The market performance on Sunday was decent, calm and stable, but in the U.S., the issue of tariffs on Greenland has started to heat up. On Saturday, Trump announced that he would impose tariffs on countries related to the Greenland issue, and on Sunday, those countries began to retaliate against the U.S. If both sides really go through with it, then inflation in the U.S. is likely to rise, and the unfortunate ones may be the investors who believe a bull market has arrived.

Trump finds it hard to be idle for a week without stirring things up. The overall IEEPA tariffs are already under scrutiny, and he is taking advantage of the fact that the Supreme Court has not yet made a ruling to impose tariffs under the IEEPA name. Once the Supreme Court rules them illegal, Trump will have a reasonable excuse to backtrack. He is also putting in effort for the midterm elections.

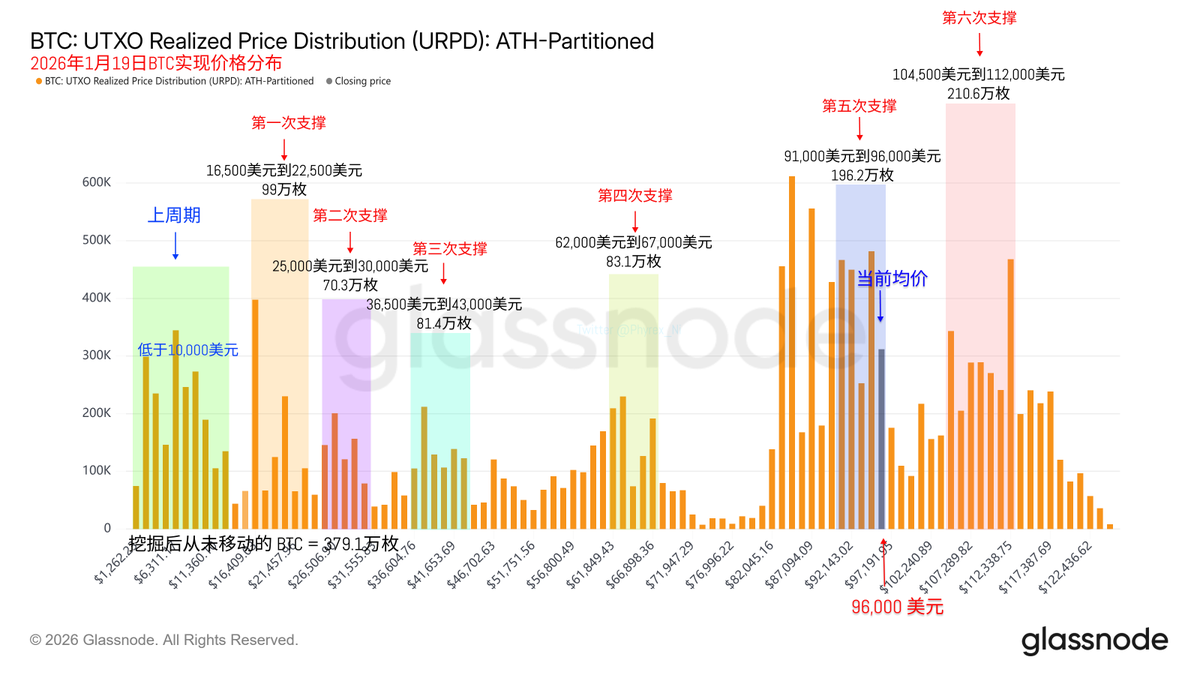

Looking back at Bitcoin data, despite the tariff turmoil on Sunday, the price fluctuation of $BTC was not significant, indicating that regular users are not sensitive to the events. However, once institutions start working on Monday, it remains to be seen if they will maintain this attitude. Some clues might be visible through U.S. stock futures; the opening of futures in the morning reflects the views of Asian investors and institutions, while the opening of U.S. stocks in the evening represents the perspectives of European and American investors.

The turnover rate over the weekend was extremely low; I haven't seen such data in years. Let's wait and see what happens on Monday.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。