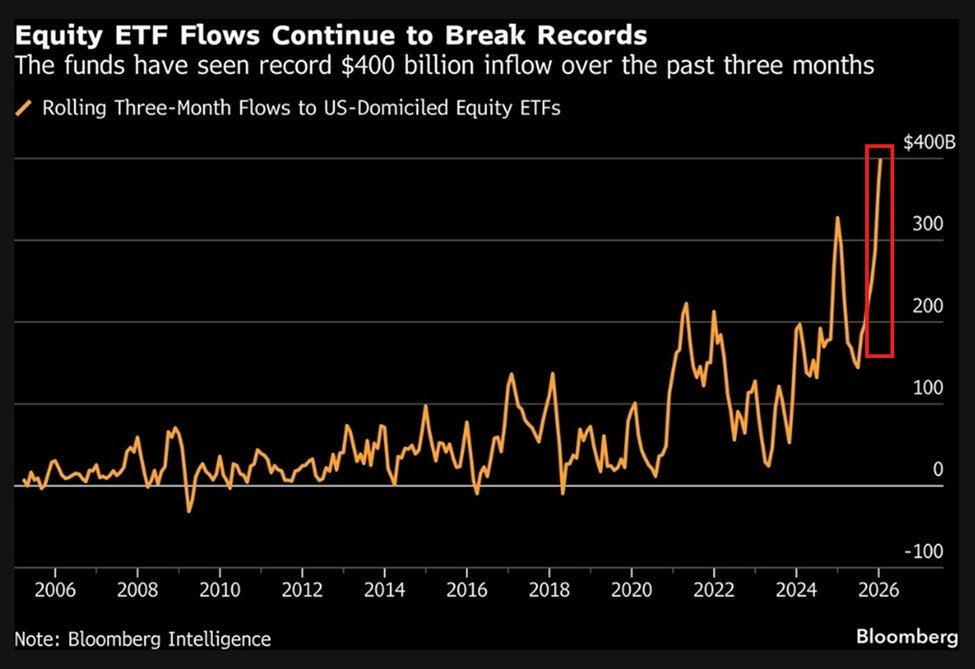

In the past three months, net inflows into U.S. ETFs have exceeded $400 billion. Much of this ETF funding comes from 401(k)s, pensions, advisory models, target date funds, and rebalancing. These funds do not consider whether assets are "expensive" or "cheap"; they buy when they feel it's the right time, judging that the trend is already happening.

Although this money has entered U.S. stock ETFs, it does not equate to an average purchase of the entire market. Ultimately, it will flow back more to the assets with the largest index weights, especially large-cap and tech-heavy assets. This generally indicates that these funds see a soft landing for the U.S. economy, expectations of interest rate cuts, narratives around AI productivity, cash migrating from short-term bonds, and overseas funds chasing dollar-denominated assets.

In simpler terms, while many still believe we are in a bear market, over $400 billion has already started to buy the dip. They are willing to believe that the trend will be better by 2026.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。