Written by: Michael Nadeau, The DeFi Report

Translated by: Glendon, Techub News

The Solana network appears to be entering a phase of cyclical adjustment. On-chain speculative demand continues to decline, while new application scenarios and the integration of traditional finance (TradFi) have yet to fill this demand gap. Specifically, Solana's operational performance in the fourth quarter (Q4) has significantly weakened, with revenue (REV) plummeting by 43%, reaching its lowest level since the third quarter of 2023. Additionally, the on-chain actual yield has also dropped sharply by 56%, falling to a low of 0.46%. Meanwhile, as user activity decreases, the fundamental condition of the Solana network is deteriorating, with operational costs trending upward relative to the fees paid by users.

Next, this article will comprehensively analyze Solana's performance in Q4 based on detailed data. Let’s dive in.

Operational Performance

Actual Economic Value

Data Source: DeFi Report

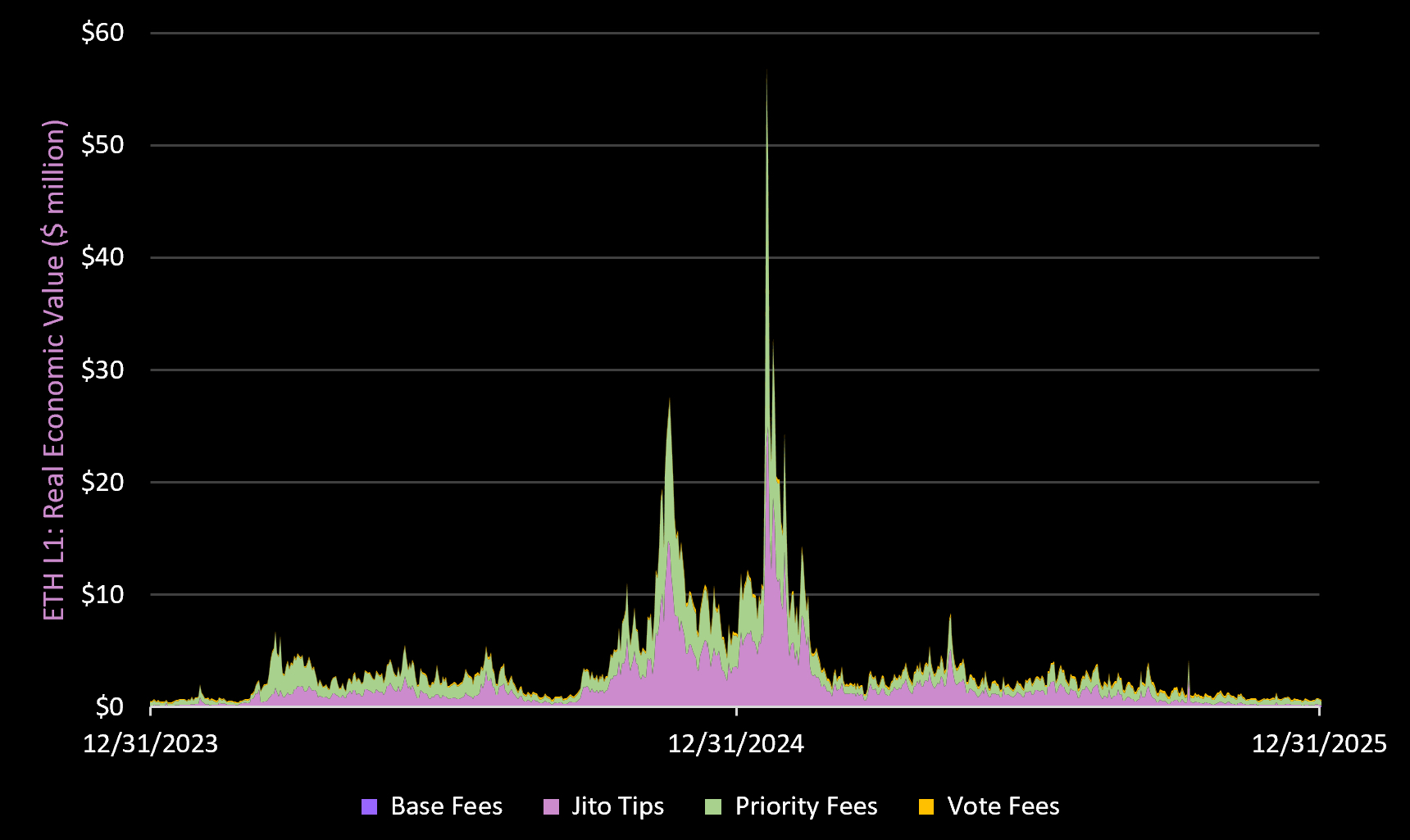

REV (Actual Economic Value) includes base fees, priority fees, MEV (Jito Tips), and voting fees for accessing L1 block space. MEV is distributed to SOL holders through staking accumulation, while the remaining fees accumulate to validators, with 50% of the base fees being burned.

The total fee revenue for the Solana network in Q4 was $91.1 million—this is the lowest level since Q3 2023, down from $222.7 million in the previous quarter. For the entire year, the network generated $1.4 billion in actual economic value, a decrease of 1.4% from last year.

For reference, the Ethereum network collected $141 million in fees in Q4, with an expected total of $763 million for the entire year of 2025.

Specific analysis:

Base fees: down 32% in Q4, but expected to rise 43% in 2025;

Jito Tips (MEV): down 75% in Q4, but expected to rise 8% in 2025;

Priority fees: down 51% in Q4, but expected to rise 15% for the entire year of 2025;

Voting fees: down 27% in Q4, but expected to rise 32% for the entire year of 2025.

Key Takeaways

Solana (and Hyperliquid) is the "speculative stronghold" in this cycle. The most powerful applications on the network (Pump, Axiom, Raydium, Jupiter) are aimed at retail traders—this makes on-chain revenue highly cyclical and entirely dependent on speculative demand.

With social media interest in cryptocurrencies reaching a six-year low, it is difficult to see a reversal of the current trend in the short term.

In the long run, we believe Solana needs to lead the tokenization of on-chain stocks (and other real-world assets RWAs) to smooth out the extreme cyclical fluctuations of its on-chain user base. Given the recent challenges to the Clarity Act, this will take some time.

Actual Onchain Yield

Onchain actual yield = MEV (Jito Tips) paid to validators and passed on to SOL stakers, excluding operator payments.

The actual on-chain yield for Q4 (annualized) was 0.46%, a decrease of 56% from the previous quarter. Of this, 72% of the yield came from priority fees, and 28% from MEV. The decline in the MEV share indicates a reduction in competitive/speculative demand this quarter.

Total Onchain Yield

Total on-chain yield = MEV (Jito Tips) + protocol issuance paid to validators and transferred to SOL stakers (excluding operator payments).

The total on-chain yield for Q4 (annualized) was 6.7%, with 93% coming from newly issued SOL. This is a decrease from 7.64% in Q3, due to a 55% decline in priority trading fees and MEV.

Network Fundamentals

Monthly GDP

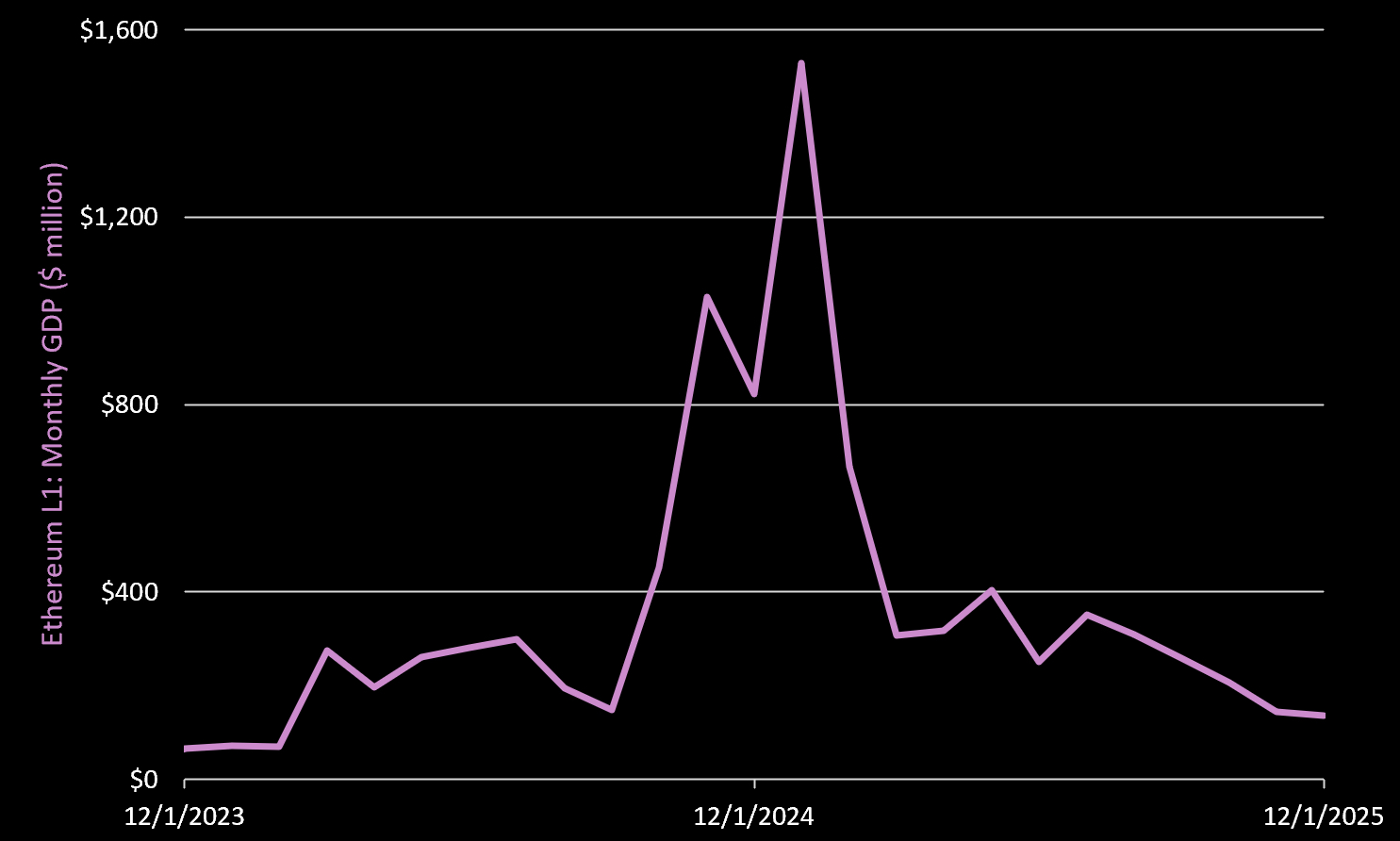

GDP = Total fees generated by top on-chain applications (excluding chain fees).

The top applications on Solana generated a network GDP of $485 million in Q4, a 47% decrease from Q3. The main drivers are as follows:

Pump Fun: $96 million (down 19% in Q4);

Circle: $85 million (up 6% in Q4);

Axiom: $55 million (down 61% in Q4);

Jupiter: $46 million (down 37% in Q4);

Raydium: $31 million (down 79% in Q4);

Jito: $23 million (down 76% in Q4).

For reference, applications on Ethereum L1 generated $2.3 billion in GDP in Q4.

Active Addresses

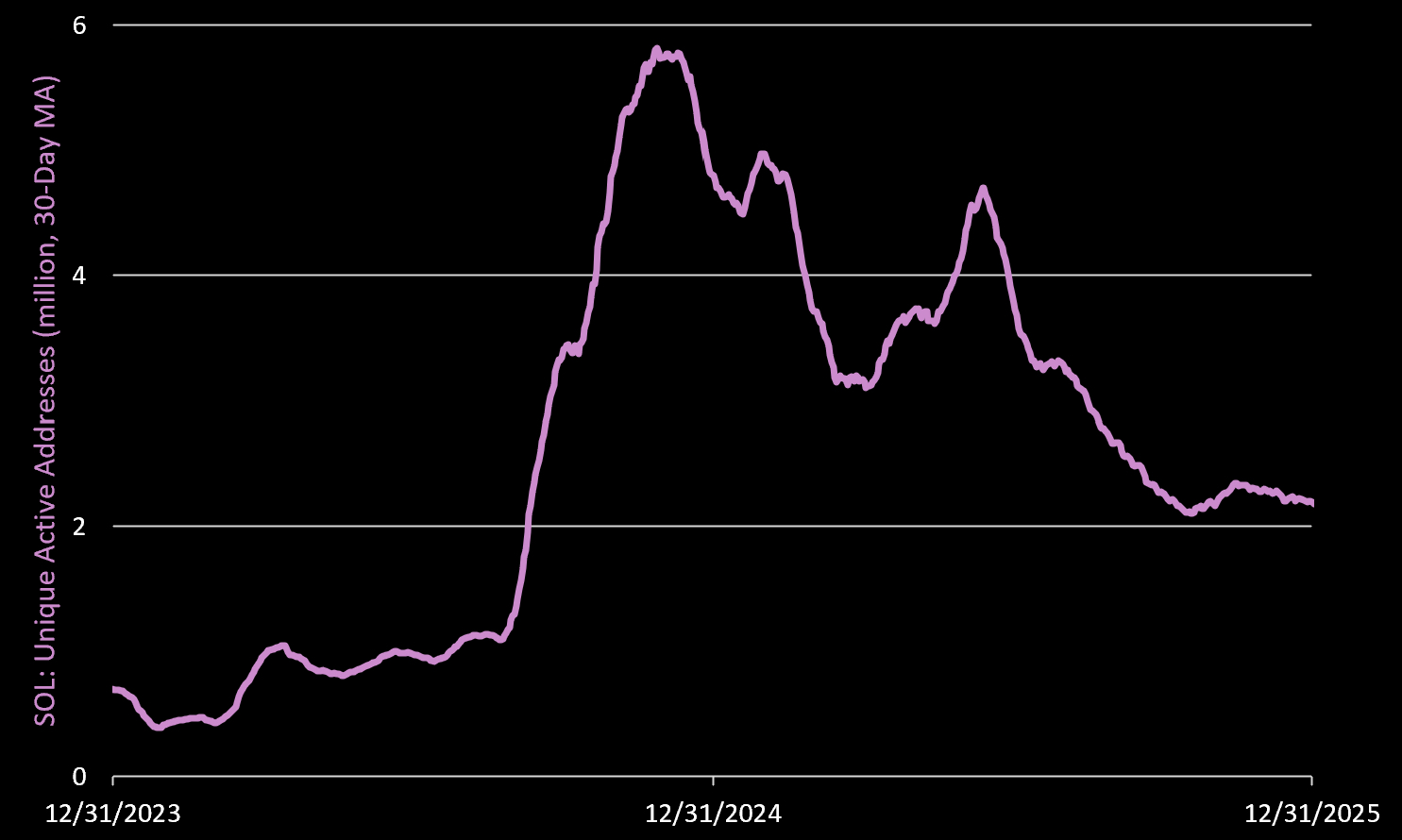

Unique active addresses = different wallet addresses that initiate at least one transaction per day.

The Solana network had an average of 2.2 million active addresses per day in Q4, a 19% decrease from Q3, due to the continued decline in on-chain speculative demand.

Active Staked SOL

Active staked volume grew by 3.5% in Q4. As of December 31, 2025, 421.7 million SOL have been staked on the network, accounting for 75% of the circulating supply and 68% of the total supply.

Unlike Ethereum, the increase in the amount of SOL staked does not reduce the new issuance paid to validators. Instead, the issuance will decrease by 15% annually according to a predetermined deflationary schedule until it reaches 1.5% per year.

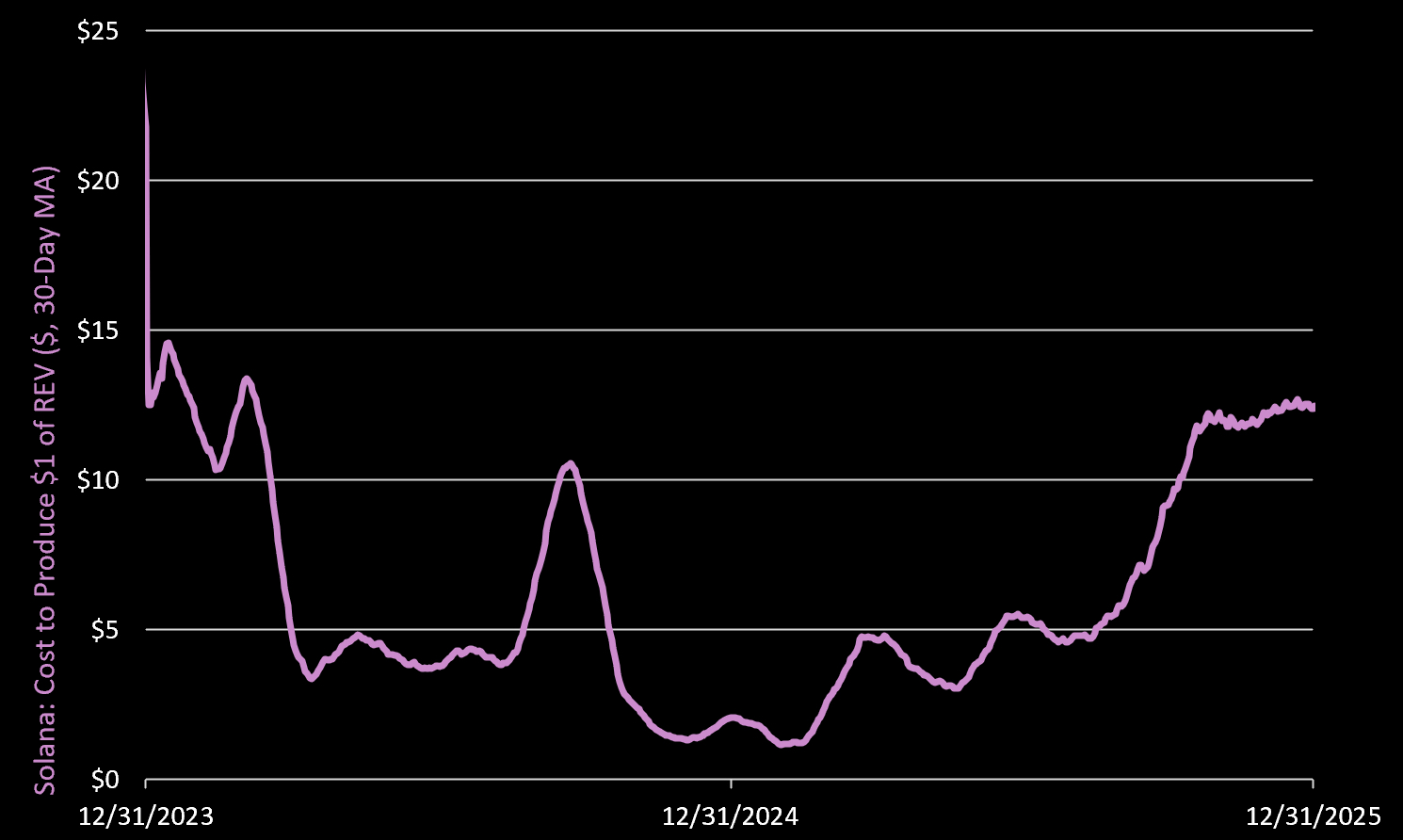

Cost of Generating $1 Revenue

In Q4, the average cost to generate $1 of actual economic value rose to $11.76, an increase of 105% from Q3.

Why This Matters

The rising cost of producing $1 of actual economic value indicates that more tokens (network inflation) need to be issued to secure the network relative to the actual value generated this quarter. This suggests that network costs/operational expenses are rising relative to network fees.

If Solana were a company, it might consider cutting costs/reducing operational expenses in such an environment.

Stablecoins

Stablecoin Supply

The total supply of stablecoins on the Solana network is now $15.4 billion, a 4.4% increase from Q3. This accounts for 5% of the total stablecoin supply in the cryptocurrency market, placing Solana's stablecoin market cap behind Ethereum, Tron, and BNB.

Major stablecoin issuers on the Solana platform:

Circle/USDC: $9.9 billion (down 1% in Q4);

Tether/USDT: $2.1 billion (down 10% in Q4);

PayPal/USDPY: $870 million (up 95% in Q4);

Paxos/USDG: $870 million (up 80% in Q4);

Solstice/USX: $306 million (up 83% in Q4).

Stablecoin Circulation Velocity

Effective stablecoin circulation velocity measures the daily turnover rate of each stablecoin supply on-chain. This metric filters out distortions such as "wash trading" and circular trading to derive the true circulation velocity, measured by daily net dollar transfer amount/circulating supply. An increase in this value indicates enhanced economic activity on the Solana network.

In Q4, the average circulation velocity of stablecoins was 0.22, an increase of 282% from Q3. However, this growth was primarily due to significant fluctuations around the liquidation event on October 10.

The Q4 reading of 0.22 indicates that 22% of the stablecoin supply was replaced during the quarter. For reference, the supply turnover rate for Ethereum L1 stablecoins in Q4 was 3%, while the combined turnover rate for Ethereum L2 stablecoins was 5%.

Token Economics

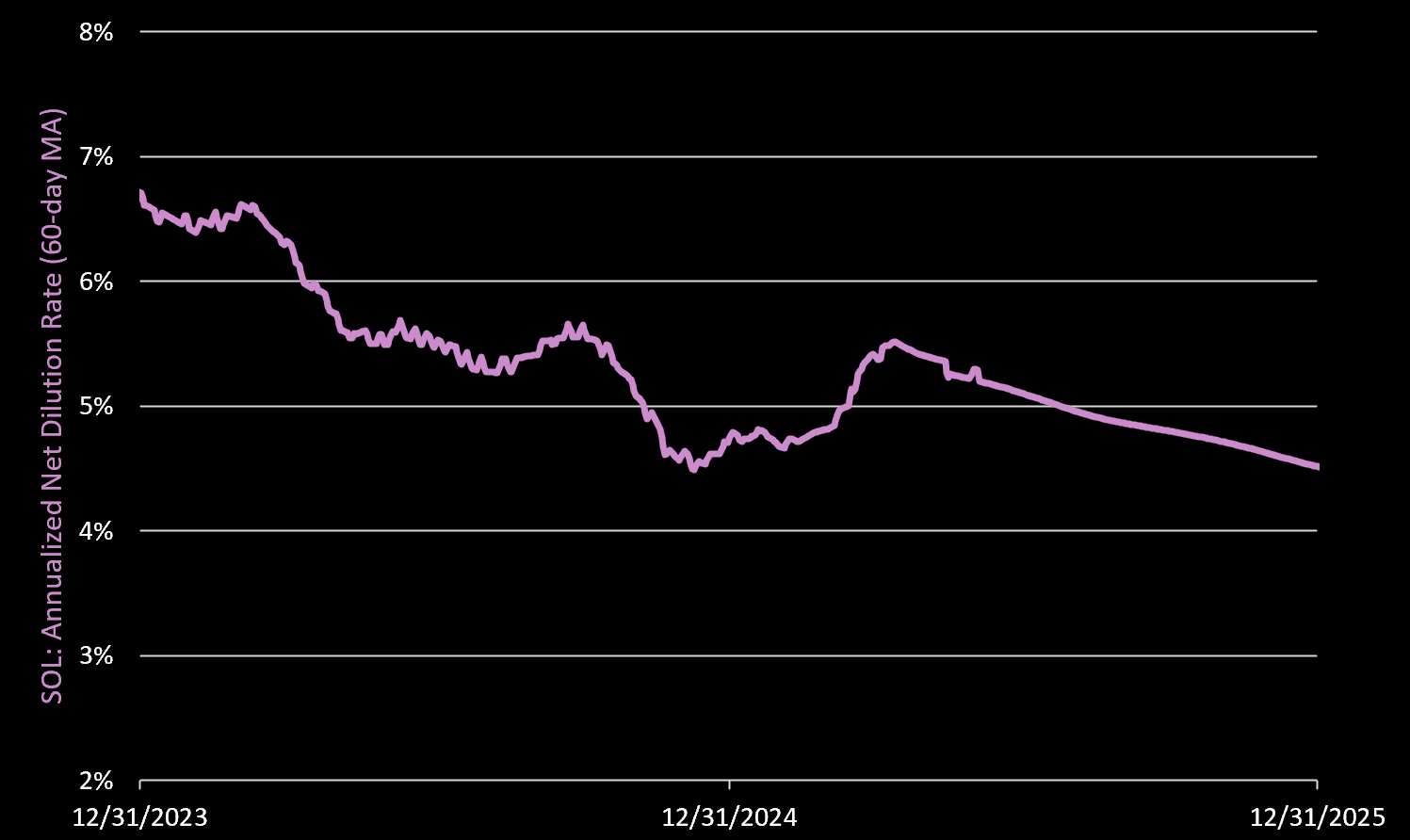

Net Dilution Rate

Net dilution rate = daily protocol issuance minus the amount of SOL burned/circulating supply (annualized). A positive net dilution rate will dilute SOL holders (non-stakers).

The net dilution rate for SOL in Q4 (annualized) was 4.57%, a decrease of 5.5% from Q3.

Driving factors:

SOL issuance: 6.45 million in Q4 (down from 6.8 million in Q3);

SOL burned in Q4: 63,764 (down from 76,247 in Q3);

Net result: approximately 6.38 million newly issued SOL in Q4 (annualized inflation rate of 4.57%).

Decentralized Finance

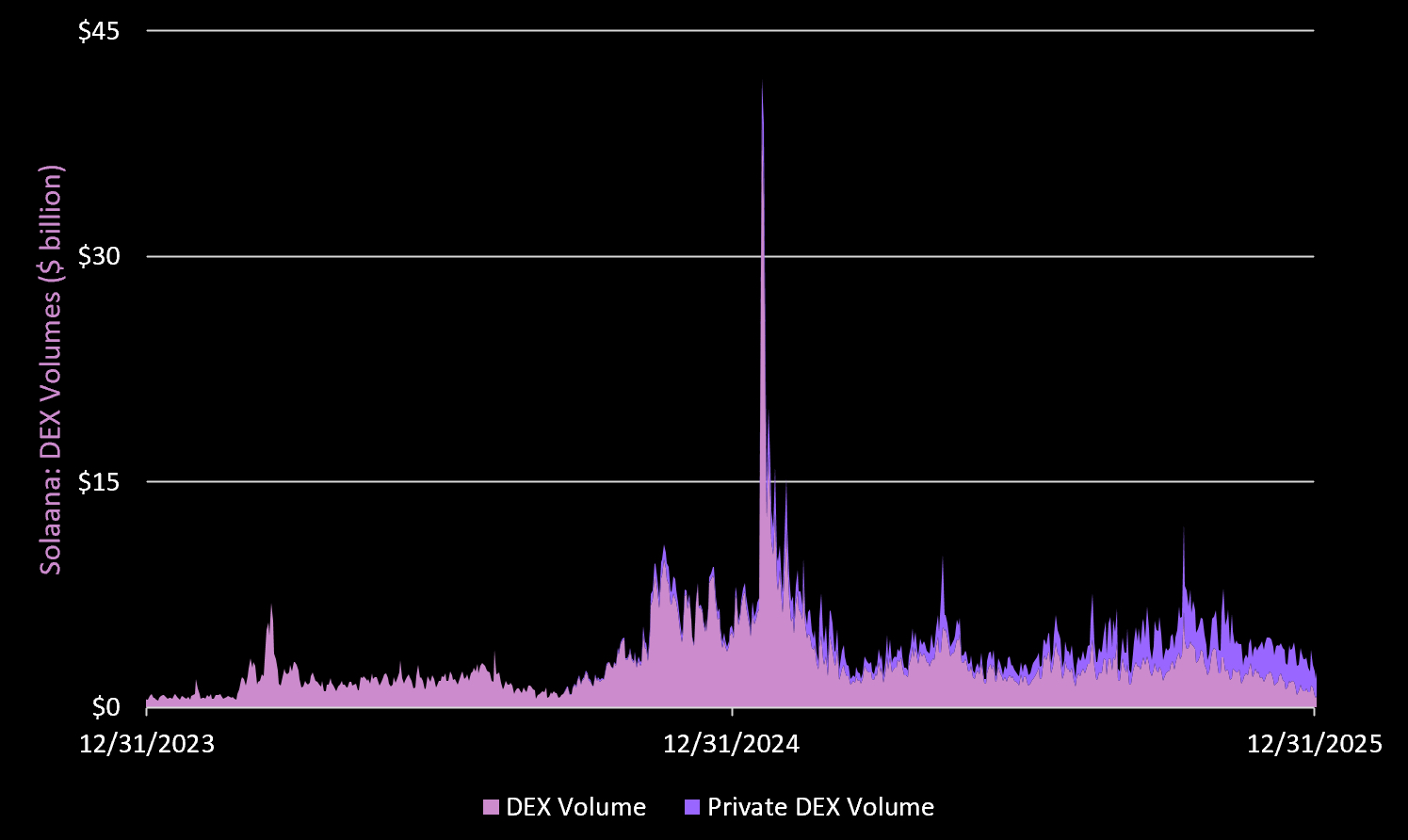

DEX Trading Volume

In Q4, the trading volume on private decentralized exchanges (DEX) on the Solana network saw a significant increase. The total trading volume averaged $2.2 billion per day (accounting for 48% of all DEX trading volume), a 50% increase from Q3.

At the same time, the average daily trading volume of public DEXs in Q4 was $2.5 billion, a 5% increase from the previous quarter. Overall, the total trading volume of DEXs in this quarter grew by 15%.

The top DEXs on Solana ranked by trading volume include:

HumidiFi Private DEX: $1.4 billion/day (up 105% in Q4)

Raydium: $985 million/day (up 6% in Q4)

Meteora: $700 million/day (up 27% in Q4)

Orca: $473 million/day (down 24% in Q4)

Tessera Private DEX: $303 million/day (up 57% in Q4)

SolFi Private DEX: $245 million/day (up 25% in Q4)

Pump Swap: $133 million/day (down 44% in Q4)

Pump Fun: $88 million/day (down 24% in Q4)

DeFi Turnover Rate

The DeFi turnover rate measures the turnover speed of each dollar of funds within DeFi protocols. When this metric is greater than 1, it indicates that the daily trading volume of the network exceeds the total value locked (TVL) in the DeFi protocols.

During Q4, the DeFi turnover rate increased by 22%, with an average daily turnover TVL rate of 46%. This growth was primarily attributed to extreme fluctuations around the liquidation event on October 10.

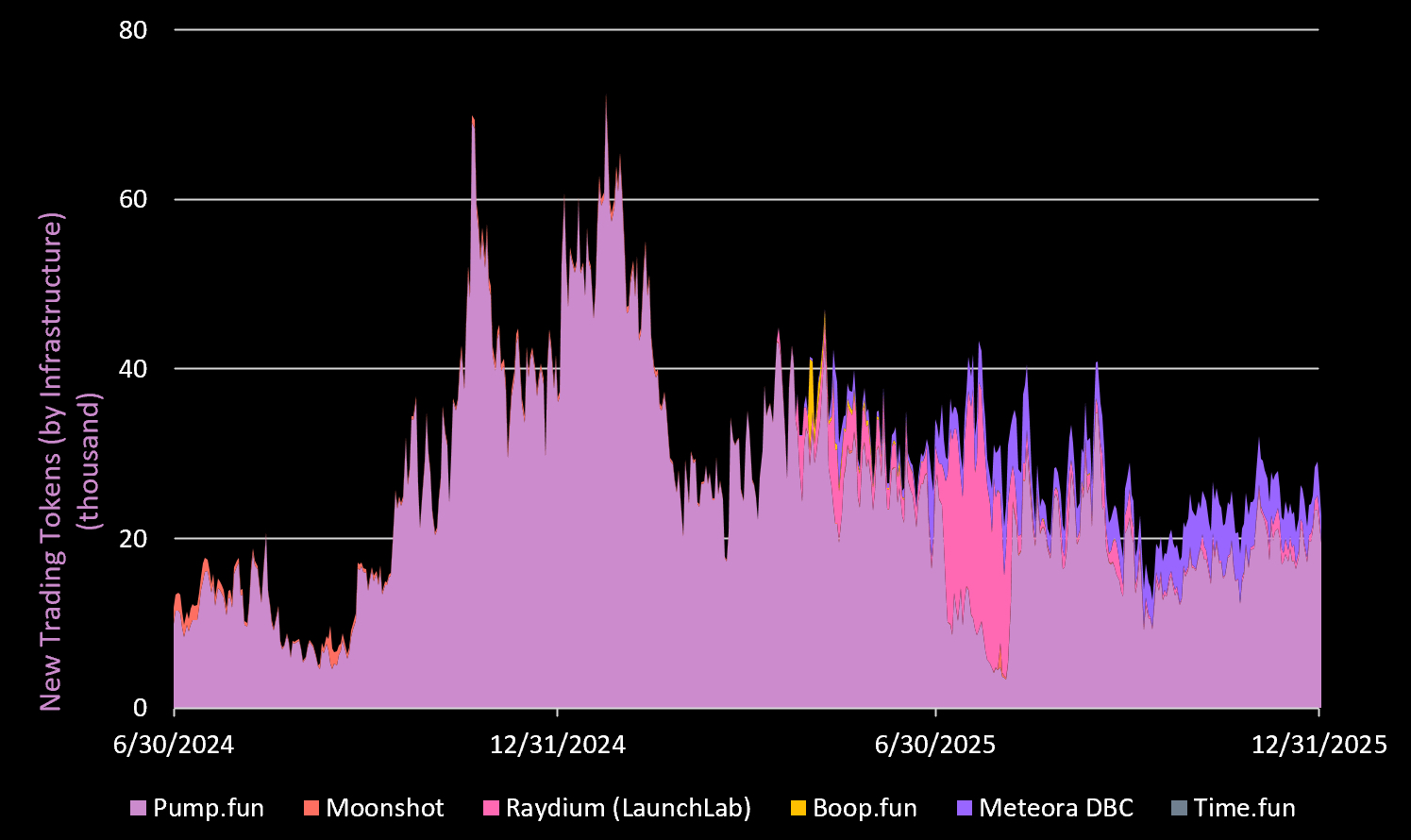

New Trading Tokens

New trading tokens refer to the number of tokens created on the Solana launch platform.

In Q4, a total of 2.1 million tokens were created on the Solana platform, a 24% decrease from Q3. Pump Fun continued to lead the market, with 1.6 million new tokens added in Q4 (market share of 75%).

Meteora was a highlight in Q4, growing by 18% and capturing 21% of the market share.

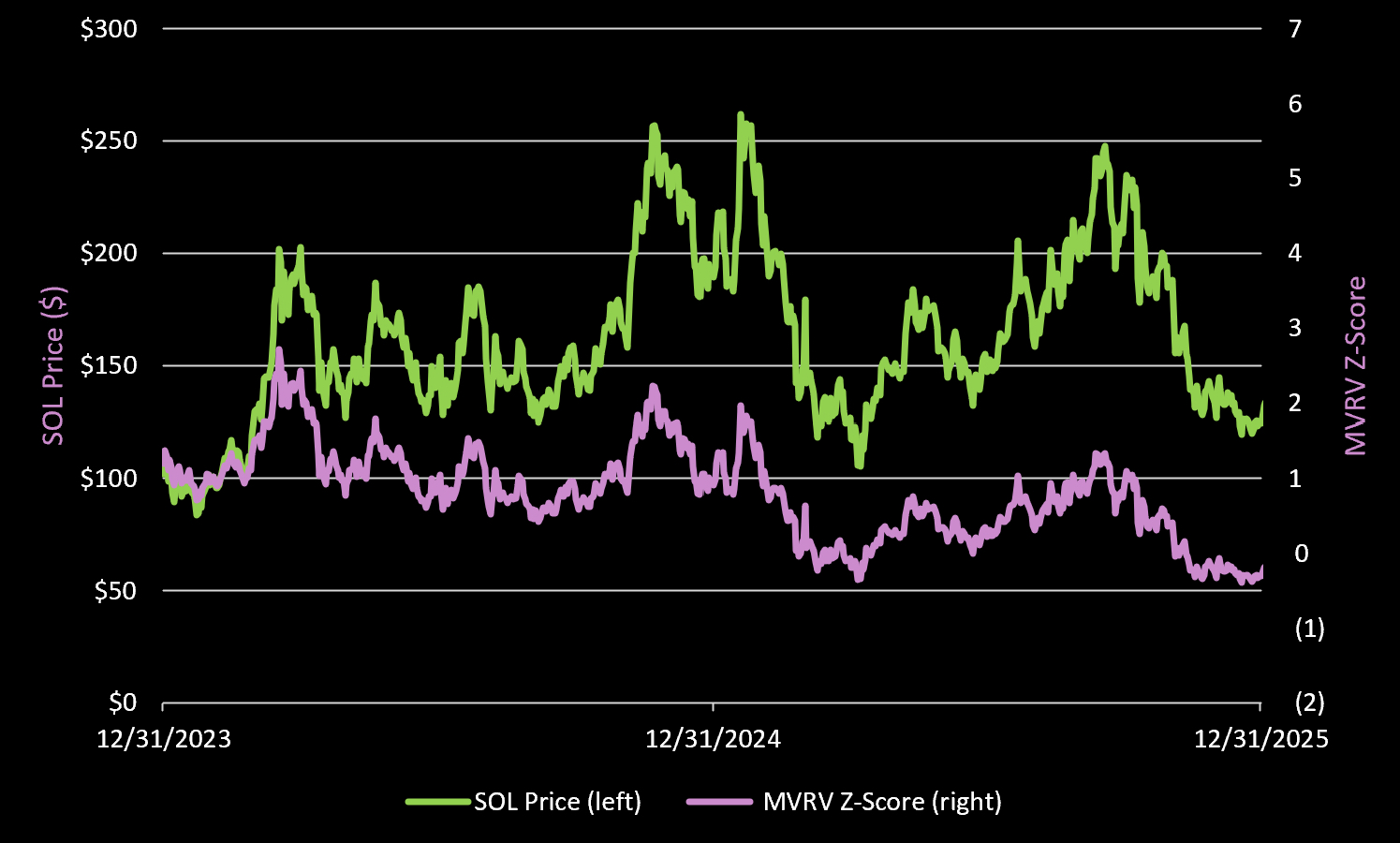

Fair Value

Market Value to Realized Value Ratio

In terms of "fair value," SOL's current trading price is below its realized price (representing the "cost basis" of all tokens on the network) of $145, with an MVRV of 0.95.

At the bottom of the bear market in 2022, SOL's trading price fell to 22% of its realized price. We do not expect this situation to occur again in this cycle, but we believe that SOL's trading price will significantly fall below its realized price at some point. We anticipate that its realized price will ultimately trend towards a range of $90 to $110.

200-Week Moving Average

We also expect the SOL price to eventually revert to its 200-week long-term moving average, which is currently at $103.

Conclusion

Solana has started 2025 with strong momentum. It is not only the place where Trump launched his Memecoin but also where most new crypto users have been introduced during this cryptocurrency cycle, witnessing the birth of the fastest and most profitable applications in this cycle.

However, it ended the year on a subdued note.

Nevertheless, looking back, the Solana Network has made significant progress. Compared to December 2022, when the entire industry was criticizing the ecosystem and predicting that developer talent would flow to Ethereum.

However, this did not happen. On the contrary, Solana has made a strong comeback with a more resilient posture, and it is now a different entity. Yet, there is still much work to be done. We believe that for Solana to continue to grow and mature, it needs to achieve the following three points:

Increase investment in consumer/retail trading applications. For years, crypto-native venture capital firms have been funding on-chain "gaming" applications. However, there are no real games in the cryptocurrency space. The essence of "gaming" is retail trading. Moreover, it can be said to be the most valuable application scenario in the cryptocurrency field (projects like Pump Fun, Raydium, Axiom, Jupiter are good examples). That said, the rules of the game should not be manipulated by insiders. Therefore, we hope to see innovations in user protection to prevent front-running/malicious cashing out and to crack down on pump-and-dump schemes.

Embrace traditional finance (TradFi). To become the "Nasdaq on the blockchain," Solana needs to bring in Nasdaq assets. This means it needs to attract asset issuers who want to tokenize their assets (stocks, bonds, etc.). Aside from regulatory challenges, finding an incentive mechanism that works for issuers may be the biggest hurdle. This will take some time, but it is a necessary path.

Continue to win the "developer war." Compared to other companies in the cryptocurrency space, the Solana Foundation operates more like a well-managed tech company. Therefore, Solana has a stronger developer reserve, thanks to its global "hackathon" program aimed at finding and helping developers join Solana. Continuously strengthening organizational efforts and investment in this area is crucial for the ongoing success of the Solana network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。