Author: FinTax

1 Introduction

In the context of the rapid evolution of the global digital asset market, France, as a core member of the European Union, has initially formed a regulatory and tax system for crypto assets that aligns with the EU's unified framework while retaining the characteristics of its national tax system. From the promulgation of the 2019 "Action Plan for Business Growth and Transformation" (PACTE Law) to the full implementation of the EU's "Markets in Crypto-Assets Regulation" (MiCAR) in December 2024, France's institutional framework has evolved from national-level pioneering exploration to unified regulations across the EU. Meanwhile, the advancement of the EU's "Directive on Administrative Cooperation No. 8" (DAC8) and the OECD's "Crypto-Asset Reporting Framework" (CARF) marks the beginning of the era of tax transparency for crypto assets. In this article, we will outline France's existing regulatory framework, tax policies, and the pathways for alignment with international standards.

2 Overview of France's Crypto Asset Regulation and Taxation Landscape

France's governance of crypto assets is characterized by proactive regulation and classified taxation. On the regulatory front, France has established a registration system for Digital Asset Service Providers (DASP), becoming the first in the EU to achieve compliance management for crypto service institutions. Starting from December 30, 2024, the DASP framework will officially transition to the Crypto Asset Service Provider (CASP) framework to comply with EU MiCAR requirements. This transition marks a shift in France's crypto regulation from a voluntary registration system to a mandatory licensing system, imposing stricter capital, governance, and risk management requirements on service providers such as exchanges and custodians.

On the taxation front, the French tax authority (DGFiP) categorizes participants based on the nature and frequency of their transactions, applying different tax logic and rates accordingly. Occasional investors are subject to a fixed tax rate of 30%, while professional investors face a progressive tax rate ranging from 0% to 45%. Additionally, different participants such as crypto mining companies, DeFi participants, NFT traders, and exchanges are subject to different tax regimes, including non-commercial profits (BNC) and corporate income tax, due to their economic substance differences. This refined classification tax system reflects France's recognition of the diversity of crypto activities and provides relatively transparent tax expectations for different participants.

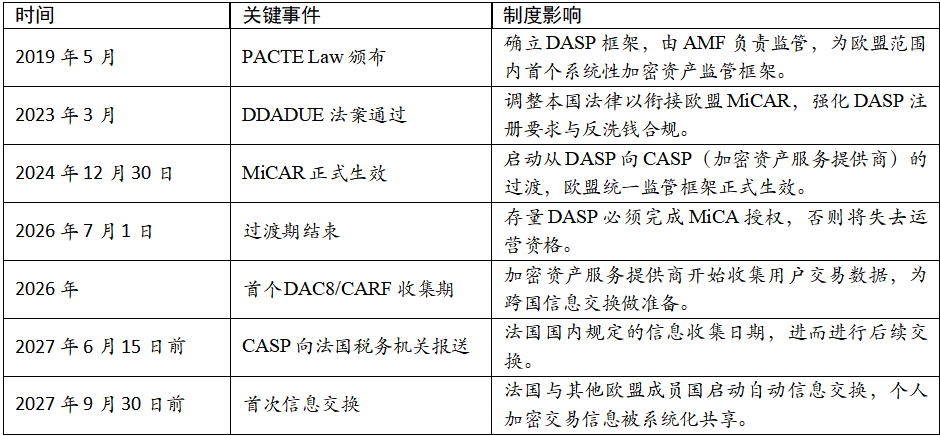

In the evolution of France's crypto tax system, the 2019 PACTE Law established the legal status of crypto assets, and in 2023, the tax regime for professional investors shifted from business profits (BIC) to a non-commercial profit framework. With the implementation of the DAC8/CARF framework, 2026 will be the first year for the automatic exchange of cross-border crypto transaction information, potentially ending the era of tax evasion through the anonymity of crypto assets. A series of institutional changes reflect France's ongoing adjustment in balancing innovation support and tax compliance. The table below outlines key milestones in France's crypto asset regulation and taxation:

Table 1: Timeline of France's Crypto Asset Regulation and Taxation

3 Current Regulatory System: Institutional Leap from DASP to CASP

3.1 Core Regulatory Agencies and Their Roles

The regulation of crypto assets in France is collaboratively managed by two main agencies: the Financial Markets Authority (AMF) and the Prudential Supervision and Resolution Authority (ACPR). The AMF is the core regulatory body responsible for the registration, authorization of digital asset service providers, and the approval of initial coin offerings (ICOs), focusing on market access, information disclosure, and investor protection. The ACPR emphasizes compliance reviews related to anti-money laundering and counter-terrorism financing, ensuring that crypto asset transactions are not used for illegal purposes.

3.2 Legal Framework and Alignment with MiCAR

Before the implementation of MiCAR, the regulation of the French crypto market primarily operated under the PACTE Law. This law defines crypto assets as digital assets and requires institutions providing custody, fiat exchange, and other services in France to register with the AMF. With the official implementation of MiCAR on December 30, 2024, France is currently in a critical transition period from the DASP framework to the EU's unified CASP framework.

According to the French "DDADUE Law," DASP institutions registered with the AMF before December 30, 2024, can enjoy a transition period lasting until July 1, 2026. During this period, these institutions can continue to operate within France, but if they wish to obtain a passport to operate across the EU, they must apply in advance and obtain MiCA authorization. CASPs under MiCAR must meet stricter capital requirements, governance standards, risk management, and customer protection measures.

3.3 International Cooperation Framework: DAC8/CARF and Tax Transparency

To further enhance the transparency of the crypto asset market, France is implementing the EU's DAC8 and the OECD's CARF. According to the current plan, CASPs will be required to collect user transaction data starting in 2026 and submit the first annual report to the French tax authorities by June 15, 2027.

This means that starting in 2027, an automatic information exchange mechanism will be initiated between France and other EU member states, allowing for the systematic sharing of individuals' cross-border crypto transaction information with the relevant tax authorities. This shift marks the end of anonymity in crypto asset transactions conducted through centralized platforms, transitioning tax compliance from relying on taxpayers' voluntary reporting to relying on systematic reporting by CASPs and cross-border information sharing.

4 Crypto Asset Taxation System: Classified Taxation and Reporting Logic

4.1 Taxation Principles and Trigger Conditions

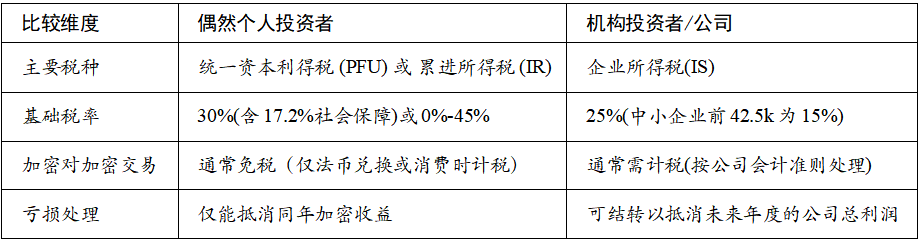

For individuals, France's taxation of crypto assets follows the principle that taxation is triggered only when exchanged for fiat currency or used to purchase physical goods, meaning that a taxable event occurs only when crypto assets are sold for legal tender or used to buy goods or services. Crypto-to-Crypto exchanges do not incur immediate tax obligations under the current system, significantly promoting the activity of the on-chain ecosystem.

For institutional investors and companies, France's taxation of crypto assets follows the realization principle of corporate accounting standards. Crypto-to-Crypto exchanges typically require recognition of gains and losses based on fair value changes, meaning that even if not exchanged for fiat currency, immediate tax obligations may arise. This treatment aligns with traditional financial asset accounting standards, requiring companies to value their held crypto assets at the end of each accounting period and include unrealized capital gains or losses in the current taxable income. Additionally, capital losses for institutional investors can be carried forward to offset total profits in future years, providing greater tax planning flexibility for businesses.

4.2 Classification of Participants and Tax Rate Structure

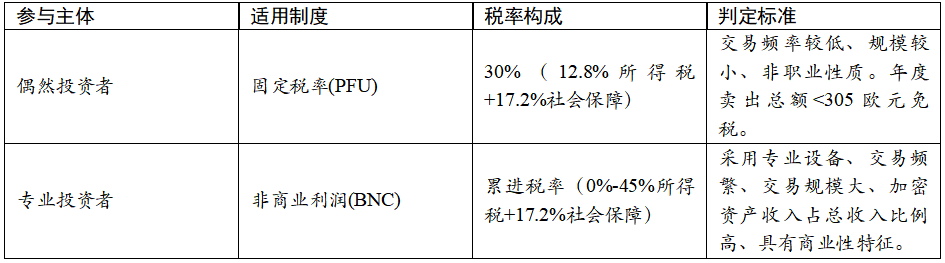

French tax law categorizes participants based on their nature and activity characteristics, applying different tax rules to each category. Below, we discuss occasional investors, professional investors and traders, crypto mining companies and pool operators, DeFi participants and liquidity providers, NFT traders, crypto exchanges and custodians, as well as institutional investors and fund managers.

4.2.1 Occasional Investors

Occasional investors are individuals with low trading frequency, small scale, and non-professional nature. The French tax authority uses qualitative rather than quantitative standards for determination, typically considering the following comprehensive factors: the complexity of transactions, tools used, trading frequency, trading scale, and their proportion in the taxpayer's total income.

Occasional investors are subject to a fixed tax rate (PFU, Prélèvement Forfaitaire Unique). The rate is 30%, which includes 12.8% income tax and 17.2% social security contributions. Additionally, the portion of total sales by occasional investors that is below €305 per year is tax-exempt, and losses incurred from crypto transactions within the year can offset gains for the same year. The capital gains of occasional investors are calculated using the overall cost ratio method (Portfolio Method). The specific formula is:

Net Capital Gain = Selling Price - (Total Acquisition Cost × Selling Price) / (Total Asset Market Value on Transaction Date)

This method allows taxpayers to consider the cost basis of the entire portfolio when calculating gains, rather than calculating on a transaction-by-transaction basis, significantly simplifying the reporting process in practice. Meanwhile, occasional investors can choose to forgo the fixed tax rate and opt for taxation based on progressive income tax rates (0%-45%) plus 17.2% social security contributions. This option provides potential tax optimization opportunities for low- to middle-income taxpayers.

4.2.2 Professional Investors and Traders

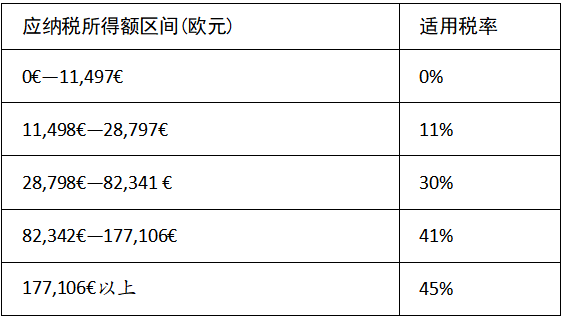

Professional investors are individuals or entities with high trading frequency, large trading scale, a high proportion of crypto asset income in total income, using professional equipment, and exhibiting commercial characteristics. As of January 1, 2023, the tax regime for professional investors has shifted from business profits to a non-commercial profit framework.

Professional investors are subject to a progressive income tax rate (0%-45%) plus 17.2% social security contributions. This means that the tax burden increases with total income, reaching a maximum income tax rate of 45%. The taxable income for professional investors is net capital gains, which is total revenue minus total losses. Unlike occasional investors, professional investors can deduct losses within the same tax year, but losses cannot be carried forward to subsequent years.

Table 2: Comparison of Occasional Investors and Professional Investors

The distinction between professional and occasional investors is made using qualitative rather than quantitative standards. The French tax authority typically considers the complexity of transactions, tools used, trading frequency, trading scale, and their proportion in the taxpayer's total income among other comprehensive factors.

4.2.3 Crypto Mining Companies and Pool Operators

The mining income of crypto mining companies is treated under non-commercial profit rules and must be included in total annual income at the market value at the time of acquisition. According to guidance issued by DGFiP in August 2019, mining income does not incur value-added tax obligations.

Mining income is recognized as income at the market price on the day the miner acquires the crypto asset. For example, if a miner receives 1 Bitcoin on a certain day, it should be recognized as taxable income at the market price of Bitcoin on that day. Mining companies can deduct costs directly related to mining activities, including but not limited to electricity costs, hardware depreciation, maintenance expenses, and cooling system operating costs. These cost deductions follow general business expense deduction principles.

According to DGFiP's guidance, mining activities are not considered taxable transactions for value-added tax purposes unless personalized services are provided to specific beneficiaries. Therefore, miners do not need to pay value-added tax on the digital asset rewards they receive and cannot enjoy the right to deduct value-added tax. The tax treatment for individuals or entities participating in mining pools is the same as for independent miners, i.e., taxed under BNC rules. Mining pool operators, as intermediary institutions, need to provide detailed records of profit distribution to participants for accurate reporting.

Table 3: Progressive Tax Rate Table for BNC Net Income in France for 2026

4.2.4 Crypto Exchanges and Custodians

Crypto exchanges and custodians in France are subject to strict regulation. Starting from December 30, 2024, these institutions will need to transition from the DASP framework to the CASP framework to comply with EU MiCAR requirements.

As commercial entities, the income of crypto exchanges and custodians (including transaction fees, custody fees, interest, etc.) should be taxed according to France's corporate income tax rules. The standard corporate income tax rate is 25% (since 2022). According to EU and French VAT rules, the exchange of crypto assets is generally considered a financial service and may be exempt from VAT. However, certain ancillary services (such as consulting, custody, etc.) may be subject to VAT.

CASPs are required to meet stricter capital requirements, governance standards, risk management, and customer protection measures. However, we expect that these compliance costs may be deductible as business expenses.

4.2.5 Institutional Investors and Fund Managers

The trading income from crypto assets for institutional investors should be taxed according to France's corporate income tax rules. Companies or funds registered in France must include the capital gains generated from crypto asset trading in their annual profits. The income is considered ordinary business income, with a standard tax rate of 25%. Depending on the specific structure of the fund (such as UCITS, AIF, etc.), the tax treatment may vary. Certain types of funds may enjoy special tax treatment; for some specific accounting standards, the "mark-to-market" system may also apply, requiring the valuation and taxation of unrealized gains at the end of each accounting year.

Unlike the 30% flat tax (PFU) applicable to individual investors, France offers a preferential tax rate of 15% on the first €42,500 of profits for qualifying small and medium-sized enterprises with revenues below a certain threshold (usually €7,630,000), with the excess taxed at 25%.

Table 4: Comparison of Individual Investors and Institutional Investors

At the same time, institutional investors engaging in cross-border crypto transactions need to consider the relevant countries' tax treaties and the information exchange obligations under the CARF/DAC8 framework (see 3.3).

4.2.6 DeFi and NFT: Tax Categories Not Clearly Defined in French Tax Law

DeFi participants include stakers, liquidity mining participants, users of lending platforms, and all participants who earn income by locking crypto assets in smart contracts. The legal classification of staking and liquidity mining is not clearly defined in French tax law, lacking specific legal provisions or tax guidance. According to existing tax guidance, since staking and liquidity mining contribute to the maintenance of blockchain systems, their income may be taxed under BNC rules, requiring recognition at market value when the income is received, but this interpretation still needs further confirmation.

DeFi participants should maintain detailed transaction records, including staking times, income amounts, and market prices on income dates, and consult professional tax advisors when filing taxes until legal clarity is achieved.

There is significant uncertainty regarding the tax classification of NFTs in France, with a lack of specific legal provisions or tax guidance. Depending on the specific legal classification of NFTs, tax rates may vary widely: if classified as digital assets (like cryptocurrencies), they may be subject to a fixed tax rate of 30% or a progressive rate (0%-45%) depending on the participant; if classified as artworks, they may be subject to a fixed tax rate of only 6.5% based on the total sales price. This simplified and highly favorable tax rate in France is a special regime aimed at encouraging the trading of artworks and other specific movable properties.

Given the uncertainty in classification, NFT traders should keep detailed transaction records, including purchase prices, sale prices, transaction dates, and specific characteristics of the NFTs, and consult professional tax advisors during tax filings to determine the most reasonable classification scheme.

5 Conclusion and Outlook

France's institutional development in the crypto asset field reflects a balanced approach between regulation and incentives. Through the implementation of MiCAR and the advancement of DAC8/CARF, France is transforming its pioneering regulatory advantages into competitive advantages across the EU. However, this process also marks the end of the era of anonymity in crypto asset trading, as the entire market is gradually moving towards openness and transparency. To adapt to regulatory changes, individual investors and institutions have different response paths:

Individual investors should establish a comprehensive trading ledger and use professional tax software to record each transaction. Beyond the €305 tax-exempt threshold, they should ensure accurate reporting to avoid compliance risks arising from unreported foreign accounts. Additionally, they should pay attention to the progress of DAC8/CARF and understand the implications of the automatic information exchange starting in 2027.

Crypto service institutions should accelerate their transition from DASP to CASP, focusing on strengthening internal AML/CFT audit processes to meet the stricter capital and operational standards under MiCAR. They should also establish comprehensive data collection and reporting systems to prepare for DAC8/CARF data collection starting in 2026. Furthermore, both institutions and individuals should continuously monitor policymakers' legal classifications of DeFi and NFTs, coordination with other EU member states, and the consistency and effectiveness of DAC8/CARF implementation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。