Introduction

Since the end of 2024, Meme coins have transitioned from a fringe subculture to one of the most explosive and controversial categories of crypto assets in the market. They are neither products of technological innovation nor typical long-term value investments, yet they continuously rewrite on-chain activity, capital flows, and retail participation methods amid waves of sentiment. In this Meme craze, Solana and BSC have gradually become the two main battlefields for Meme coins. So, are the differences between Solana Meme and BSC Meme merely "different themes," or do they reflect fundamental divergences in user structure, capital attributes, and speculative mechanisms between the two public chains? Is Meme evolving from a one-time emotional spike into a long-term tool for public chains to compete for new users and on-chain activity?

This article will systematically compare the Meme ecosystems of Solana and BSC, dissecting the underlying logic and phase gains and losses of the Meme models on both chains from multiple dimensions, including market landscape, issuance platforms, market capitalization and trading volume, project lifecycle, characteristics of Meme coin themes, community culture, and official support. Additionally, it will assess the future direction and investment risks of the Meme sector in light of the latest market conditions in early 2026, aiming to present readers with a clearer picture of the Solana Meme and BSC Meme ecosystems.

1. The Battlefield of Meme Between Solana and BSC

- Meme Market Landscape: Solana Meme Vs BSC Meme

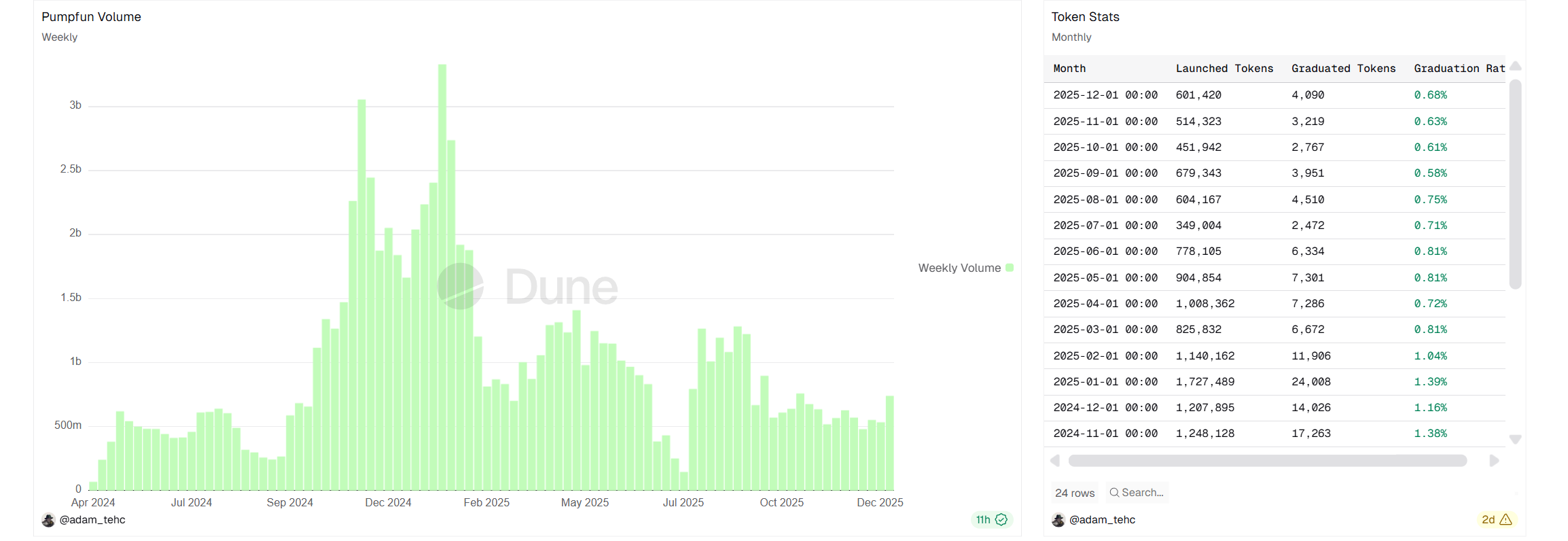

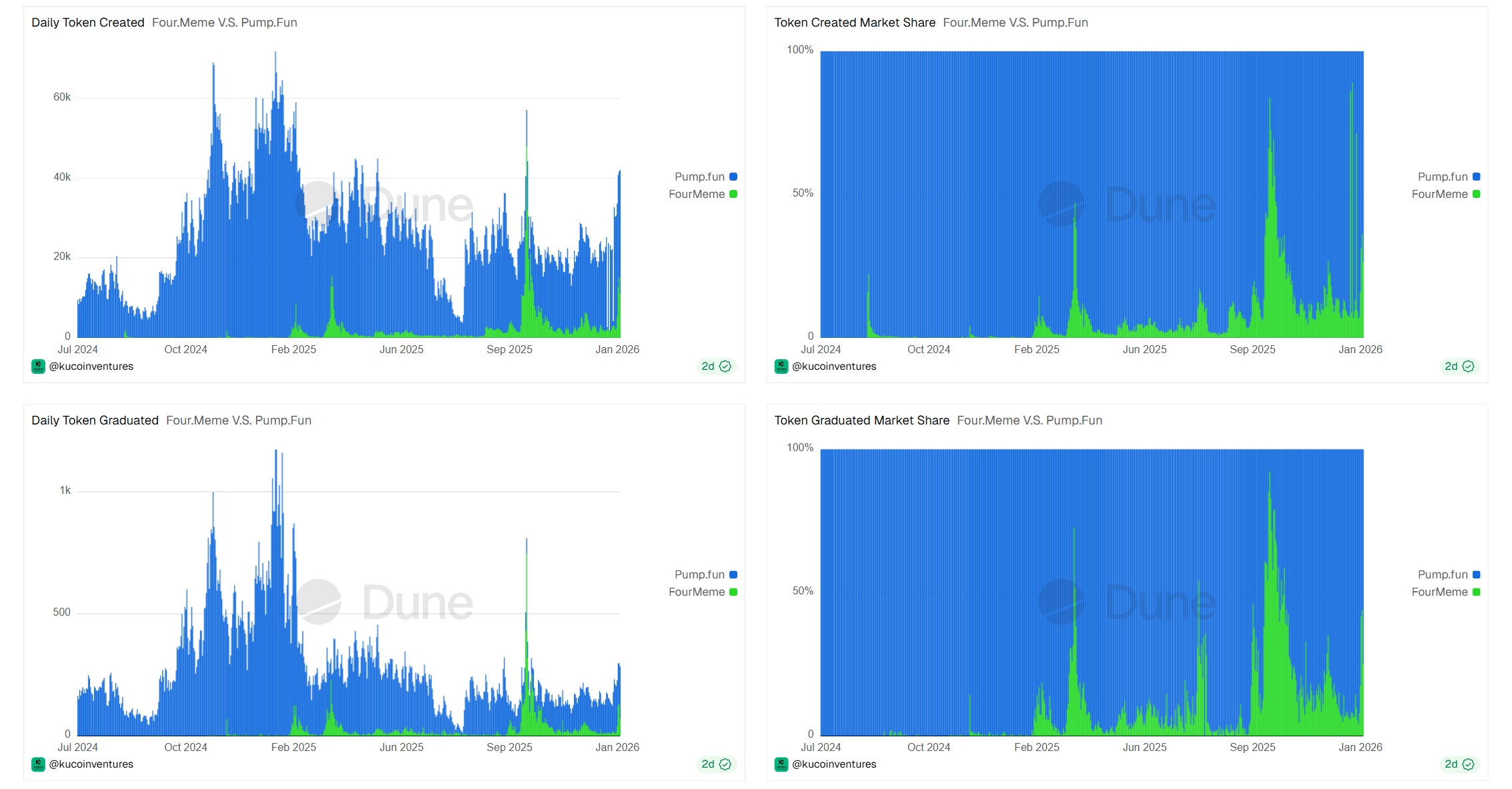

Since the launch of Pump.fun on Solana in 2024, which sparked the "Summer of Meme," Meme tokens have become the hottest phenomenon on-chain. This platform significantly lowered the barriers to issuing tokens, and although the graduation rate is less than 2%, it once contributed about 70% of new token issuance on Solana, pushing Solana's activity to its peak. In early 2025, the platform began to actively embrace the Meme craze, with tokens related to TST and Broccoli, and [mubarak driving traffic to Four.meme](http://mubarak driving traffic to Four.meme). By mid-2025, a capital rotation formed between Solana and BSC, with BSC exploding in the fourth quarter due to "Chinese Meme" such as “Binance Life” and “Hakimi” driving cross-cultural FOMO; however, by the end of October, most projects plummeted to zero. In early 2026, Chinese Memes like “I’m Here”, “Life K-Line”, “Old Man”, and “Dark Horse” surged again, but the momentum was clearly insufficient, and they have significantly retraced from their highs.

Looking back over the past two years, the Meme ecosystems of Solana and BSC have shown a pattern of alternating leadership: Solana gained a first-mover advantage with Pump.fun at the end of 2024 and reached a peak of frenzy in early 2025; subsequently, the Binance ecosystem leveraged its influence to rapidly rise through Four.meme in 2025, shifting the main battlefield of Meme to the BSC chain. However, the cumulative advantages of the Pump.fun platform remain evident, far surpassing BSC in terms of "Meme minting factory" capacity. The main reason lies in the exhaustion of internal narratives within the BSC Meme ecosystem and the lack of external incremental capital: the community has grown resentful and divided over the "edict-style" hype model overly reliant on CZ/He Yi (jokingly referred to as "Shandong School of the Coin Circle"), and the failure to attract overseas or other chain capital has led to a lack of new funding, resulting in insufficient momentum for the market.

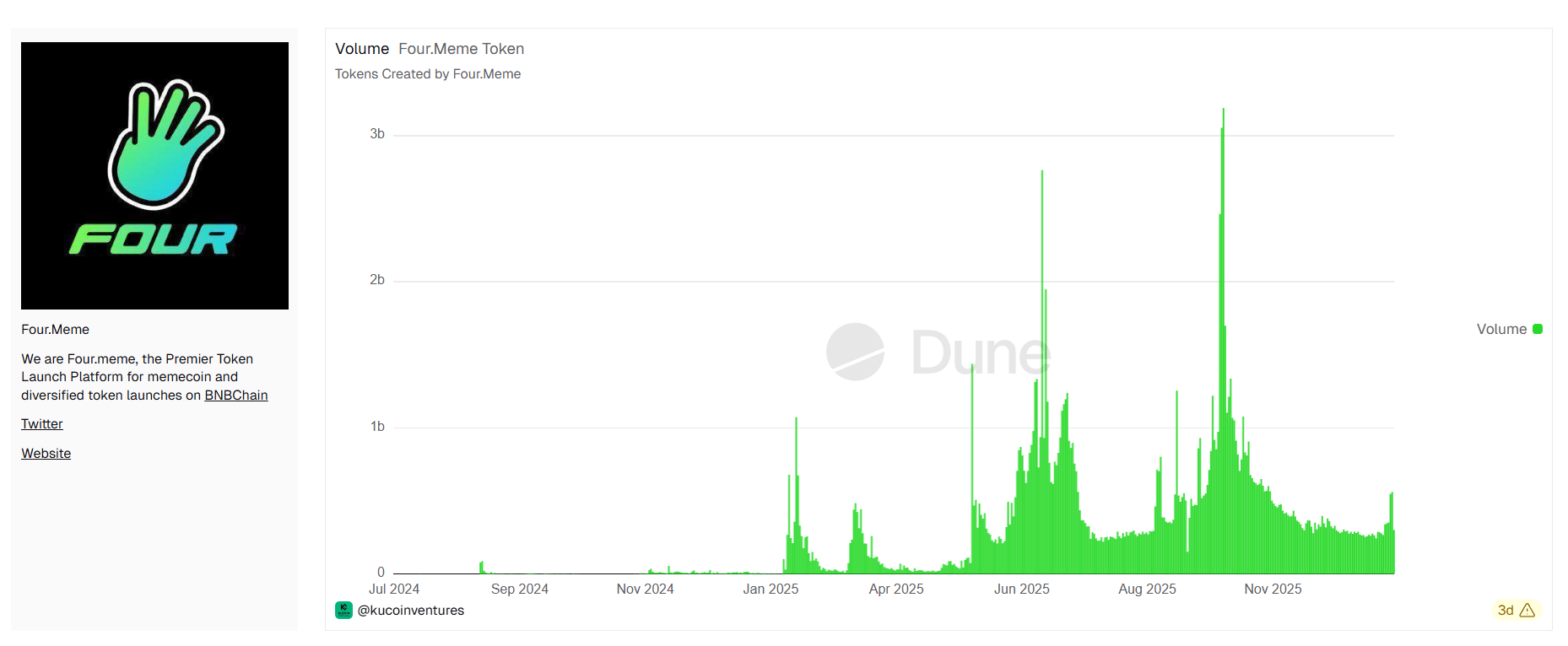

As the representative Meme launchpads for Solana and BSC, the competition between [Pump.fun and Four.meme](http://Pump.fun and Four.meme) has run throughout the entire Meme craze cycle. Pump.fun benefits from its first-mover advantage, having established a monopoly position as early as 2024 when the Meme wave began, with daily new accounts exceeding 100,000 at one point, making it an unavoidable issuance platform on the Solana chain. Four.meme, backed by the Binance ecosystem, surged in 2025, rapidly climbing from fewer than 500 daily new accounts to over 20,000. Although its initial scale was only 40% of Pump.fun, its weekly growth rate reached an impressive 325%, demonstrating strong latecomer momentum. Throughout 2025, the two platforms chased each other, with market shares fluctuating multiple times. The competition between [Pump.fun and Four.meme](http://Pump.fun and Four.meme) is essentially a battle for funds and users between the Solana and BSC ecosystems. Besides these two giants, other Meme issuance platforms or tools have also emerged in the market. For example, competitors like LetsBonk and Moonshot exist on Solana. On the BSC side, Four.meme dominates, solidifying the Meme ecosystem infrastructure of the BSC chain.

Both Pump.fun and Four.meme have issued their native platform tokens, PUMP and FORM, respectively, and have implemented certain incentive mechanisms to promote user retention and participation. PUMP token holders can share in platform profits or receive fee discounts. Four.meme adopts a "trading mining" + future airdrop approach, which may yield slightly lower short-term profit margins but has stronger user stickiness. This also reflects the different operational philosophies of the two: Pump.fun resembles a traditional business, focusing on increasing trading volume and commissions; Four.meme places greater emphasis on community operations, leveraging the BNB chain's tradition of "fun mining" to drive popularity.

2. Data Performance Discrepancy Analysis

- Market Capitalization and Scale

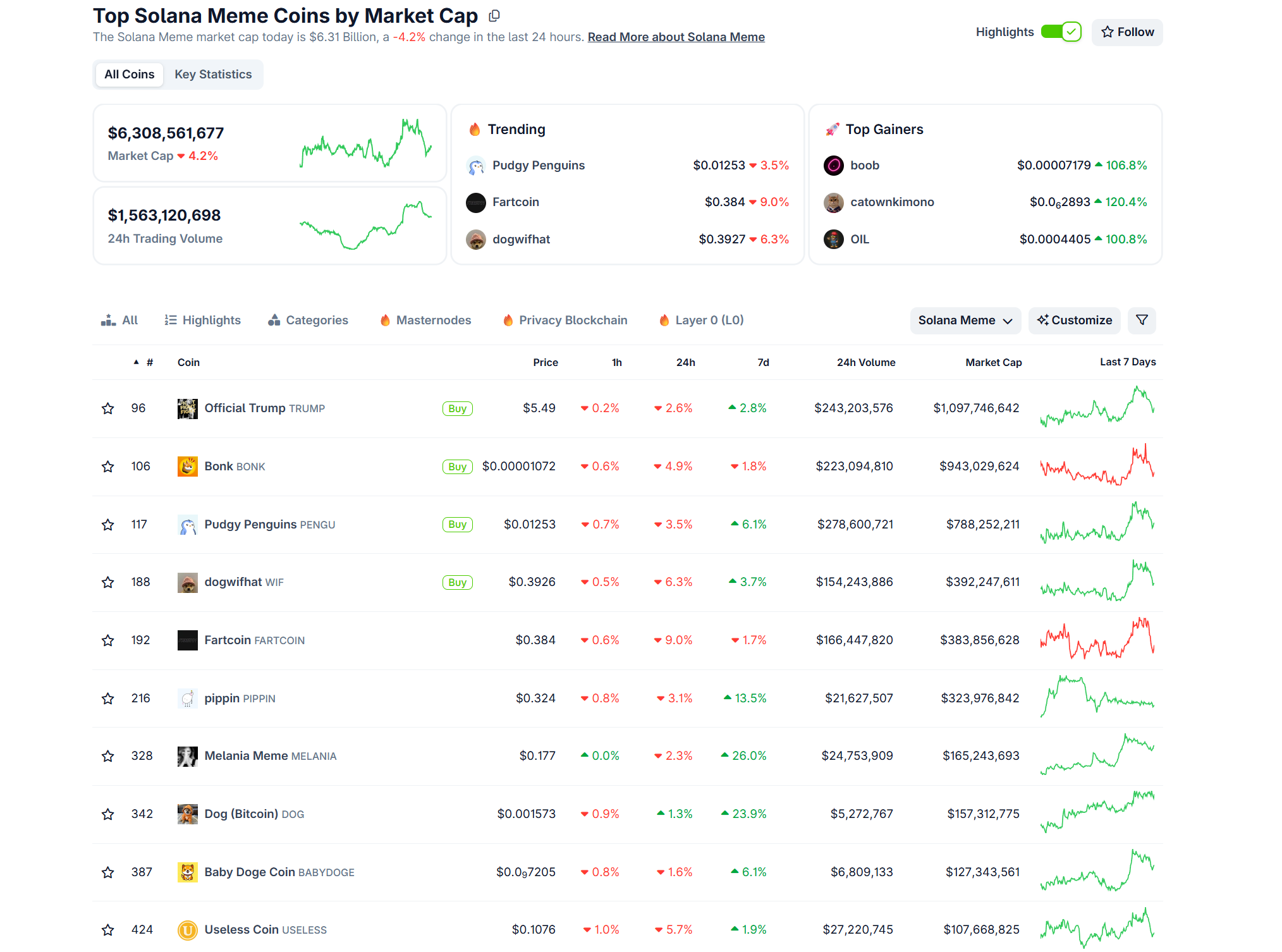

The Meme coin ecosystems on Solana and BSC have both become significant in overall scale. According to CoinGecko data, as of January 15, 2026, the total market capitalization of the Solana Meme sector is approximately $6.3 billion, with a 24-hour trading volume of $1.5 billion. Among them, the market capitalization of the top 10 Meme coins exceeds $100 million, even ranking among the top in the entire crypto market.

Source: https://www.coingecko.com/en/categories/solana-meme-coins

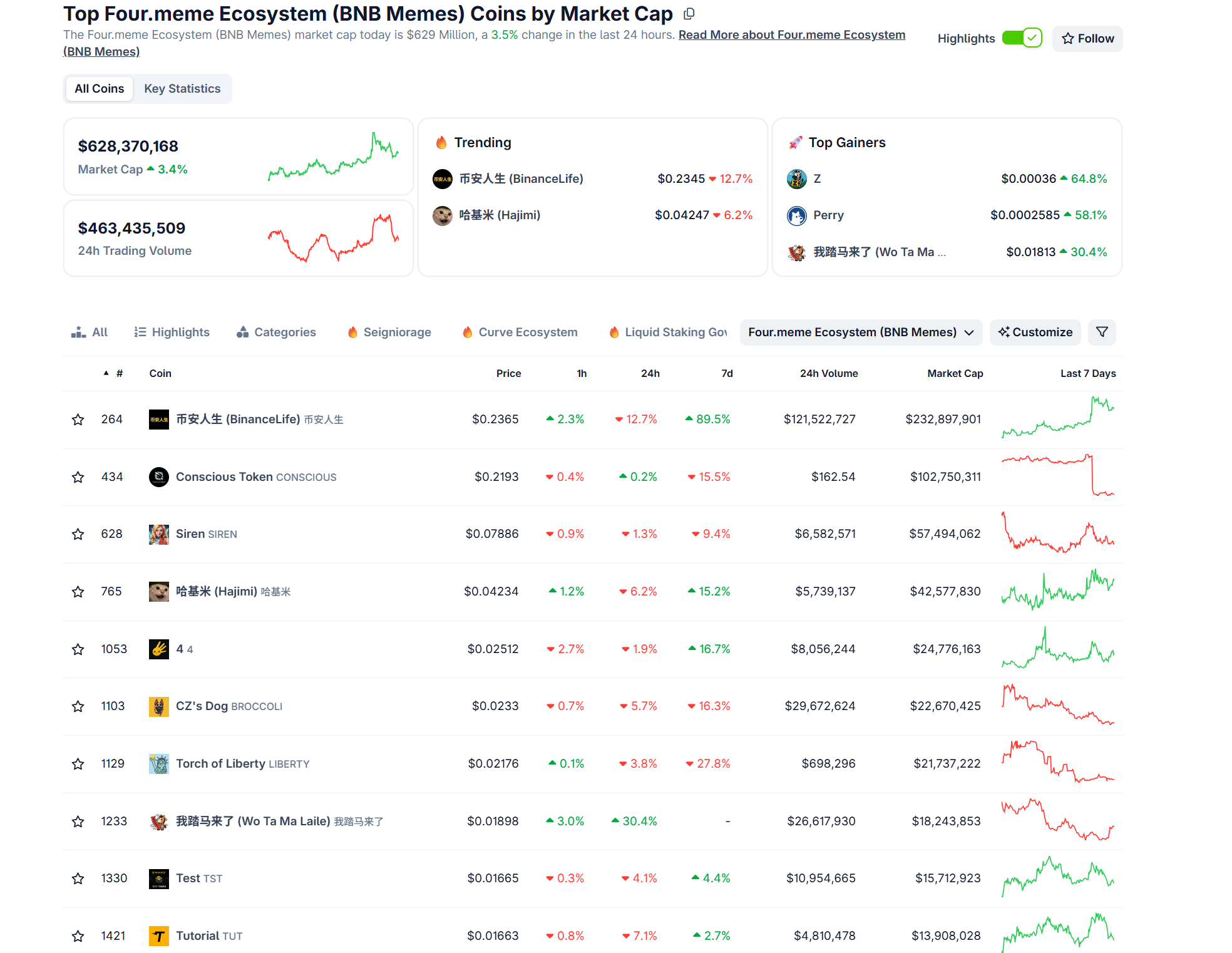

In contrast, the total market capitalization of BSC Memecoins issued on the Four.meme platform is about $620 million, with a 24-hour trading volume of approximately $460 million. It is evident that Solana, with its first-mover advantage and the emergence of large-cap projects, has a significantly larger Meme sector compared to BSC's nascent Meme sector. However, BSC's growth has been more rapid—going from virtually no dedicated Meme sector at the end of 2024 to amassing hundreds of millions in market capitalization and daily trading volumes in the hundreds of millions by the end of 2025, showcasing astonishing growth. The ebb and flow of the two reflect the dynamic allocation of capital between different ecosystems: when the market capitalization of BSC Meme surged in the second half of 2025, the Solana Meme sector had once contracted; conversely, when the BSC craze waned, capital flowed back to Solana, driving some tokens to rebound. This sector rotation may continue in the future.

Source: https://www.coingecko.com/en/categories/four-meme-ecosystem

- Trading Volume and Activity

In terms of trading activity, both Solana and BSC Meme markets have had their highlights. The trading volume of Meme coins on the Solana chain peaked between Q4 2024 and Q1 2025, with Pump.fun reaching a single-day trading volume of over $300 million at one point. Even after the frenzy subsided, the daily trading volume on the Pump.fun platform remained above tens of millions of dollars, indicating a certain level of stickiness. Throughout 2025, the Pump.fun platform contributed approximately 40%+ of the DEX trading volume on the Solana chain, consistently ranking among the top revenue-generating applications in the Solana ecosystem.

Source: https://dune.com/adam_tehc/pumpfun

The trading volume of Meme coins on the BSC chain reached new highs multiple times around October 2025: on October 7, 2025, the trading volume related to BSC Meme coins surged to approximately $6.05 billion. The Four.meme platform itself also achieved an average daily trading volume of several million dollars in October, comparable to Pump.fun. However, BSC Meme trading exhibited a "volcanic eruption" pattern—extreme volume in a short time, followed by a rapid decline. For example, in early January 2026, during a two-day surge of Chinese Meme coins, the 24-hour trading volume of related tokens skyrocketed several times, only to drop by over 50% shortly after. Solana Meme, on the other hand, has been relatively more stable and enduring; although there were massive transactions during peak periods, the decline was more gradual, and platform revenue remained above the average level during the bear market until the end of 2025. This reflects that the Solana Meme ecosystem has cultivated a group of permanent speculators, forming a fixed sector effect that no longer relies entirely on overall market sentiment fluctuations. In contrast, the BSC Meme ecosystem is still in the explosive-cooling experimental stage, with clear seasonal characteristics.

Source: https://dune.com/kucoinventures/four

- Lifecycle and Survival Rate

The short lifecycle of Meme tokens is a commonality between the two chains, but there are slight differences in project survival rates. Data from the Pump.fun platform shows that of the millions of tokens issued, less than 2% ultimately succeed and remain. The vast majority of tokens go from creation to price zero in no more than a week or two, with many even exhausting their trading volume within a few days. This fleeting nature is common on both Solana and BSC. However, due to its first-mover advantage, Solana has birthed some relatively long-lived Meme projects, such as FARTCOIN and PIPPIN, which are still operational and have a certain community foundation. The Meme coins on the BSC chain currently seem to have poorer durability. Among the batch of Chinese Meme coins from October 2025, aside from "Binance Life" and "Hakimi," which still have some popularity, others like "Customer Service Xiao He," "Cultivation," and "Milk Dragon" have disappeared without a trace. Even in this wave in January 2026, the leading "I'm Here" currently lacks sustained popularity. The pattern of "cold start—interaction—go up Alpha—plummet and dump" has almost become a fixed script.

Source: https://dune.com/kucoinventures/four

Solana Meme has experienced the bursting of the bubble earlier, resulting in a relatively higher maturity of the sector. Many Solana investors have reached a consensus on "quick in and out" with Meme coins, no longer blindly holding with diamond hands. This has led to a situation where, although the project death rate is similarly high, the efficiency of capital circulation has improved—when an old project cools down, a new one immediately fills the gap, allowing the sector's heat to be maintained repeatedly. The BSC Meme is still undergoing the painful process of rapid cycles, and it may take one or two rounds of significant filtering to settle on projects with lasting appeal.

3. Comparison of Project Characteristics and Community Culture

- Meme Themes and Styles

Meme coins on the Solana and BSC chains exhibit certain differences in thematic style. Solana Meme coins are diverse and internationalized, featuring projects that originate from Western internet celebrity culture as well as some absurd creative ideas. For example, the Meme coin Bonk, which initially gained popularity on Solana in early 2023, was seen as the "Solana version of Dogecoin," and its market capitalization still stands at around $900 million. From 2024 to 2025, Pump.fun saw a surge of bizarre coin names, such as FARTCOIN, TRUMP, PENGU, and PNUT. These Solana Meme projects often have humorous names and exaggerated styles, catering to popular memes in the global crypto circle, with strong satirical and social attributes, and the international community participates in the hype, resembling a global crypto subculture carnival.

In contrast, BSC Meme coins have distinct local and community characteristics, with strong elements of imitation and homage. For example, tokens like TST, Broccoli, and mubarak are all related to Binance officials or CZ, while "Chinese Meme" such as "Binance Life," "Hakimi," "I'm Here," and "Old Man" are almost entirely derived from popular Chinese phrases or internet memes. It can be seen that Meme projects on BSC are more grounded, revolving around figures and jokes within the crypto circle, even carrying a self-deprecating tone. This self-contained meme culture has been referred to by Odaily as "Shandong School of the Coin Circle," as this model is humorously likened to Shandong people studying "which way the fish head faces" during festivals to please their leaders, and Chinese Memes are becoming increasingly "local." This is also why when Chinese Memes attempt to go overseas, they encounter bottlenecks—overseas investors often do not grasp these memes, lacking a sense of identification, and discussions in English communities are sparse. Even when coin prices surge in the short term, they fail to attract external capital, ultimately returning to silence.

- Community and Players

The composition of the Meme enthusiast groups on the two chains also differs. The early Solana Meme community was primarily composed of young investors from Europe and America, as well as existing Solana ecosystem users, who were stimulated by cases like Pepe in 2023 and were full of expectations for replicating the Meme myth on emerging high-speed chains. It can be said that the Solana Meme craze is a product of global retail investors working together. In contrast, the BSC Meme community has a significant portion of players who are Chinese both domestically and abroad, as well as existing users active on the Binance exchange. This group is generally quick to sense opportunities and act, but they also tend to cluster around short-term hotspots; once internal funds disperse, the game becomes difficult to sustain. This is why the Chinese Meme craze comes quickly and goes just as fast.

In comparison, Solana's Meme community is broader, including diverse groups such as KOLs on European and American social media, NFT players, and DeFi users, making its Meme ecosystem more likely to attract external attention. During peak periods, even investors from Ethereum would come to Solana to chase trends. However, BSC's heavy reliance on the Chinese-speaking community results in significantly lower dissemination on overseas social media, which becomes a major limitation for its Meme ecosystem.

- Capital Scale and Speculation

From the perspective of capital structure, the speculators in Solana and BSC's Meme markets also differ. Solana is more characterized by retail investors and small to medium-sized funds flocking in, with Pump.fun itself promoting the concept of "common people's minting." Many people try to issue tokens or buy new coins with hundreds of dollars, betting on high-odds low-probability events. This leads to a large number of projects being fleeting, but it has also nurtured community coins with certain sustainability, such as FARTCOIN and PIPPIN.

On the BSC side, in addition to retail investors, the influence of whale accounts is significant. BSC Meme is often ignited by some early heavy investors: they buy into new coins with thin liquidity at low prices, and once the market capitalization and liquidity reach a certain threshold, these whales use social media or insider information to trigger a "viral" pump. When retail investors rush in, the whales have already secured substantial paper profits due to their first-mover advantage. Although this also occurs in Solana Meme, BSC's projects are often associated with statements from CZ/He Yi, making the manipulation by market makers more pronounced. In the chaotic battle for the Broccoli token, many fake projects were pumped by behind-the-scenes market makers and then quickly dumped. It can be said that Solana Meme is closer to disordered group gaming, while BSC Meme tends to be dominated by a few market makers. Therefore, the fluctuations in BSC Meme are often more intense, with shorter cycles of rise and fall, as evidenced by several market movements in 2025.

- Media and KOL Influence

The public opinion environment in the two ecosystems is also different. The early wave of Solana's Meme was primarily driven by overseas KOLs on Crypto Twitter, who were eager to share the quirky coins they discovered on Pump.fun, creating viral spread. Overall, Solana's official stance has remained relatively restrained, with more community-driven actions. On the BSC side, every move by Binance's upper management has a magnifying effect. Tweets from CZ and He Yi are often interpreted as "Meme edicts," and KOLs scramble to analyze the nuances in search of inspiration for the next coin name. Some opinion leaders in the Chinese community have begun to call for Meme creation to be decentralized and deified, urging not to revolve around big shots. This sentiment has been particularly prominent in discussions in early 2026.

Thus, it is evident that the Meme cultural atmosphere on the two chains differs: Solana leans towards entertainment, focusing on creativity and subculture, while BSC has at times veered towards authority worship, with Meme becoming a form of community mockery of leaders. This difference also determines the value orientation of their respective mainstream communities—the former tends to imbue Meme with a spirit of self-deprecating irony, while the latter quickly chases trends and hot topics, lacking a long-term narrative. This also explains why some projects in the Solana Meme sector maintain vitality even after the frenzy subsides, while most following coins on the BSC side are fleeting.

4. Current Status and Outlook of the Meme Market in 2026

- Current Status of the Meme Market

As of mid-January 2026, overall, the Meme coin market has cooled compared to its peak, but the sector effect still exists, and the rotation of hotspots continues. On the Solana chain, the daily active users and trading volume on the Pump.fun platform have significantly decreased from their peak, but thousands of new tokens are still being created daily, with user numbers in the tens of thousands. The increased activity on the Solana network also provides a certain level of natural traffic support for the Meme sector. On the BSC chain, after a brief surge of Chinese Meme coins over the past two weeks, it is currently in a consolidation phase. However, the BSC Meme ecosystem has not extinguished: some players have turned their attention to new themes (such as AI-related Meme coins and Meme coins from other language cultures), attempting to find the next story. Meanwhile, Binance officials are closely monitoring community trends and may brew new activities or strategies to reignite interest. It is foreseeable that Meme coins, as a sector, have taken root on both Solana and BSC chains and may be periodically reignited in the future. In the current market situation, investors' attitudes towards Meme coins are becoming more cautious and rational; those who have experienced significant volatility understand that these assets are high-risk and high-volatility, leading to more restrained participation. This is evident from the recent performance of several Meme coins after being listed on Binance—after a surge, they quickly retraced, indicating that speculative enthusiasm has somewhat diminished compared to previous cycles. This is also one of the signs of market maturation.

- Future Outlook

Looking ahead, the Meme ecosystems of Solana and BSC may follow differentiated development paths. For Solana, the Meme coin craze has validated its high-performance chain's capacity to support a large user base and has brought a group of active users to the SOL chain. After experiencing a bubble, the Solana Meme ecosystem has the opportunity to cultivate IPs with community cultural value. In the future, Meme coins on Solana may shift towards empowering applications in NFT, GameFi, and other scenarios, forming a cross-domain entertainment ecosystem. For example, the Bonk team has already attempted to launch NFTs, games, and other expanded applications to give the token some utility, thereby extending its lifespan and gradually moving towards quality and community focus.

For BSC, the success of the Meme ecosystem in 2025 has proven that BSC is not limited to DeFi but can also capture social traffic. Binance will clearly continue to support this sector. The future development of BSC Meme hinges on breaking out of the Chinese-speaking community to reach a broader user base. This may require creating globally appealing Meme themes or integrating with broader internet pop culture, rather than being confined to internal memes. At the same time, the roadmap released by BSC at the end of 2025 will enhance performance, reduce fees, and introduce anti-MEV mechanisms, making BSC more suitable for high-frequency trading and small-scale speculation, which is expected to further boost the activity of Meme trading. It is foreseeable that when market sentiment warms up again, BSC Meme may make a comeback, and with lessons learned from past experiences, there may be some more sustainable projects emerging. Binance may also integrate Meme elements into its ecosystem development, making it a "soft landing" sector to attract new Web3 users.

- Investor Risk Warning

Essentially, Meme coins remain a high-risk speculative game, and investors should always participate with a calm and rational attitude; surviving in Meme coin investments is far more important than making money. Whether on Solana or BSC, the short lifecycle and extreme volatility of Meme projects are ironclad rules, and chasing after price increases can easily lead to significant losses. It is recommended that ordinary investors:

Small Position Trials, Entertainment Mindset: Treat Meme investments as entertainment, participating with a very small proportion of funds, and avoid going all in. When the market is booming, a little "risk capital" can be invested for high returns, but be mentally prepared for that money to go to zero. Consider any profits as unexpected gains and any losses as tuition fees.

Follow Trends, Quick In and Out: Meme markets are often driven by social media trends, with information being extremely fragmented. Investors need to closely monitor community movements on Twitter, Telegram, and other platforms to capture first-hand signals. Once deciding to participate in a trending coin, the strategy should focus on short-term: enter quickly and take profits in batches while upward momentum remains. If trading volume declines or public interest wanes, exit decisively.

Identify On-Chain Signals: Make good use of block explorers and data tools to monitor market maker dynamics. For example, observe changes in the holdings of the top ten addresses of a Meme coin; if a whale address is transferring out a large amount, it may indicate a sell-off. Additionally, use on-chain data to determine whether funds are flowing into or out of the sector. Utilize this on-chain transparency to avoid becoming the last buyer.

Diversify Risks, Avoid Blind All-In: Consider multiple Meme opportunities for diversification. If you miss this round, keep an eye on the next one. Also, do not go all in on a single coin within a single chain; it is better to have small positions across multiple tokens, as hitting one or two can help offset other losses. After all, the probability of hitting a "hundredfold coin" is minuscule; spreading the net wider increases the chances of catching fish.

Beware of Scams and Hackers: Due to the low entry barrier for Meme coins, it is inevitable that there will be a mix of good and bad. Be cautious of various fake coin traps (e.g., contracts imitating popular coins but adding fees or black hole addresses); verify the source of contracts before investing (preferably through official channels or reliable block explorers). Do not click on unknown Meme airdrop links to avoid phishing sites. It is advisable to use hardware wallets for participating in such high-risk speculation to prevent losing your entire wallet's assets due to a single Meme coin.

- Conclusion

The Meme coin craze on the Solana and BSC chains is a unique spectacle in the recent crypto market. On one side, the intertwining of tech geeks and social virality has made Solana a "meme factory" brimming with creativity; on the other, the collision of Binance traffic and Eastern meme culture has turned BSC into a phenomenon of a speculative casino. Both have jointly promoted the prosperity of Meme culture while exposing bubbles and risks. Looking to the future, the dual-chain Meme ecosystems may each mature and coexist long-term, continuously delivering new users and topics to the industry. However, regardless of how the market changes, investors should maintain a sense of reverence and participate rationally.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hot Coin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing itself carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。