Preface: In 2026, the global capital markets are undergoing a milestone transformation. With the New York Stock Exchange (NYSE) and Nasdaq advancing plans to extend trading hours, the traditional concepts of "opening" and "closing" are becoming blurred. This is not just an extension of trading hours, but a new round of competition for global pricing power, liquidity, and settlement efficiency.

I. Core Dynamics: U.S. Stocks Officially Enter "23/5" Around-the-Clock Mode

Currently, major U.S. exchanges have officially entered an ultra-long standby phase, breaking the limitations of physical time:

- Official Confirmation: The NYSE has been approved to extend its electronic trading platform's trading hours to 22 hours each business day. Nasdaq has gone further, applying to implement a 23-hour trading system, leaving only 1 hour for system maintenance.

- Time Window: Trading hours will run from Sunday evening Beijing time until Saturday morning. This means global investors can respond to sudden events at any time, just like trading cryptocurrencies.

II. Deep Transformation: Evolving from T+1 Settlement to a Semi "T+0" Experience

For investors accustomed to A-share rules, the change in trading mechanisms resonates the most:

- Leap in Settlement Efficiency: The U.S. stock market fully implemented the T+1 settlement system in 2024 (meaning that after selling stocks, funds can be settled the next day).

- Addressing Pain Points: Compared to the current "T+1 trading" restrictions in A-shares, the U.S. stock market already supports T+0 trading (intraday reversal trading).

- Sensory Upgrade: With the popularization of 24-hour trading and the real-time upgrade of the clearing system (DTCC), the future settlement experience of U.S. stocks will approach true T+0. This high-frequency, efficient capital turnover capability will greatly enhance market activity, giving participants a stronger sense of "trading control."

III. Chain Reaction: Why Must Hong Kong Stocks "Respond"?

Market predictions suggest that Hong Kong stocks will follow suit within 1-2 years, driven by a brutal liquidity defense battle:

- Preventing "Liquidity Siphoning": Giants like Alibaba and Tencent have comparable assets in the U.S. stock market. If the U.S. stock market achieves around-the-clock trading while Hong Kong stocks still have a gap of several hours, global funds will prioritize flowing into the more liquid and responsive U.S. market to avoid overnight risks.

- International Central Position: Achieving synchronized trading with Europe and the U.S. is an inevitable choice to maintain Hong Kong's competitiveness as an international financial center.

IV. Investment Logic: From "Blind Guessing" to "Real-Time Hedging"

The extension of trading hours will fundamentally change the competitive ecology between A-share and Hong Kong stock investors:

- Eliminating Weekend Information Gaps: In the past, policy benefits or geopolitical crises that erupted over the weekend could only be digested on Monday morning through "gaps." In the future, the performance of U.S. stocks on Sunday evening will become the most intuitive "weather vane."

- Increased Certainty: Before the Monday opening of A-shares, investors can more rationally assess risks by observing the real-time performance of U.S. stocks, significantly reducing blind following.

V. Correlation of Price Movements: Deep Financial Transmission Mechanism

Under the ultra-long trading model, the market exhibits the following patterns:

Follow-Up Effect: When U.S. stocks rise due to positive news, it usually indicates a warming of global risk appetite (Risk-on), which will drive offshore markets like Hong Kong stocks to rise in tandem.

Risk of Overselling: It is worth noting that if U.S. stocks plummet first, Hong Kong stocks often experience larger declines.

- Reason 1: When global funds incur losses in U.S. stocks, they often sell off more liquid Hong Kong stock assets to replenish margin (Margin Call).

- Reason 2: The Hong Kong dollar is pegged to the U.S. dollar, and significant fluctuations in U.S. stocks often coincide with tightening U.S. dollar liquidity, which can exert dual pressure on Hong Kong stock valuations.

VI. Conclusion: More Transparent, Yet More Brutal

Around-the-clock trading and shortened settlement cycles mark the arrival of a "fast-paced, high-transparency" era. For investors, this not only means more flexible risk avoidance but also that the competition will be more real-time.

Are you ready to welcome the T+0 era without time differences?

Is Bybit TradFi the tool for this bull market?

1. Settle in USDT, Say Goodbye to Complicated Currency Exchange

No need to find offshore accounts or wait for lengthy cross-border remittances. Directly use the USDT in your account to buy gold (XAUUSD+), silver (XAGUSD+), and leading U.S. stocks in seconds.

2. Unified Account: Doubling Asset Utilization

With Bybit's UTA (Unified Trading Account), your contract margin can be shared with TradFi assets. Capture the volatility of cryptocurrencies with one hand and hedge gold's stability with the other—one set of funds, two sources of income.

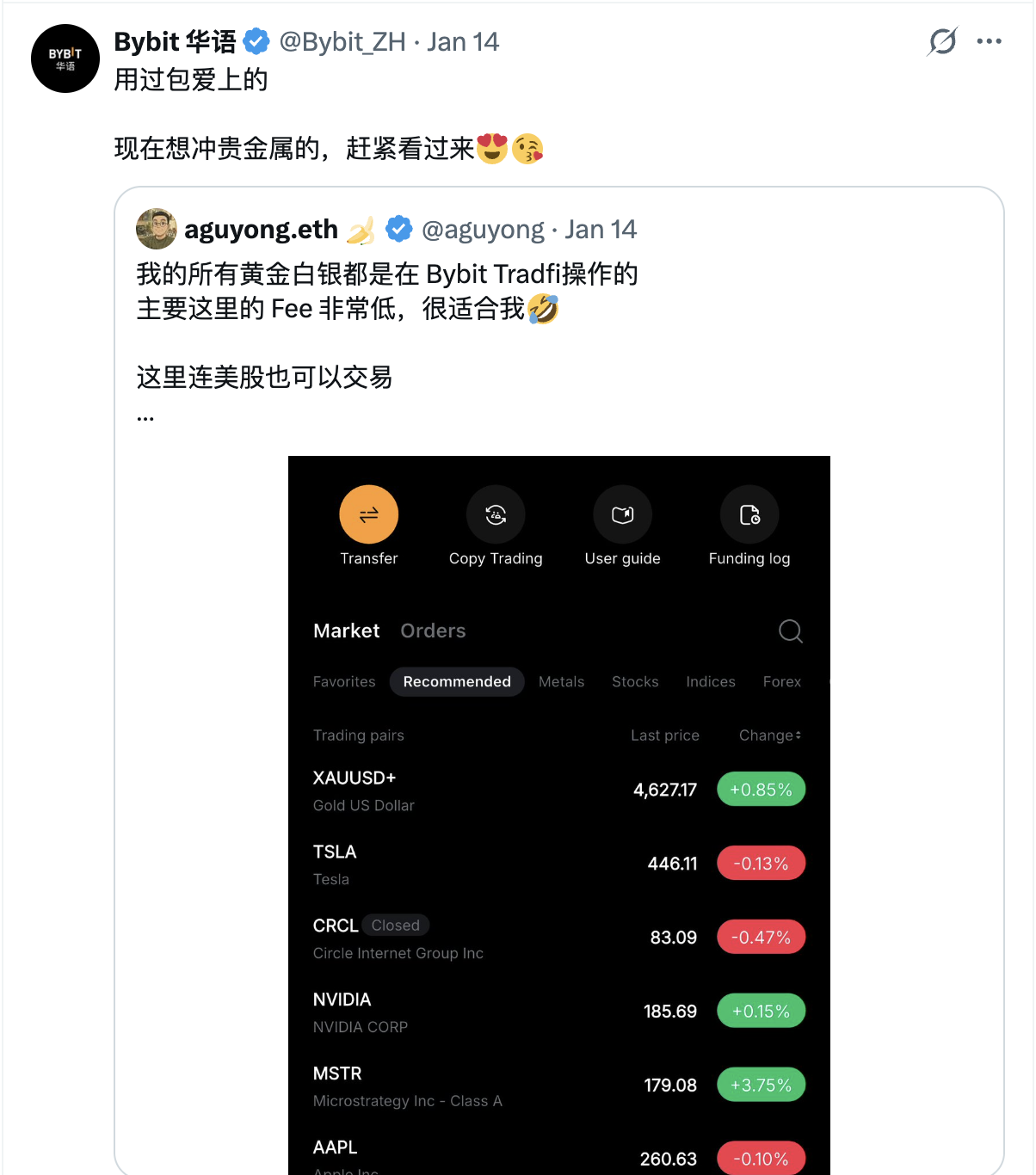

3. Extremely Low Fees, Institutional-Level Experience

As shown in the screenshot, Bybit TradFi has optimized rates specifically for high-frequency and retail traders. Compared to the various fees deducted by traditional brokers, the savings here are profits!

4. 24-Hour Around-the-Clock Opportunity Capture

When traditional markets are closed, you can adjust your positions at any time, ensuring precise strikes during the golden hours of market fluctuations.

Exclusive Benefits: Join Now and Get Up to $30,100

To help new and existing users prepare for the 2026 bull market, Bybit has launched an epic welcome event! Register through the exclusive link below to enjoy the following packages:

- $100 registration experience bonus (given upon account opening)

- Up to $30,000 deposit cashback (the more you deposit, the more you get)

- VIP Upgrade benefits, with additional discounts on fees!

Click the link below to start your all-asset trading journey (long press the link to copy and open in your browser)

https://jump.do/zh-Hans/xlink-proxy?id=15

In today's highly developed financial tools, "cognition" and "tools" are the keys to widening the wealth gap. Don't let your USDT sit idle in your account; quickly allocate some to "hard currency"!

Disclaimer: The above content is compiled from online information and does not constitute investment advice. Cryptocurrency investment carries high risks; please make cautious decisions.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Bybit Benefits Group:

https://aicoin.com/link/chat?cid=7JmRjnl3w

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。