CoinW Research Institute Weekly Report (January 12, 2026 - January 18, 2026)

CoinW Research Institute

Key Points

The total market capitalization of cryptocurrencies is $3.22 trillion, up from $3.19 trillion last week, representing an increase of approximately 0.94% this week. As of the time of writing, the cumulative net inflow of U.S. Bitcoin spot is approximately $57.82 billion, with a net inflow of $1.42 billion this week; the cumulative net inflow of U.S. Ethereum spot is approximately $12.91 billion, with a net inflow of $479 million this week.

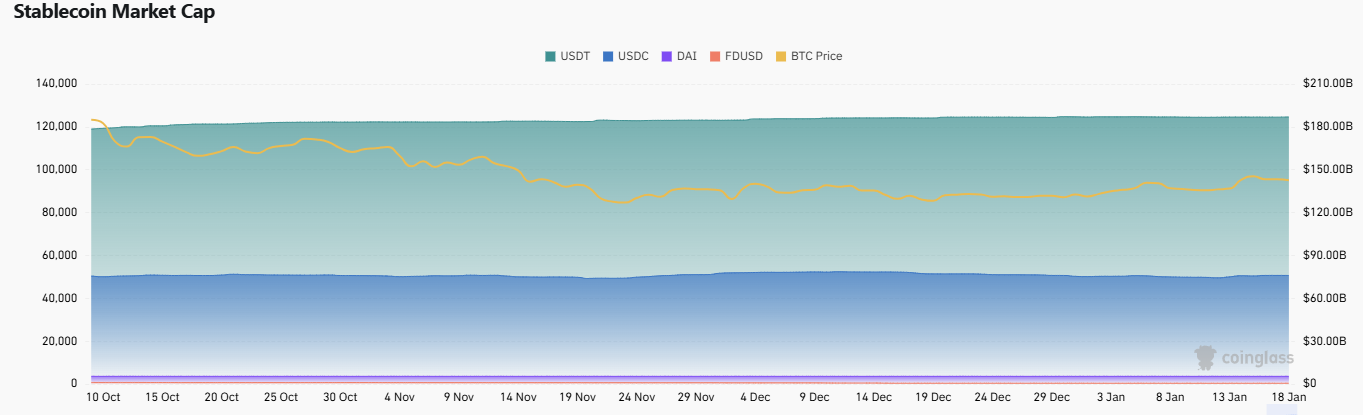

The total market capitalization of stablecoins is $314 billion, up from $308.1 billion last week, an increase of 1.9%; among them, the market capitalization of USDT is $186.9 billion, accounting for 59.5% of the total stablecoin market capitalization, slightly up from $186.6 billion last week, an increase of about 0.2%; followed by USDC with a market capitalization of $76 billion, accounting for 24.2%, up from $74.6 billion last week, an increase of about 1.9%; DAI has a market capitalization of $5.36 billion, accounting for 1.7% of the total stablecoin market capitalization, unchanged from last week.

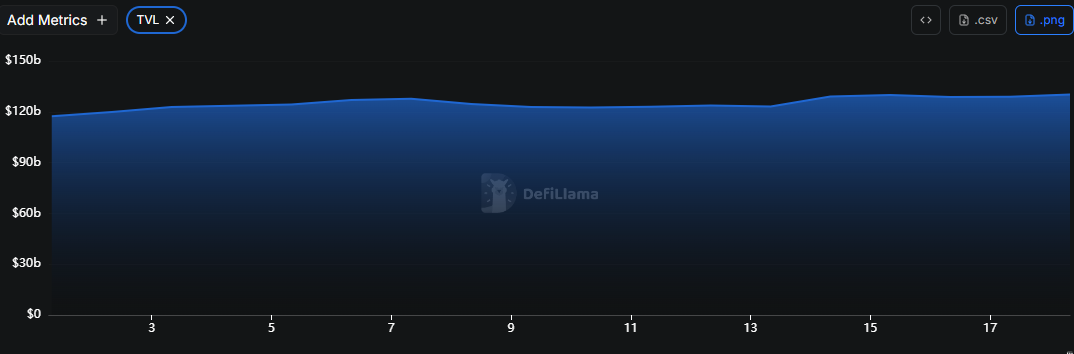

According to DeFiLlama data, the total TVL of DeFi this week is $130.2 billion, up from $123.9 billion last week, an increase of approximately 5.08%.

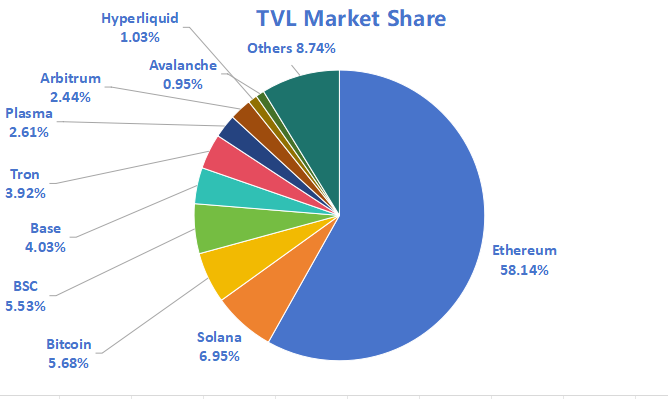

By public chain classification, the three public chains with the highest TVL are Ethereum, accounting for 58.14%; Solana, accounting for 6.95%; and Bitcoin, accounting for 5.68%.

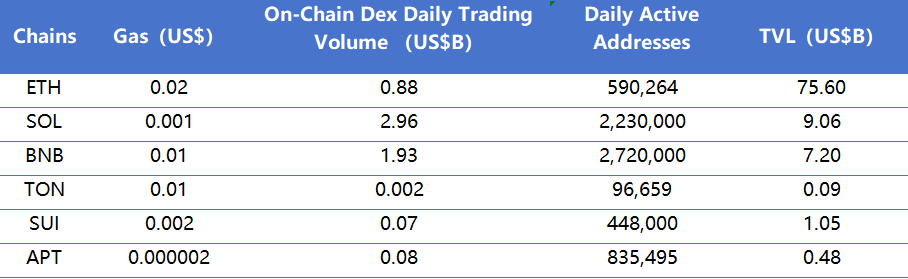

In terms of daily trading volume on-chain DEXs this week, BNB Chain saw the most significant increase, rising from $1.252 billion to $1.93 billion, an increase of approximately 54.15%; Ethereum increased from $650 million to $880 million, an increase of approximately 35.38%; Solana increased from $2.587 billion to $2.96 billion, an increase of approximately 14.42%. Aptos slightly rebounded to $80 million, an increase of approximately 9.8%; TON remained at a low level of $2 million; Sui saw a significant drop, falling from $142 million to $70 million, a decrease of approximately 50.7%. In terms of transaction fees, the overall Gas level changed little. Ethereum rose from $0.01 to $0.02; Solana and Sui fell to $0.001 and $0.002, respectively; BNB Chain, TON, and Aptos remained basically unchanged from last week.

In terms of daily active addresses this week, Sui showed the most significant growth, rising to 448,000, up from 264,000 last week, an increase of approximately 69.7%; BNB Chain increased from 2.35 million to 2.72 million, an increase of approximately 15.74%. In contrast, Ethereum fell to 590,000, a decrease of approximately 8%; Solana fell to 2.23 million, a decrease of approximately 17.4%; TON fell to 97,000, a decrease of approximately 10.9%; Aptos saw a significant decline, falling to 835,000, a decrease of approximately 37%. In terms of TVL, most public chains maintained moderate growth, with Ethereum rising to $75.6 billion, an increase of approximately 5%; BNB Chain increased to $7.2 billion, an increase of approximately 4.5%; TON rose to $9 million, an increase of approximately 4.7%; Solana rose to $9.06 billion, an increase of approximately 1.3%; Sui remained stable at $1.05 billion; Aptos increased to $480 million, an increase of approximately 9.1%.

New Project Focus: Bluff is an AI-driven prediction market project, core positioned to allow users to bet and gamble around narratives that people genuinely care about; Pumex focuses on reconstructing the heavy reliance on manual operations for LPs and traders in traditional DEXs through automated and intelligent trading and liquidity management mechanisms; Liqfid is a social finance liquidity layer built on the Base ecosystem, with its core innovation being the transformation of users' social identities into on-chain assets that can generate income based on the Farcaster social protocol.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Capitalization and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

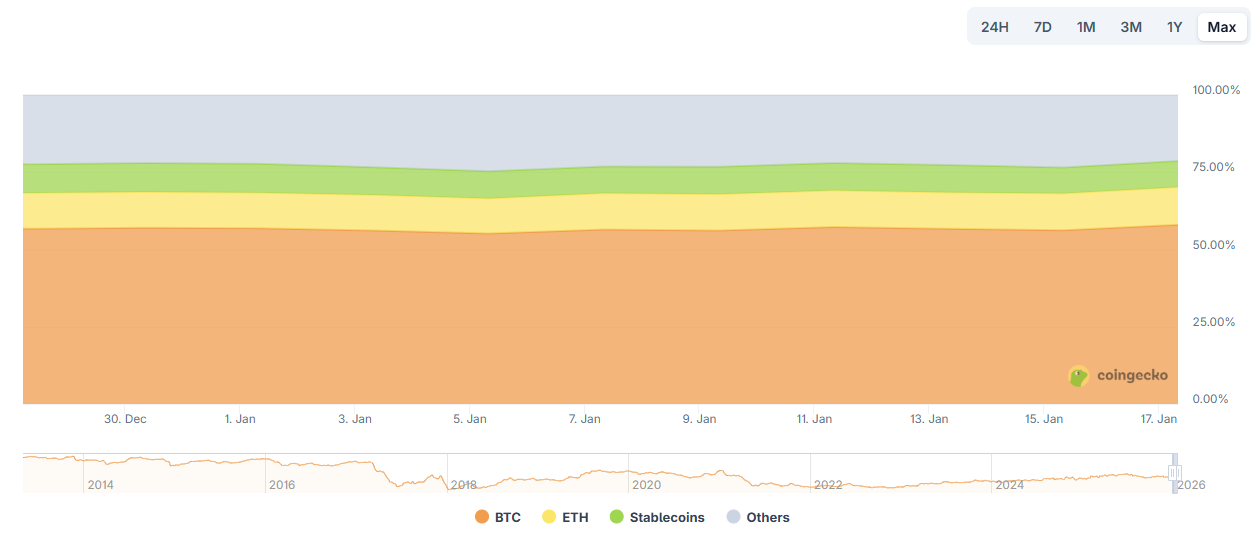

The total market capitalization of cryptocurrencies is $3.22 trillion, up from $3.19 trillion last week, representing an increase of approximately 0.94%.

Data Source: Cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of January 18, 2026

As of the time of writing, the market capitalization of Bitcoin is $1.85 trillion, accounting for 57.54% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $314 billion, accounting for 9.77% of the total cryptocurrency market capitalization.

Data Source: Coingecko, https://www.coingecko.com/en/charts

Data as of January 18, 2026

2. Fear Index

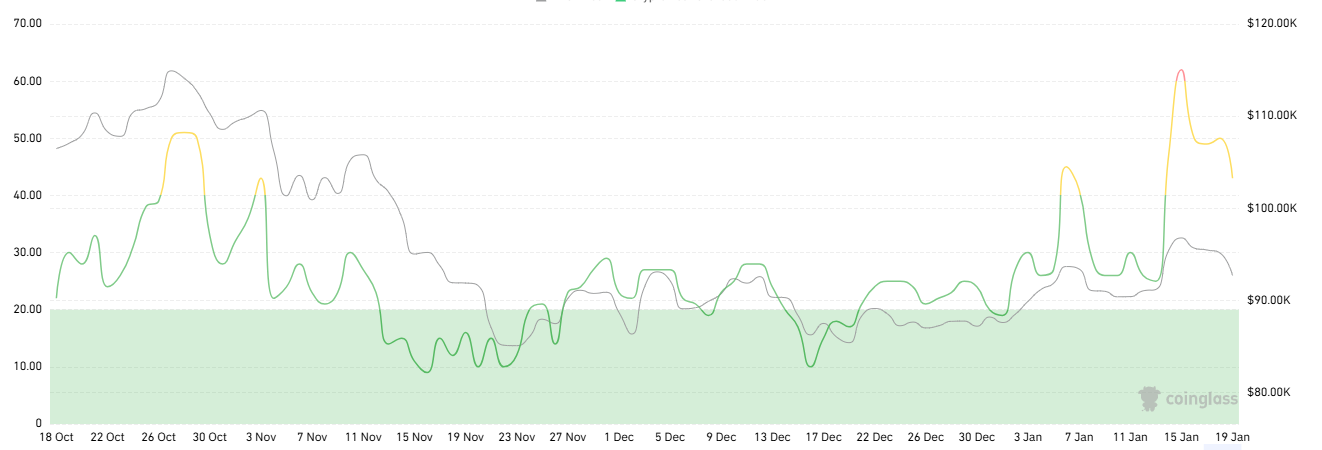

The cryptocurrency fear index is 43, indicating a neutral sentiment.

Data Source: Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of January 18, 2026

3. ETF Inflow and Outflow Data

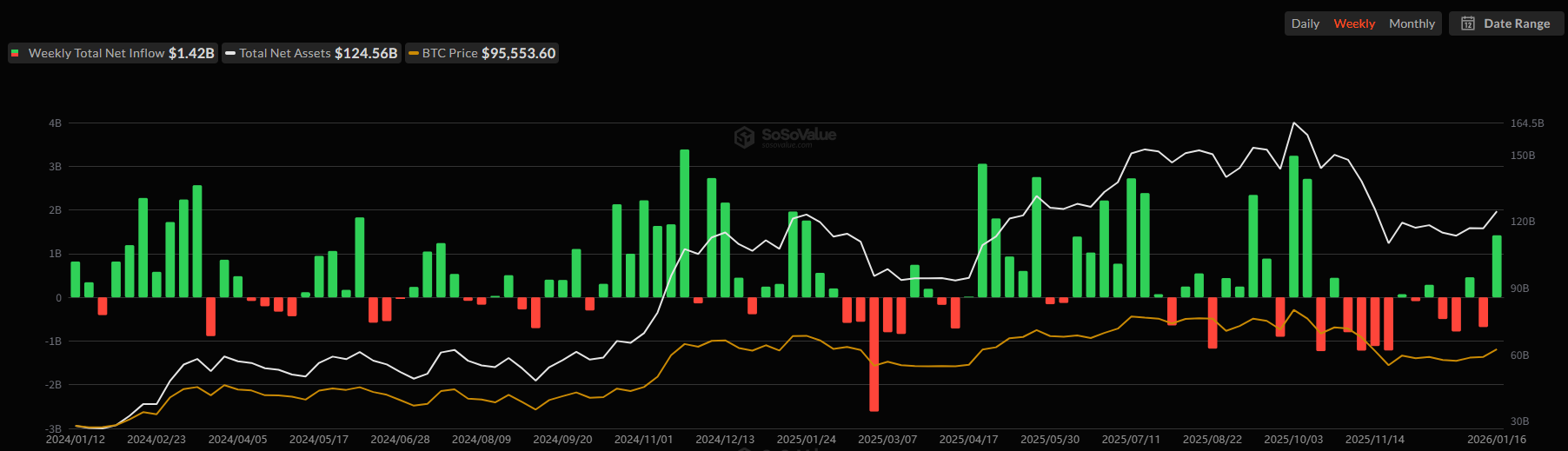

As of the time of writing, the cumulative net inflow of U.S. Bitcoin spot ETFs is approximately $57.82 billion, with a net inflow of $1.42 billion this week; the cumulative net inflow of U.S. Ethereum spot ETFs is approximately $12.91 billion, with a net inflow of $479 million this week.

Data Source: Sosovalue, https://sosovalue.com/assets/etf

Data as of January 18, 2026

4. ETH/BTC and ETH/USD Exchange Rates

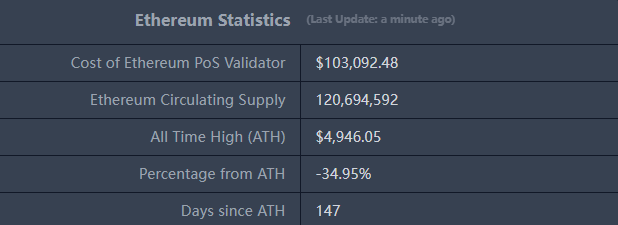

ETHUSD: Current price $3,220, historical highest price $4,946.05, down approximately 34.95% from the highest price.

ETHBTC: Currently at 0.034653, historical highest at 0.1238.

Data Source: Ratiogang, https://ratiogang.com/

Data as of January 18, 2026

5. Decentralized Finance (DeFi)

According to DeFiLlama data, the total TVL of DeFi this week is $130.2 billion, up from $123.9 billion last week, an increase of approximately 5.08%.

Data Source: Defillama, https://defillama.com

Data as of January 18, 2026

By public chain classification, the three public chains with the highest TVL are Ethereum, accounting for 58.14%; Solana, accounting for 6.95%; and Bitcoin, accounting for 5.68%.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of January 18, 2026

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current Layer 1 data related to daily trading volume on-chain DEXs, daily active addresses, and transaction fees, including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of January 18, 2026

On-Chain DEX Daily Trading Volume and Transaction Fees: The daily trading volume and transaction fees of on-chain DEXs are core indicators of public chain activity and user experience. In terms of daily trading volume on-chain DEXs, BNB Chain saw the most significant increase this week, rising from $1.252 billion to $1.93 billion, an increase of approximately 54.15%; Ethereum increased from $650 million to $880 million, an increase of approximately 35.38%; Solana rose from $2.587 billion to $2.96 billion, an increase of approximately 14.42%. Aptos slightly rebounded to $80 million, an increase of approximately 9.8%; TON remained at a low level of $2 million; Sui saw a significant drop, falling from $142 million to $70 million, a decrease of approximately 50.7%. In terms of transaction fees, the overall Gas level changed little. Ethereum rose from $0.01 to $0.02; Solana and Sui fell to $0.001 and $0.002, respectively; BNB Chain, TON, and Aptos remained basically unchanged from last week.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of user trust in the platform. In terms of daily active addresses, Sui showed the most significant growth, with daily active addresses rising to 448,000 this week, up from 264,000 last week, an increase of approximately 69.7%; BNB Chain increased from 2.35 million to 2.72 million, an increase of approximately 15.74%. In contrast, Ethereum fell to 590,000, a decrease of approximately 8%; Solana fell to 2.23 million, a decrease of approximately 17.4%; TON fell to 97,000, a decrease of approximately 10.9%; Aptos saw a significant decline, falling to 835,000, a decrease of approximately 37%. In terms of TVL, most public chains maintained moderate growth, with Ethereum rising to $75.6 billion, an increase of approximately 5%; BNB Chain increased to $7.2 billion, an increase of approximately 4.5%; TON rose to $9 million, an increase of approximately 4.7%; Solana rose to $9.06 billion, an increase of approximately 1.3%; Sui remained stable at $1.05 billion; Aptos increased to $480 million, an increase of approximately 9.1%.

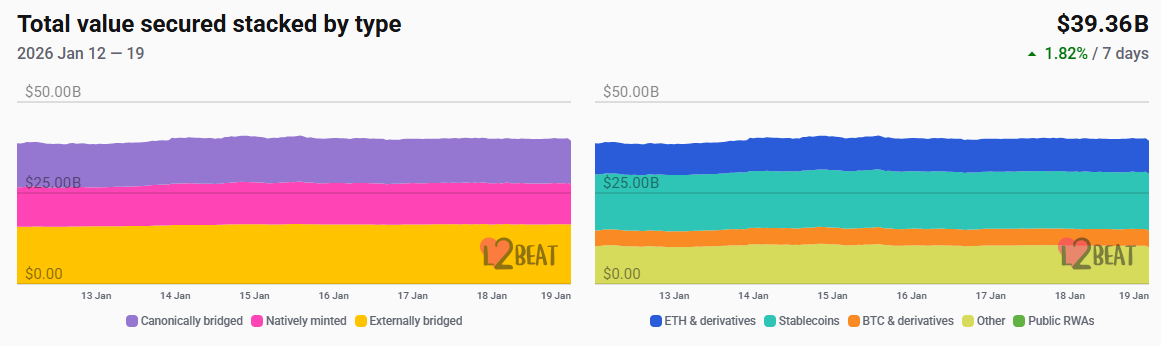

Layer 2 Related Data

According to L2Beat data, the total TVL of Ethereum Layer 2 is $39.36 billion, up from $38.6 billion last week, an increase of approximately 1.82%.

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of January 18, 2026

Base and Arbitrum occupy the top positions with market shares of 37.68% and 35.03%, respectively. This week, Base ranked first in TVL among Ethereum Layer 2.

Data Source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of January 18, 2026

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $314 billion, up from $308.1 billion last week, an increase of 1.9%; among them, the market capitalization of USDT is $186.9 billion, accounting for 59.5% of the total stablecoin market capitalization, slightly up from $186.6 billion last week, an increase of about 0.2%; followed by USDC with a market capitalization of $76 billion, accounting for 24.2%, up from $74.6 billion last week, an increase of about 1.9%; DAI has a market capitalization of $5.36 billion, accounting for 1.7% of the total stablecoin market capitalization, unchanged from last week.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of January 18, 2026

According to Whale Alert data, this week the USDC Treasury issued a total of 565 million USDC, while Tether Treasury did not issue any USDT. The total issuance of stablecoins this week was 565 million, down approximately 79.4% from last week's total issuance of 2.74 billion stablecoins.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of January 18, 2026

II. This Week's Hot Money Trends

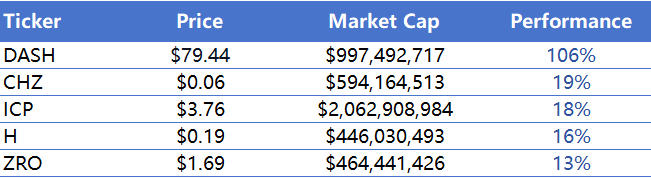

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of January 18, 2026

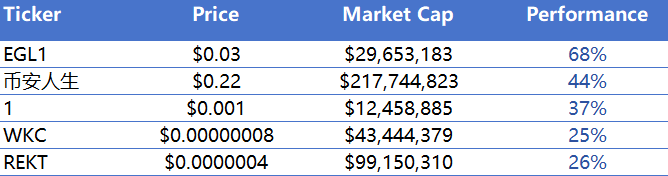

The top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of January 18, 2026

2. New Project Insights

Bluff is an AI-driven prediction market project, core positioned to allow users to bet and gamble around narratives that people genuinely care about. Unlike traditional prediction markets that focus on single outcome events, Bluff introduces AI to identify and structure social sentiment, trending topics, and narrative trends, transforming vague but highly focused market consensus into tradable prediction targets, enabling users to participate in pricing and arbitrage in the early stages of information diffusion and consensus formation. Bluff aims to upgrade prediction markets from outcome-oriented to narrative-oriented, exploring new possibilities for the combination of AI and on-chain finance while enhancing participation and entertainment.

Pumex is a strategy-centric decentralized exchange built on the Injective ecosystem. Pumex focuses on reconstructing the heavy reliance on manual operations for LPs and traders in traditional DEXs through automated and intelligent trading and liquidity management mechanisms. Pumex no longer requires liquidity providers and traders to frequently manually adjust positions or parameters; instead, it automatically completes matching, market-making, and risk control under different market conditions through a preset and dynamically optimized strategy system, thereby improving capital efficiency and user experience.

Liqfid is a social finance liquidity layer built on the Base ecosystem, with its core innovation being the transformation of users' social identities into on-chain assets that can generate income based on the Farcaster social protocol. Liqfid combines social influence, activity, and on-chain liquidity mechanisms, giving previously non-financializable social relationships and identity data asset attributes, allowing participation in DeFi yield distribution and incentive systems. Liqfid aims to bridge the value gap between Social and DeFi, making social identity not just an entry point or label, but a financial element that is combinable, priceable, and sustainably generates income.

III. Industry News

1. Major Industry Events This Week

Fluent announced the release of the first version of the Press Collection NFT, which has four levels. Users can unlock different levels of purchasing rights by accumulating social and on-chain reputation. Prices range from 0.2 ETH to 0.5 ETH, with higher levels having lower purchase prices. The minting period is from January 15 to January 21, with levels opened sequentially. Investors participating in the first round of issuance will have the opportunity to receive 5% of the initial token supply when Fluent issues its tokens, with 50% of the tokens unlocking at TGE and the remaining portion unlocking linearly over six months.

OpenSea CMO Adam Hollander released the latest updates, stating that the team is currently improving mobile and super liquidity applications. Adam Hollander suggested that users connect and associate their wallets on OpenSea, which will first allow users to experience the mobile operating system and manage all portfolios. Secondly, as TGE approaches, this will enable the foundation to gain a comprehensive understanding of users' on-chain history and associate current activities with wallets that were previously dormant. The foundation's TGE preparation work is ongoing, and it will carefully consider historical trading volume, with the Treasures data in the reward program also being equally important. This reward program will continue until TGE, and 50% of each round's fees will be injected into the prize pool.

The high-performance blockchain Fogo has opened a FOGO token airdrop, which will be distributed to approximately 22,300 addresses, with an average allocation of about 6,700 FOGO per wallet, and the tokens are fully unlocked. Eligible addresses include holders of Flames points from the first and 1.5 phases, the first 5,400 early testers, holders of specific Discord roles, and Lil Fogees NFT holders. Eligible addresses can claim their tokens through the official claim portal before April 15, 2026.

Web3 robot company XMAQUINA has opened community auction token DEUS claims, with a claim ratio of 33%. Users can use the tokens for voting, participating in DAO strategy formulation, and more. These tokens cannot be transferred before the TGE and cannot be traded on any exchange. The remaining DEUS tokens will follow a 12-month linear unlocking plan, effective from the TGE.

The Base network Perp DEX protocol RollX has officially launched the ROLL token and opened the first phase of the genesis airdrop distribution. Airdrop claims opened on January 16, with the first batch of unlock claims ending on January 26. This airdrop aims to reward early supporters, with over 161,000 traders participating in the V1 version development over the past 18 months.

2. Major Events Happening Next Week

ETHGas announced a snapshot on January 19, which will determine user eligibility for participation in the genesis harvest. ETHGas also stated that it will comprehensively assess eligibility based on proof of pain, social contribution value, and community participation.

Aster announced the launch of the second season of Human VS AI experiments, with the second season moving to the Aster Chain testnet. This competition will feature 100 human traders competing against complex AI agents from top laboratories. Each selected human contestant will receive $10,000 in risk-free capital for trading. The total prize pool for this season is $150,000, and if the human camp wins, their prize share will double to $100,000. The registration list will be announced on January 20, and the official competition will take place from January 22 to 29.

The on-chain game engine MagicBlock will launch the BLOCK token presale on February 5. The presale period will last for 3 days and will be conducted in two phases: whitelist addresses will have a 24-hour priority subscription period, followed by a 48-hour open period for all. Whitelist addresses must meet one of the following conditions: have interacted on-chain with applications built by MagicBlock or be core members of the MagicBlock community. Participation methods include a first-come, first-served Bonding Curve (fully unlocked at TGE) and quota applications (fixed price of 100 million FDV, 1-year lockup). The TGE is currently planned for the end of Q1 or the beginning of Q2 2026, with the specific timing depending on development progress.

Cross-chain aggregation DeFi platform Infinex announced that its public offering has ended, and the TGE will take place on January 30. This sale had 868 participants, raising 7.214 million USDC, allocating approximately $5 million in funds (accounting for 5% of the INX supply), and refunding about $2.21 million. After identifying and removing approximately $1.2 million in witch address funds, the maximum allocation for a single participant is $245,000, with 99.5% of participants receiving full allocation. Refunds have been issued to users' Infinex accounts.

Solana Mobile announced that on January 21, it will airdrop the native token SKR to Seeker phone users and ecosystem developers. The total supply of SKR tokens is 10 billion, with the first airdrop amounting to 2 billion, accounting for 20% of the total supply. After claiming, users can directly stake SKR to Guardians for rewards through the Seed Vault Wallet or stake via the web interface. Solana Mobile also reminds users to prepare a small amount of SOL in advance to pay for the on-chain fees required for claiming.

3. Important Financing Events from Last Week

Upexi Inc. (NASDAQ: UPXI) completed its latest round of Post-IPO financing, raising approximately $36 million, with participation from Hivemind Capital. Upexi Inc. was established in 2019, initially serving as a consumer data platform for Amazon and e-commerce brand growth, and has gradually transformed into a representative company of a publicly traded firm with both physical business and crypto asset strategies. (January 13, 2026)

Project Eleven completed Series A financing, raising $20 million, with participation from several crypto and frontier technology funds, including Coinbase Ventures and Variant Fund. Project Eleven was founded in 2024 and focuses on quantum computing security solutions, with the core goal of providing a practical quantum upgrade path for existing mainstream protocols before quantum computing threatens traditional cryptographic systems. (January 15, 2026)

Konnex completed a strategic round of financing, raising $15 million, with participation from institutions such as LD Capital and Cogitent Ventures. Konnex is positioned as a permissionless marketplace in the robotics field, aimed at robotic motion intelligence models for autonomous physical labor, with the core goal of enabling robots to autonomously sign on-chain contracts and call decentralized Robotic AI service providers without trusting intermediaries, thereby building an open infrastructure for robots as economic participants. (January 16, 2026)

IV. Reference Links

Coingeck: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

Bluff: https://x.com/CallMyBluff_io

Pumex: https://x.com/PumexFi

Liqfid: https://x.com/liqfid

Upexi Inc.: https://upexi.com/

Project Eleven: https://x.com/qdayclock

Konnex: https://x.com/konnex_world

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。