Key Points

The essence of restaking is to abstract the economic security of the underlying blockchain into a shareable resource, allowing multiple networks or modular infrastructures to share the security guarantees of the main chain without needing to build their own validation sets. This mechanism significantly reduces the reliance of new protocols on independent security mechanisms in the early stages, thereby accelerating cold starts and trust accumulation. Restaking initially completed its concept validation and early deployment mainly within the Ethereum ecosystem, but as Ethereum is a single network, its reusable security resources have certain limitations. Therefore, more emerging projects are beginning to seek to break the constraints of single-chain structures on restaking and explore new paths such as cross-chain validation.

Currently, the top three projects in the restaking sector by total TVL are EigenCloud, deployed on the Ethereum mainnet, leading with approximately $13.86 billion in locked assets; followed by Babylon, focused on the Bitcoin network, with a total TVL of $5.549 billion; and Symbiotic, also based on Ethereum, with a total TVL of $565 million, emphasizing a modular restaking structure.

This report organizes the core participants in the restaking sector along three main lines: infrastructure layer, yield aggregation layer, and active validation service layer. Although the infrastructure layer has built a security foundation worth tens of billions of dollars, it generally faces a TVL growth bottleneck and is transforming towards diverse dimensions such as AI; the yield aggregation layer lowers the participation threshold for users and enhances capital efficiency, but also lengthens the risk chain, making funds more dependent on market cycles and incentive structures; the active validation service layer, while absorbing a large amount of restaked assets on paper, is still in the early validation stage regarding punitive constraints and commercial closure.

While the restaking system improves capital efficiency and security supply, it also exposes a series of risks. The overall market demand for shared security is shrinking, with limited new space; the same staked asset is reused multiple times, which, while improving capital efficiency, also dilutes the security margin; validation resources are highly concentrated in a few leading platforms and nodes, increasing the risk factor; there is a lack of unified risk isolation and pricing mechanisms within the restaking system. At the same time, the exit cycle of underlying assets is relatively long, while the upper layer is highly liquid and layered with multiple sources of income, making the restaking system more prone to amplifying risks during market fluctuations or trust damage.

The restaking sector is currently undergoing a structural adjustment phase after the initial hype has waned, with power concentration, layered risks, and limited TVL growth becoming unavoidable constraints. Leading projects like EigenCloud are actively seeking change by introducing cross-border directions such as AI computing resources, reducing reliance on a single staking narrative, and attempting to reshape their positioning in the infrastructure layer.

Whether restaking can complete its reconstruction may hinge on whether it can establish predictable and priceable security and yield benchmarks on-chain, and convert this security capability into a credit form that traditional capital can undertake through compliance and RWA. If this condition cannot be met, its influence may struggle to expand into a broader financial system. Overall, the restaking sector is attempting to break away from a single risk narrative and shift towards a more certain infrastructure role. Although this transformation faces dual challenges of technical complexity and regulatory uncertainty, its systematic reconstruction of the on-chain credit system will still be an important dimension to observe in the next stage of digital asset ecosystem development.

Table of Contents

Key Points

I. Development and Current Status of the Restaking Sector

The Advancement of the Restaking Sector

The Multi-Chain Extension of the Restaking Sector

The Centralization Phenomenon in the Restaking Sector

II. Core Participants in the Restaking Sector

Restaking Infrastructure Layer

Restaking Yield Aggregation Layer

Restaking Active Validation Service Layer

III. Vulnerabilities and Risk Points of the Restaking System

Risks of Insufficient Demand for Shared Security

Risks of Security Dilution Under Capital Leverage

Risks of High Concentration of Trust

Weakness in the Liquidation Chain and Negative Feedback

Risks of Liquidity Mismatch and Yield Volatility

IV. Conclusion

V. References

On-chain yield mechanisms have gained more policy attention at the policy level. Although they have not yet become the main line of regulation, their potential economic impact and structural innovation value are gradually entering the scope of compliance discussions. In April 2025, Paul Atkins was appointed as the new chairman of the U.S. Securities and Exchange Commission (SEC), and during his early tenure, he led the initiation of a series of roundtable discussions titled "DeFi and the American Spirit."

In the fifth meeting held on June 9, 2025, the regulatory body expressed a relatively open attitude towards DeFi for the first time. Meanwhile, the legislation of the GENUS Act established a clear and unified legal framework for the issuance, custody, and on-chain use of stablecoins. The overall regulatory attitude is becoming more rational and constructive, releasing positive policy signals for on-chain financial innovation. At the same time, regulation will further relax in 2026, bringing more possibilities for DeFi.

Against this backdrop, the restaking mechanism, as one of the development directions of the on-chain yield system, has also attracted market attention regarding its compliance and structural design. This mechanism provides additional security service support and yield compounding capabilities for protocols by reusing native staked assets without changing the underlying consensus logic.

This report believes that a systematic analysis of the currently mainstream restaking protocols will help clarify their positioning in the on-chain yield system, identify risk exposures in protocol structures, and provide an analytical basis for future capital efficiency optimization and cross-protocol collaboration. In the following sections, this report will focus on in-depth discussions of the leading protocols in the restaking infrastructure layer, restaking yield aggregation layer, and restaking active validation service layer.

I. Development and Current Status of the Restaking Sector

1. The Advancement of the Restaking Sector

Staking, as a fundamental means of ensuring on-chain security under the PoS consensus mechanism, has undergone a multi-layered development from the initial native staking to liquid staking and then to restaking. In the native staking phase, users directly lock assets in the underlying consensus protocol in exchange for validator status and block rewards, ensuring network security, but this leads to low capital efficiency due to assets being completely locked, with staked assets lacking liquidity and composability, limiting their value release.

Subsequently, liquid staking (LSD) emerged, allowing users to obtain liquid tokens such as stETH and rETH based on staked assets. These tokens can participate in trading, lending, and liquidity provision within the DeFi ecosystem, significantly enhancing asset utilization efficiency and user yields. However, while liquid staking has improved the liquidity and composability of staked assets, the security of the underlying staked assets still has limitations and has not achieved cross-protocol security sharing and expansion.

The restaking mechanism, as an innovation in the staking sector, breaks through this limitation by allowing users to treat the security of native or liquid staked assets as programmable resources, empowering other protocols or networks, and supporting active validation services, thereby obtaining additional incentives beyond the original staking yields. The essence of restaking is to abstract the economic security of the underlying blockchain into a shareable resource, enabling multiple networks or modular infrastructures to share the security guarantees of the main chain without needing to build their own validation sets.

This mechanism significantly reduces the reliance of new protocols on independent security mechanisms in the early stages, thereby accelerating their cold starts and trust accumulation. It provides developers with an open architecture that allows them to call upon shared validation capabilities without needing to build their own consensus mechanisms, thus forming a market model of security as a service. Among them, liquid restaking is an important branch of the restaking mechanism, which packages restaked assets into liquid derivative tokens, allowing users to enjoy restaking yields while flexibly utilizing these tokens in DeFi, achieving multi-layered yield compounding.

2. The Multi-Chain Extension of the Restaking Sector

The restaking mechanism was first scaled in the Ethereum ecosystem, with its rapid development relying on three key factors: a modular on-chain architecture, sufficient liquid staked assets (LST), and an active validator network. However, as Ethereum is a single network, its reusable security resources have certain limitations. Emerging projects are beginning to seek to break the constraints of single-chain structures on restaking and explore new paths such as asset collateralization.

At the same time, another type of project is choosing to build a native restaking system starting from non-Ethereum ecosystems. A typical example is Babylon, which proposes a staking mechanism design for the Bitcoin ecosystem that does not require modifications to the Bitcoin main chain and provides Bitcoin security as a service for other chains. Overall, the restaking ecosystem is evolving from a single-chain system centered on Ethereum to a multi-chain integrated structure.

3. The Centralization Phenomenon in the Restaking Sector

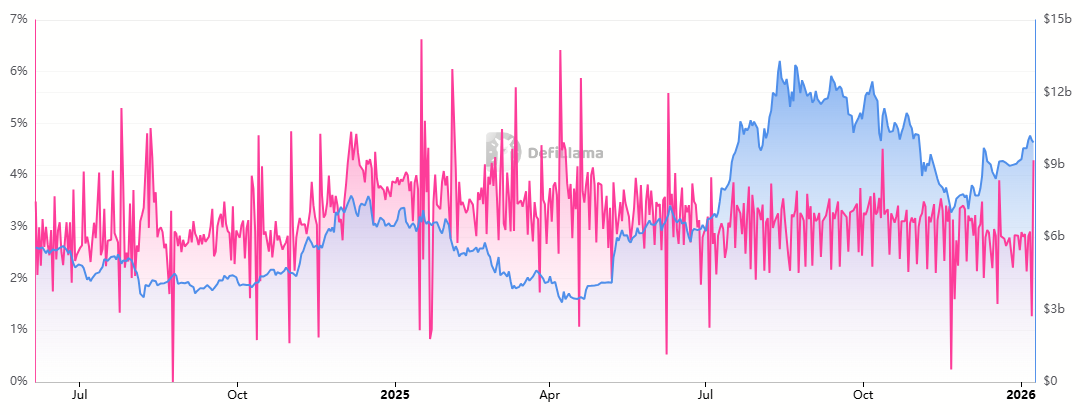

Currently, the restaking sector is mainly concentrated in the Ethereum ecosystem, primarily due to the leading project EigenCloud, which has been designed and deployed based on Ethereum since its inception. According to data from defillama, the total TVL of the restaking sector is currently $20.376 billion, with EigenCloud's total locked amount (TVL) at $13.86 billion, ranking first in the restaking sector, accounting for 68%.

_Source: defillama, _https://defillama.com/protocols/restaking

According to the current ranking of total TVL in the restaking sector, the top three projects are EigenCloud, deployed on the Ethereum mainnet, leading with approximately $13.86 billion in locked assets; followed by Babylon Protocol, focused on the Bitcoin network, with a total TVL of $5.549 billion; and Symbiotic, also based on Ethereum, with a total TVL of $565 million, emphasizing a modular restaking structure.

II. Core Participants in the Restaking Sector

In the following sections, this report will systematically analyze the core projects in the current restaking sector from the infrastructure layer, yield aggregation layer, and active validation service layer, covering leading protocols in various on-chain ecosystems such as Ethereum, Solana, Bitcoin, and Sui, and will delve into their business models, staking models, and staking data. At the same time, this report will also focus on the market acceptance and current status of these projects, aiming to restore a highly dynamic overview of the restaking sector.

1. Restaking Infrastructure Layer

The restaking infrastructure layer is the cornerstone of the entire restaking ecosystem. The main function of the infrastructure layer is to allow users to reuse already staked assets (such as ETH or LSTs) for security guarantees across multiple networks or applications, thereby enhancing capital efficiency and network security. These infrastructures not only support restaking platforms and applications but also enhance the scalability and interoperability of the blockchain ecosystem by allowing them to create customized staking and security models. In the following sections, this report will focus on the main projects in the restaking infrastructure layer: EigenCloud, Symbiotic, and Babylon.

1.1 Representative Projects in the Infrastructure Layer

1.1.1 EigenCloud (formerly EigenLayer)

EigenCloud, formerly known as EigenLayer, underwent a product upgrade in June 2025, changing its protocol name to EigenCloud. At the same time, the well-known institution a16z invested an additional $70 million in EigenLabs to promote the research and development of EigenCloud. EigenCloud is positioned as an infrastructure platform for verifiable applications and services powered by AI. After the name change, its goal is to build a Web3 native cloud service platform that combines the flexibility of cloud computing with the verifiability of blockchain, and it has recently integrated with the x402 track. The renaming and other measures taken by EigenCloud also indicate that the platform is actively seeking a strategic direction for transformation.

In this report, we will first focus on EigenCloud's role in the restaking system. EigenCloud is one of the first protocols to propose the concept of restaking within the Ethereum ecosystem. Its core idea is to reuse ETH (or liquid staking derivatives such as LST) that has already been staked on the Ethereum consensus layer for the security of other middleware and infrastructure, thereby achieving cross-protocol extension of Ethereum's economic security.

Actively Validated Services (AVS) is the core architectural design proposed by EigenCloud, aimed at modularizing and opening up Ethereum's economic security capabilities. Under the AVS architecture, external protocols or validation services can obtain security guarantees close to that of the Ethereum mainnet without independently building a complete consensus and economic security mechanism by reusing restaked assets and validator sets.

EigenCloud aggregates validator resources and restaked assets to provide unified security access and operational capabilities for multiple AVS, thereby forming a platform market for on-demand security purchases within the AVS ecosystem. Additionally, to ensure stable operation and prevent short-term arbitrage behavior, EigenCloud has set a 14-day custody period for asset withdrawals.

Business Model

EigenCloud has established a security service market connecting stakers, active validation services (AVS), and application chains through the introduction of the restaking mechanism. The specific operational process of its business model is as follows:

Stakers restake their Ethereum or LSD (such as stETH, rETH) into EigenCloud;

These assets are allocated to AVS to provide validation and security guarantees for external protocols and infrastructure services;

The relevant protocols or service providers pay fees for the security obtained, which are typically distributed as approximately 90% to stakers, about 5% to AVS node operators, and about 5% retained by the EigenCloud protocol as platform revenue.

Staking Model

EigenCloud introduces a flexible restaking mechanism that supports not only native staked assets but also extends to various derivative assets, allowing more on-chain capital to efficiently participate in the validation and security guarantee process. The specific methods include:

Native Restaking: Users can directly transfer their natively staked ETH on the Ethereum mainnet into EigenCloud for restaking. This is the most direct and native staking path, with high security but low flexibility.

LST Restaking: Users can restake LSTs (such as stETH, rETH) obtained through liquid staking protocols like Lido into EigenCloud. This staking model introduces a DeFi layer as an intermediary, achieving a combination of liquidity and restaking yields, balancing flexibility and profitability.

ETH LP Restaking: Users can also use LP tokens obtained from providing ETH liquidity in DeFi protocols for restaking in EigenCloud. This staking model utilizes DeFi derivative assets that include ETH for restaking, releasing additional value from LP assets.

LSD LP Restaking: LP tokens based on LSD, such as Curve's stETH-ETH LP token, can also be restaked on EigenCloud. This method is the most complex yield stacking path, integrating the yield structures of Ethereum mainnet staking, DeFi liquidity provision, and EigenCloud restaking.

Staking Data

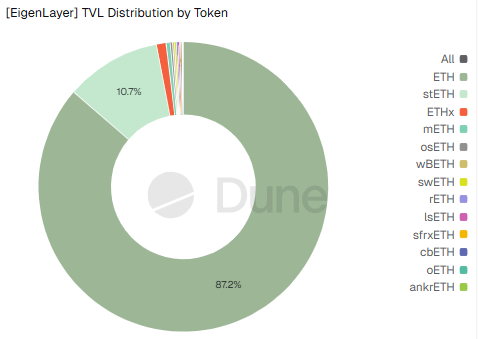

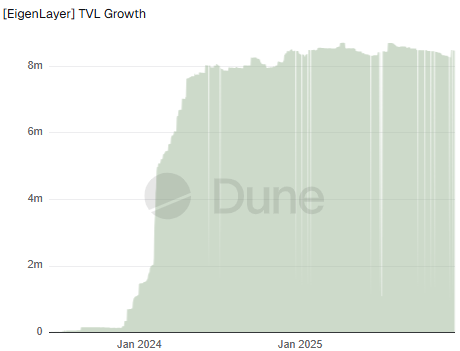

As of the time of writing, EigenCloud has a total TVL of $13.86 billion, with 8,465,305 ETH restaked and 82 AVS integrated. Currently, in EigenCloud's restaking market share, native restaking using ETH accounts for 87.2% of the market share, while other assets only account for 12.8%.

_Source: Dune, _https://dune.com/hahahash/eigenlayer

A more detailed observation point is that, from the growth trend of the total locked amount (TVL) of ETH in EigenCloud's native restaking shown in the chart below, from January to June 2024, EigenCloud experienced explosive growth, after which its total TVL of ETH (the largest share being native restaking) has remained fluctuating in the range of $8 million, with no significant influx of new capital later on.

_Source: Dune, _https://dune.com/hahahash/eigenlayer

In summary, although EigenCloud occupies a significant market share in terms of data, considering its transformation and the trend of TVL, its restaking business is facing the following deeper challenges:

First, business growth has hit a stagnation bottleneck. According to the data analysis in this report, after experiencing explosive growth in the first half of 2024, EigenCloud's TVL has remained fluctuating within a fixed range, lacking subsequent incremental funds. This lack of growth compels it to transform through renaming and pivoting towards AI infrastructure and cloud services, indirectly confirming that the pure restaking narrative has lost its appeal.

At the same time, the asset structure is singular and liquidity is limited. Although EigenCloud has designed complex LSD and LP restaking paths, nearly 90% of the market share is still held by native ETH, indicating that its deep integration in the DeFi space has not been successful. Additionally, the 14-day withdrawal custody period set by the protocol sacrifices liquidity, and in the highly volatile crypto market, this time cost and potential penalty risks make the additional yields from restaking seem insufficient in terms of cost-effectiveness.

Finally, the premium capability of the business model is in doubt. Although stakers can receive 90% of the fee distribution, faced with a complex security-sharing risk model, users' willingness to exchange risk for returns is diminishing at the margin. When the market's recognition of the actual demand for restaking and the endorsement of its security cannot continue to improve, the entire restaking ecosystem is likely to become a capital stock game lacking practical application support.

1.1.2 Symbiotic

Symbiotic is a modular restaking protocol that supports multiple assets, aimed at providing shared security services for decentralized applications and blockchain networks. Launched in June 2024, its mainnet is deployed on Ethereum. Unlike EigenCloud, which only supports ETH and ETH derivative staking, Symbiotic allows any ERC-20 asset to participate in staking and enables protocols, DAOs, and validation networks to customize their security models and staking rules, offering greater flexibility and composability.

Compared to EigenCloud, Symbiotic has taken a different route, providing a more flexible restaking mechanism. The core differentiation of Symbiotic lies in its highly modular and cross-chain restaking architecture, where its validation methods, penalty logic, and collateral assets can be freely configured, supporting multi-asset restaking. Modular networks such as Layer2 and oracles can be integrated as needed. It reshapes restaking from another dimension, providing flexible and secure validation services for the entire on-chain world.

Additionally, an interesting observation point is that the differentiated strategies between EigenCloud and Symbiotic are also seen as a competition among major VC firms. EigenCloud previously rejected an investment from Paradigm and chose a16z instead, prompting Paradigm to turn to Symbiotic. At the same time, Symbiotic has also gained support from the co-founder of Lido. Currently, Symbiotic is one of the few leading restaking protocols that has not yet issued a native token.

Business Model

Symbiotic's openness and modular design allow it to support various asset types, enabling networks to customize staking implementations according to their needs, thus achieving higher capital efficiency and security. Symbiotic's business model is based on building a decentralized restaking market that dynamically matches supply and demand for security, with its core revenue sources including:

Security Rent: Networks such as Rollups, data availability layers, and oracles pay fees to Symbiotic to rent its security.

Validator Commission Sharing: Symbiotic can charge fees or commission cuts from node operators running validators.

Protocol Fees: Symbiotic can take a certain percentage from the security rent paid by AVS as protocol revenue.

Staking Model

Symbiotic's staking mechanism adopts a modular design, allowing users to stake various different assets rather than being limited to the native Ethereum token ETH. Users can deposit ETH, staking derivatives, stablecoins, and other ERC-20 assets into different staking vaults, each configured with different rules and purposes, supporting various validation services.

In practice, after users lock their assets into the staking vaults, these assets are used by nodes within the Symbiotic network to support the security validation of different PoS networks or Layer2 projects. Node operators must meet certain reputation and staking requirements, with a registration system managed by the protocol dynamically managing node qualifications. If a node violates rules or performs poorly, the protocol's penalty system will impose economic penalties on the violating node according to the rules of each staking vault and service, thereby ensuring network security.

As of the time of writing, Symbiotic has a total TVL of $560 million. However, from the following TVL growth trend chart, it is evident that Symbiotic's TVL growth is similar to that of EigenCloud, showing a downward trend after peaking in 2024 (around $2.5 billion). In the second half of 2025, the decline in TVL accelerated, falling to less than one-third of its peak by early 2026. This reflects a gradual withdrawal of funds driven by early narratives and incentive mechanisms, while new long-term incremental funds have not entered, significantly weakening Symbiotic's financial foundation.

_Source: defillama, _https://defillama.com/protocol/symbiotic

Although Symbiotic initially attracted attention with Paradigm's endorsement and its extremely flexible multi-asset restaking concept, its current data trends reveal that it faces more severe survival challenges than EigenCloud. Its TVL has dropped from a high of $2.5 billion to less than $600 million, and this sharp decline reflects that its early capital inflows were primarily driven by speculative expectations and airdrop games. As one of the few leading protocols without a native token, once the airdrop expectations are prolonged or incentives diluted, Symbiotic's ability to retain short-term speculative capital is extremely weak, leading to a significant outflow of funds.

At the same time, there is a disconnect between multi-asset flexibility and real security needs. Although Symbiotic supports restaking of various assets such as ERC-20, in practical applications, the core security demands of most decentralized services still anchor on ETH and its derivatives. The security provided by non-ETH assets has low recognition at the consensus level, which means that its flexibility advantage has not translated into real order increments in actual business deployment.

Symbiotic is also facing strategic passivity; compared to EigenCloud, which has begun to pivot towards AI and cloud computing, Symbiotic remains entrenched in its modular restaking framework. Without issuing a token to restart its incentive mechanism, Symbiotic faces a shrinking market, and its risk resistance and ecological stickiness are significantly weaker than its competitors that have completed brand transformations, facing the risk of being marginalized by the market.

1.1.3 Babylon

Babylon is a native restaking protocol designed specifically for the Bitcoin ecosystem, aiming to bring BTC into the staking economy and provide trustless security guarantees for multiple PoS networks. Unlike traditional cross-chain bridges or wrapped asset mechanisms, Babylon builds its staking system based on Bitcoin's native scripting, allowing users to lock BTC directly on the Bitcoin main chain and earn yields without relinquishing asset ownership or relying on intermediaries. This mechanism not only preserves the self-custody and non-custodial attributes of BTC but also expands the pathways for Bitcoin's staking use, opening up a new direction for the BTCFi ecosystem.

Business Model

Babylon's business model is based on a bilateral market structure, with one side being BTC holders as staking providers, who lock assets to receive token incentives; on the other side are PoS networks that require security, which pay fees to the protocol to introduce BTC as a source of restaking security. At the same time, Babylon introduces the BABY incentive mechanism to encourage PoS chains to pay security fees to BTC holders, creating a decentralized security leasing market.

Staking Model

Babylon utilizes Bitcoin's native smart scripting capabilities to construct a trustless restaking system. When users stake BTC, the funds are locked in time-locked or multi-signature contracts, without needing to transfer assets to other chains or third-party custodians. This mechanism allows the use of BTC to support the consensus mechanisms of other networks while retaining ownership and establishing clear rules for penalties and redemptions, forming a trust-minimized staking structure. Currently, after users stake BTC into Babylon, they must go through an unlocking period of about 7 days before they can redeem their assets.

Staking Data

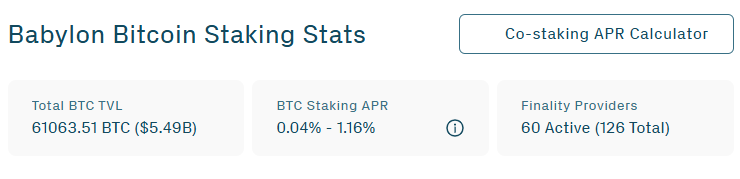

As of now, Babylon has locked approximately 61,063 BTC in the protocol, making it one of the largest BTC restaking protocols currently. Babylon ranks second in TVL among restaking protocols. The total amount of BTC staked in Babylon accounts for about 0.31% of the circulating supply of Bitcoin, with staking yields ranging from 0.04% to 1.16%, and the number of active validators reaching 60.

_Source: babylonlabs, _btcstaking.babylonlabs.io

It is noteworthy that on January 7, 2026, Babylon completed a $15 million financing round led by a16z. Additionally, Babylon is expected to integrate its technology with the lending protocol Aave in the second quarter of this year. This indicates that Babylon is also breaking away from a purely business-focused approach. By bringing BTC in a staked state into the lending ecosystem, Babylon is effectively mimicking the DeFi model on Ethereum. This serves both as compensation for the current insufficient restaking yields and as an attempt to lock in funds by empowering BTC with more financial attributes, aiming for a more comprehensive development of BTCFi.

In summary, the performance of leading projects in the restaking infrastructure layer shows that the current core issue lies not in the mechanism design or insufficient security supply capabilities, but in the difficulty of translating the abstract capability of shared security into real, stable demand and returns. Whether it is EigenCloud and Symbiotic in the Ethereum ecosystem or Babylon in the Bitcoin ecosystem, they share the common characteristic of having aggregated high-level underlying security assets technically, but they generally face pressures of slowing growth, capital withdrawal, or forced transformation at the business level.

2. Restaking Yield Aggregation Layer

The core function of the yield aggregation layer is to financialize, liquidate, and standardize restaked assets. Through liquidity restaking tokens, positions that were originally limited by unlocking periods and insufficient liquidity are transformed into tradable and composable assets, allowing users to retain exposure to underlying restaking yields while still participating in lending, market-making, and other DeFi activities. On this basis, asset aggregation platforms such as EtherFi, Pendle, Jito, and Haedal Protocol have gradually developed into the central hubs for yield and risk management within the restaking system, providing users with more convenient participation paths and yields by aggregating different restaking sources. However, it is important to note that while the yield aggregation layer enhances capital efficiency, it also accelerates risks.

2.1 Representative Projects of the Yield Aggregation Layer

2.2.1 Pendle

Project Overview

Pendle focuses on making the yields of restaked assets tradable, allowing already staked or restaked assets to generate tradable yield rights and principal shares after processing. This means that users' yields can not only come from on-chain channels but can also be cashed out or invested in future yields in the market. The process first converts the original asset into standardized yield tokens (SY), then splits them into principal tokens (PT) and yield tokens (YT), forming a tradable asset combination.

In the early explosive phase of the restaking track in 2024, Pendle successfully captured the breakout point through its collaboration with EtherFi. After EtherFi launched the liquid staking asset eETH, Pendle quickly launched a PT/YT split pool based on eETH, which became the largest pool on the platform within just a few days of its launch. By separating its yield rights from principal rights, Pendle allows users to cash out future yields early or buy yield tokens at a low price for investment, attracting a large number of arbitrageurs and structured funds, driving rapid expansion of the pool.

Business Model

Pendle's core business logic is to split various yield-bearing assets into principal tokens (PT) and yield tokens (YT), thereby creating a market for tradable yields. With the rise of restaking assets, Pendle has become an important tool for liquidity providers, arbitrageurs, and structured product teams, offering capabilities such as locking in yields early and low-risk arbitrage.

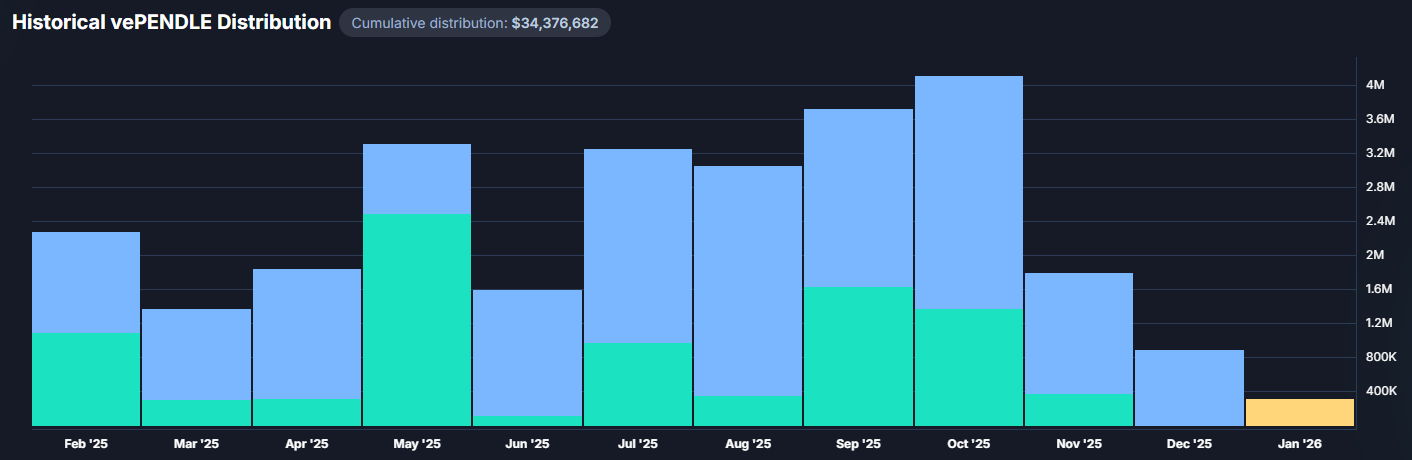

In terms of revenue, Pendle generates income through two paths. One is to charge a protocol fee of 3%–5% on accumulated yields from YT, which is stable and has low correlation with market fluctuations; the other is to collect transaction fees from PT/YT trades, which is also a major source of income. Both sources of revenue are fully returned to locked vePENDLE users, leaving nothing for the protocol team. This complete profit-sharing mechanism enhances the holding value of the governance token.

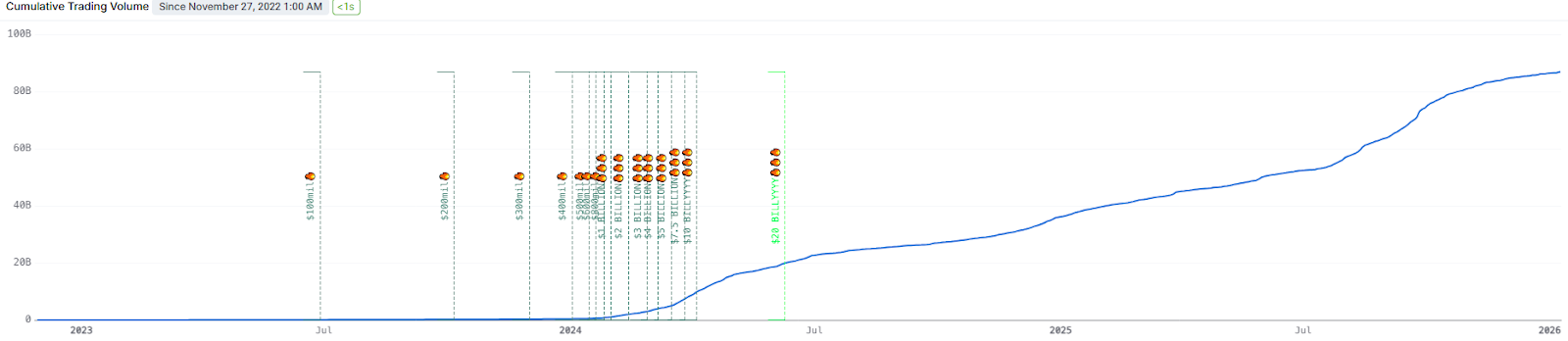

It is worth noting that Pendle has seen exponential growth in trading volume since the beginning of 2024. As of now, Pendle's cumulative trading volume has approached $90 billion, with an overall growth pace that is relatively smooth, showing no significant retracement. This indicates that Pendle's trading activity is not driven by a single event or short-term incentives, but rather accumulates gradually alongside the expansion of product use cases and increased user activity.

_Source: app.sentio.xyz, _[https://app.sentio.xyz/share/lv18 U9fyu1b558xf](https://app.sentio.xyz/share/lv18 U9fyu1b558xf)

Staking Model

Pendle itself does not provide restaking services but collaborates with platforms like EtherFi (eETH) to bring assets with restaking yield capabilities into the Pendle platform. By splitting these assets into principal parts (PT) and future yield parts (YT), Pendle achieves early pricing and liquidity release of restaking yields. Users can choose to sell YT to lock in future restaking yields or buy YT to seek higher yield growth. This mechanism makes Pendle the core platform for trading restaking yields, transforming future yields that were difficult to monetize into configurable and tradable financial instruments, thereby broadening the use cases for restaked assets.

Staking Data

Pendle has a total TVL of approximately $3.791 billion and total revenue of $76.03 million. Notably, Pendle's development has not been limited to the restaking track. As the platform's user base and liquidity continue to expand, Pendle is accelerating its penetration into a broader on-chain yield market. Currently, the assets it supports include stablecoin yield assets, short-term U.S. Treasury bonds, and more. By building a unified yield separation and pricing market, Pendle is attempting to establish the infrastructure for liquidity of on-chain yield assets. This strategy not only positions Pendle as a core hub for DeFi fixed income and yield curve trading but also lays the foundation for constructing a more comprehensive on-chain yield financial market.

_Source: app.pendle.finance, _https://app.pendle.finance/vependle/overview

In summary, Pendle has evolved from an early yield-splitting protocol into a comprehensive yield pricing and liquidity infrastructure across chains. Its continuous growth in trading volume and revenue indicates that Pendle's core value is no longer confined to a single track or asset type, but rather in building a cross-asset, cross-cycle yield market.

2.2.2 Haedal Protocol

Haedal Protocol is the first liquid staking protocol on the Sui mainnet, allowing users to stake SUI and receive representative tokens called haSUI. haSUI can further be used to participate in liquidity mining, lending, and derivatives-related applications within mainstream DeFi protocols in the Sui ecosystem, enabling staked assets to retain their native staking yields while gaining liquidity and composability, thereby enhancing capital efficiency and amplifying overall staking returns.

Haedal's model is similar to the restaking logic, granting derivative properties to staked assets through haSUI, allowing them to be reinvested in other protocols for additional yields. As the most representative LST protocol on Sui, the haSUI produced plays an important asset hub role within the ecosystem. Currently, the Sui ecosystem's restaking protocols have not yet formed on a large scale, and in this context, Haedal, as the first liquid restaking platform on Sui, plays a role in transitioning staked assets from static to dynamic. It represents liquid staking and intersects with the restaking track in both practical functionality and ecological impact, thus this report includes it in the research scope.

Business Model

Haedal's revenue sources can be divided into three parts: the first is management fees from staking rewards (approximately 6%); the second is LP, lending, and trading fees generated by haSUI in external DeFi scenarios; the third is net income from combined strategies realized through HMM market-making and haeVault strategy pools. Part of this revenue is used to replenish protocol operations, while another part is automatically fed back to haSUI holders through a Rebase mechanism.

Additionally, the protocol implements a veHAEDAL locked governance model, allowing users holding veHAEDAL to participate in voting and receive buyback rewards from protocol revenue, including staking management fees and market-making profits. This revenue and governance closed-loop mechanism enhances users' long-term locking motivation and provides an incentive basis for the protocol's stable development.

Staking Model

Haedal's staking mechanism is designed to be simple and efficient. After users deposit SUI tokens into the protocol, the system automatically distributes the assets across multiple high-quality validator nodes for staking. The allocation strategy is dynamically adjusted based on multi-dimensional indicators such as node historical performance, yield, and stability to maximize user staking returns. After staking, users receive liquid staking tokens haSUI, and staking rewards are automatically reflected through this token on a daily compounding basis, requiring no additional actions from users.

In addition to basic staking functions, Haedal also offers diversified yield strategies. Users can deposit haSUI into the haVault strategy pool to participate in various combination strategies such as automated arbitrage and liquidity mining, achieving multi-channel asset appreciation. Meanwhile, Haedal supports users in providing liquidity to decentralized trading platforms using haSUI through a hybrid market maker (HMM) mechanism, thereby earning fee income. The protocol also has built-in risk control mechanisms that can promptly adjust staking allocations in case of abnormal validator node performance, ensuring asset safety and stable returns.

Staking Data

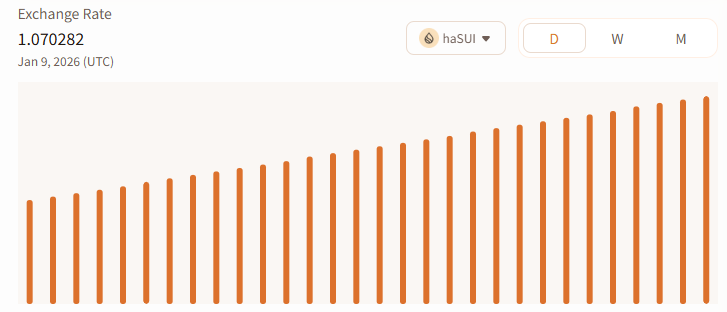

As of now, Haedal has a total TVL of approximately $97 million. The circulation of haSUI exceeds 45.67 million tokens. The current pegged exchange rate of haSUI is approximately 1.070282, meaning that users holding haSUI have achieved an accumulated staking yield of about 7.03%.

Haedal's staking return mechanism is that when users deposit SUI into the protocol, an equivalent amount of haSUI is minted at the current exchange rate; during the holding period, the number of haSUI remains unchanged, but its exchange ratio with SUI continuously increases, accumulating staking rewards. When users redeem, they can exchange the same number of haSUI for more SUI at the new exchange rate, thus obtaining returns.

In the initial phase, 1 haSUI corresponds to 1 SUI; as staking rewards continue to accumulate, the exchange rate gradually increases. Currently, this exchange rate has stabilized at around 1.07, representing that each haSUI corresponds to approximately 7% more SUI assets than initially. This mechanism effectively achieves automatic compounding, allowing users to avoid frequent manual withdrawals and restaking of rewards, making it suitable for long-term holders to continuously accumulate returns, and reflecting the robustness and transparency of Haedal's staking mechanism.

_Source: haedal.xyz, _https://www.haedal.xyz/stats

Haedal is also upgrading related products, with Haedal Liquidity Vault v2 officially launched to help users achieve long-term sustainable LP returns. However, from the current data, its scale is still in the early stages, with limited capital volume and application coverage, and its ecological influence has not yet been fully realized. The more forward-looking significance of Haedal lies in pre-setting the infrastructure for the financialization of staked assets in the Sui ecosystem, and its subsequent growth potential will depend on the expansion of the Sui public chain in DeFi scale and the actual implementation of related scenarios.

2.1.3 Jito

Jito is the most systematically influential restaking platform in the Solana network, with its core value in capturing the ordering rights revenue (MEV) that originally belonged solely to node operators and returning it to staking users. Jito does not introduce additional service validation or protocol guarantees but aims to maximize the value of staked assets by enhancing basic staking returns.

Unlike the Ethereum restaking ecosystem, which emphasizes service security guarantees, Jito's approach leans more towards yield optimization. In Solana's high-performance execution environment, Jito monetizes the hidden MEV space in block ordering and incorporates this revenue into the jitoSOL reward system. This mechanism bypasses the complexity of intermediate service layer competition, achieving an efficient restaking path that directly redistributes the protocol's native revenue structure.

Business Model

Jito's business model consists of two parts: basic staking returns and transaction ordering incentives (MEV). Basic staking returns refer to the network's basic inflation rewards generated when users delegate SOL to Jito validator nodes; transaction ordering incentives (MEV) refer to Jito's design of a specialized ordering system to manage the arrangement of transactions in each block on the Solana network. This order itself is valuable, as the position of a transaction can determine how much profit it can earn. Jito publicly auctions the rights to this transaction order, with the highest bidder getting priority. Ultimately, this portion, referred to as ordering income, has 80% returned to users, specifically those staking SOL to receive jitoSOL.

Staking Model

Users can exchange SOL for jitoSOL through the Jito frontend or Solana ecosystem wallets, with the latter serving as a tradable staking certificate while accumulating two types of yields. jitoSOL can be reused for various purposes, including lending, LP market-making, and derivatives trading, forming a composite model of restaking and reuse.

Jito's mechanism resembles a secondary capture of protocol-native revenue, with no additional protocol dependencies or new penalty mechanisms, significantly reducing risk exposure and providing a more certain user experience. This low-friction structure lowers the user threshold, allowing the reuse of staked assets to seamlessly integrate into the DeFi system, thereby constructing a restaking path based on yield stratification.

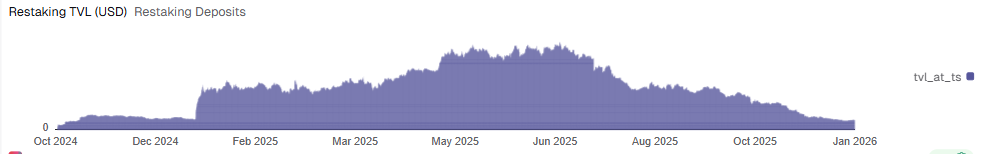

Currently, Jito has a total TVL of approximately $2.026 billion, with an annual average yield of 5.94%, and a total restaking TVL of about $46.33 million. The trend of Jito's restaking is shown in the following chart, which presents a pattern of phase expansion followed by a decline. Its restaking TVL continued to grow from the end of 2024 to the first half of 2025, peaking in the second quarter of 2025; thereafter, the capital scale gradually decreased, entering a noticeable decline phase in the second half of 2025, indicating a shift from early rapid expansion to deleveraging and structural adjustment, with the market's attitude towards restaking becoming more cautious.

_Source: Dune, _https://dune.com/jito/jito-restaking

It should be noted that although this report includes Jito in the discussion of restaking, its restaking scale still accounts for a relatively low proportion of the overall business. Currently, the restaking TVL is only about $46 million, which is limited, and restaking serves more as a marginal supplement to its staked asset reuse capabilities. Overall, Jito's restaking reflects more of a functional extension and strategic exploration within its system, and its development pace is more susceptible to changes in market cycles and risk preferences.

2.2.4 EtherFi

EtherFi provides users with a way to participate in the automatic integration of Ethereum native staking and EigenCloud restaking by issuing eETH or weETH. After users deposit ETH into EtherFi, the protocol completes the staking on the Ethereum consensus layer in the background and automatically connects the corresponding assets to EigenCloud's restaking system; the eETH or weETH held by users serves as a yield certificate that can be used in DeFi scenarios for lending, market-making, and other operations while continuously accumulating underlying staking rewards. Compared to traditional restaking, EtherFi encapsulates complex operations at the protocol level, allowing users to automatically enjoy dual yields and on-chain liquidity.

EtherFi's revenue sources include native staking rewards from the Ethereum network and additional income obtained through EigenCloud's restaking mechanism. The platform also charges a certain percentage of users' staking rewards as platform income. According to DefiLlama data, EtherFi's total TVL is approximately $8.703 billion, with an average annual yield of 4.29%. From a time series perspective, EtherFi's yield has shown relatively stable performance overall, while its TVL experienced phase expansion in mid-2025, followed by a decline and entry into a range of fluctuations.

_Source: exponential.fi, _https://defillama.com/protocol/tvl/ether.fi-stake

It is noteworthy that, in addition to its layout in the restaking track, Ether.fi is currently accelerating the expansion of crypto applications into real-world consumption scenarios, continuously enhancing its practicality beyond the restaking ecosystem. On June 10, 2025, Ether.fi launched the ether.fi Hotels booking platform, allowing Club members to use crypto payments to book over 1 million high-end hotels worldwide and receive 5% cashback through the ether.fi Visa card.

At the same time, ether.fi Cash has partnered with Scroll to utilize its zk-Rollup technology to support physical payments, allowing users to use physical crypto credit cards or Apple Pay or to mortgage their earning assets for instant consumption, enjoying up to 5% cashback. Additionally, users depositing LiquidUSD or LiquidETH can earn liquidity rewards of 0.15 ETHFI for every $1,000 held daily. This series of actions indicates that ether.fi is gradually expanding from restaking to applications in consumer finance and Web3 practical scenarios.

_Source: ether.fi, _https://www.ether.fi/app/cash

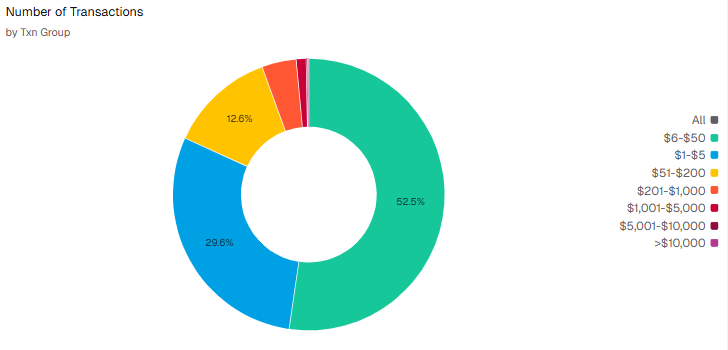

Interestingly, since the launch of the EtherFi Cash business, it has resonated well with the market. According to Dune data, this business has accumulated a consumption amount of approximately $197 million, completing 2.36 million transactions and distributing approximately $7.75 million in cashback, with the number of active cards reaching 46,900. Overall, the transaction frequency and active card numbers indicate that the product has entered a phase of actual use, while the scale of cashback is relatively controllable, suggesting that current incentives primarily serve to acquire and retain users, reflecting that its payment scenario is in a steady growth phase. It is worth noting that, based on usage, cardholders primarily engage in small, exploratory consumption, with transaction frequencies concentrated around amounts of $6 to $50.

_Source: Dune, _https://dune.com/etherfi/etherfi-cash_

In summary, EtherFi is gradually transforming from a single restaking yield aggregation platform into a crypto financial entry point with real payment capabilities. Current transaction data indicates that this model has entered a phase of real use, but overall, it remains focused on small, high-frequency, exploratory consumption.

3. Active Verification Service Layer for Restaking

The Active Verification Service (AVS) layer is designed to allow infrastructures and protocols that do not require building their own verification networks to share the economic security of underlying staked assets through the integration of restaking mechanisms, thereby reducing security startup costs and enhancing attack resistance. Currently, only a few infrastructure modules that are highly sensitive to security and have the ability to pay continuously truly require Ethereum-level economic security, leading to the AVS layer's development lagging behind that of the infrastructure layer and yield aggregation layer. In this context, this report selects the three most prominent AVS projects in the leading EigenCloud ecosystem within the restaking track for analysis: EigenDA, Cyber, and Lagrange.

3.1 Representative Projects of the AVS Service Layer

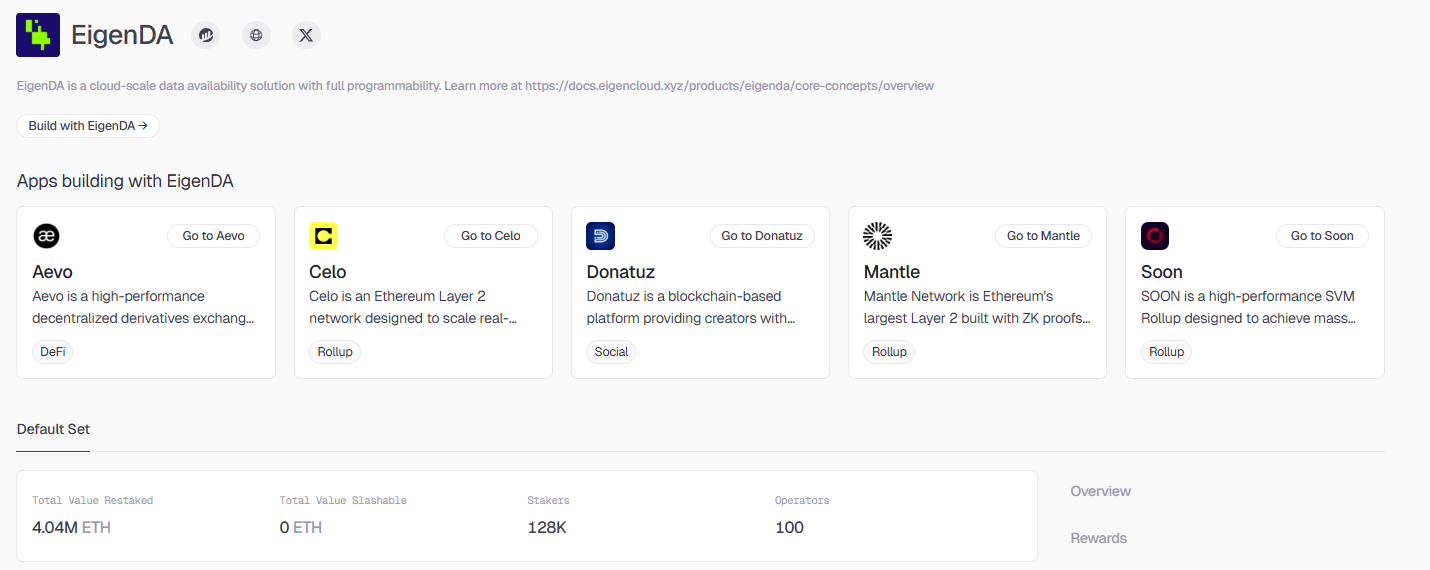

3.1.1 EigenDA

EigenDA is the first AVS launched by EigenLabs, designed to provide cheap and massive storage space for various Rollups. In the blockchain world, data availability (DA) acts like a cloud hard drive for public ledgers, where Rollups need to back up transaction data to this hard drive to ensure that anyone can retrieve and verify the authenticity of transactions at any time. The emergence of EigenDA aims to make this hard drive faster and cheaper while maintaining Ethereum-level security.

Traditional blockchains typically require every node to download and store all data completely, which, while secure, is very congested and expensive. EigenDA adopts a smarter sharding approach, using mathematical principles to break data into many fragments and distribute them to different nodes in the network. Each node only needs to store a small portion of the data, but as long as enough nodes are online, the system can reconstruct the original data like a puzzle. This design allows EigenDA to overcome traditional performance bottlenecks, achieving throughput levels comparable to Web2.

Its greatest advantage lies in directly leveraging Ethereum's existing vast credit system. Through EigenCloud, users who have already staked ETH on Ethereum can choose to restake these assets to EigenDA's validators. This means that if someone wants to attack EigenDA, they are essentially challenging the security barrier of ETH worth hundreds of billions of dollars. For Rollup developers, this saves the enormous costs of building a secure network themselves, achieving a "turnkey" level of security.

In terms of commercialization strategy, EigenDA behaves more like a flexible cloud service provider. Traditional Ethereum storage prices fluctuate dramatically with network congestion, while EigenDA allows project parties to reserve bandwidth in advance. Additionally, it is extremely open in terms of payment methods; project parties can pay fees not only with ETH but also with their own issued tokens.

EigenDA is the largest AVS in the entire restaking ecosystem. As of now, it has locked over 4 million ETH in restaked assets, attracting more than 120,000 addresses to participate, dominating in both capital depth and network distribution.

_Source: app.eigenlayer, _https://app.eigenlayer.xyz/avs

However, it must be objectively noted that EigenDA is still in the early stages of commercialization. Although it has the largest amount of staked assets on paper among AVS projects, the actual number of penalty cases is zero, indicating that its security constraint mechanisms are still largely at the institutional planning level and have not yet undergone real large-scale malicious attack tests.

3.1.2 Cyber

Cyber is an application-based AVS that introduces restaking security through Cyber MACH. Its core logic is to provide additional verification and rapid confirmation capabilities for chain states through MACH AVS while keeping the OP Stack execution layer unchanged, thereby enhancing the interaction experience and security in social and AI scenarios. This model reflects the practical use of AVS at the application layer; it does not replace the existing Rollup security model but serves as an additional security layer that can be integrated as needed.

As of now, its restaked asset scale is approximately 3.49 million ETH, with about 114,000 addresses participating in staking and 45 node operators. Its security budget ranks in the top tier among application-based AVS. However, at the same time, its punishable assets remain zero, indicating that the relevant punishment and constraint mechanisms have not yet entered a verifiable stage in real-world operations, reflecting the general lag in the implementation of security mechanisms for application-based AVS.

More concerning is that Cyber has noticeably slowed down in its project advancement pace. Its official website and white paper content are still at the level of the first quarter of 2025. This means that, despite Cyber having absorbed a certain scale of restaking security on paper, how to convert this security budget into sustainable product capabilities and commercial value remains highly uncertain.

3.1.3 Lagrange

Lagrange is a decentralized computing network aimed at zero-knowledge proof generation, with the core goal of providing high reliability and high availability proof generation services for Rollups, cross-chain protocols, and complex on-chain computing scenarios. Unlike infrastructure-based AVS like EigenDA that directly ensure chain state security, Lagrange addresses a more fundamental issue in computation-intensive scenarios: whether proofs can be generated timely, correctly, and continuously.

In the AVS architecture, Lagrange imposes economic security on ZKProver nodes to constrain nodes to complete computational tasks on time and maintain network activity. As of now, Lagrange has absorbed approximately 3.05 million ETH in restaked assets, with about 141,000 addresses participating in staking and 66 node operators.

Lagrange exemplifies the typical use of AVS in the direction of computing services, where restaking security does not directly create demand but provides reliable delivery assurance for existing demand. It is important to emphasize that the core competitiveness of the ZK Prover network ultimately depends on performance, latency, and unit cost. Restaking security plays more of a stabilizing role rather than a decisive advantage. Therefore, the long-term sustainability of Lagrange is highly dependent on whether ZK applications continue to expand and whether proof services can form a clear and sustainable paid market. This also reflects a common characteristic of computing-based AVS: while the security budget is sufficient, the path to commercialization still requires time for validation.

In summary, the core issue exposed by the AVS layer is not whether restaking security is strong enough, but whether high-level economic security is "necessarily utilized" in reality. From the latest operational situation, it can be observed that leading AVS have generally absorbed millions of ETH in restaked assets, but this security supply has not been simultaneously transformed into clear and sustainable demand. On one hand, the punishable assets of leading AVS have remained zero for a long time, and security constraints are more at the institutional and expectation level; on the other hand, whether in data availability, application-based Rollups, or ZK computing services, their real payment capabilities and commercial closed loops are still in the early validation stage. This means that the current AVS layer resembles a pre-configuration of security rather than a security demand driven by application necessity.

3. Vulnerabilities and Risk Points of the Restaking System

1. Risk of Insufficient Shared Security Demand

The core of shared security in restaking lies in replacing self-built security with paid rental security, thereby reducing the overall cost during the cold start phase. New chains often lack a sufficient validator ecosystem and market trust in the early stages, and self-built security must bear multiple costs, including inflation incentives, node operation, and security endorsement. During this phase, inheriting the main chain's security through restaking protocols indeed helps concentrate resources on product and ecosystem development.

However, the premise for this model to hold is that the marginal cost of renting security is significantly lower than the overall cost of self-built security, and that external security can have a verifiable positive impact on user growth or capital retention. As the network enters the mid to late stages, when income, inflation models, and verification systems gradually mature, project parties often have the conditions to internalize security budgets, leading to a decrease in the relative attractiveness of shared security, with demand exhibiting a decreasing characteristic as the project grows.

On the other hand, from the overall market structure perspective, the establishment of shared security demand implies the continuous emergence of a large number of new chains or networks in the on-chain ecosystem, i.e., the expansion scenario of "ten thousand chains issuing tokens." However, at the current stage, this situation has clearly weakened, with the number of new public chains and application chains and their financing scale continuously declining, and development and capital resources accelerating towards a few mature ecosystems. Project parties are more inclined to build applications within existing main chains or Layer 2 systems rather than restarting a new chain that requires comprehensive investment from consensus, security to ecosystem.

In this context, the demand foundation for providing general shared security to new chains has shrunk. This means that the market demand related to shared security is shrinking and is difficult to form a continuous new demand, with its application scope gradually converging.

2. Risk of Security Dilution Under Financial Leverage

From a mechanism design perspective, restaking reuses the economic security that has already been deposited in the main chain, allowing the same staked asset to provide verification support for multiple protocols or services simultaneously, theoretically improving capital efficiency. Under the framework of modular architecture and security as a service, this approach is seen as an optimization path that replaces redundant construction with vertical division of labor, helping to lower the threshold for individual protocols to independently bear security costs and enhancing the overall capital efficiency of the system at specific stages.

However, combining the actual operational situations of the infrastructure layer, yield aggregation layer, and AVS layer, it can be observed that this efficiency improvement has gradually developed into implicit leverage amplification in reality. Currently, multiple protocols often share the same batch of collateral assets and validator sets, essentially forming a structure where one pool of funds corresponds to multiple security commitments. As the number of connected protocols continues to increase, the actual attack resistance corresponding to each unit of asset is continuously diluted, leading to a decrease in security margins.

At the same time, the punishable assets of leading AVS have remained close to zero for a long time, indicating that the staked scale on paper has not effectively transformed into executable economic constraints. In this structure, although the restaking system nominally improves capital efficiency, its security assurance remains more at the expectation level. In the event of extreme situations, the actual defensive capability may be weaker than the security scale reflected on paper, thereby exposing the risk of security being overly leveraged in the pursuit of efficiency.

3. Risk of Highly Concentrated Trust

At the same time, in actual operations, the power of verification nodes in the restaking system is highly concentrated. This structural imbalance leads to an increasing Matthew effect among validators, where leading nodes gain priority in AVS collaborations due to their brand, capital, and historical reputation, further accumulating more income and governance rights, thereby consolidating their monopoly position. The operational stability of some key AVS systems has become highly dependent on a few large validators. Once issues such as downtime, double signing, or collusion occur, it is highly likely to cause a cascading collapse among multiple AVS.

As of now, EigenCloud still holds over 60% market share in the restaking field. This dominant position gives its protocol decision-making influence an exceptionally large impact, forcing many projects to build around EigenCloud, further amplifying its leverage effect on the overall security of the ecosystem. If the platform experiences smart contract vulnerabilities, governance attacks, or policy changes, the chain reaction will be difficult to isolate. Although protocols like Babylon are attempting to enter this market and introduce innovative mechanisms such as Bitcoin staking to weaken centralization, their user base and ecosystem depth are still far inferior to EigenCloud. This means that the current ecosystem has not established an effective multipolar check-and-balance mechanism, and the restaking system still faces systemic risks triggered by single-point failures at the top.

4. Weakness of the Liquidation Chain and Negative Feedback

The increasing complexity of restaking protocols has made liquidation risk one of the core challenges facing the entire ecosystem. Different protocols exhibit significant differences in their reduction mechanisms and liquidity designs, making it difficult for the restaking system to form a universal assessment standard. This structural heterogeneity not only increases the threshold for cross-protocol integration but also weakens the unified response capability of the liquidation market to risks. Currently, there is a lack of an effective cross-protocol risk liquidation mechanism, leaving the entire restaking system in a potential state of systemic loss without unified credit anchoring or risk isolation. Different protocols adopt their own reduction trigger mechanisms, validator distribution logic, and collateral liquidity strategies, leading to the formation of isolated risk structures on-chain, making coordinated governance in cross-protocol scenarios challenging.

5. Liquidity Mismatch and Yield Volatility Risk

Restaking takes already liquid staking derivatives or native ETH and re-collateralizes them to external services, supporting users in participating in lending, trading, and yield aggregation operations. This seemingly improves capital efficiency, but the actual exit cycle of the underlying staked assets remains lagging. For example, EigenCloud's restaked assets require a 14-day mandatory custody period to be withdrawn. This mismatch between exit cycles and liquidity does not manifest as a problem when market sentiment is stable, but once a trust event occurs, it can easily trigger a liquidity run. Restaking yields do not come from a single source but are driven by multiple factors, including ETH main chain staking rewards, AVS incentive distributions, node operation profit sharing, and additional returns from participating in DeFi protocols. This multi-source driven yield structure increases yield rate volatility, making it difficult for investors to assess their real yield-risk ratio and thus make stable holding or allocation decisions.

Conclusion

Currently, the restaking track has shifted from early rapid growth to a stage where structural issues are gradually emerging. On one hand, it quickly rose as an extension of Ethereum's staking mechanism, seen as a new way to release on-chain trust capital; on the other hand, the actual operational mechanisms continuously expose issues of centralization and risk accumulation, posing challenges of limited resources and growth bottlenecks for the entire track.

Market demand related to shared security is shrinking and is difficult to form continuous new demand, with its application scope gradually converging. At the same time, there is also the risk of security dilution under financial leverage. In most mainstream protocols, the concentration of validator delegation continues to rise, with leading nodes bearing almost the entire trust weight of the system, and the design of the protocol layer often relies on a single governance structure and highly centralized authority control. This structural defect not only undermines the original intention of redistributing trust but also, to some extent, forms a new center of concentrated power. Restaking, as an independent track, is experiencing a periodic retreat, with the market not only losing confidence in a single project but also beginning to question the efficiency of the entire shared security model and the sustainability of its yields.

Due to the persistence of this situation, leading projects are actively exploring diversified paths. The most representative, EigenCloud, is no longer limited to the positioning of restaking protocols; its new positioning is attempting to undertake a broader decentralized computing resource market and integrate with the X402 track. This transformation indicates that EigenCloud is seeking to establish itself as a more comprehensive infrastructure layer. Meanwhile, projects like Ether.fi are also beginning to expand into non-staking directions, attempting to penetrate broader use cases such as payments, reflecting the track's adjustment and shift away from a single staking logic.

However, whether it is staking, restaking, or liquidity restaking, it is difficult to escape dependence on the price of underlying assets. Once the price of native tokens declines, stakers' principal will suffer losses, and the multi-layered structure of the restaking system will further amplify risk exposure. This risk layering structure gradually exposed itself after the market boom in 2024, raising doubts about the restaking model.

From a future potential perspective, the restaking track is seeking a possible path from high-yield tools to the development of underlying credit protocols amid growing pains. The effectiveness of this reshaping largely depends on whether it can break through in two directions: internally, the market is observing whether restaking can achieve deeper integration with stablecoin mechanisms, attempting to construct a foundational infrastructure prototype similar to on-chain benchmark interest rates by outputting standardized underlying security and expected yield rates, thereby providing a low-volatility, liquidity-deep yield anchor for digital assets; externally, restaking has the potential to become a connection between decentralized ecosystems and traditional financial credit centers. If it can effectively solve the challenges of risk quantification and compliance integration, it may transform Ethereum's consensus security into credit endorsement understandable by traditional capital, accommodating institutional-level assets such as RWA.

Overall, the restaking track is attempting to break away from a single risk layering narrative and shift towards a more certain infrastructure role. Although this transformation faces dual challenges of technical complexity and regulatory uncertainty, its systematic reconstruction of the on-chain credit system will still be an important dimension to observe in the next stage of digital asset ecosystem development.

References

https://docs.eigencloud.xyz/products/eigenlayer/concepts/eigenlayer-overview

[https://app.sentio.xyz/share/lv18 U9fyu1b558xf](https://app.sentio.xyz/share/lv18 U9fyu1b558xf)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。