Good evening everyone, I am Xin Ya. The recent market trend has been relatively in line with expectations. If you were paying attention half a month ago, you should know that I provided a possible scenario where Bitcoin would move towards 96,800 and Ethereum towards 3,400 before turning downwards. The first half of this played out completely as expected. During Bitcoin's high-level consolidation, Ethereum reached 3,368 as anticipated before both plummeted. This round of market movements has also maximally curtailed risks; even if we can't catch the timing, we must protect ourselves and, at the very least, avoid being affected by the market, keeping losses to a minimum. Moreover, we have already taken positions on both sides, which is what we call the arms and ammunition of the crypto world.

Looking at the market over the past two days, Bitcoin has mainly been consolidating in a reduced volume range around 94,500-95,500. At six in the morning, two one-hour candlesticks broke below the one-hour and four-hour EMA 120 and EMA 144, with a low spike down to 91,800, and the afternoon consolidation focused around 92,500.

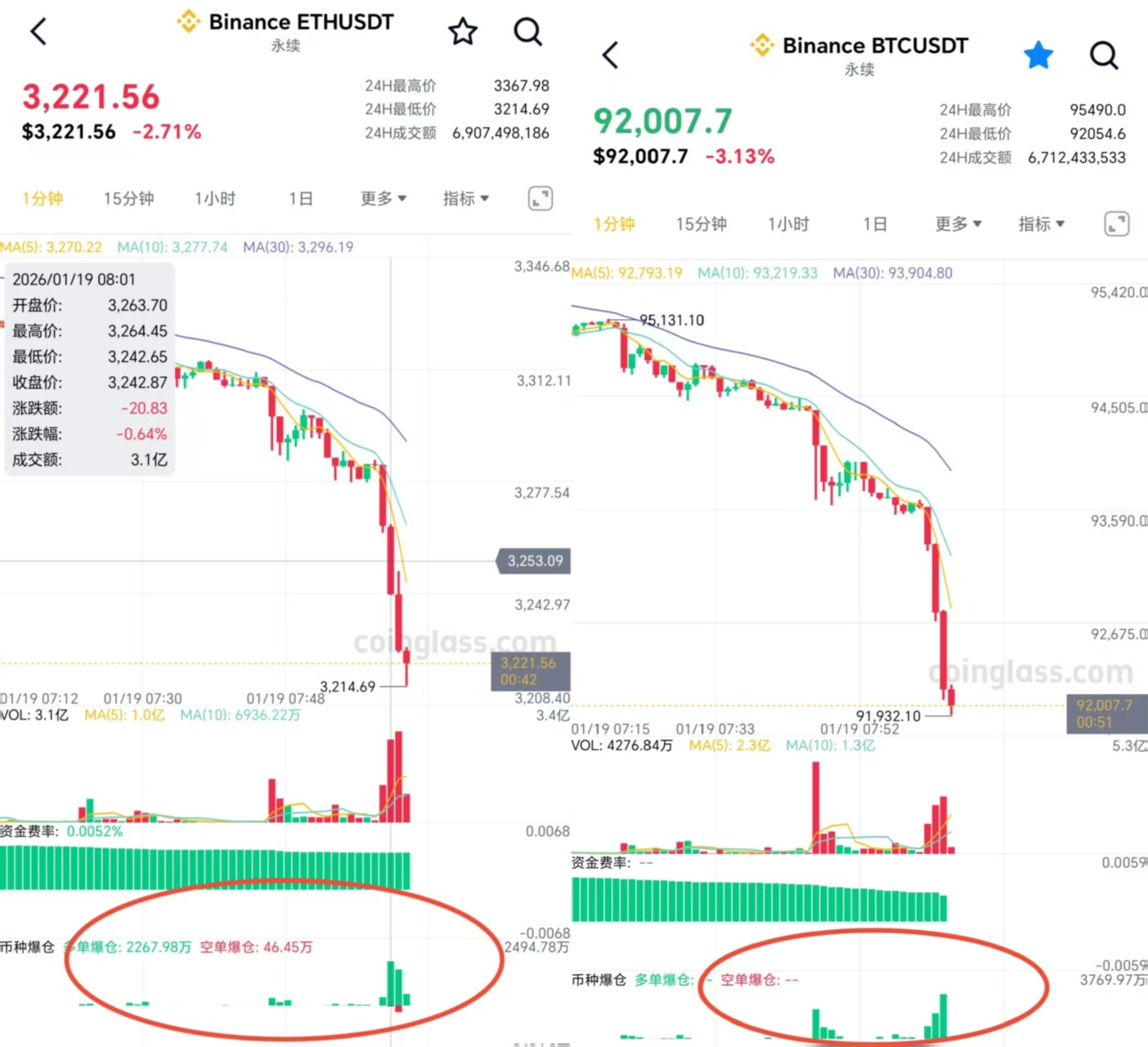

This sell-off was quite fierce, with a chain reaction of liquidations. When the price dropped to 94,500, a ten million dollar liquidation occurred first, followed by a fifty million dollar liquidation when it broke below 93,500, and then a direct evaporation of ninety million dollars when it spiked down to 91,800. Ethereum's drop was two-sided, with a twenty million dollar liquidation on the way up, followed by a drop to 3,300 that triggered six million dollars in liquidations, a spike down to 3,280 that triggered ten million, and a spike around 3,180 that triggered over seventy million dollars. From 3,360 to 3,175, a total of over one hundred million dollars was liquidated. It was very bloody.

In the morning at seven, Ethereum's two one-hour candlesticks first broke below EMA 144 around 3,280, and the second candlestick spiked down a hundred points to EMA 120 around 3,180. These key points were significant and could disrupt the market direction. Our most conservative approach is to trade short-term on a larger scale. After all, there are only three types of market movements: continuation, recovery, and consolidation. The structure of the rebound and trading volume will determine the direction.

Key points to watch below are the spike down to 91,800 and the rebound around 92,500. The 90,500 platform and the 91,200 starting point are important, while above we should focus on the one-hour EMA 120, 144, and around 94,500. Pay close attention to the reaction between 93,500-93,800, which is where the first significant sell-off occurred, as well as our initially suggested stop-loss level for long positions. The variables here can determine the future market direction. Similarly, for Ethereum, watch the four-hour EMA 120 around 3,180 below, and the range of 3,250-3,280 above.

The market is expected to consolidate between the spike points and sell-off points. It is recommended to primarily focus on short positions, as the market has liquidated too many long positions, significantly impacting confidence in the future market. You can short at 94,000, add at 94,800, and set a stop-loss at 95,500. For a conservative approach, short at 94,800 with a stop-loss at 95,800. For Ethereum, short at 3,280 with a stop-loss at 3,325. For a conservative approach, short at 3,320 with a stop-loss at 3,348. Make layouts in these important ranges, and for rebounds, you can initially position at the spike down, with the second rebound at 3,135 and 91,200. I suggest everyone trade short-term during this consolidation process. Observe whether the market tends to repair or continue. Use these key positions as references for your trades.

Together we move forward, WeChat Official Account: Xin Ya Talks About Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。