Author: Vaidik Mandloi

Translation: Block unicorn

Introduction

DeFi lending appears to be vast at first glance, but its underlying operational efficiency is low. The same assets are scattered across multiple pools, markets, and chains. As a result, a significant amount of capital remains idle, not due to a lack of borrowers, but because of improper liquidity allocation.

This structure stems from the way DeFi protocols manage risk. Protocols do not charge different borrowers based on risk levels; instead, they opt to create independent markets.

While this structure enhances security, it also brings some unexpected consequences. Even with the same underlying assets, each market requires its own liquidity. ETH deposited in the Aave core market cannot be used to fund loans in other independent markets, even if those markets have higher demand. Over time, protocols ultimately lead to the same assets being dispersed across multiple pools, each of which is only partially utilized.

Aave v4 aims to address this structural inefficiency. It centralizes liquidity and shifts risk management to the edges of the system. Different types of lending still exist, but they no longer require separate pools of funds. The idea is simple: utilize existing liquidity more effectively while controlling risk.

Why DeFi Lending Becomes Inefficient

DeFi lending protocols manage risk by segmenting users into different markets rather than charging different prices.

When a protocol wants to support assets with varying risk levels, it does not finely adjust interest rates or collateral costs; instead, it creates independent markets. Assets deemed safe are grouped into one market, while newer or riskier assets are placed into lower-limit independent markets. High-leverage strategies are pushed into special modes, such as E-mode. E-mode is designed for assets whose price movements are closely correlated, such as stablecoins or highly liquid staked tokens. Because these assets are highly correlated, the protocol allows users to borrow in a more aggressive manner.

Each market has its own set of rules, and more importantly, its own liquidity. This makes the system easier to control. If a market encounters issues, losses are confined to that market. However, this also means that even if the underlying assets are the same, liquidity cannot be shared across different markets.

For example, ETH provided by the Aave core market can only be borrowed by users within that market. If borrowing demand increases in an independent market, the protocol cannot automatically reallocate idle ETH from the core market to meet that demand. Liquidity can only be redistributed through users manually transferring funds.

As Aave expands to various assets and blockchains, this pattern continues to repeat. With each additional risk category, a new market is required, and each market needs its own liquidity. This leads to assets being dispersed across multiple pools, with none being fully utilized. Although total deposits may increase, the protocol's ability to deploy capital efficiently has not kept pace.

This structure also affects pricing. Since borrowers are segmented by market rather than charged based on risk levels, users within the same market often pay similar interest rates, regardless of the actual safety of their collateral. Risks do exist, but they are reflected through access restrictions rather than pricing. Safer positions indirectly subsidize riskier positions, not by design, but due to these constraints.

This creates a large and rigid system.

Funds exist, but they are bound by market barriers. Supporting more assets or strategies requires more pools, higher liquidity, and more dispersed capital flows. This is precisely the problem Aave v4 aims to solve.

Separating Liquidity and Risk

The core idea of Aave v4 is simple, but it requires a complete overhaul of the previous DeFi lending construction. Liquidity and risk do not have to coexist.

In earlier versions, markets simultaneously undertook two tasks: maintaining liquidity and enforcing risk rules. Because these two functions were tightly coupled, the only way to change risk was to split liquidity. This is what led to market fragmentation. Aave v4 attempts to break this coupling.

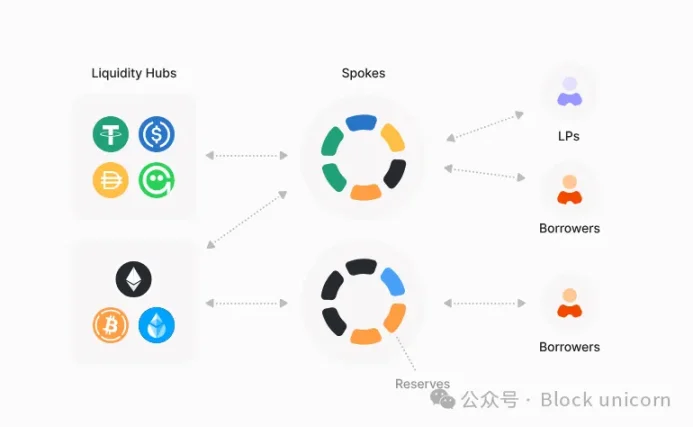

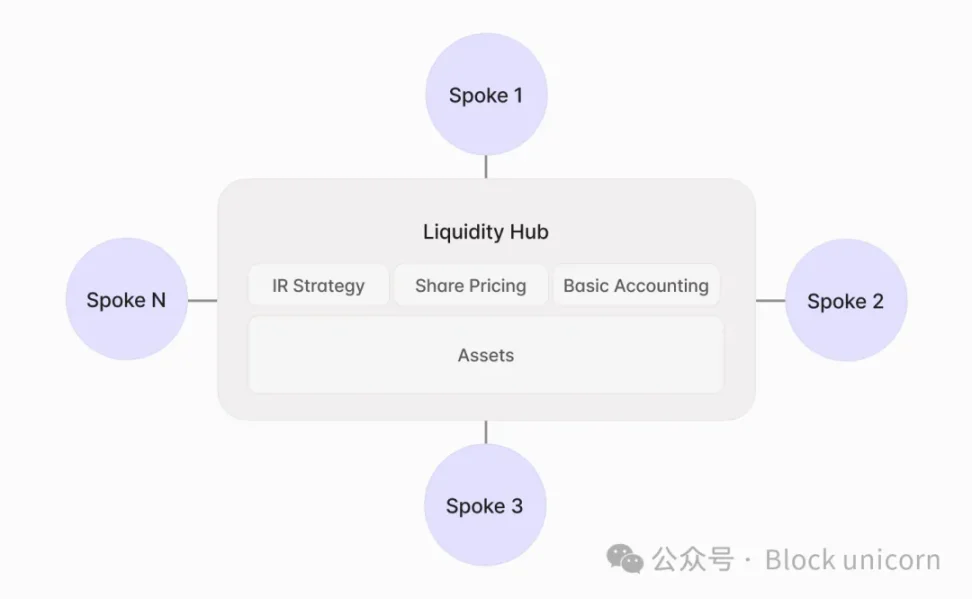

In version v4, liquidity on each chain is centralized in a place called the "Liquidity Hub." This hub is not a user-facing market; it does not determine who can borrow, the amount borrowed, or the collateral. Its responsibilities include safeguarding assets, tracking supply and borrowing balances, calculating interest, and ensuring the overall solvency of the system.

All user interactions occur elsewhere.

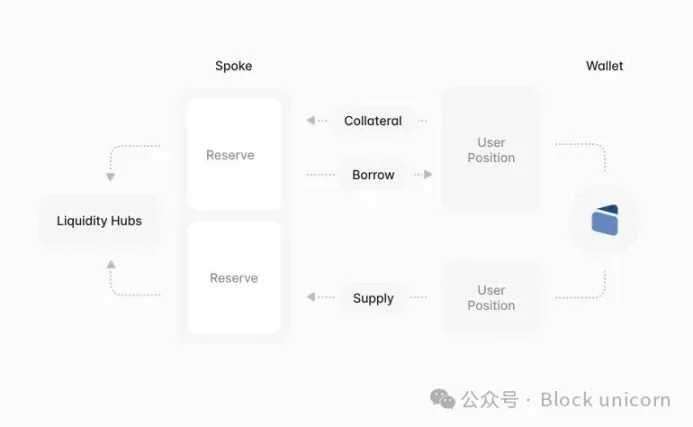

Next, Aave v4 no longer uses the concept of "markets" but introduces Spokes. A Spoke is not a liquidity pool but a set of rules that determines who can access liquidity under what conditions and what risk limits. When users borrow, they do not borrow directly from the Spoke; instead, they borrow from the Hub through the Spoke.

Since Spokes do not hold liquidity, Aave v4 no longer needs to create new pools each time it needs to support different types of risk. All assets are consolidated into a single balance sheet. The changes between Spokes do not lie in where the funds are stored but in the rules governing their use.

In earlier versions of Aave, these two aspects were inseparable. Markets defined both the risk assumptions and the pools that supported those assumptions. If the protocol needed stricter rules, higher leverage, or different collateral handling, it had to create an independent market with its own deposits. Over time, this led to liquidity fragmentation. The only way to change risk was to split capital.

Aave v4 eliminates this limitation by separating accounting from access. The Hub exists solely to hold assets, track positions, and ensure solvency across the system. It does not determine which assets can be used as collateral, the allowed leverage ratios, or which oracle to trust. These decisions are all handled by the Spoke. A Spoke is not a market in the traditional sense; it does not contain liquidity but defines a borrowing environment. When users borrow through a Spoke, they are borrowing from the same underlying asset pool as other users but must adhere to specific rules. These rules dictate how collateral is valued, the maximum amount that can be borrowed, and how to quickly liquidate positions when they become unsafe.

This structure allows the protocol to express entirely different risk preferences without requiring repeated capital input. One Spoke can simulate today's conservative core market. Another Spoke can set strict limits and parameters for riskier assets or allow higher leverage for correlated assets, similar to the E-Mode. All these configurations can coexist without needing to pre-fund separate pools.

The key to avoiding dangerous situations is that Spokes do not allow unlimited access to liquidity. Each Spoke has clear limits set by governance mechanisms. These limits define the risk exposure a Spoke can create and the types of assets it can interact with. If a Spoke begins to accumulate risk beyond expectations, these limits can be lowered. If the risk becomes completely unacceptable, the Spoke can be entirely disabled without affecting other parts of the system or forcing other users to move funds.

This is where capital efficiency truly improves. Liquidity is no longer reserved to cater to specific types of borrowers or strategies but is available for the entire system and allocated through a set of rules rather than separate pools. The protocol does not need to continually split its balance sheet into smaller, less efficient parts to support more assets and strategies.

How Aave v4 Prices Risk

Liquidity sharing can only truly work when the protocol can distinguish between safe and unsafe participants. In earlier versions, this distinction was primarily structural. If you wanted safer lending, you entered a safer market. If you wanted higher leverage or to use riskier collateral, you were assigned to another pool. While price differences existed, they were relatively crude and implemented only at the market level.

Aave v4 moves the differentiation of risk from the market level to the borrower level.

In version v4, the interest rates of assets are still based on a benchmark rate determined by supply and demand at the central node. What changes is the additional rate above the benchmark. Borrowers are no longer considered interchangeable simply because they are borrowing the same asset. Borrowing costs now depend on the collateral used.

When users borrow through a Spoke, the protocol assesses the risk of that position based on the collateral, leverage ratio, and the rules of the Spoke. If the position is deemed high risk, an additional fee, known as a risk premium, is charged. Positions with lower risk pay a risk premium close to the benchmark rate, while higher-risk positions pay a higher risk premium. The Spoke plays a subtle but important role here. It not only controls access to liquidity but also defines how the risk premium is calculated and applied. Conservative Spokes may charge little to no premium because their allowed positions are already tightly constrained. In contrast, Spokes that allow riskier collateral or higher leverage will charge a higher premium to compensate for the risk exposure the system is taking on.

These premiums flow back into the shared liquidity pool. Therefore, liquidity providers are compensated not only for the use of liquidity but also for the level of risk the system is taking on. Capital is rewarded for supporting higher-risk activities, provided those risks are clearly priced.

Over time, this creates a feedback loop: if a certain type of lending risk becomes too high, its cost will increase; if demand shifts towards safer configurations, prices will adjust accordingly. The protocol does not need to create new markets to reflect this differentiation; it is directly reflected in the interest rates. The resulting system is closer to a credit system, where the value of borrowers depends on their behavior and collateral, not just the market they enter. Liquidity can be shared, but risk is no longer averaged out.

Unified Accounting and Liquidation

Once liquidity is shared, the most obvious concern is the failure mode. What happens if everyone borrows from the same balance sheet and something goes wrong? In earlier designs, decentralization provided a rough form of protection. Because markets were isolated from each other, losses could be contained. However, the concern with unified liquidity is that risks may further spread.

Aave v4 addresses this issue by changing how the protocol accounts for positions and enforces solvency.

In version v3, each market effectively maintained its own accounts. Solvency was assessed locally. Liquidations were triggered within the pools, and losses were absorbed by the liquidity of those pools. This made markets easier to understand, but it also meant that the protocol lacked a global perspective on the accumulation of risk across the entire system.

In version v4, accounting is moved to the central node (Hub). The central node maintains a unified view of assets, liabilities, and interest accumulation across the entire protocol. Every loan, regardless of which Spoke it originates from, is recorded on the same balance sheet. This allows the protocol to assess solvency from a global perspective rather than on a market-by-market basis. It always has a clear understanding of the total liquidity, outstanding debts, and remaining buffer funds.

When users open positions through a Spoke, those positions are still subject to the global solvency rules enforced by the central node. If a position becomes unsafe, liquidation logic is triggered based on the rules defined by the Spoke, but the settlement still uses the same underlying liquidity. The Spoke defines when and how liquidation occurs. The central node ensures that liquidation can restore the system's solvency.

Each Spoke has clear limits on risk exposure. These limits are designed to control the risk each Spoke may pose to the system. Even if all positions within a Spoke fail simultaneously, the maximum loss is capped. Losses will not exceed the acceptable range set by governance for that Spoke. Other Spokes can continue to operate normally, as their liquidity acquisition is unaffected.

This differs from previous designs that employed a different failure model. Version v4 isolates losses not by isolating liquidity but by limiting risk exposure.

The liquidation process has also become more predictable. With unified accounting, liquidators only need to interface with a single source of liquidity. There is no need to transfer assets between markets or rebalance pools during the liquidation process. The system does not rely on users transferring funds when markets are under pressure; instead, it relies on pre-set limits and consistent accounting.

This reduces the likelihood of chain liquidations triggered by liquidity shortages in specific pools. In fragmented designs, the bankruptcy of a liquidity pool may not be due to a lack of funds in the system but because funds have flowed elsewhere. In version v4, liquidity shortages are a global signal. The unified accounting mechanism makes risks clear and manageable. The protocol always knows where losses may occur, the scale of those losses, and which part of the system is responsible for them. It is this clarity that allows liquidity to be shared without turning pressure events into collapses across the protocol.

Long-Term Unlocking

Aave v4 is not just a cleaner lending system. It also changes the speed and safety with which new forms of risk can be introduced into DeFi.

In earlier versions, supporting new things always meant taking on structural risks. Whether it was listing new assets, trying new types of collateral, or accepting specific borrower groups, a new market with its own liquidity had to be established. Governance decisions were also challenging, as they affected capital allocation, and each attempt came with the cost of market fragmentation.

In version v4, experimentation becomes easier because liquidity no longer needs to be transferred.

There is no need for users to deposit funds into a new pool to introduce new Spokes. Governance mechanisms can define rules, limits, and pricing for specific use cases while maintaining the integrity of the balance sheet. If an experiment is successful, limits can be increased. If it fails, the Spoke can be capped or shut down without affecting other parts of the system.

Rather than debating whether an asset "deserves" a full market, new assets and strategies can be viewed as limited risk exposures. This shifts the question from "Should we create a market?" to "How much risk are we willing to allocate?" This is a more precise decision-making process that can be adjusted incrementally. This is particularly important for real-world assets (RWAs) and institutional use cases.

RWAs often have limitations that make it difficult to fully integrate into existing markets, such as licensing mechanisms, legal packaging, slower settlement processes, or non-standard collateral behavior. In previous designs, accommodating these differences required either sacrificing the core market or completely isolating liquidity. In version v4, these limitations can exist within a Spoke, with strict limits and custom rules, while still leveraging shared liquidity.

In earlier versions, changing risk assumptions often required migrating markets or coordinating liquidity adjustments. In version v4, governance mechanisms operate at the level of limits and rules. Adjustments can be made incrementally, and risks can be increased or decreased without forcing users to take action. This reduces governance costs and minimizes the cost of errors.

Over time, this will bring different growth patterns to the Aave protocol.

Aave no longer scales by launching more markets and attracting isolated liquidity; instead, it scales by increasing the utility of its balance sheet. Since liquidity no longer needs to be pre-allocated to specific markets and is idle when demand shifts to other markets, capital efficiency improves.

The result is a DeFi protocol that resembles a financial system more closely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。