On-chain data shows that the risk exposure in the Bitcoin options market is undergoing significant changes at key price levels. Cryptocurrency market analysts warn that this could lead to a substantial amplification of Bitcoin's price volatility.

The latest analysis by on-chain data analyst Murphy indicates that the support strength for Bitcoin in the $88,000 to $90,000 range has significantly weakened.

This change primarily stems from the Gamma risk exposure adjustments of options market makers, where the long-term Gamma in this range has shifted to short-term Gamma, suggesting that the support may disappear.

1. Key Support Lost

● On January 18, 2026, on-chain data analyst Murphy released data showing a significant change in the Bitcoin market structure. The dynamics of the options market at the key price levels of $88,000 and $90,000 have fundamentally shifted.

● Compared to data from January 12, the $88,000 level has shifted from long-term Gamma to short-term Gamma, indicating that the support at this price level has vanished. Although the $90,000 level still maintains long-term Gamma, its Gamma risk exposure has decreased from $1.2 billion to $590 million, nearly halving.

● This change indicates that the support generated by the funding structure in the $88,000 to $90,000 range has significantly weakened. In contrast, the Gamma risk exposure at $92,000 has surged to $1.4 billion, which could amplify Bitcoin's volatility.

2. Market Sentiment Turning Point

Analyst Murphy points out that Bitcoin investor sentiment is shifting from the "Hesitation Zone" to the "Disappointment Zone."

● He explains that Bitcoin price cycles typically go through four emotional stages: Optimism Zone, Profit-Taking Zone, Hesitation Zone, and Disappointment Zone. Current market indicators show that investor sentiment is transitioning from the third stage to the fourth stage.

● Changes in the behavior of large holders corroborate this sentiment shift. From October to December 2025, whale groups holding 100-1,000 Bitcoins actively increased their holdings, followed by whale groups holding 1,000-10,000 Bitcoins taking over the accumulation process.

● However, the mega whales have now stopped accumulating, with some even starting to reduce their holdings, reflecting a lack of investor confidence. Analysts believe the market needs a prolonged recovery or lower prices to attract demand and establish a new bottom consensus.

3. Chip Structure and Price Dynamics

● Despite changes in the funding structure of the options market, Bitcoin's chip structure has not seen significant changes. According to URPD data, a large amount of chips is still accumulated from $87,000 to $92,000, which remains the strongest support zone currently and is not easily broken.

Image Source: AiCoin Membership Product

● After experiencing a decisive correction and consolidation phase, the market enters 2026, with on-chain indicators showing reduced profit-taking pressure and early signs of structural stability at the lower end of the current range.

● Analysts warn that if extreme conditions lead to a breach of the $87,000-$92,000 range, the probability of Bitcoin filling the "gap" below will significantly increase. According to the "double anchor structure" principle, the midpoint is around $72,000 to $74,000.

● Bitcoin broke through a long-term compression at around $87,000 in the first week of 2026, rebounding approximately 8.5% to reach $94,400. This rise was followed by a noticeable cooling of profit-taking pressure in the market.

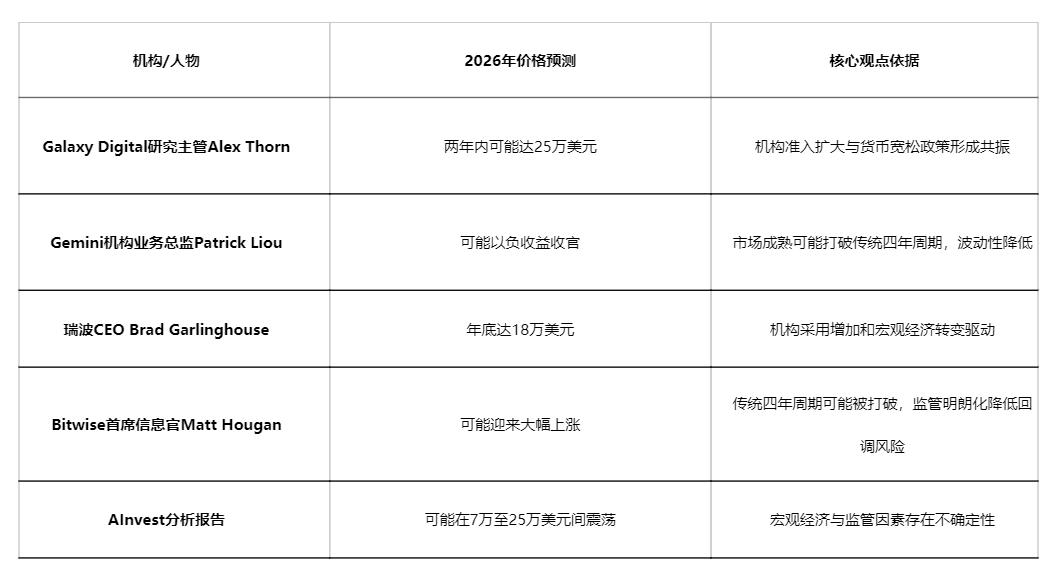

4. Divergence in Institutional Market Outlook

In the face of complex market changes, different institutions show significant divergence in their price outlook for Bitcoin in 2026. The following table summarizes the views of several institutions:

The significant differences in these predictions indicate a high level of uncertainty in the market regarding Bitcoin's trajectory in 2026. In particular, the pricing in the options market shows that by the end of June 2026, the probability of Bitcoin dropping to $70,000 or rising to $130,000 is almost equal; similarly, by the end of 2026, the probabilities of dropping to $50,000 or rising to $250,000 are also close.

5. Options Expiration and Market Impact

The expiration events in the options market have become a significant influencing factor for Bitcoin's price volatility. The first major settlement in 2026 saw the expiration scale of Bitcoin and Ethereum options exceed $2.2 billion.

● On the largest expiration date in December 2025, the settlement amount for Bitcoin options was approximately $23.6 billion, setting a historical record, while the total settlement scale for Bitcoin and Ethereum options on major exchanges reached $28 billion.

● As options approach expiration, the Gamma acceleration effect significantly intensifies, and market-making hedging actions become increasingly aggressive. Market makers and institutional investors continuously adjust their Bitcoin positions to maintain Delta neutrality—buying when prices fall and selling when they rise to keep the market balanced.

● When a large number of call options cluster above the spot price, the maximum pain point price is usually at a high; if put options concentrate below the spot price, the maximum pain point price shifts downward. In January, with $2.2 billion expiring, the market viewed $90,000 as the maximum pain point price, which had a critical impact on Bitcoin's price movement during the expiration window.

6. Structural Changes in the Market

The Bitcoin market is undergoing structural changes, challenging the traditional four-year cycle theory. Bitwise Chief Investment Officer Matt Hougan believes that Bitcoin may break the traditional four-year market cycle and experience explosive growth in 2026.

The reasons behind this change are multifaceted:

● The increasing clarity of U.S. regulations on Bitcoin and cryptocurrencies reduces the risk of significant price corrections;

● Political and macroeconomic changes, particularly interest rate cuts, may stimulate capital to flow into cryptocurrencies and other risk assets earlier than expected.

Market maturity is improving, with the 2025 correction being about 30%, much lower than the historical declines of 75% to 90%. The decrease in implied volatility in the options market also indicates that the investor base is expanding, providing a more sustainable bullish rationale for the asset.

At the same time, the connection between cryptocurrencies and politics is strengthening. It is expected that both major political parties in the U.S. will intensify efforts to gain support from the cryptocurrency community ahead of the midterm elections in 2026, and the stalled Market Structure Bill is likely to gain bipartisan support and pass in early 2026.

As profit-taking pressure eases, prices can continue to rise, but this rebound has now entered a structurally different supply phase. The Gamma risk exposure at $92,000 has surged to $1.4 billion, and analysts warn that this could amplify Bitcoin's volatility. According to URPD data, the $87,000-$92,000 range remains the strongest support zone currently, but if extreme conditions lead to a breach of this range, the probability of Bitcoin filling the "gap" below will significantly increase.

Market analysts whisper as they look at the data curves on their screens: "We are standing at a node of market structure change; the old support has disappeared, and the new balance has yet to form."

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。