self-built permissioned blockchain

- Maintained by exchanges, clearing institutions, and compliance nodes

- Not inheriting Ethereum's consensus and security

- Not using ETH as gas or settlement asset

This means that traditional finance has chosen the route of "borrowing blockchain technology rather than accessing public chain systems."

This choice is not surprising. For securities-level assets, compliance, controllability, and retrievability always take precedence over decentralization and openness.

But it also clearly indicates: this is not a narrative to channel traffic to public chains, but a targeted absorption of the institutional advantages of the crypto market.

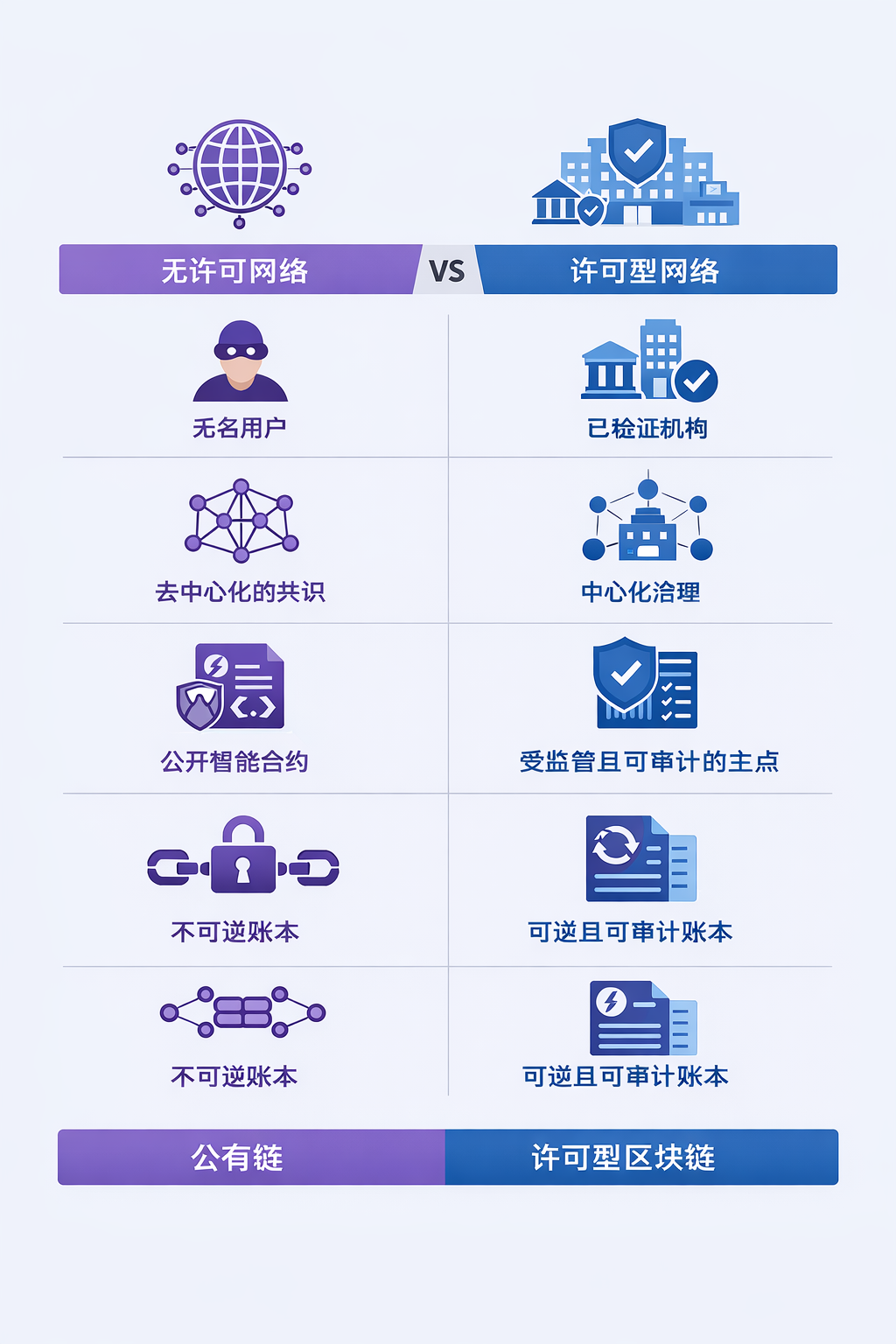

Figure 4: Comparison of public chain vs. permissioned blockchain structure

4. The Most "Invisible" Moat of the Crypto Space May Be Weakened

The competitiveness of the crypto market has long not solely stemmed from technology or asset volatility, but from a complete set of operational methods:

- 24/7 uninterrupted trading

- T+0 or even atomic-level settlement

- Global unified pricing continuity

When these features begin to be systematically replicated by traditional finance, their scarcity will decrease.

If in the future, investors can trade core U.S. stock assets at any time using compliant accounts and achieve near real-time settlement, then the logic of "going to crypto because U.S. stocks are closed" will be weakened.

This does not mean that the crypto market will disappear, but it indicates that its "passive dividends" in terms of liquidity are being eroded.

Figure 5: NYSE trader

5. The Real Focus Should Be on Subsequent Institutional Diffusion

The NYSE is not the only observation sample.

Once 24/7 trading is proven feasible at the tokenized securities level, what may follow is:

- More stocks and ETFs being tokenized

- A broader cross-time zone market-making system

- Deep integration with stablecoins and on-chain settlement systems

At that point, the boundary between traditional finance and crypto finance will no longer be defined by "whether there is a blockchain," but by who controls the liquidity entry and who defines the trading rules.

Conclusion: A Direct Competition Without Slogans

The NYSE's 24/7 trading plan is not an ideological statement towards the crypto world, but a calm, pragmatic, and de-narrativized institutional competition.

It does not need to claim to embrace decentralization, nor does it need to align with any public chain. It only does one thing:

Incorporate the most effective operational mechanisms of the crypto market into its controllable system.

For the crypto space, this may not be a short-term negative, but it is a clear reminder—

When traditional finance begins to "not clock out," the crypto market must also rethink:

What is its truly irreplaceable value that remains.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。