"As long as you don't invest in Crypto, you can make money elsewhere."

Recently, the cryptocurrency market and other global markets seem to be experiencing a stark contrast.

In 2025, gold rose over 60%, silver skyrocketed 210.9%, and the U.S. Russell 2000 index increased by 12.8%. Meanwhile, Bitcoin, after a brief new high, closed the year with a decline.

Entering 2026, the divergence is intensifying. On January 20, gold and silver hit new highs again, the U.S. Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and the A-share Sci-Tech 50 index saw a monthly increase of over 15%. However, Bitcoin experienced another five consecutive days of decline on January 20, dropping from $98,000 back to $91,000 without looking back.

Silver's performance over the past year

Funds seem to have decisively left the cryptocurrency market after October 11, with BTC oscillating below the $100,000 mark for over three months, and the market has entered a period of "the lowest volatility ever."

Disappointment is spreading among cryptocurrency investors. When asked about making money in other markets after leaving Crypto, they even shared the "secret" of "ABC"—"Anything But Crypto," meaning as long as you don't invest in Crypto, you can make money elsewhere.

The "Mass Adoption" that everyone anticipated in the last round seems to have indeed arrived. However, it is not the widespread adoption of decentralized applications that everyone expected, but rather a thorough "assetization" dominated by Wall Street.

This round, the establishment in the U.S. and Wall Street are embracing Crypto like never before. The SEC has approved a series of Bitcoin spot ETFs from BlackRock, Fidelity, and others; BlackRock and JPMorgan have allocated assets to Ethereum; the U.S. government has established a national strategic Bitcoin reserve through legislation; several states' pension funds have invested in Bitcoin; the SEC chairman has publicly stated that U.S. stocks will be on-chain within two years; and even the New York Stock Exchange (NYSE) has announced plans to launch its own cryptocurrency trading platform.

So the question arises: why, after Bitcoin has received so much political and capital endorsement, does its price perform so disappointingly while precious metals and stock markets are hitting new highs?

When cryptocurrency investors have become accustomed to watching pre-market U.S. stock prices to judge the ups and downs of the cryptocurrency market, why is Bitcoin not following the upward trend?

Why is Bitcoin so weak?

Leading Indicator

Bitcoin is a "leading indicator" of global risk assets, as repeatedly mentioned by Raoul Pal, founder of Real Vision, in many of his articles. This is because Bitcoin's price is purely driven by global liquidity and is not directly affected by any country's financial reports or interest rates, so its volatility often leads that of mainstream risk assets like the Nasdaq index.

According to data from MacroMicro, Bitcoin's price turning points have often preceded those of the S&P 500 index in recent years. Therefore, once Bitcoin, as a leading indicator, stagnates in its upward momentum and fails to reach new highs, it constitutes a strong warning signal that the upward momentum of other assets may also be nearing exhaustion.

Liquidity Tightening

Secondly, Bitcoin's price remains highly correlated with the net liquidity of global dollars to this day. Although the Federal Reserve has lowered interest rates in 2024 and 2025, the quantitative tightening (QT) that began in 2022 continues to withdraw liquidity from the market.

Bitcoin's new high in 2025 was more due to new funds brought in by ETFs, but this did not change the fundamental pattern of tightening global macro liquidity. Bitcoin's sideways movement is a direct response to this macro reality. In an environment lacking money, it is difficult for it to initiate a super bull market.

Moreover, the world's second-largest source of liquidity—the yen—has also begun to tighten. The Bank of Japan raised its short-term policy interest rate to 0.75% in December 2025, the highest level in nearly 30 years. This directly impacts an important source of funding for global risk assets over the past few decades: the yen carry trade. Historical data shows that since 2024, the Bank of Japan's three interest rate hikes have been accompanied by Bitcoin price declines of over 20%. The synchronized tightening by the Federal Reserve and the Bank of Japan has exacerbated the global liquidity environment.

Bitcoin's decline during each interest rate hike in Japan

Geopolitical Conflicts

Finally, the potential "black swan" of geopolitical tensions is keeping the market on edge, and a series of actions by Trump in early 2026 has pushed this uncertainty to new heights.

Internationally, the actions of the Trump administration are filled with unpredictability. From military intervention in Venezuela and the unprecedented capture of its president to renewed war threats with Iran; from attempts to forcibly purchase Greenland to issuing new tariff threats against the EU. This series of radical unilateral actions is intensifying great power conflicts.

Domestically in the U.S., his actions have sparked deep public concern over a constitutional crisis. He has not only proposed renaming the "Department of Defense" to the "Department of War," but has also ordered active-duty troops to prepare for potential domestic deployments.

These actions, combined with his previous hints of regretting not using military force and his unwillingness to accept defeat in the midterm elections, have made public concerns increasingly clear: will he refuse to accept defeat in the midterm elections and use force to secure re-election? This speculation and pressure are already exacerbating internal conflicts in the U.S., with signs of expanding protests in various locations.

Last week, Trump invoked the Insurrection Act and deployed troops to Minnesota to quell protests, and the Pentagon has ordered about 1,500 active-duty soldiers stationed in Alaska to be on standby.

The normalization of such conflicts is dragging the world into a "gray area" between localized wars and a new Cold War. Traditional full-scale hot wars have relatively clear paths and market expectations, and have even been accompanied by liquidity "rescue" measures.

The destructive power of these localized conflicts lies in their extreme uncertainty, filled with "unknown unknowns." For risk capital markets that heavily rely on stable expectations, this uncertainty is fatal, significantly raising the market's risk premium. When large capital cannot assess future directions, the most rational choice is to increase cash holdings and wait on the sidelines, rather than allocate funds to high-risk, high-volatility assets.

Why aren't other assets falling?

In stark contrast to the silence in the cryptocurrency market, since 2025, precious metals, U.S. stocks, and A-shares have been rising in succession. However, the rise in these markets is not due to an overall improvement in macro and liquidity fundamentals, but rather a structural market driven by sovereign will and industrial policy against the backdrop of great power competition.

The rise in gold is a response from sovereign nations to the existing international order, rooted in the cracks of trust in the dollar system. The 2008 global financial tsunami and the 2022 freezing of Russian foreign exchange reserves completely shattered the "risk-free" myth of the dollar and U.S. Treasuries as the ultimate global reserve assets. In this context, global central banks have become "price-insensitive buyers." They buy gold not to make short-term profits, but to find a means of ultimate value storage that does not rely on any sovereign credit.

Data from the World Gold Council shows that in 2022 and 2023, global central banks net purchased over 1,000 tons of gold for two consecutive years, setting a historical record. This round of gold's rise is primarily driven by official forces, rather than market-driven speculative forces.

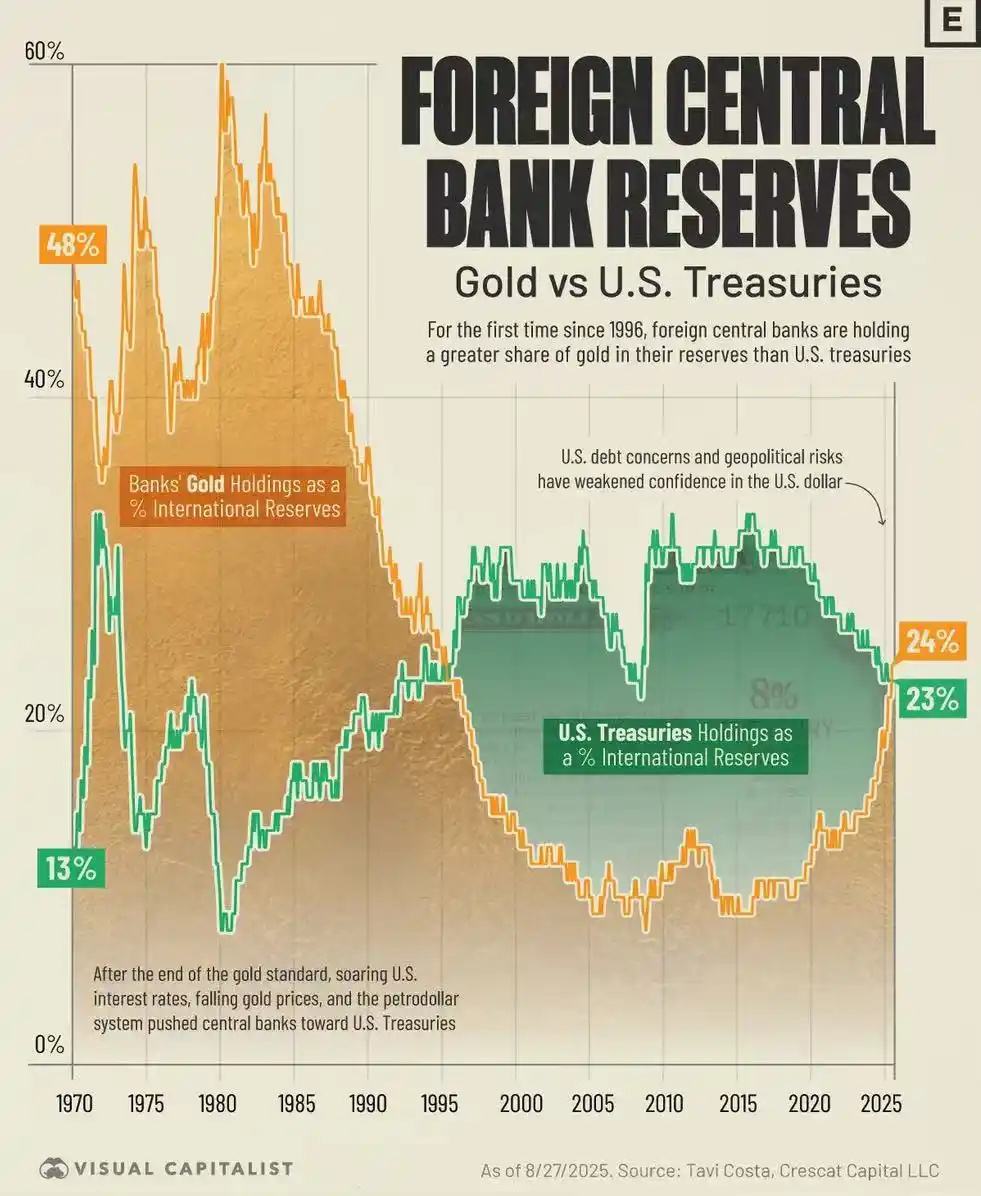

Comparison of gold and U.S. Treasury holdings in sovereign central bank reserves; by 2025, total gold reserves have surpassed U.S. Treasuries.

The rise in the stock market reflects national industrial policies. Whether it is the U.S. "AI nationalization" strategy or China's "industrial autonomy" policy, it represents a deep intervention and direction of capital flows by national power.

In the U.S., through the CHIPS and Science Act, the artificial intelligence industry has been elevated to a strategic level of national security. Funds have noticeably flowed out of large tech stocks and into smaller growth stocks that align with policy directions.

In the Chinese A-share market, funds are also highly concentrated in areas closely related to national security and industrial upgrades, such as "Xinchuang" and "defense and military industry." This government-led market trend has a pricing logic that is fundamentally difficult to reconcile with Bitcoin, which relies purely on market liquidity.

Will history repeat itself?

Historically, Bitcoin has not been the first time to show divergence from other assets. Each time this divergence has occurred, it has ultimately ended with a strong rebound in Bitcoin.

Historically, Bitcoin's relative strength index (RSI) against gold has fallen below 30 in extreme oversold conditions four times: in 2015, 2018, 2022, and 2025. Each time Bitcoin was extremely undervalued relative to gold, it signaled a subsequent significant rebound.

In 2015, at the end of a bear market, Bitcoin's RSI against gold fell below 30, leading to the super bull market of 2016-2017.

In 2018, during a bear market, Bitcoin fell over 40%, while gold rose nearly 6%. After the RSI fell below 30, Bitcoin rebounded over 770% from its 2020 low.

In 2022, during a bear market, Bitcoin fell nearly 60%. After the RSI fell below 30, Bitcoin strongly recovered in early 2024 and 2025, once again outperforming gold.

From the end of 2025 to now, we are witnessing this historic oversold signal for the fourth time. Gold surged 64% in 2025, while Bitcoin's RSI against gold has once again fallen into the oversold range.

Historical performance of Bitcoin/Gold, with the RSI indicator below.

Can we still chase other assets?

In the clamor of "ABC," easily selling off crypto assets to chase the currently more prosperous markets may be a dangerous decision.

When small-cap U.S. stocks begin to lead the rally, it often marks the last frenzy before liquidity exhaustion at the end of a bull market. The Russell 2000 index has risen over 45% since its low in 2025, but most of its constituent stocks have poor profitability and are highly sensitive to interest rate changes. Once the Federal Reserve's monetary policy falls short of expectations, the vulnerabilities of these companies will be immediately exposed.

Secondly, the enthusiasm for the AI sector is showing typical bubble characteristics. Whether it's Deutsche Bank's survey or warnings from Bridgewater founder Ray Dalio, the AI bubble is cited as the biggest risk for the market in 2026. The valuations of star companies like Nvidia and Palantir have reached historical highs, and there is increasing skepticism about whether their earnings growth can support such high valuations. A deeper risk lies in the massive energy consumption of AI, which could trigger a new wave of inflationary pressure, forcing central banks to tighten monetary policy and burst the asset bubble.

According to a January survey by Bank of America, global investor optimism has reached a new high since July 2021, with expectations for global growth soaring. The cash holding ratio has dropped to a historic low of 3.2%, and protective measures against market corrections are at their lowest level since January 2018.

On one side are the wildly rising sovereign assets and generally optimistic investor sentiment; on the other side are escalating geopolitical conflicts.

In this broader context, Bitcoin's "stagnation" is not simply a matter of "underperforming the market." It serves more as a sobering signal, a pre-warning of greater risks ahead, and a buildup of strength for a more significant narrative shift.

For true long-termists, this is precisely the moment to test their beliefs, resist temptation, and prepare for the impending crisis and opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。