AI infrastructure is booming but the financing behind it is broken.

@USDai_Official is unlocking capital for the long tail of AI infrastructure.

Private credit has financed the real economy for over a decade. Data centers, warehouses, and industrial assets are all long lived projects with stable counterparties. AI infrastructure does not fit that mold. It is too capital heavy for software style funding and too fast moving for traditional infrastructure finance.

Private credit firms finance massive GPU clusters backed by contracts from large companies. Smaller AI companies sit below the threshold where custom structuring makes sense. They have demand and revenue but need financing that matches their needs.

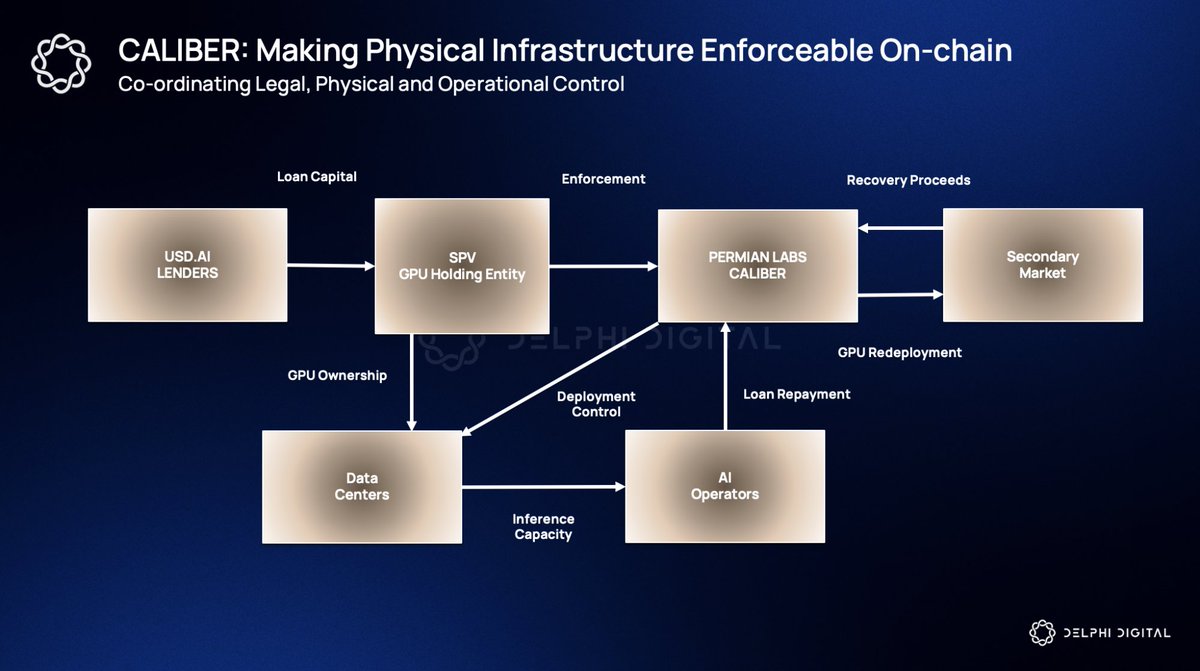

USDAI uses uniform terms across all deals and only finances hardware that is already deployed.

A two-layer capital stack means first-loss capital absorbs downside before senior depositors are touched. The model assumes a finite inference phase where cash flows are steady and redeployment is possible if a borrower fails.

T-Bill reserves provide liquidity without relying purely on GPU cash flows. Loans amortize within real hardware lifespans rather than the multi-year schedules most lenders assume.

GPU backed debt is estimated at $20-25 billion outstanding. The risk is not that AI demand disappears. The risk is that debt has been written against optimistic assumptions about hardware longevity.

Most GPU financing may need to be restructured as hardware economics catch up. USDAI is building for that reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。