However, that's not the case! After researching Hyperliquid for a month, I found that Hyperliquid is playing a much bigger game!

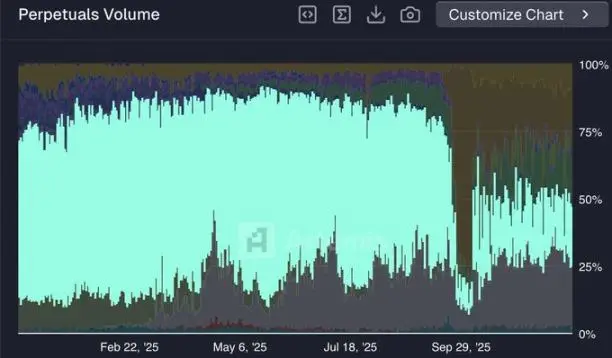

Recently, while scrolling through cryptocurrency news, did you also see the reports that Hyperliquid's market share dropped from a peak of 80% to 20%?

Competitors Lighter and Aster are frantically airdropping and subsidizing, users have fled like sheep, yet Hyperliquid remains still, not issuing tokens, not providing subsidies, not engaging in internal competition…

At first glance: It's over, this project is doomed, right?

But the more I dig, the more I feel something is off—

A project founded by high-frequency trading moguls, with a team of only 11 people, yet generating over $1 billion in annual revenue (almost $100 million per person! Even more impressive than Tether) would make such a rookie mistake?

Is it really "cooling off," or is it deliberately "playing dead," waiting to unleash a big move?

Come, let's analyze Hyperliquid's "counterintuitive operations," and you might regret not going all in sooner~

1. Once upon a time, it started with a textbook-level ace

In the first half of 2025, Hyperliquid almost dominated the decentralized perpetual contract (Perp DEX) space.

With extremely low latency, zero downtime, and a super smooth experience, it once captured 80% of the market share!

It even dared to go head-to-head with centralized giants like Binance and Bybit, becoming synonymous with "decentralized trading."

At that time, people said: Hyperliquid = the Apple of Perp DEX.

2. Market share halved in the second half? Yet it is "strategically abandoning" traffic

Lighter and Aster started aggressively subsidizing, offering points and airdrops, and users flocked in.

What about Hyperliquid? Official incentives were directly halted! Market share dropped from 80% to 20%.

Many in the crypto space are shouting: It's over, it's done for.

But do you know what it has been doing this past six months?

- Intensively launching technical hard updates: Builder Codes, HIP-3 permissionless token listing mechanism, Portfolio Margin combined margin

- On October 11, during extreme market conditions, $19 billion in liquidations occurred across the network, many CEXs experienced temporary downtime, yet it maintained zero downtime and zero bad debts throughout!

This isn't luck; it's true technical confidence!

Since May 2025, Hyperliquid's market share has sharply declined, and by early December, its trading volume share had dropped from about 80% to nearly 20%.

(Based on trading volume market share statistics from @artemis)

3. Founder Jeff Yan: Physics Olympiad gold medalist + Harvard + Wall Street high-frequency trading background

In his early 30s, Jeff Yan is a typical genius.

He represented the U.S. in high school to win a gold medal at the IPhO → Harvard for mathematics and computer science → worked at a top high-frequency trading firm as a systems developer.

He only cares about code efficiency, latency, and matching performance, never about short-term traffic.

With a team of 11, generating over $1 billion in annual revenue, their efficiency surpasses that of Apple, NVIDIA, and Meta.

He refuses VC funding, relying solely on protocol revenue for bootstrapping, not being tied down by capital, allowing him to focus on the long term.

4. HIP-3: Actively handing over "token listing rights" is true big-picture thinking

In traditional DEXs, token listing = lifeline; whoever controls the listings is the market maker.

Hyperliquid goes against the grain: HIP-3 allows anyone who stakes enough HYPE to deploy their own perpetual contract market.

The protocol only manages underlying clearing and security, while Builders are responsible for operations and market.

Profit-sharing is done well, and penalties for poor performance are enforced.

This effectively transforms Hyperliquid from "an exchange" into "financial infrastructure"—like AWS, allowing others to build their own Perp markets on top!

Want to do pre-market trading for U.S. stocks? Build it yourself. Want to do perpetual forex? Build it yourself.

Unlimited scalability opens up the realm of imagination.

5. Saying goodbye to "sheep shearing" and embracing Wall Street institutions

Retail investors love to exploit subsidies, with zero loyalty; they flee as soon as subsidies stop.

Hyperliquid directly states: I'm not playing this game.

Instead, it promotes Portfolio Margin, perfectly suited for market makers and institutional strategies.

Once institutional APIs are integrated, the migration cost is extremely high, creating strong stickiness.

Bitwise has even launched an HYPE ETF with staking rewards, and Wall Street is quietly entering the scene.

In the future, as regulations tighten, Perp DEXs that cannot avoid KYC will struggle, but a neutral protocol like Hyperliquid will be even safer.

6. Conclusion: The second act has just begun

Hyperliquid is not cooling off; it is actively withdrawing from the "traffic war" to focus on building more challenging and valuable foundational infrastructure.

Just like AWS, which didn't care about the consumer side and directly served enterprises, ultimately becoming the king of cloud computing.

In the crypto space, short-term looks at market share, while long-term focuses on moats and technology.

It hasn't fallen from grace; it has simply entered a second act that most people temporarily cannot comprehend.

Will you continue to exploit Lighter/Aster's subsidies, or go all in on this long-term project with faith?

Hyperliquid 4% trading cost reduction exclusive benefit

Link:

https://app.hyperliquid.xyz/join/AICOIN88

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。