Author: FinTax

News Overview

On January 15, 2026, multiple media outlets reported that the retrospective period for tax residents in mainland China to pay taxes on overseas income has been extended, potentially going back to as early as 2020 or even 2017. Since 2025, many tax residents have received prompts and notifications from tax authorities, urging them to self-examine their domestic and foreign income and to file tax returns in a timely manner. The retrospective scope for back taxes mainly covers the past three years, focusing on 2022 and 2023.

On January 16, relevant departments of the State Administration of Taxation of China stated that tax authorities will continue to strengthen publicity and guidance on the taxation of residents' overseas income, reminding taxpayers to self-examine income obtained from abroad between 2022 and 2024 since last year.

FinTax Brief Commentary

1. Event Interpretation: Retrospective Taxation on Overseas Income Back to 2017

1.1 Event Content and Background

Recently, a report by a well-known media outlet regarding "retrospective taxation on overseas income" has gone viral across various financial platforms, sparking heated discussions. The report pointed out that the retrospective period for tax residents in mainland China to pay back taxes on overseas income has been extended, potentially going back to 2020 or even 2017. The day after the report was published, relevant departments of the State Administration of Taxation revealed that since last year, taxpayers have been reminded to self-examine income obtained from abroad between 2022 and 2024. This means that many Chinese tax residents who have overseas income accounts from trading U.S. stocks, investing in foreign funds, or establishing offshore trusts may face "retrospective" tax audits for previously unreported overseas income and be required to pay back taxes and penalties.

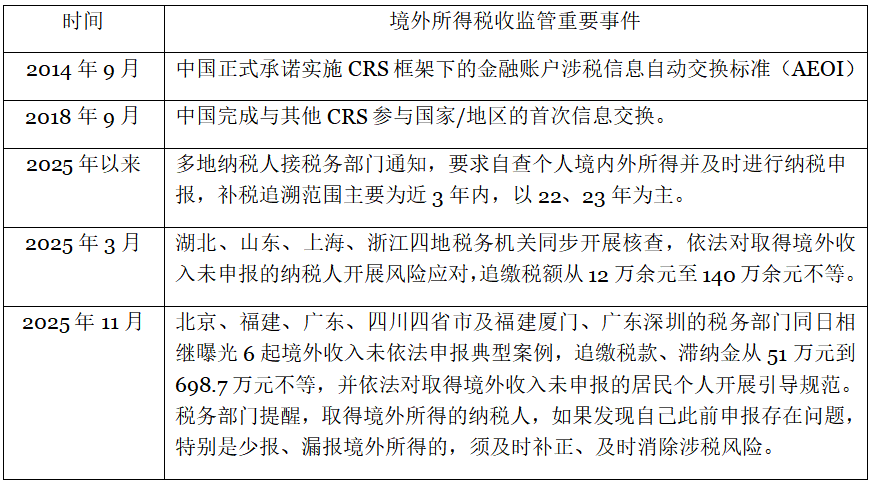

This retrospective taxation event occurs against the backdrop of China implementing the CRS system and tax authorities conducting a series of tax administration actions regarding overseas income (as shown in the table below). From the objective logic of tax supervision, the premise for tax authorities to conduct precise audits is to have access to relevant tax information. China first conducted CRS information exchanges in 2018, exchanging account information for the year 2017. As a result, Chinese tax authorities can obtain account balances, transaction records, and holder information of Chinese taxpayers in overseas banks, securities, trusts, and other institutions under the CRS exchange framework, making it possible to trace overseas income tax audits back to 2017.

Table 1: Review of Important Events in Overseas Income Tax Regulation

1.2 Regulatory Trend Observation

Looking back at the series of law enforcement trends by tax authorities over the past 25 years, it is clear that the issue of unreported overseas income has become a regulatory focus. Analyzing this event and related law enforcement actions, the following regulatory trends can be summarized:

Extension of the retrospective period: The scope of retrospective taxation on overseas income has further expanded, covering multiple years of historical tax data, potentially going back to 2017, and previously unreported overseas income may be included in the audit scope;

Batch identification and upgraded methods: Relying on CRS information exchanges and big data analysis, tax authorities now have the capability to conduct batch identification and precise localization of overseas income, and combined with the "five-step working method," they are shifting the regulatory model from "relying on voluntary reporting" to "substantive verification and accountability";

Expanded enforcement scope and increased intensity: Taxpayers in multiple regions have received text messages and phone calls from tax authorities, and the regulatory targets are no longer limited to specific high-risk groups but cover a wide range of individuals with different income levels and types of overseas income.

2. How is Retrospective Taxation Possible? Legal, Information, and Technological Factors

As long as the legal conditions are met, whether the retrospective period goes back three years, to 2017, or even earlier, tax authorities have the right to enforce the law. The threefold factors of law, information, and technology provide the practical conditions for tax authorities to conduct retrospective taxation, elaborated as follows:

First, there is sufficient legal basis and a clear retrospective period. China implements a global taxation principle for tax residents. Individuals who have a residence in China or meet the 183-day residency standard are recognized as "Chinese tax residents" and are required to report and pay individual income tax on their domestic and overseas income. This is based on existing provisions in the Individual Income Tax Law and related regulations, and is not a new obligation. Taxable overseas income includes comprehensive income (salary, labor remuneration, royalties, etc.) from outside China, business income, and other income (interest, dividends, capital gains, rental income, occasional income), with classification standards consistent with domestic income.

In addition, the law clearly stipulates the legal responsibilities for tax violations and the retrospective period for recovering taxes and penalties. Legal responsibilities include recovering taxes, penalties, administrative punishments, and criminal penalties, while the retrospective period is stipulated in Article 52 of the Tax Collection and Administration Law, which states that if taxpayers or withholding agents fail to pay or underpay taxes, tax authorities have the right to recover taxes and penalties within three years; in special circumstances, the recovery period can be extended to five years; if it involves tax evasion, resistance to tax, or tax fraud, tax authorities can recover unpaid or underpaid taxes and penalties without being limited by the aforementioned periods.

Second, the implementation of the CRS system breaks down cross-border information barriers. China officially completed the domestic legislative process for CRS in 2017 and conducted the first automatic exchange of financial account tax information with other participating jurisdictions in September 2018, covering major countries such as the UK, France, Germany, Switzerland, Singapore, as well as traditional tax havens like the Cayman Islands, British Virgin Islands (BVI), and Bermuda, including core data such as account balances and investment income. The accumulation and integration of historical exchange data have changed the asymmetry of cross-border tax information, providing a basis for tax authorities to conduct tax risk assessments and substantive audits of overseas income from earlier years.

Finally, implementing "data-driven taxation" enhances the efficiency of tax administration. The deepened application of the "Golden Tax Phase IV" and comprehensive support from tax big data have achieved intelligent integration and analysis of cross-departmental, cross-year, and cross-border capital flow data, allowing tax authorities to accurately identify tax risk points through big data models. Combined with the "five-step working method" of "prompt reminders, urging corrections, warning interviews, case investigations, and public exposure," tax enforcement is gradually shifting towards proactive substantive verification. The continuous upgrading of enforcement technology provides technical support for conducting retrospective audits.

3. Turning Crisis into Opportunity: Compliance Response Guide for Taxpayers

Taxpayers with overseas income and related tax risks can refer to the following measures to sort out their tax situations and respond to compliance challenges:

First, conduct a self-examination of income and assets to assess tax implications. Systematically review bank accounts, securities accounts, insurance products, trust rights, and fund shares held overseas since 2017 (especially from 2022 to 2024), and organize various types of income obtained in corresponding years, such as dividends, labor remuneration, and capital gains. Compare with annual individual income tax filing records to confirm whether there are any unreported or underreported situations. Based on the self-examination results, assess the amount of tax, fines, or penalties (if applicable) and make appropriate responses to potential personal tax impacts.

Second, take proactive measures to reduce compliance costs. The actual costs of unreported overseas income are not only reflected in taxes but also in daily accruing penalties and administrative fines, with the timing of handling having substantial legal consequences. For individuals with historical reporting flaws, it is essential to seize the opportunity for self-examination and complete the reporting in a timely manner, paying back taxes and penalties to avoid the continuous accumulation of penalties and fines. If a risk alert has been received from tax authorities via text message or phone call, it may be in the "prompt reminder" stage of the "five-step working method," and actively cooperating to correct the report may help secure leniency.

Third, seek professional advisory support. The tax issues related to overseas income involve multiple complex factors, including domestic and foreign regulations, tax treaties, and income nature determinations. Taxpayers can timely seek help from professional financial advisors to enhance their response capabilities and mitigate legal risks.

The FinTax team can provide customized tax planning and consulting services for individuals at different stages:

Stage One: No notification of audit from the competent tax authority has been received. In conjunction with current individual income tax management policies and national risk control requirements for overseas income, assist clients in sorting out their domestic and foreign income situations and preparing for potential risk control responses.

Stage Two: Notification of audit from the competent tax authority has been received. Assist clients in organizing corresponding annual overseas income data according to the requirements of the tax authority, preparing explanations based on income types; assist clients in communicating with tax inspectors to facilitate compliance throughout the audit process; assist clients in addressing individual income tax issues related to overseas income and provide optimization suggestions for subsequent overseas tax-related business and domestic and foreign individual income tax arrangements.

4. Conclusion

Since China participated in CRS information exchanges, tax authorities have continuously improved their ability to grasp overseas financial accounts and investment income, making the tax risks related to individual overseas income more prominent. In this era of highly transparent tax information, taxpayers can no longer rely on "regulatory blind spots." Only by establishing a comprehensive compliance awareness, assessing their overseas income structure early, and paying attention to its tax implications in China can they effectively respond to the challenges brought by regulatory upgrades and achieve the stability and security of their assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。