Author: Steve Ngok, Chief Strategy Officer of DoraHacks

Introduction

For nearly a decade, the existing financial order has viewed the cryptocurrency industry with skepticism and even disdain. In the eyes of observers in the ivory tower, this industry is merely a casino, a chaotic speculative place disconnected from the real economy. For a long time, this criticism has indeed had some merit.

But by 2026, the early chaos has given way to clear structural opportunities. The industry is not only growing but also diversifying.

We are witnessing a fission. On one side is ongoing speculation: prediction markets, exchanges, volatility optimization. This remains a vibrant yet noisy arena. But beyond that, a more serious, professional, and efficiency-seeking scene has emerged.

Stablecoins have become the TCP/IP protocol of money. They are swallowing the cross-border payment market, eliminating foreign exchange inefficiencies, and empowering AI entities with new economic primitives.

In this new land, the early DeFi mantra of "move fast and break things" has been replaced by a demand for certainty, compliance, and institutional-scale operations. This is why the Circle and Arc ecosystems have become the dominant technology stack. They have built an economic operating system that handles the tedious, core yet unglamorous "dirty work" of regulatory integration and liquidity facilitation for you.

If you are an entrepreneur in 2026, you no longer need to reinvent the wheel. DoraHacks and its partners have paved the way. The regulatory moat has been dug. Liquidity is deep and unfathomable. The question is no longer whether we can put real-world assets on-chain, but what happens when money becomes as programmable as Bitcoin?

The entrepreneurial code lies here, and the time to build is now.

Direction I: Global Capital Superhighway

From simple remittances to programmable settlements

1. Core Argument

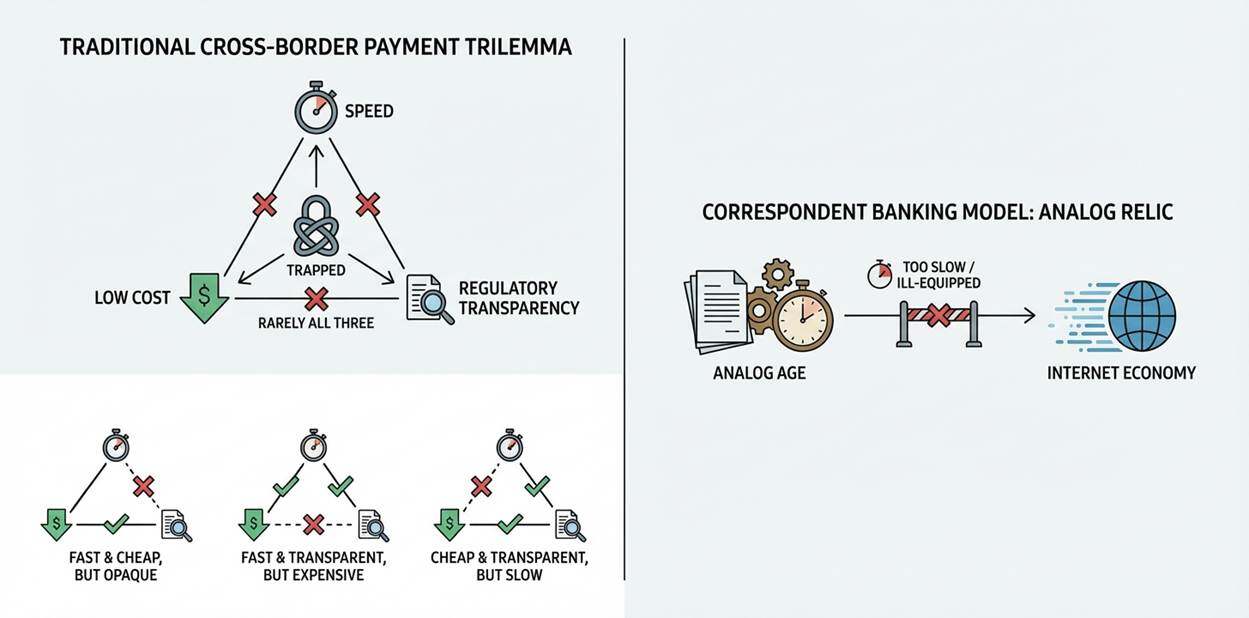

Traditional cross-border payment systems are trapped in a structural "impossible triangle": you can have speed, low cost, or regulatory transparency, but rarely all three at the same time. The current model is a relic of a bygone era, unable to adapt to the speed of the internet economy.

The Circle and Arc ecosystems have finally solved this coordination dilemma:

● CPN (Circle Payments Network): Solves the "last mile" problem, connecting digital ledgers with the global banking system.

● CCTP & Gateway: Addresses the issue of liquidity fragmentation, unifying assets scattered across different blockchains.

● Arc: Provides a "matching and clearing engine," delivering the sub-second certainty and low latency required by Wall Street.

Mission: To position Arc as the central clearing layer for global capital, building the next generation of commercial payment applications, thereby rendering the SWIFT network a thing of the past.

2. High-Value Opportunities

Our focus extends beyond basic payroll or merchant acquiring. The real opportunity lies in reconstructing B2B cash flows and platform economics.

A. Programmable Trade Finance

● Argument: "The moment goods are delivered, funds are instantly available."

● Pain Point: International trade operates with friction. Exporters must wait 30-90 days for payment or rely on expensive, cumbersome letters of credit. Trust is both slow and costly.

● Solution:

○ Escrow: Importers lock USDC in a smart contract on Arc.

○ Trigger: Oracles deliver real-time logistics data on-chain. "Goods received" = "Payment triggered."

○ Settlement: The contract automatically releases USDC.

○ Exit: CPN converts USDC to local currency (e.g., Vietnamese Dong) and instantly remits it to the exporter.

● Why choose Arc? Only Arc's sub-second finality and near-zero fees make trigger-based payments based on high-frequency logistics updates economically viable.

● Builder Profile: Supply chain ERP experts and logistics data specialists.

B. Internal Treasury Engine

● Argument: "Stop burning money on internal wire transfers."

● Pain Point: Multinational companies like Toyota or Siemens have subsidiaries in 50 countries. When the Brazilian subsidiary owes the German subsidiary money, and Germany owes the U.S., they wire money back and forth, bleeding heavily on exchange rate fees and capital lock-up.

● Solution:

○ On-chain aggregation: Subsidiaries convert local cash to USDC via CPN and pool it into a central Arc treasury.

○ Netting: A "netting algorithm" runs on Arc, calculating who owes whom on the ledger.

○ Settlement: You only need to move the net amount.

○ Withdrawal: Subsidiaries only convert liquidity back to local fiat when necessary.

● Why choose Arc? Privacy tools protect internal financial data, while high throughput handles complex mathematical operations for real-time netting.

● Builder Profile: Fintech architects and enterprise SaaS founders.

C. "Web3 Version of Stripe Connect"

● Argument: "A universal payment routing for the gig economy."

● Pain Point: Platforms like Uber, Airbnb, or Upwork struggle to pay a global workforce. Sending $50 to a freelancer in the Philippines often incurs unacceptably high costs.

● Solution:

○ Aggregation: Platforms load a single USDC liquidity pool on Arc.

○ Distribution: A single API call triggers thousands of payments.

○ Routing: Smart contracts act as routers. Crypto-native users? Sent to wallets. Traditional users? Routed to their local banks via CPN.

● Why choose Arc? Batch processing capabilities make "micropayments" feasible, which are mathematically unviable on traditional rails.

● Builder Profile: Payment gateway engineers and platform aggregators.

D. Programmable Corporate Cards

● Argument: "Give your AI agent a credit card, but control spending with code."

● Pain Point: Companies need to procure software globally, but corporate cards are clunky. They lack fine control, making it difficult to hand them over to AI agents or temporary contractors.

● Solution:

○ Liquidity pool: Corporate USDC treasury on Arc.

○ Cards: Instant issuance of virtual Visa/Mastercard credentials via CPN.

○ Rules: Embed logic in smart contracts: "This card is only for AWS" or "Daily max spend $100."

○ Settlement: Transactions are settled on-chain instantly via StableFX.

● Why choose Arc? It shifts financial control from the bank's policy department to the company's codebase.

● Builder Profile: Expense management and B2B fintech teams.

3. Technical Blueprint

For developers, the architecture is now standardized. The building process is as follows:

Deposit: Use CPN API to generate a virtual IBAN. Fiat flows in; USDC is automatically minted to the Arc address.

Liquidity: Use Gateway SDK to aggregate USDC from decentralized chains (Ethereum, Solana) into your central Arc application.

Business Logic: Deploy your Solidity contracts on Arc.

○ Payroll: distributeSalary(recipients, amounts)

○ Trade: releaseFunds(proofOfShipping)

- Withdrawal: Call CPN Payout API to burn USDC and trigger local bank wire transfers, or use Programmable Wallets to settle directly on-chain.

4. Conclusion

"Build a bank that runs on code."

Recognize your opponent: you are competing against the friction of a 1970s banking system.

By combining the speed of Arc with the coverage of CPN, you have the ability to reduce global settlement costs by 80% and increase speed from "T+2 days" to "T+0 seconds." This is a ticket to enter a multi-trillion-dollar market.

Direction II: On-Chain Forex Revolution

From manual exchanges to algorithmic liquidity networks

1. Core Argument

The traditional foreign exchange (FX) market is the largest financial market in the world, currently constrained by outdated "three inefficiencies": settlement delays (T+2 standard), gatekeeper mechanisms (only giants can access the best rates), and opacity (layered hidden fees).

The combination of Circle and Arc dismantles this structure:

● StableFX provides institutional-grade price sources (RFQ mechanism), meaning "quote equals execution."

● Partner stablecoins (e.g., MXNB, JPYC, BRLA) provide necessary local currency anchoring.

● Arc offers an execution environment that allows these currencies to be exchanged in milliseconds.

Mission: To autonomously manage currency risk using code, eliminating exchange friction in cross-border commerce.

2. High-Value Opportunities

We are looking beyond simple hedging or remittance applications. The real opportunity lies in deep financial engineering applied to global trade.

A. Autonomous Multi-Currency Treasury System

● Argument: "Bring Apple-level treasury capabilities to SMEs."

● Pain Point: A medium-sized cross-border e-commerce company earns euros (EUR), pays server fees in US dollars (USD), and pays salaries in Japanese yen (JPY). Traditional banks charge high spreads for these conversions, and finance teams often miss the best windows due to manual processing.

● Solution:

○ Automated strategy: Companies set rules on Arc: "If EURC balance > 50,000 and EUR/USD rate > 1.08, automatically convert 50% to USDC."

○ Instant execution: Smart contracts monitor StableFX quotes via oracles, executing immediately when conditions are met.

○ Payroll: At the end of the month, USDC is automatically converted to JPYC at the best market rate and distributed to employee wallets.

● Why choose Arc? Only Arc supports this level of high-frequency monitoring and low-cost execution. Traditional banks cannot provide this level of programmability.

● Builder Profile: Corporate finance SaaS teams and ERP integrators.

B. "1inch" of Forex

● Argument: "Optimal execution globally in real-time."

● Pain Point: When converting USDC to EURC, prices vary between Uniswap, StableFX, and Curve. Users rarely know where liquidity is best.

● Solution:

○ Aggregation: Build a dApp on Arc that connects StableFX (RFQ mode) with on-chain AMMs.

○ Routing: When a user wants to exchange $1 million, the algorithm splits the order: 60% through StableFX (good depth), 40% through AMM.

○ Atomic settlement: The user clicks once. Complexity is abstracted away.

● Why choose Arc? Its high performance allows querying multiple liquidity sources and executing trades within a single block.

● Builder Profile: DeFi developers and market makers.

C. Tokenized Arbitrage Trading Protocol

● Argument: "Bringing Wall Street's oldest strategy into the DeFi realm."

● Pain Point: Arbitrage trading (Carry Trade) — borrowing low-interest currencies to invest in high-interest currencies — has traditionally been the exclusive domain of hedge funds and banks.

● Solution:

○ Mechanism: Users deposit USDC.

○ Operation: The protocol borrows low-interest currencies (like JPYC) in the background, exchanges them through StableFX, and invests in high-yield assets (like tokenized government bonds).

○ Risk Control: Utilizing Arc's automation capabilities, if the exchange rate hits a volatility threshold, the system executes millisecond-level liquidation.

● Why choose Arc? This strategy requires extremely fast speeds. Arc's deterministic finality is a key safeguard against liquidation failures.

● Builder Profile: Quantitative trading teams and senior DeFi architects.

D. "Local First" Cash Register

● Argument: "Pay in pesos, settle in dollars. Zero friction."

● Pain Point: An American Shopify merchant wants USDC, but their Mexican customers want to pay in pesos (MXN). Current credit card channels charge a 3-5% exchange rate fee for this.

● Solution:

○ Frontend: Buyers see the price in MXNB (Mexican peso stablecoin).

○ Payment: Buyers pay in MXNB.

○ Backend: The transaction reaches Arc, instantly converting MXNB to USDC through StableFX.

○ Settlement: The merchant receives USDC. No banks involved. Total fee is 1%.

● Why choose Arc? Instant confirmation makes the checkout experience seamless, with no need to "wait for block confirmation."

● Builder Profile: Payment gateway developers and e-commerce infrastructure teams.

3. Technical Blueprint

For developers, the integration path is clear:

- Pricing: Integrate StableFX API (Oracle). This is a stream of executable quotes.

- Assets: Ensure your smart contracts are compatible with the ERC-20 standard for USDC, EURC, and partner stablecoins (JPYC, MXNB).

- Execution: Build a swapCurrency(tokenIn, tokenOut, amount, minRate) function. Internally call the StableFX settlement contract, passing the signed RFQ quote to complete the atomic swap.

- Interoperability (optional): Use xReserve mode. If your strategy requires assets from the Bitcoin network, encapsulate them into the Arc ecosystem via xReserve for forex liquidity.

4. Conclusion

"Forex is the largest market in the world, yet it still operates on 1980s technology."

In this race, you are reshaping the vascular system of global trade.

With StableFX and Arc, you have the opportunity to build the next generation of forex applications: operating 24/7, T+0 settlement, zero bank fees. This is the crown jewel of fintech.

Direction III: Silicon-Based Economy

From Human-Machine Interaction to Machine-to-Machine Commerce (M2M Commerce)

1. Core Argument

The current generation of artificial intelligence faces a structural paradox: infinite intelligence, yet zero financial autonomy. An AI agent can plan a complex trip to Tokyo but has no authority to book flights. It can write server code but cannot rent hardware. It is a "brain in a vat," talented yet disconnected from the real economy.

The Circle and Arc ecosystems provide this missing limb:

● Circle Programmable Wallets: Grant each agent a unique, strategy-controlled on-chain identity.

● x402 Protocol: Serves as a universal "negotiation language" for value (restoring the Web's "402 Payment Required" status code).

● Gas Station: Solves UX friction, abstracting away the complexities of ETH and Gas, making payments feel like a simple API call.

● Arc: Provides the high concurrency and deterministic environment required for machine-speed trading.

Mission: To build the infrastructure and applications that allow AI to autonomously earn, consume, and manage assets. Empowering machines with economic sovereignty.

2. High-Value Opportunities

We are looking for more than just a simple "Crypto browser." We are seeking the foundational rails for machine-native GDP.

A. API Negotiator

● Argument: "The demise of subscription models; the birth of real-time bidding."

● Pain Point: Developers are currently forced to manually subscribe to dozens of APIs (OpenAI, Twilio, SerpApi), managing a chaotic array of keys and credit card limits.

● Solution:

○ Dynamic Gateway: Service providers publish APIs on Arc with dynamic, load-based pricing.

○ Agent: Before calling data, the user's AI agent asks via x402, "What’s the price?"

○ Settlement: The provider responds, "0.002 USDC." The agent verifies its budget and executes the payment immediately.

○ Pay-as-you-go: No subscriptions. No waste. Millisecond-level settlement.

● Why choose Arc? High-frequency micropayments are economically unfeasible on traditional rails. On Arc, they are standard.

● Builder Profile: API aggregators and developer tool architects.

B. "Pay-per-Context" Gateway

● Argument: "Resolving the legal deadlock between 'The New York Times vs OpenAI.'"

● Pain Point: Large language models (LLMs) need fresh data, but publishers are blocking crawlers because they are not compensated. The legal system is at an impasse.

● Solution:

○ Compliance: Publishers deploy x402 headers on their content.

○ Micro-access: When AI crawlers access, they do not hit a paywall; they autonomously pay the publisher's Arc wallet 0.01 USDC for the legal right to ingest that specific article.

○ Revenue Stream: Funds flow instantly to creators and platforms, establishing a sustainable "AI-media" ecosystem.

● Why choose Arc? Extremely low transaction fees make a "1 cent economy" feasible.

● Builder Profile: Media tech companies and Web3 browser plugin developers.

C. "Budgeted Butler" Protocol

● Argument: "Trust code, not faith."

● Pain Point: You want your AI to buy coffee and book flights for you, but you would never give a credit card to a chatbot that might hallucinate.

● Solution:

○ Scoped Permissions: Utilize the "strategy engine" of Circle Programmable Wallets.

○ Rules: Issue the AI a sub-wallet with strict on-chain logic: "Daily max spend 50 USDC," "Only transfer to whitelisted addresses (Starbucks, Uber)," "Transactions over $100 require human biometric approval."

○ Autonomy: Within these guardrails, the AI has complete freedom.

● Why choose Arc? On-chain strategy execution is transparent and immutable, providing flexibility unmatched by traditional banking risk control models.

● Builder Profile: Smart home hubs and personal assistant application developers.

D. RLHF Lightning Bounty

● Argument: "Reverse Turing test."

● Pain Point: AI still gets stuck. It cannot read fuzzy captchas or misunderstand the nuances of sarcasm.

● Solution:

○ Request: The AI agent encapsulates difficult tasks as "micro-bounties" and broadcasts a reward of 0.5 USDC to Arc.

○ Humans: "Micro-workers" around the world click notifications to solve captchas or annotate data.

○ Payment: The AI verifies the input and releases funds immediately.

● Why choose Arc? This creates a global, frictionless labor market settled in USDC.

● Builder Profile: Data annotation platforms and crowdsourcing networks.

3. Technical Blueprint

For engineers, the assembly instructions for building silicon-based economic entities are as follows:

- Identity: Use Circle Programmable Wallets API to instantiate a smart contract account (SCA) for the AI.

○ Key Point: Configure spending strategies (e.g., maxAmountPerDay = 10 USDC).

Protocol: Integrate x402 (HTTP 402) standard. When the AI makes a request, the server returns 402 Payment Required along with the target address and amount. The AI parses this information and signs the transaction.

Gas: Configure Gas Station and Paymaster. The AI only holds USDC. The Paymaster abstracts away gas fees in the background, ensuring the AI's logical loop never gets interrupted due to a lack of native tokens.

Logic: Deploy verification contracts on Arc. Ensure successful payments trigger oracles or event listeners to release API keys or service access off-chain.

4. Conclusion

"Give your AI a wallet, not just a prompt."

Currently, your AI is like a genius locked in a library: it knows everything but cannot affect the physical world.

By combining the speed of Arc with the identity layer of Circle Wallets, you are handing that genius a key. You are architecting the GDP of the machine economy.

Direction IV: Economic Leapfrogging and Inclusion

From "waiting for aid" to "accessing the global network"

1. Core Argument

The failure of traditional financial inclusion is not due to malice but to mathematics. The unit economics of traditional banking systems are bankrupt: the customer acquisition cost and service management fees for opening an account for a user in a developing market far exceed the profits generated from their deposits. Banks simply cannot afford to open a $50 account.

The Circle and Arc ecosystems fundamentally change this equation:

● Arc's extremely low gas fees make a $1 transfer economically rational, not just charitable.

● Circle User-Controlled Wallets address the "key management" barrier by replacing terrifying mnemonic phrases with familiar social logins and passkeys.

● USDC solves the "volatility" problem, protecting vulnerable groups from the inflation of their local currencies.

Mission: To build a "Leapfrog Stack" that creates minimalist, anti-inflationary, and decentralized financial tools to serve the bottom 50% of the global population.

2. High-Value Opportunities

We are talking about building sustainable and scalable business models for the next billion users.

A. Reputation-Based Microloans

● Argument: "Digitizing the social capital of villages to access global liquidity."

● Pain Point: A fruit vendor in Kenya needs $100 for inventory. She has no credit score and is forced to accept predatory loans. Meanwhile, DeFi protocols sit on billions of dollars in idle funds, unable to deploy without over-collateralization.

● Solution:

○ ROSCA 2.0: Move the traditional "Rotating Savings and Credit Association" (i.e., merry-go-round) onto Arc.

○ SBT: If members repay on time, this behavior will be minted as a soulbound token, i.e., a digital credit score.

○ Bridge: High-reputation ROSCA groups are bundled together to borrow from global DeFi pools at competitive rates (e.g., 10%), bypassing local usury (100%+).

● Why choose Arc? Only Arc can handle massive amounts of micro-repayment data while providing the transparent audit trail required by global lenders.

● Builder Profile: Fintech founders in emerging markets and DeFi protocol architects.

B. Pay-As-You-Go Asset Networks

● Argument: "Providing liquid funding for liquid usage rights."

● Pain Point: A low-income family cannot afford the upfront costs of solar panels or motorcycles, even though they have stable cash flow to pay in installments.

● Solution:

○ IoT + Blockchain: Connect physical assets (solar panels) to internet controllers.

○ Micro-unlocking: Users pay 0.50 USDC through the Arc wallet.

○ Smart Contract Logic: Payment confirmation -> Send signal -> Device unlocks for 24 hours.

○ Ownership: If payments stop, the device locks. Once the principal is paid off, an NFT represents full ownership transfer.

● Why choose Arc? The friction of traditional payments makes daily micropayments unfeasible. Arc makes it effortless.

● Builder Profile: IoT hardware geeks and ReFi (Regenerative Finance) entrepreneurs.

C. Programmable Aid Protocol

● Argument: "Ensuring donated funds are spent on medicine, not alcohol."

● Pain Point: Humanitarian aid is plagued by two major issues: intermediary corruption (layered exploitation) and misuse of funds at the grassroots level.

● Solution:

○ Restricted Assets: Issue "wrapped USDC" on Arc specifically for aid.

○ Whitelisting: Write token code so it can only be transferred to whitelisted wallets (verified pharmacies, schools, grocery stores).

○ Automatic Redemption: Vendors receiving the tokens can instantly redeem them 1:1 for liquid USDC.

○ Privacy: Use zero-knowledge proofs to show the public where funds are flowing to valid categories without exposing the identities of refugees.

● Why choose Arc? Programmable money is the ultimate solution to the principal-agent problem in charity.

● Builder Profile: GovTech developers and NGO tech partners.

D. Direct Bill Remittances

● Argument: "Don't send cash; pay the bills."

● Pain Point: Migrant workers send money home to pay tuition. Cash is received, but due to urgent needs or lack of discipline, the money is spent elsewhere. Remitters want to control how the funds are used.

● Solution:

○ Aggregation: The platform integrates with utility and education providers in the destination country.

○ Direct Payment: Remitters in the U.S. pay USDC in the app.

○ Settlement: Arc settles the transaction in the background, converting to local currency via CPN and paying directly to the utility company.

○ Certainty: Remitters receive an instant digital receipt: "Bill paid."

● Why choose Arc? It acts as a global settlement layer, bypassing the slow and opaque chain of intermediary banks.

● Builder Profile: Cross-border payment startups and digital nomad service providers.

3. Technical Blueprint

In this race, user experience (UX) is survival. Your users are on low-end devices and unstable networks.

- Invisible Wallet: Use Circle User-Controlled Wallets with PIN or biometric recovery features. If you make users write down 12 words, you've already lost.

- Gas Sponsorship: You must configure Gas Station. Users should know they received "10 dollars," not that they need "Arc tokens" to pay for gas. Completely abstract away the blockchain.

- Lightweight Tech Stack: Build Progressive Web Apps (PWA) or Telegram mini-programs. Installation packages must be small; interfaces must be fast.

- Offline Tolerance: Design for latency. Allow users to sign transactions offline and broadcast them when the network reconnects.

4. Conclusion

"Technology has no conscience, but builders do."

On Wall Street, being 1 millisecond faster can mean an extra million dollars in profit. But in the developing world, saving $1 in fees and transferring it instantly means a family can have a full meal tonight.

This race is about using code to eliminate the "poverty premium." By leveraging the power of Arc and Circle, you are building a ladder to economic freedom.

Conclusion

The Time to Build is Now

History does not repeat itself, but it rhymes. In the late 1990s, we laid fiber optic cables to scale the internet. In the 2000s, Stripe and PayPal built the logical layer that enabled the explosion of e-commerce. Today, we are at a similar turning point in the financial internet.

The opportunities mentioned above—borderless payment rails, programmable forex, machine economy, and financial inclusion—are not theoretical science projects. They are imminent, reachable markets worth trillions of dollars.

The frictions of the traditional banking system—3-day settlement times, predatory remittance fees, walled gardens—are anomalies that technology is correcting.

Circle and Arc provide the "AWS" for this financial revolution: scalable, compliant, and ready to deploy at any time. Infrastructure risk has been eliminated. What remains is execution risk.

We are looking for founders who are not just interested in launching the next meme coin but are obsessed with dismantling banks, reconnecting global trade, and empowering AI agents with economic sovereignty.

The economic operating system is open, APIs are live, and the time to build is now.

About DoraHacks

DoraHacks is a leading global hackathon community and open-source developer incentive platform. DoraHacks provides a toolkit for all parties to empower them to organize hackathons and fund early-stage ecosystem startups.

DoraHacks is committed to driving a global hackathon movement in the fields of Web3, AI, quantum computing, and space technology. To date, over 30,000 startup teams have received more than $300 million in funding through the DoraHacks community. Numerous open-source communities, enterprises, and tech ecosystems are actively leveraging DoraHacks and its BUIDL AI capabilities to organize hackathons and fund open-source initiatives.

Official Website| Twitter|Discord|Telegram|Binance Live|YouTube

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。