As the Iranian public frantically transfers Bitcoin into personal wallets due to the currency collapse, Wall Street is preparing for a surge of over 100 cryptocurrency ETFs in 2026. These two seemingly unrelated phenomena are together marking a watershed moment in Bitcoin's evolution from an underground financial tool to a mainstream safe-haven asset.

“The surge in Bitcoin withdrawals from local exchanges in Iran to unknown personal wallets indicates that during the protests, Iranians are acquiring and controlling Bitcoin at a pace far exceeding previous times.” This was described in a report by blockchain analysis firm Chainalysis in January 2026.

Around the same time, Bloomberg intelligence analyst James Seyffart predicted that 2026 would see a concentrated issuance of cryptocurrency ETFs, with many products likely to be liquidated or delisted before 2027.

The exchange rate of the rial against the dollar has plummeted from about 420,000 to over 1,050,000, leading to a rapid loss of purchasing power.

1. The Desperate Choices of the Public

Iran is experiencing multiple pressures from both internal and external sources. Large-scale protests erupted in Iran starting December 28, 2025.

● On January 8, over 150 protests occurred across 27 provinces in Iran, with armed conflicts reported in some areas. Meanwhile, tensions between the U.S. and Iran are escalating. President Trump is delaying a decision on military strikes against Iran but has begun to withdraw or recommend the withdrawal of some personnel from key areas in the Middle East.

● Economically, the Iranian currency, the rial, is undergoing catastrophic devaluation. Data shows that the rial's exchange rate against the dollar has dropped sharply from about 420,000 to over 1,050,000 in a short period. In some areas, the black market rate has even fallen to 1,340,000-1,400,000 rials per dollar.

● Against this backdrop, Bitcoin, due to its decentralized, censorship-resistant, and cross-border transfer characteristics, has become an important tool for the Iranian public to combat currency collapse and economic instability.

2. The Highlighted Safe-Haven Attributes of Bitcoin

● Chainalysis's report reveals a key trend: from the start of the protests to the internet blackout, the BTC withdrawal transactions from local exchanges to unknown personal wallets in Iran significantly increased. This surge indicates that during times of social unrest, the Iranian public is self-custodying Bitcoin at a higher frequency.

● Bitcoin is evolving from a speculative asset to a store of value and economic hedge in the eyes of some people. The scale of Iran's cryptocurrency ecosystem exceeded $7.78 billion in 2025, growing at a pace significantly faster than the previous year.

● Interestingly, it is not just ordinary citizens; Iranian government agencies are also deeply involved in cryptocurrency activities. Addresses associated with the Iranian Islamic Revolutionary Guard Corps accounted for over 50% of the total amount of Iranian crypto assets received in the fourth quarter of 2025, with over $3 billion processed on-chain throughout the year.

The IRGC transferred approximately $1 billion worth of cryptocurrency through two UK-registered exchanges between 2023 and 2025.

3. The Prosperity and Concerns of the ETF Market

● While geopolitical turmoil is driving demand for Bitcoin as a safe haven, the traditional financial world is also opening new doors for cryptocurrencies. On September 17, 2025, the SEC approved a universal listing standard for cryptocurrency exchange-traded products, shortening the product listing cycle to 75 days.

● Bitwise predicts that over 100 cryptocurrency-related ETFs will be launched in 2026. Bloomberg's senior ETF analyst James Seyffart supports this prediction but also warns: “We will witness a large number of ETF liquidations.” This pattern of “explosive growth alongside rapid elimination” will become the next phase in the development of cryptocurrency ETFs.

● This rule mirrors the SEC's reforms for stock and bond ETFs in 2019: at that time, the annual number of new ETFs surged from 117 to over 370, followed by immediate fee compression, with dozens of small funds liquidating over the next two years.

4. The "Single Point of Failure" Risk of Crypto ETFs

● Currently, there is a significant structural issue in the cryptocurrency ETF market—high concentration of custody. Coinbase holds assets for the vast majority of cryptocurrency ETFs, with a market share of up to 85% in the global Bitcoin ETF market. By the third quarter of 2025, Coinbase's custodial assets had reached $300 billion.

● U.S. Bancorp has restarted its institutional Bitcoin custody program, and Citigroup and State Street are also exploring custody partnerships for cryptocurrency ETFs. These new custodians are making their “selling points” very clear: “Do you want to rely on a single counterparty for 85% of ETF fund flows?”

● For Coinbase, more ETFs mean more revenue, more regulatory scrutiny, and a higher risk of “a single operational error triggering panic across the entire industry.” This concentration of custody creates potential systemic risks; if issues arise, they could affect the asset security of the vast majority of cryptocurrency ETFs globally.

5. The Upcoming Wave of Liquidations

● Seyffart predicts that the wave of cryptocurrency ETF liquidations will arrive between late 2026 and early 2027. Each year, dozens of ETFs are liquidated—funds with assets below $50 million typically close within two years due to difficulty covering costs.

● The most vulnerable products include high-fee, repetitive single-asset funds, niche index products, and thematic products. The fees for Bitcoin ETFs launched in 2024 have already dropped to 20-25 basis points, and as the market becomes crowded, issuers will further lower flagship product fees, making high-fee repetitive products uncompetitive.

● For niche index products with poor liquidity and high tracking errors, as well as thematic products where the underlying market changes faster than the ETF structure can adjust, survival will be particularly challenging. In contrast, for Bitcoin, Ethereum, and Solana, the situation is the opposite: more ETF products will deepen their “spot-derivative linkage,” narrow the price spread, and solidify their status as “core institutional collateral.”

6. Global Insights from the Iranian Case

The phenomenon of the Iranian public withdrawing large amounts of Bitcoin is not an isolated case. Chainalysis's report points out that this trend aligns with other regions globally experiencing war, economic crises, or government repression.

● In contexts of war, economic turmoil, or strong regulatory environments, the increase in Bitcoin withdrawals is a global phenomenon. For many Iranians, Bitcoin and other digital assets are becoming a “financial buffer,” providing relatively controllable liquidity options in constrained environments.

● Notably, as Iranian elites massively transfer funds abroad, some privacy concept tokens in the cryptocurrency market have seen astonishing price increases. XMR reached an all-time high, touching $800. DASH surged over 120% in the past week, and DCR rose nearly 70%.

● Although there is no clear evidence linking the rise of privacy concept tokens to the outflow of funds from Iranian elites, the timing of these events is worth noting for industry participants.

7. The Future Role of Bitcoin

● K33 Research holds a constructive bullish outlook for 2026, predicting that Bitcoin will outperform stock indices and gold. They expect that in the first quarter of 2026, broader cryptocurrency legislation will be signed into law through the Clarity Act.

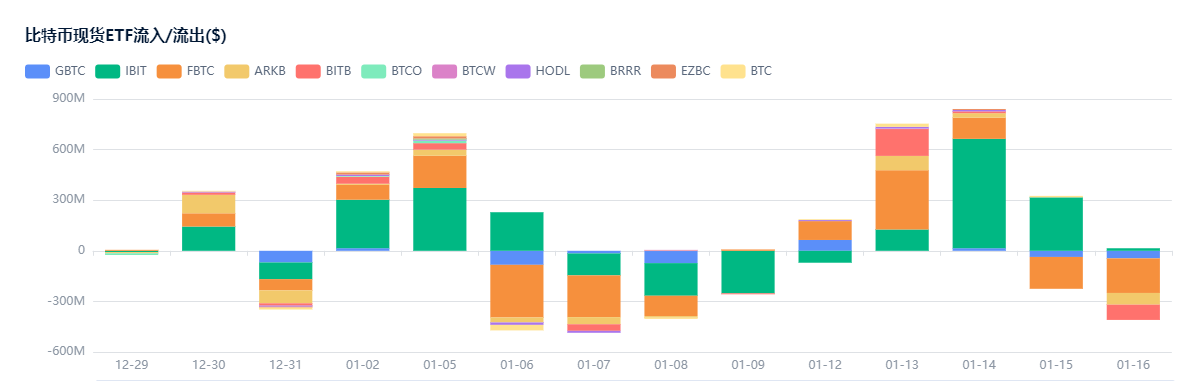

● The institutional side is set to explode: Morgan Stanley plans to allow advisors to allocate 0-4% of Bitcoin ETFs for clients starting January 1, 2026, and E*Trade's retail crypto trading is expected to launch in the first half of 2026. In terms of specific data predictions, net inflows into ETFs in 2026 are expected to exceed those in 2025.

● On the corporate finance side, it is predicted that MicroStrategy will not sell its Bitcoin, and the net absorption of Bitcoin by the entire industry is expected to be 150,000 BTC, a decrease of 330,000 BTC year-on-year. The supply of Bitcoin held for over two years is expected to end its downward trend, rebounding to over 12.16 million BTC by the end of the year, with early selling pressure dissipating and turning into net buyer demand.

● With the opening of 401(k) plans, the market will see a huge potential buying spree based on different allocation weights of 1% to 5%.

As the Iranian public exchanges their devalued rials for Bitcoin via their phones, Wall Street traders are adjusting risk models for the hundreds of cryptocurrency ETFs set to launch next year.

The financial behaviors of these two worlds converge on the blockchain, with Bitcoin's price touching $97,694 during intraday trading on January 14, 2026, marking the highest level since mid-November.

Whether ordinary citizens in Tehran or institutional investors in New York, both are redefining this digital asset born in 2009 in their own ways—it has simultaneously become a shield against sovereign currency collapse and a new darling in the traditional financial system.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。