Original author: ChandlerZ, Foresight News

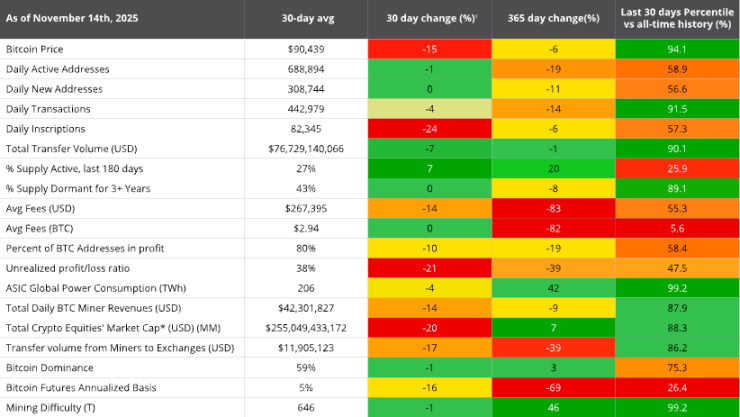

Bitcoin's hash rate has increased by about 10 times since 2020, but there has been a noticeable decline in recent months.

Data shows that the Bitcoin network's hash rate has dropped by about 15% from its peak in October, with miner capitulation lasting nearly 60 days. The network's average hash rate has decreased from about 1.1 ZH/s in October to about 977 EH/s, indicating that miners are shutting down machines or capitulating as profitability declines.

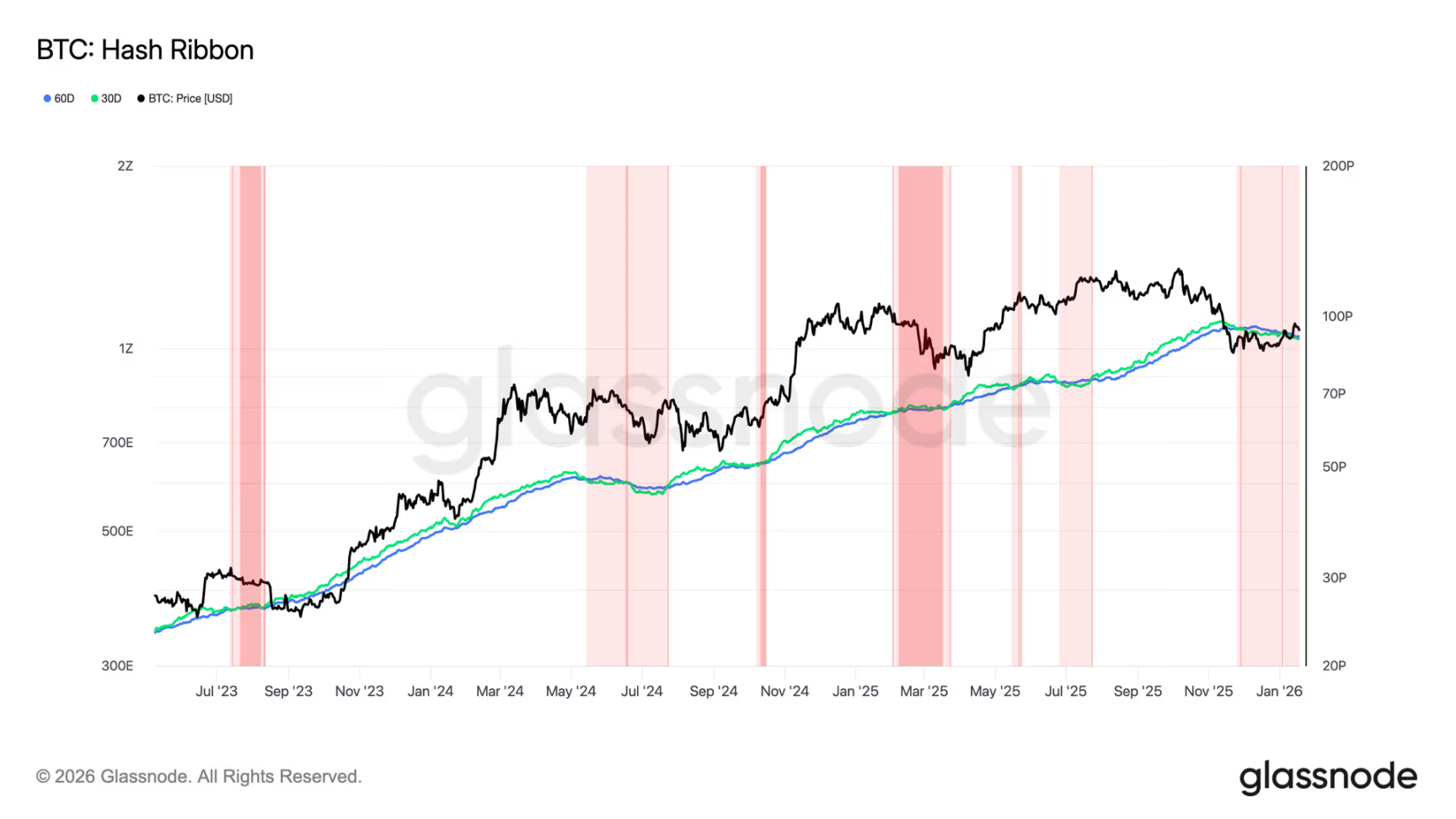

Additionally, Glassnode's Hash Ribbon indicator reversed on November 29, reflecting miner capitulation by tracking short-term and long-term hash rate trends. Currently, short-term supply pressure in the Bitcoin market may further increase, and Bitcoin mining difficulty is expected to see its seventh downward adjustment on January 22, dropping to around 139 T.

Mining profitability has declined for five consecutive months

JPMorgan stated that the Bitcoin network's hash rate is expected to decrease by about 3% month-on-month to 1045 EH/s by December 2025, indicating a slight easing of miner competition, but mining profitability continues to decline.

However, data shows that in December 2025, miners' average daily block reward income per EH/s is $38,700, down 7% from November and down 32% year-on-year, reaching a historical low.

VanEck's report analysis suggests that the Bitcoin mining industry is facing significant pressure. On one hand, the periodic halving of block subsidies causes miners' income to decline in a "stair-step" manner; on the other hand, since 2020, the overall network hash rate has expanded at a compound growth rate of about 62%, forcing miners to continuously invest in CAPEX to increase hash rate to avoid being eliminated. If the price of Bitcoin cannot offset the rising unit costs brought about by the decline in subsidies and the increase in hash rate, miners' profitability will be systematically compressed.

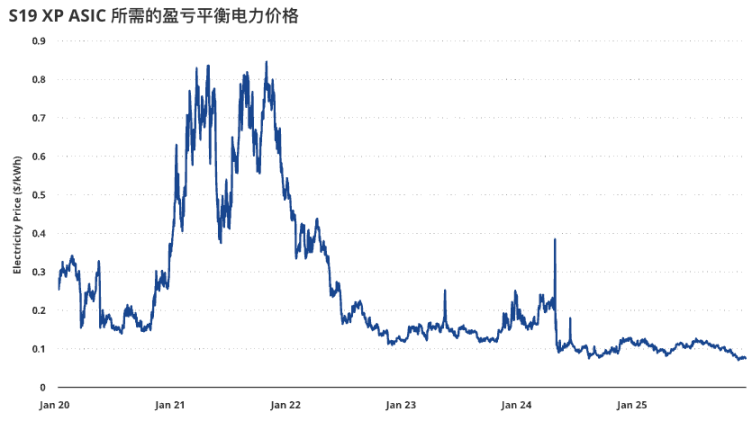

The deterioration of miner profitability can be directly observed from the breakeven electricity price. Taking the 2022 mining machine S19 XP as an example, its breakeven electricity price has decreased from about $0.12 per kWh in December 2024 to about $0.077 per kWh in December 2025, indicating that under the recent backdrop of weakening BTC prices, the marginal economics of mining have significantly worsened, and the industry's reliance on low electricity resources, economies of scale, and operational efficiency has further increased.

Although the overall network hash rate has increased by about 10 times since 2020, the hash rate has decreased by about 4% over the past 30 days based on the 30-day moving average, marking the largest decline since April 2024. At the same time, supply-side disruptions are also affecting hash rate, such as the shutdown of about 1.3GW capacity in mining farms in Xinjiang under regulatory scrutiny, with an estimated 400,000 mining machines offline.

Mining farms actively transforming into AI data centers

A report from Guojin Securities shows that by the third quarter of 2025, the mining costs of U.S. listed companies, including depreciation, have risen to $112,000, exceeding the current Bitcoin price. Cryptocurrency mining companies have power infrastructure near major metropolitan areas that are already electrified and have high communication bandwidth, with electricity costs generally between 3 to 5 cents, making them naturally suitable for AI cloud service businesses. With the growing demand for AI computing power, the transformation of cryptocurrency mining farms into AI data centers is an inevitable choice.

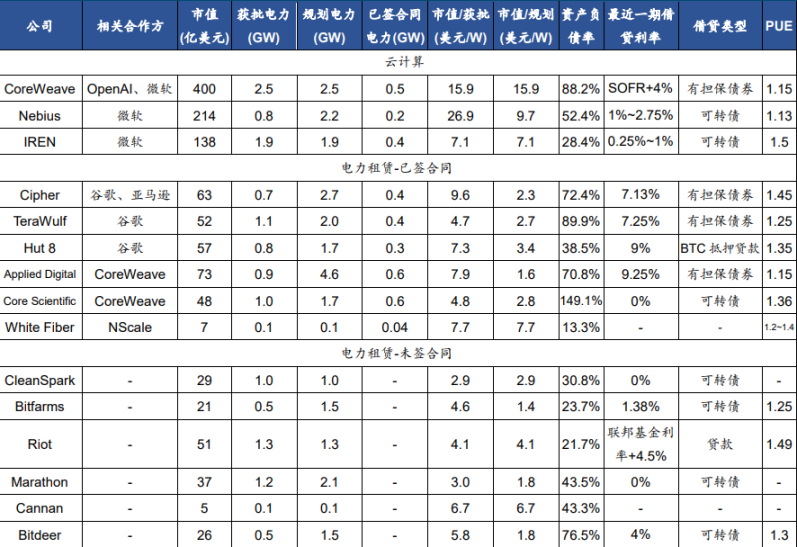

Among 14 major U.S. listed mining companies, it is expected that by 2027, power capacity will reach 15.6GW, with the main business models for transformation being cloud computing leasing and IDC power leasing.

There are mainly two business models for cryptocurrency mining farms transforming into AI data centers.

One is similar to CoreWeave and Nebius, which involves purchasing chips for cloud computing leasing; currently, IREN adopts this business model. IREN's gross power capacity is 2.91GW, corresponding to about 1.9GW of core capacity, with a market value per watt lower than CoreWeave and Nebius, and it has currently partnered with Microsoft for 200MW of core capacity.

The second is similar to the IDC power leasing model, which only rents out the rights to use the data center building and power capacity, with servers and electricity paid for by the tenants. Currently, most cryptocurrency mining farms adopt this hosting model. Some companies have signed leasing contracts with Google, Amazon, CoreWeave, etc., while most other companies, due to late transformation, are still looking for partners.

VanEck: The decline in hash rate may actually be a positive factor

However, the VanEck report also suggests that the decline in hash rate may actually be a positive factor. By comparing the changes in Bitcoin's hash rate over 30 days and the expected returns over the next 90 days since 2014, it shows that when Bitcoin's hash rate declines, the likelihood of positive expected returns is higher than when the hash rate increases. Moreover, when Bitcoin's hash rate declines, the average expected return over 180 days is about 30 basis points higher than when the hash rate increases.

When hash rate compression persists for a long time, positive forward returns tend to occur more frequently and with greater magnitude. Since 2014, during the 346 days when the 90-day hash rate growth was negative, the probability of positive 180-day Bitcoin forward returns was 77%, with an average return of +72%. Additionally, the probability of positive 180-day Bitcoin forward returns is about 61%, with an average return of +48%.

Therefore, historically, purchasing BTC when the 90-day hash rate growth is negative can increase the expected return over 180 days by 2400 basis points.

Even during periods of weak economics, many entities still choose to continue mining. The pressure on short-term profitability and hash rate fluctuations are more likely to lead to accelerated clearing and centralization in the industry, which does not necessarily mean a long-term decline in the mining industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。