Written by: Glendon, Techub News

On January 22, the Ethereum ecosystem star project MegaETH will launch its mainnet. Last night, MegaETH tweeted that it will conduct a 7-day global stress test, aiming to achieve a sustained and real transaction volume of 5,000 to 35,000 transactions per second (TPS) during the testing period. During the test, multiple on-chain interactive applications will be launched simultaneously to verify the system's stability under high load.

MegaETH is a high-performance Ethereum Layer 2 blockchain project developed by MegaLabs. As the first fully Ethereum-compatible "real-time blockchain," MegaETH focuses on breaking through the bottlenecks of current Ethereum Virtual Machine (EVM) compatible chains in terms of transaction processing capacity, complex application adaptation, and block generation efficiency. It employs an innovative heterogeneous blockchain architecture and a "super-optimized" EVM execution environment, aiming to achieve sub-millisecond latency (with block times as low as 1-10 milliseconds) and ultra-high throughput of 100,000 TPS.

Looking back over the past year, the Layer 2 sector has generally performed poorly, with low market enthusiasm. However, in October 2025, MegaETH ignited market enthusiasm with a groundbreaking public sale event, quickly becoming one of the most notable projects in the crypto market last year. The final subscription amount for this public sale exceeded $1.39 billion (with an actual cap of $49.95 million), achieving an overall subscription ratio of 27.8 times, attracting over 50,000 investors. Now, with the mainnet launch imminent, what has MegaETH experienced in its development over the past two months?

One month after the public sale ended, MegaETH launched the Beta version of its mainnet, Frontier, in early December, officially opening to the public on the 15th to invite developers to deploy and test applications, while allowing users to track project progress in real-time through explorers and dashboards.

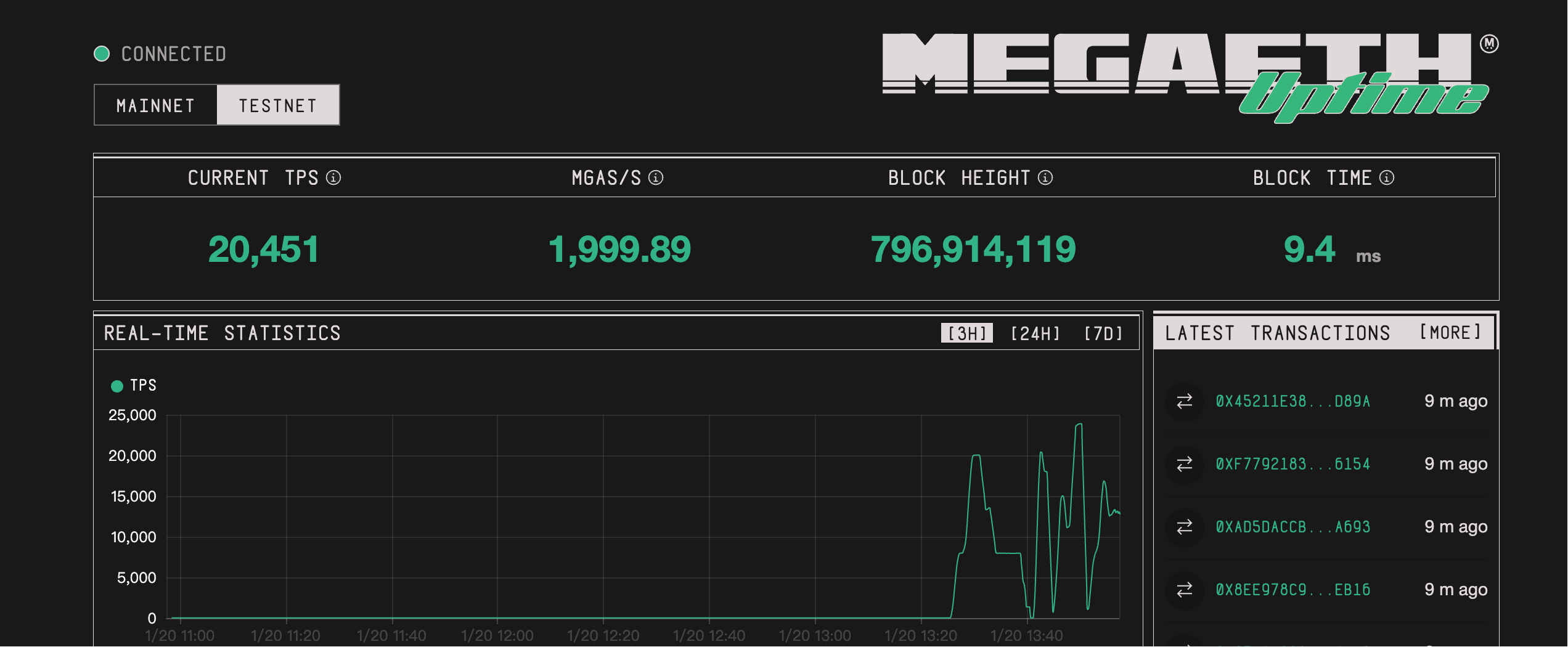

As of the time of writing, MegaETH Uptime website data shows that in the past 3 hours, the MegaETH testnet TPS fluctuated between 2,000 and 24,000, with block generation times ranging from 9 to 11 ms. Although the TPS and block generation speed of the testnet have not fully achieved their set target vision, they have far exceeded existing mainstream L2 solutions on Ethereum.

In terms of business expansion, MegaETH has been active recently, establishing deep collaborations with multiple protocols, with specific progress as follows:

On December 14, MegaETH partnered with the intent-based cross-chain exchange protocol Mayan Finance, enabling quick cross-chain instant exchanges of MegaETH through its bridging function.

On January 5, the stablecoin protocol Cap was successfully deployed on MegaETH. Users can mint cUSD or stcUSD on the Ethereum mainnet and bridge directly to MegaETH through the Cap interface or Stargate.

On January 6, MegaETH integrated the cross-chain infrastructure provider deBridge to provide efficient and stable cross-chain services for users on the first day of the mainnet launch.

Meanwhile, MegaETH's recognition within the industry continues to rise. As early as mid-December, the Aava community released an ARFC proposal to "deploy Aave V3 on MegaETH," intending to deploy Aave V3 on MegaETH, with an initial token list including btc.b, ETH, USDM, cUSD, and iTRY. Earlier this month, Coinbase directly added the MegaETH token MEGA to its listing roadmap. Additionally, on January 13, Grayscale officially released its "Alternative Assets List for Potential Inclusion in Grayscale Investment Products" for Q1 2026, explicitly including MegaETH in the smart contract platform section.

It is evident that although MegaETH's recent popularity has declined compared to the public sale, its business development has been steady. However, during this period, MegaETH also experienced some setbacks.

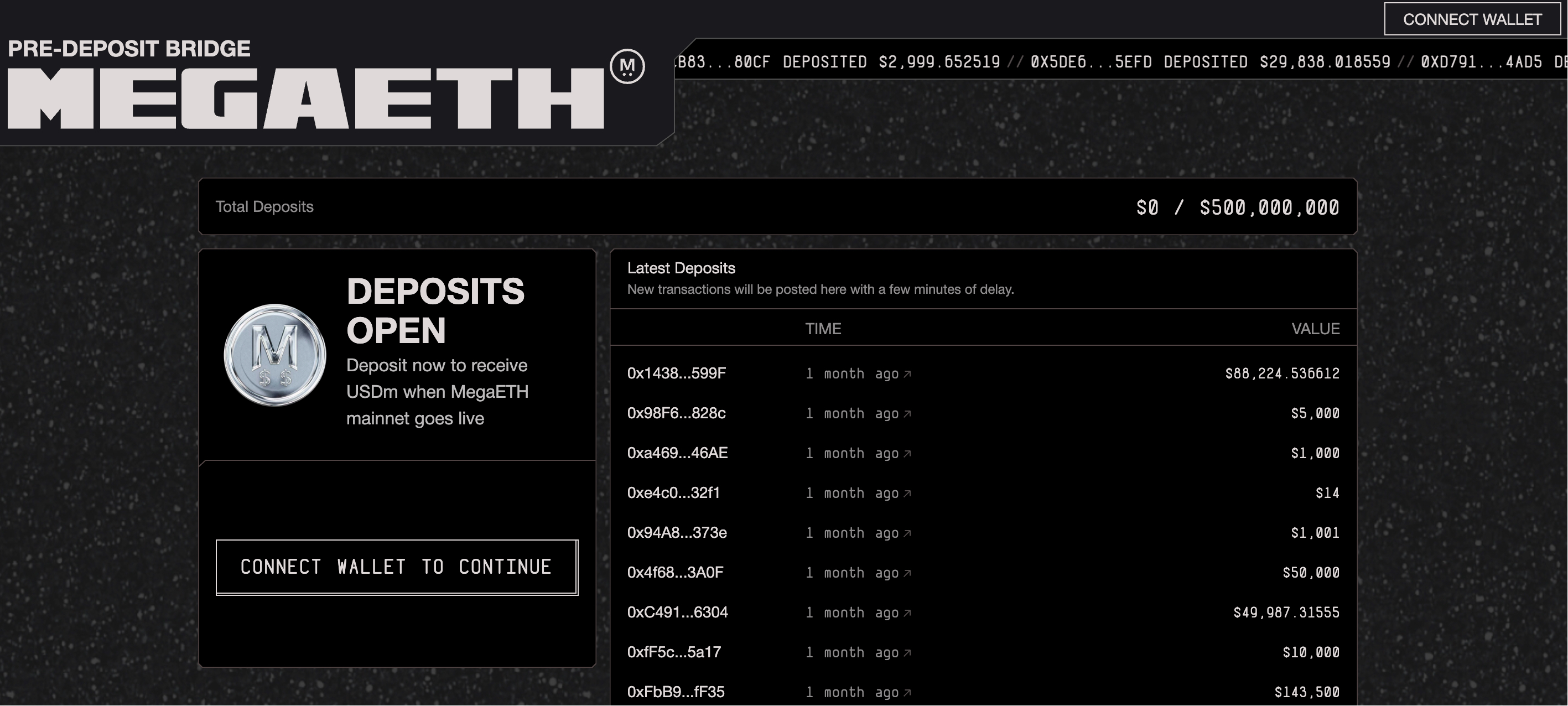

On November 25, MegaETH launched a pre-deposit cross-chain bridge, supporting the cross-chain exchange of Ethereum USDC into MegaETH mainnet USDm, with a cap of $250 million. Deposit users would be able to receive USDm tokens when the MegaETH mainnet launches (note: USDm is the native stablecoin launched in collaboration with DeFi protocol Ethena Labs, aimed at addressing the issue of multiple Layer 2 networks generating revenue by inflating sorting fees).

Unexpectedly, due to the lack of individual account limit rules, the $250 million pre-deposit quota was completely sold out in less than 3 minutes after the USDm pre-deposit channel opened. Consequently, the MegaETH official quickly tweeted to announce that the USDm pre-deposit quota limit would be raised to $1 billion.

However, this move sparked strong dissatisfaction within the crypto community. Community members criticized the arbitrary change in deposit limits and the significant increase in the quota, accusing it of being "too greedy." Nevertheless, the USDm pre-deposit quota still easily reached $500 million.

Fortunately, the MegaETH team quickly recognized the problem. In the early hours of November 26, MegaETH announced that it would no longer pursue the $1 billion cap plan and added a feature allowing users to withdraw funds. Two days later, MegaETH directly terminated the pre-deposit activity, promising to refund all funds raised through the pre-deposit bridge. Thus, this incident came to a close.

In hindsight, MegaETH co-founder brother bing expressed dissatisfaction with the pre-deposit activity, stating that the incident exposed the team's lack of preparedness for alternative plans. The team's original intention was to allow community users to exchange some USDm in advance so that they could interact with on-chain applications as soon as the mainnet launched. However, this good intention was buried by poor execution and incorrect market predictions. He emphasized, "A healthy ecosystem should grow gradually; raising funds too quickly can instead become a pressure on ecological development. Rather than stacking overly high expectations that lead to backlash later, it is better to start over early."

The USDm pre-deposit page shows that the $500 million quota has been completely cleared.

Currently, the countdown to the MegaETH mainnet launch has begun. After more than two months of refinement and development, MegaETH's network technology and ecological construction have made significant progress and are becoming increasingly mature. Its announcement clearly states that the public mainnet will officially open shortly after the global stress test concludes, with a series of USDM-driven applications launching on the first day, covering DeFi and consumer applications to provide users with diverse experiences. Furthermore, MegaETH boldly claims that it will ultimately become the chain with the highest transaction volume among all EVM chains, allowing users to seamlessly use this chain.

It is worth mentioning that currently, the probability of betting on "MegaETH FDV exceeding $1 billion within one day of launch" on Polymarket is 88%, with the prediction market's transaction volume approaching $7.28 million.

It can be seen that MegaETH is steadily advancing towards its established core goals. As the mainnet officially launches, will MegaETH be able to realize its vision of becoming the chain with the highest transaction volume among all EVM chains? Will its ecosystem quickly attract a large number of developers and users, successfully bridging the gap from technical concept to practical application? The answers to these questions may gradually be revealed in the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。