Original Title: "NYSE Plans to Launch 24/7 Stock Tokenization Trading, Competitors Are Stunned"

Original Author: Wenser, Odaily Planet Daily

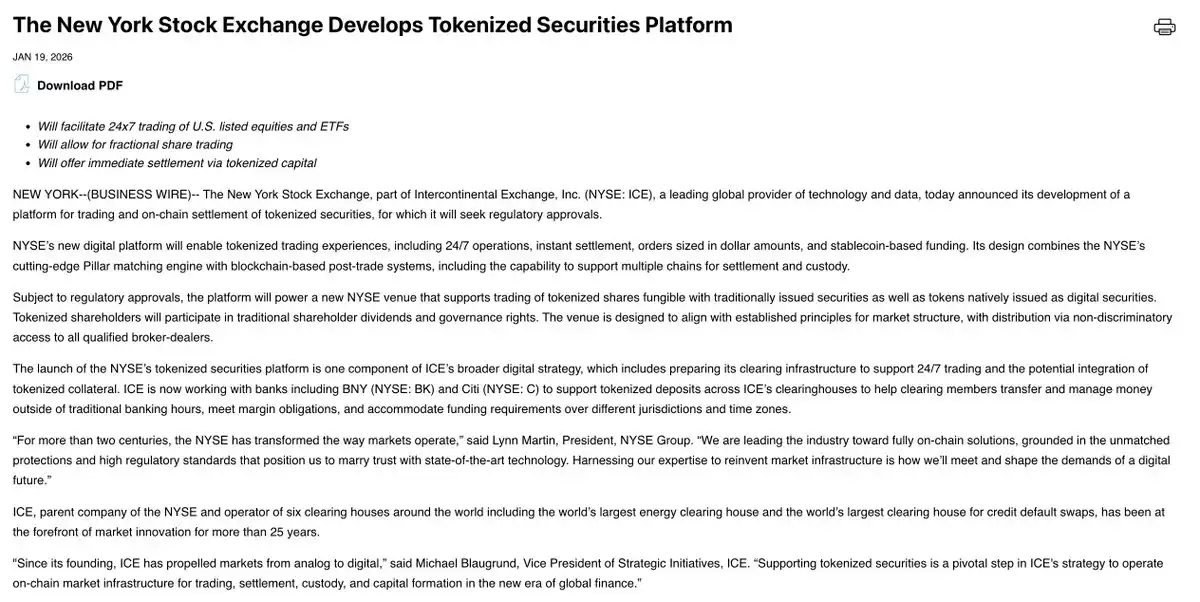

The "Flash Crash Monday" has not yet ended, and just now, the crypto market is hit with a heavy bombshell—according to multiple media sources, the NYSE plans to launch a tokenized securities trading and on-chain settlement platform that supports 24/7 trading. After investing $2 billion in Polymarket last year, the ICE Group is once again leveraging its securities trading platform to join the wave of cryptocurrency transformation. It is worth mentioning that as early as last September, competitor Nasdaq had submitted a tokenized stock trading application to the SEC, and the NYSE's change is also interpreted as a response to competition among securities trading platforms.

The NYSE is not sitting idle: A more aggressive "On-Chain Tokenization Solution" than Nasdaq

After Trump took office, the regulatory environment for cryptocurrencies in the U.S. changed, leading to a flourishing development of crypto IPOs, stablecoins, PayFi, and DeFi, sweeping away the policy shadows of the Biden administration. According to statistics, last year, the trading volume of stablecoins reached $33 trillion, a staggering 72% year-on-year increase, behind which Tether and Circle, the two stablecoin issuers, reaped substantial revenue profits, representing a massive liquidity that could guide into the stock securities market.

Moreover, unlike Nasdaq's tokenized stock trading application submitted to the SEC last September, nearly half a year later, the NYSE's actions regarding "stock tokenization trading" are not just an application to regulatory authorities but a complete "on-chain solution."

Specifically, the NYSE's "On-Chain Tokenization Solution" includes the following three aspects:

It is a tokenized securities trading and on-chain settlement platform that plans to support 24/7 trading of U.S. stocks and ETFs, fractional trading, stablecoin-based fund settlement, and instant delivery, integrating the existing matching engine of the NYSE with a blockchain settlement system.

According to the NYSE's plan, tokenized stocks will have the same dividends and governance rights as traditional securities.

The NYSE's parent company, ICE, is also collaborating with banking giants like BNY Mellon and Citigroup to explore tokenized deposit and clearing infrastructure to support cross-timezone, round-the-clock fund and margin management.

In comparison, if Nasdaq's application for stock tokenization seems like a "new bottle for old wine" made in response to policy, then the NYSE's plan resembles a "new retail trading platform" that connects all aspects of "brewing, packaging, distribution, and recycling."

Most importantly, the NYSE's "stock tokenization" trading platform supports 24/7 trading, which was originally one of the advantages of various cryptocurrencies over securities stocks. Now, this advantage becomes a joke in the face of the massive asset targets and liquidity possessed by one of the world's largest stock trading platforms, the NYSE.

As a result, there are some pessimistic views in the crypto market: "The RWA track of the cryptocurrency market and the increasingly tightening liquidity will face the harshest 'father'; compared to the NYSE with an annual trading volume exceeding $100 trillion, crypto RWA projects can almost be said to be nonexistent."

How crypto practitioners view it: Mixed impacts, the past is the past, the present is the present

In 1792, 24 securities brokers signed the Buttonwood Agreement under a sycamore tree outside 68 Wall Street in New York, marking the birth of the NYSE's predecessor. At that time, limited investment targets and market activity meant that stock trading hours were flexible, with no strict continuous trading periods, and brokers mainly traded through auctions or informal methods.

On March 8, 1817, the organization officially changed its name to the New York Stock Exchange by drafting a charter.

In May 1887, the NYSE standardized stock trading hours to "Monday to Friday: 10:00 AM to 3:00 PM; Saturday: 10:00 AM to 12:00 PM."

In 1952, Saturday trading was officially canceled.

In 1985, the stock trading opening time was moved to 9:30 AM, and closing was extended to 4:00 PM, forming the current 9:30–4:00 period, which has lasted for about 41 years.

**If the NYSE's application for 24/7 tokenized stock trading is approved, it means that this "limited trading model" that has lasted for decades or even centuries will soon become history. From this perspective, *the crypto market gains high recognition from the mainstream financial community.*

Proponents' View: The Era Train is Rushing In

BTC OG and BankToTheFuture founder Simon Dixon stated, "Nothing can stop this (era) train. Tokens are IOUs for actual assets held by custodians, complementing DTCC claims. 24/7 trading can be achieved without tokens. This is an upgraded version of monitoring the state. You will own nothing but feel happy." The accompanying image shows BlackRock CEO Larry Fink embracing Coinbase CEO Brian Armstrong.

Indian crypto KOL Open4profit expressed, "This will allow the market to react immediately to global news; AI and algorithms will play a greater role in pricing and risk management; this is a significant change for the stock market, so pay close attention to liquidity changes."

Marcin, co-founder of Redstone DeFi, sees "entrepreneurial opportunities," stating, "This is a good start and aligns with what we are going to do next."

Jake O, head of Wintermute OTC business, also highly affirmed this matter: "Traditional infrastructure can extend trading hours but cannot solve T+1/2 friction, nor eliminate the rent-seeking behavior that increases costs and delays. Ironically, cryptocurrencies solved this problem years ago: 24/7 trading, instant settlement, global access, no gatekeepers or (traditional bank) data fees. Integration is imperative: equity trading on-chain, settlement achieving atomization, the boundary between 'crypto' assets and 'traditional' assets will completely disappear. Welcome to the 21st century…"

Of course, some see it as an opportunity, while others view it as a threat.

Opponents' View: Trading Platforms Reap Profits, While the New Generation Suffers

Unlike the industry’s belief that the NYSE's move will stimulate the development of the crypto market and promote the popularization of cryptocurrencies, some insiders also see potential issues.

LouisT, a partner at investment firm L1D, stated, "The entire global financial system is migrating on-chain, but for some reason, they don't seem to be bidding for our 'bear drug' tokens." In other words, the traditional financial market does not buy into the so-called RWA assets of cryptocurrencies.

The founder of MoonRock Capital expressed concern for the younger generation's living conditions: "This is not good news for the baby boomer generation; your lives have become more difficult." This likely refers to the fact that compared to the previous generation with significant incremental opportunities, the baby boomer generation faces a more complex investment environment and a 24/7 "liquidity gaming stage."

BingX advisor Nebraskangooner also raised his doubts: "Why allow the stock market to trade 24 hours? No one wants this except trading platforms. (The only benefit) is that there is no interference from after-hours trading, and stop-loss and take-profit points can truly take effect. I wonder what impact this will have on stock price movements after earnings reports?" This viewpoint emphasizes the impact of information and the profits of trading platforms.

Summary: Traditional Finance and Crypto Native Groups Still Have a Gap, Opportunities for Users and Entrepreneurs Remain

Finally, I would like to briefly share my personal views based on the above information:

First, based on the current information, the NYSE's related application may be approved as early as the end of 2026, with the main approval authority still being the U.S. SEC, which presents an important time difference for crypto platforms.

Second, the main service targets of the NYSE's stock tokenization trading and on-chain settlement platform are likely still conventional investment institutions and compliant investors. For the crypto native community and global investors, they need not only functional requirements to be met but also to achieve "KYC-free registered trading, global asset liquidity allocation, and higher-risk leverage" through stock tokenization and RWA platforms, which may be the advantage of crypto RWA projects.

Finally, the core purpose of the NYSE, Nasdaq, and others promoting stock tokenization remains trading volume and transaction fees, just like how current CEXs continuously launch new token projects. In the short term, they may still need to learn from CEXs, DEXs, and even on-chain Perp DEXs, which is also the foundation for existing mature platforms to potentially counterattack. At that time, the NYSE, Nasdaq, and other U.S. stock trading platforms are not without the possibility of falling from grace. The key still lies in where liquidity is, where attention is, and where the user base is.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。