Original Author: Gino Matos

Original Translation: Deep Tide TechFlow

Introduction: Against the backdrop of global macroeconomic fluctuations and intensified geopolitical games, Philip Lane, the Chief Economist of the European Central Bank (ECB), has issued a rare warning: the "tussle" between the Federal Reserve and political forces may jeopardize the international status of the dollar.

This article delves into how such political pressure is transmitted to global financial markets through term premiums and explains why, at a time when this credit system is shaking, Bitcoin may become the last refuge for investors.

The author combines multidimensional data such as U.S. Treasury yields, inflation expectations, and the stablecoin ecosystem to dissect the two distinctly different macro paradigms that Bitcoin may face in the future.

The main text is as follows:

Philip Lane, the Chief Economist of the European Central Bank (ECB), has issued a warning that most market participants initially regarded as an internal "household matter" for Europe: while the ECB can currently maintain its accommodative path, the "tussle" surrounding the Federal Reserve's independence may lead to global market turmoil by pushing up U.S. term premiums and triggering a reassessment of the dollar's role.

Lane's framing is crucial as it identifies several specific transmission channels that have the most significant impact on Bitcoin: real yields, dollar liquidity, and the credibility framework supporting the current macro system.

The direct trigger for the recent market cooling is geopolitical. As concerns over the U.S. crackdown on Iran have eased, the risk premium for crude oil has weakened. As of the time of writing, Brent crude has fallen to about $63.55, and West Texas Intermediate (WTI) has dropped to about $59.64, retreating approximately 4.5% from the high on January 14.

This has at least temporarily severed the chain reaction from geopolitical events to inflation expectations and then to the bond market.

However, Lane's comments point to another risk: it is not supply shocks or growth data, but rather political pressure imposed on the Federal Reserve that may force the market to reassess U.S. assets based on governance factors rather than fundamentals.

The International Monetary Fund (IMF) has also emphasized in recent weeks that the independence of the Federal Reserve is crucial, noting that a weakening of this independence would have a "negative impact on credit ratings." This institutional risk often manifests in term premiums and foreign exchange risk premiums before it makes headlines.

Term premiums are a part of long-term yields that compensate investors for the uncertainty and term risk they face, independent of expected future short-term interest rates.

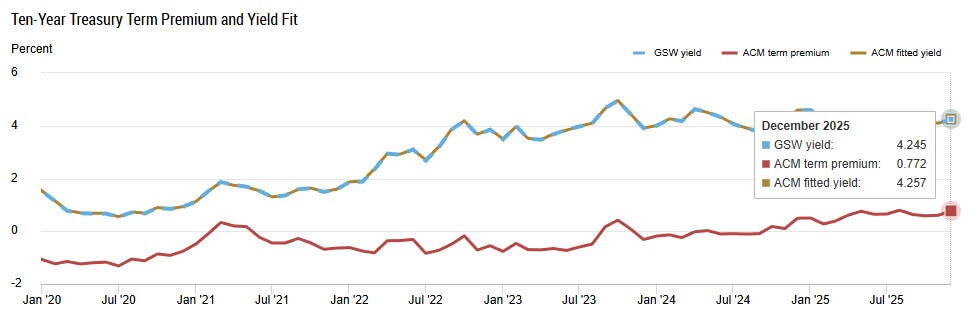

As of mid-January, the New York Fed's ACM term premium remained around 0.70%, while the St. Louis Fed's 10-year zero-coupon valuation was about 0.59%. On January 14, the nominal yield on 10-year Treasuries was approximately 4.15%, the real yield on 10-year Treasury Inflation-Protected Securities (TIPS) was 1.86%, and the 5-year breakeven inflation expectation (as of January 15) was 2.36%.

By recent standards, these figures are within a stable range. However, Lane's core argument is that if the market begins to factor in a "governance discount" for U.S. assets, this stability could quickly unravel. The impact of term premiums does not require the Federal Reserve to raise interest rates; it may occur when credibility is damaged, even if policy rates remain unchanged, leading to higher long-end yields.

Caption: The 10-year U.S. Treasury term premium rose to 0.772% in December 2025, the highest level since 2020, at which point the yield reached 4.245%.

The Term Premium Channel as the Discount Rate Channel

Bitcoin exists in the same "discount rate universe" as stocks and other term-sensitive assets.

When term premiums rise, long-end yields climb, financial conditions tighten, and liquidity premiums are compressed. ECB research has documented how the dollar's exchange rate appreciates with the Federal Reserve's tightening across multiple policy dimensions, making U.S. interest rates the core standard for global pricing (pricing kernel).

Historically, the upward momentum of Bitcoin has often stemmed from the expansion of liquidity premiums: when real yields are low, discount rates are loose, and risk appetite is high.

A shock to term premiums can reverse this dynamic without the Federal Reserve changing the federal funds rate. This is why Lane's remarks are significant for cryptocurrencies, even though he was addressing European policymakers at the time.

On January 16, the U.S. Dollar Index (DXY) was around 99.29, close to the lower end of its recent volatility range. However, the "reassessment of the dollar's role" mentioned by Lane opens up two distinctly different scenarios rather than a single outcome.

In the traditional "yield differential" paradigm, rising U.S. yields would strengthen the dollar, tighten global liquidity, and put pressure on risk assets, including Bitcoin. Research shows that since 2020, cryptocurrencies have become more correlated with macro assets, and in some samples, they exhibit a negative correlation with the dollar index.

But under the credibility risk paradigm, the outcomes would diverge: if investors demand a premium for U.S. assets due to governance risks, term premiums may actually rise when the dollar weakens or fluctuates. In this case, Bitcoin's trading attributes would resemble a "safety valve" or alternative currency asset, especially if inflation expectations rise alongside credibility concerns.

Moreover, Bitcoin is now more closely linked to the stock market, artificial intelligence (AI) narratives, and Federal Reserve signals than in previous cycles.

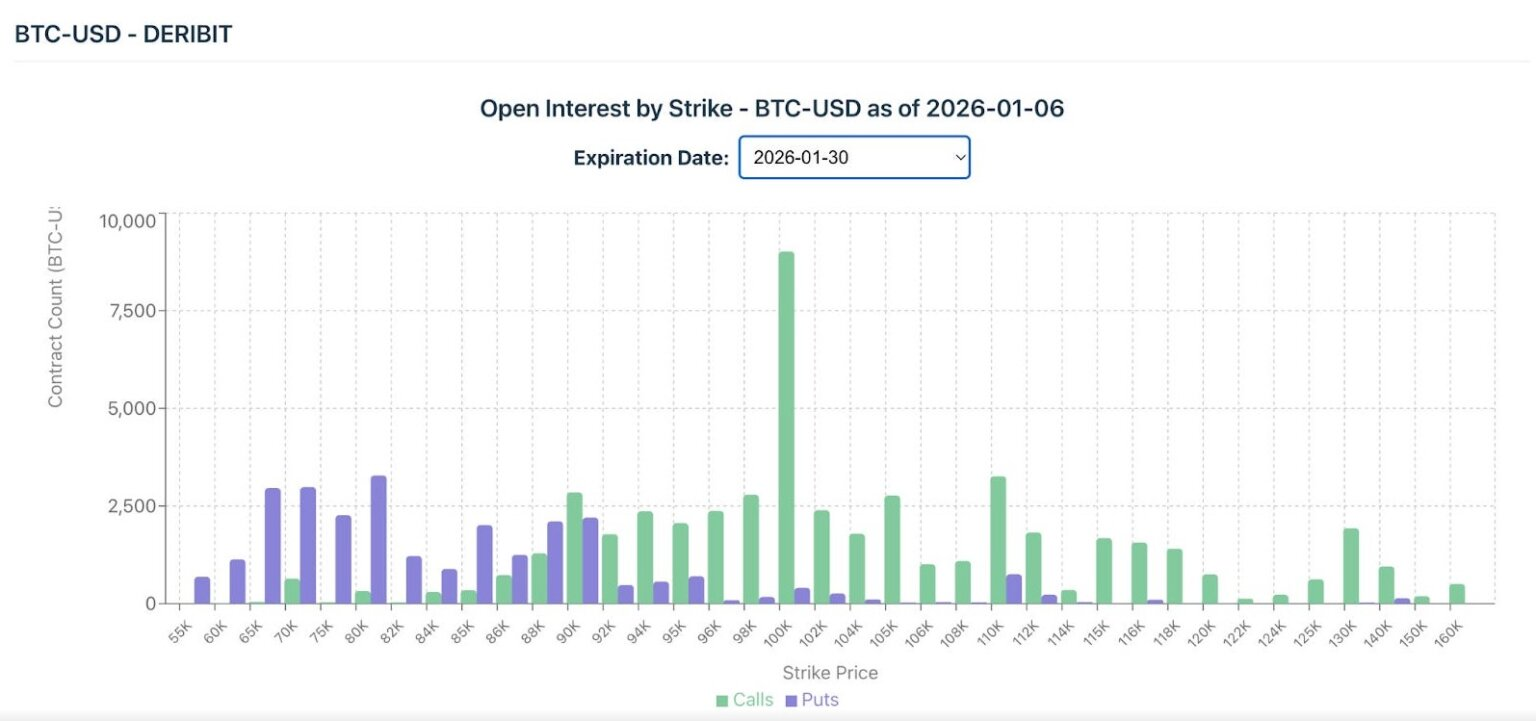

According to data from Farside Investors, Bitcoin ETFs saw a return to net inflows in January, totaling over $1.6 billion. Coin Metrics noted that open interest in spot options is concentrated around the $100,000 strike price expiring at the end of January.

This positioning structure means that macro shocks could be amplified through leverage and gamma dynamics, turning Lane's abstract concerns about "term premiums" into concrete catalysts for market volatility.

Caption: Open interest in Bitcoin options expiring on January 30, 2026, shows over 9,000 call contracts at the $100,000 strike price, indicating high concentration.

The Infrastructure of Stablecoins Makes Dollar Risk "Crypto-Native"

A significant portion of cryptocurrency trading operates on stablecoins pegged to the dollar, which are backed by safe assets (typically U.S. Treasuries).

Research from the Bank for International Settlements (BIS) links stablecoins to the pricing dynamics of safe assets. This means that shocks to term premiums are not merely a "macro atmosphere"; they directly permeate the yields, demand, and on-chain liquidity conditions of stablecoins.

When term premiums rise, the cost of holding duration increases, which may affect the reserve management of stablecoins and alter the liquidity available for risk trading. Bitcoin may not be a direct substitute for U.S. Treasuries, but in the ecosystem where it exists, U.S. Treasury pricing sets the benchmark for defining "risk-free."

Currently, the market estimates about a 95% probability that the Federal Reserve will maintain interest rates at its January meeting, with major banks pushing back the expected timing of rate cuts to 2026.

This consensus reflects confidence in the continuity of recent policies, thereby anchoring term premiums. However, Lane's warning is forward-looking: if this confidence breaks, term premiums could jump by 25 to 75 basis points within weeks, without any change in the federal funds rate.

A mechanical example: if term premiums rise by 50 basis points while expected short-term rates remain flat, the nominal yield on 10-year Treasuries could drift from 4.15% to around 4.65%, with real yields also being repriced accordingly.

For Bitcoin, this means a tightening financial environment, which could bring downside risks through the same channels that squeeze high-duration stocks.

However, if a credibility shock leads to a weakening dollar, entirely different risk characteristics would emerge.

If global investors begin to reduce their holdings of U.S. assets based on governance grounds, the dollar could weaken even if term premiums rise. In this scenario, Bitcoin's volatility would soar, and its trajectory would depend on whether the yield differential paradigm or the credibility risk paradigm dominates at that time.

While there is still debate in academia about Bitcoin's "anti-inflation" properties, under most risk regimes, the dominant channels remain real yields and liquidity, rather than merely breakeven inflation expectations.

Philip Lane's discourse forces us to consider both possibilities simultaneously. This is why "dollar repricing" is not a one-way bet but a systemic fork in the road.

Observation Checklist

The checklist for tracking this situation is very clear:

At the Macro Level:

- Term Premiums

- Real Yields on 10-Year TIPS

- 5-Year Breakeven Inflation Expectations

- Levels and Volatility of the U.S. Dollar Index (DXY)

At the Crypto Level:

- Fund Flows of Bitcoin Spot ETFs

- Options Positions Near Key Strike Prices like $100,000

- Changes in Skew Before and After Major Macro Events

These indicators will link Lane's warning to Bitcoin's price behavior without speculating on the Federal Reserve's future policy decisions.

Lane's signal was initially directed at European markets, but the "pipelines" he described are the same logic that determines Bitcoin's macro environment. The oil premium has faded, but the "governance risk" he pointed out still exists.

If the market begins to price in the political tussle surrounding the Federal Reserve, this shock will not be confined to the U.S. alone. It will transmit globally through the dollar and the yield curve, and Bitcoin's response to such shocks is often more sensitive and anticipatory than most traditional assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。