Author: JW, Techub News

Since the beginning of this year, the concept of privacy has suddenly been brought back into the market.

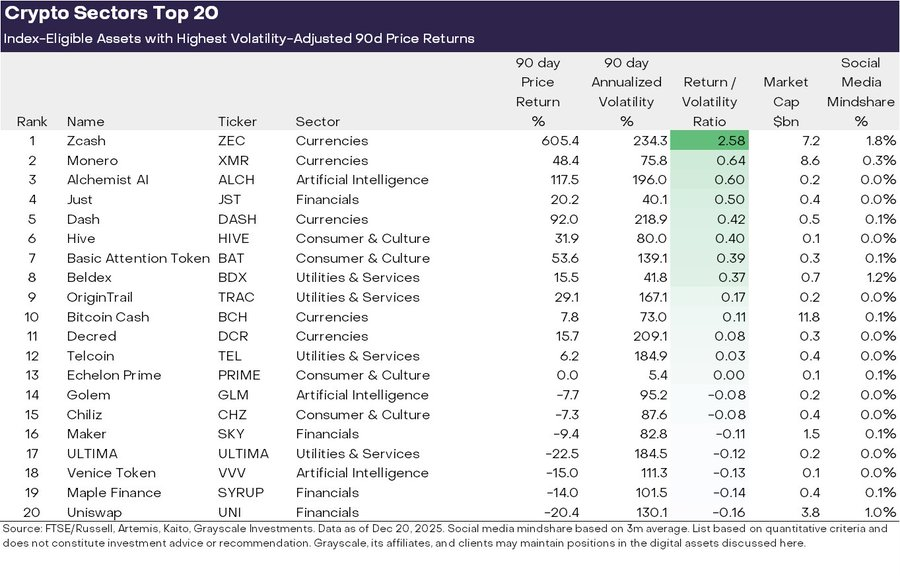

Source: Grayscale

Monero (XMR) surged by 89%. Monero is a representative privacy coin focused on hiding the sender, receiver, and amount, and such performance is already noteworthy. During the same period, DASH also skyrocketed by 144%. These older coins, which emphasize "hiding personal information during transactions," have once again outperformed many mainstream assets.

Source: Binance

If we only look at the price increase, this does not constitute an extreme market trend. However, in the context of the overall situation of privacy coins over the past two years, such performance seems quite unusual.

XMR was collectively delisted by South Korean exchanges as early as 2021, and access to the mainstream market was almost completely cut off. Among privacy coins, Zcash (ZEC) finds itself in a somewhat awkward position. Due to the entire core development team, Electric Coin Company (ECC), stepping down, it triggered an epic collapse.

This round of surges is generally believed to be related to the upcoming virtual asset tax reporting rules DAC8 to be implemented by the European Union (EU). According to existing information, starting from January 1, 2026, virtual asset service providers will need to collect and report users' tax-related data. This means that the association between on-chain addresses and real identities, as well as asset scales, will be further institutionalized. Under such expectations, the investment psychology that views "privacy" as a core function has resurfaced.

At the same time, the tightening of regulations itself is amplifying short-term volatility. The Dubai Financial Services Authority (DFSA) recently explicitly prohibited trading privacy tokens within the Dubai International Financial Centre (DIFC) and restricted the promotion of related derivatives. Market interpretations are inconsistent, but in the short term, this move has instead strengthened the expectation of the scarcity of privacy coins, stimulating some short-term buying sentiment.

Why is blockchain privacy necessary?

One of the core characteristics of blockchain is transparency. Anyone can check on-chain transactions in real-time, including who sent the funds, to whom, how much, and when it was sent.

However, from an institutional perspective, this transparency brings obvious problems. Imagine a scenario where the market can observe how much Nvidia transferred to Samsung Electronics or when a hedge fund precisely deployed capital. This visibility would fundamentally change the competitive dynamics.

The level of information disclosure that individuals can tolerate differs from what businesses and financial institutions can accept. The transaction history of a company and the timing of institutional investments constitute highly sensitive information.

Therefore, it is unrealistic to expect institutions to operate on a blockchain where all activities are fully exposed. For these participants, a system without privacy is more of an abstract ideal with limited practical applications than a practical infrastructure.

The "disappearance" of privacy coins over the past two years

Looking back to 2023, most people's impressions of privacy coins revolve around a few words: troublesome, sensitive, non-compliant. This is not just an issue with a single project, but the entire privacy coin sector has been pushed into an extremely awkward position.

During those two years, the keywords in the crypto industry shifted rapidly from "innovation" to "compliance." The Japanese Financial Services Agency required exchanges to stop trading privacy coins, and the President of the European Central Bank publicly criticized these "difficult-to-trace" cryptocurrencies. What regulators are truly concerned about is the anonymous nature of privacy coins. Ordinary transfers can at least be traced along the on-chain path, while privacy coins can even hide the transfer amount itself, making anti-money laundering frameworks nearly impossible to implement.

In this context, regulatory focus shifted from what blockchain can do to where the funds on-chain come from, where they are going, and whether they can be traced. Privacy coins naturally found themselves on the opposite side of the wind. They are not without value; rather, the cost of explanation is too high.

Thus, a wave of delistings occurred, characterized by a not-so-intense attitude but exceptionally resolute execution. Exchanges did not engage in technical debates with privacy coins, nor did they deny their existence; instead, they chose the most pragmatic way to cut risks. For platforms, the potential regulatory costs of continuing to support privacy coins far outweigh the benefits from the trading volume. The delisting of privacy coins was not a "wrong judgment," but rather a "costly judgment."

During this phase, privacy coins almost simultaneously lost three things: mainstream access, liquidity, and narrative space. Without exchange support, they struggled to enter the sight of new users; without liquidity, the price discovery mechanism failed; without a narrative, the market naturally would not show patience. Privacy coins gradually transformed from once-popular experiments into a category of assets that were defaulted to be ignored.

However, the market often overlooks one point: assets can be marginalized, but demand does not simply disappear. The silence of privacy coins in terms of price and discussion does not equate to the retreat of privacy demand; it merely temporarily lost its channels of expression.

It's not that regulations are loosening, but that "privacy" is being reinterpreted

Many people simply understand the warming of privacy coins at the end of 2025 as "old coins catching up" or "emotional rotation," but a closer observation reveals that this time is not entirely the same.

What has truly changed is not the policy text, but the market's attitude towards "privacy" itself. In the past few years, on-chain transparency was seen as an absolute advantage; a public ledger meant verifiable, auditable, and trustworthy. However, as on-chain behavior gradually becomes tied to real identities, asset scales, and social relationships, transparency begins to reveal another side.

A transfer may mean the exposure of asset scales; an on-chain interaction may be recorded, analyzed, and profiled over the long term. For ordinary users, this state of "being permanently watched" is not always a source of security. Privacy has begun to shift from an extreme demand to a reasonable demand.

It is against this backdrop that privacy coins have re-entered the discussion space. Not because they suddenly became compliant, but because the market gradually realized that a completely privacy-less on-chain world also presents systemic risks. This change in perception has allowed some assets that were previously dismissed to regain the opportunity for scrutiny.

Zcash's performance during this stage is quite representative. It is not the most radical solution among privacy coins, yet it appears relatively "suitable" in the new context. The design of optional privacy allows it to retain privacy capabilities while not completely severing its connection to the compliance system. The market's re-evaluation of ZEC resembles a reassessment of this middle path.

In contrast, Monero continues to maintain its consistent stance. It does not cater or compromise, thus bearing greater pressure on the compliance front, but precisely because of this, it occupies an irreplaceable position in the narrative of privacy. Whenever the market revisits the question of "what does privacy really mean," XMR is almost always mentioned again.

When uncertainty rises, privacy is always brought up again

Privacy coins have another recurring characteristic: they are often brought back into the market's spotlight during geopolitical conflicts, escalations of sanctions, and increasing macro uncertainties. This is not a coincidence or a conspiracy theory, but a very intuitive psychological response.

When the financial system operates stably and the rules are clear, most people do not care about privacy issues. However, once uncertainty rises, people begin to worry about whether their assets are safe, whether their paths are restricted, and whether rules will suddenly change. In this emotional state, the demand for "not being easily traceable and not relying on a single system" is quickly amplified.

It should be clarified that this does not equate to "war funds flowing into privacy coins." The vast majority of participants are not trying to evade the law, but rather to leave themselves some room for choice. Privacy coins at such moments are more like a psychological hedge rather than strictly defined safe-haven assets.

Because of this, the market trends of privacy coins often exhibit event-driven characteristics. They may be rapidly boosted at certain points and return to calm after the emotions subside. This volatility is not a defect but a true reflection of their position: neither mainstream assets nor purely speculative products, but a line that is repeatedly awakened.

The existence of this line itself indicates one issue: the demand for privacy is not stable, but it always exists. It may not be discussed every day, but it will be remembered at critical moments.

Privacy is not the main line, but it is hard to bypass

From a longer time perspective, the significance of privacy coins may not lie in how many times they can multiply, but in how they repeatedly remind Web3 of a real issue: transparency is not free.

The early Web3 world was built on the idea of "public equals trust." However, as the application layer continues to expand, complete transparency begins to expose structural problems. Not all behaviors need to be recorded, and not all relationships need to be made public. Privacy is no longer a tool to combat the system but rather a necessary buffer for the system itself.

From this perspective, privacy coins do not conflict with the development direction of Web3; instead, they resemble a patch that is constantly suppressed but can never be completely deleted. They may be restricted, restructured, or repackaged, but it is difficult to completely deny them.

Of course, real risks still exist. Regulatory attitudes remain cautious, and exchange support may change at any time. Privacy coins will not easily become the main narrative of the market, nor are they suitable for simple mythologizing. However, treating them as outdated relics is also an underestimation.

The return of privacy coins at the end of 2025 is more like a calibration rather than a reversal. The market did not suddenly regain faith in them; it simply reacknowledged a fact: in an increasingly transparent and traceable on-chain world, privacy will not disappear but will continuously return to the center of discussion in new forms.

Possible future directions for privacy

Industry experts generally believe that the path of complete anonymity may not be feasible. The next step is likely to be controllable anonymity, much like antivirus measures—protecting when necessary and identifying when needed.

Another interesting phenomenon is that in certain countries where it is explicitly prohibited, underground trading has become more active. This is similar to the Bitcoin era, where the more it is banned, the more market there is. However, ordinary investors should avoid such gray areas due to the high risks involved.

In the long run, privacy technology may develop towards enterprise-level solutions. Imagine large companies using improved privacy coins for commercial settlements, protecting trade secrets while meeting audit requirements—this would be a win-win situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。