Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.22 trillion, with BTC accounting for 59%, or $1.9 trillion. The market capitalization of stablecoins is $310.6 billion, having increased by 1.01% in the last 7 days, with USDT making up 60.07%.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen. Specifically, BTC has increased by 5.5% over the past 7 days, ETH by 6.6%, SOL by 3.1%, DASH by 141.5%, and XMR by 54.9%.

This week, the net inflow for the U.S. Bitcoin spot ETF was $1.417 billion; the net inflow for the U.S. Ethereum spot ETF was $478 million.

Market Forecast (January 19 - January 25) :

The current RSI index is 47.38 (neutral zone), and the fear and greed index is 50 (the index has returned to neutral levels after several months). The altcoin season index is 33 (neutral, down from last week).

BTC core range: $94,800 - $100,000

ETH core range: $3,250 - $3,400

SOL core range: $138 - $155

On-chain data shows that profit-taking pressure has eased, institutions have shifted back to net buying through spot ETFs, and bullish bets in the options market are increasing. Risk appetite is recovering, but BTC has accumulated a large amount of historical trapped positions in the $97,000 to $117,400 range, creating strong selling pressure. Maintain a "cautiously bullish" attitude in the first half of 2026. Recently, Chinese memes have been quite popular on-chain, and while focusing on short-term opportunities, one must remain highly vigilant about a consensus risk from mainstream institutions: there may be a significant "risk liquidation event" in the market in the first half of 2026 (possibly at some point after January 26), leading to a substantial correction in asset prices.

Understanding Now

Review of Major Events of the Week

On January 12, international geopolitical tensions escalated, causing gold, silver, and oil prices to rise across the board, with gold futures surpassing $4,600 per ounce for the first time;

On January 12, The New York Times reported that U.S. federal prosecutors have launched a criminal investigation into Federal Reserve Chairman Jerome Powell. The investigation focuses on the renovation project of the Federal Reserve's Washington headquarters, marking an escalation in the long-standing conflict between President Trump and the Fed Chairman;

On January 11, CNBC reported that Walmart and Google announced a new partnership that will allow shoppers to discover and purchase products from Walmart supermarkets and Sam's Club directly using Gemini, enabling customers to complete purchases without leaving the AI chatbot;

On January 13, former New York Mayor Eric Adams launched the "NYC Token," which quickly surged and then fell after its debut;

On January 14, the Senate Agriculture Committee plans to release the draft text of its proposed cryptocurrency market structure bill (the "Clarity Act") on January 21 and hold a key hearing on the text on January 27;

On January 14, according to glassnode data, the recent rebound in the cryptocurrency market led to a liquidation of $684 million across the network in the past 24 hours, with $577 million in short liquidations, triggering the largest short liquidation of the top 500 cryptocurrencies since the "1011 crash";

On January 15, several Federal Reserve officials publicly emphasized the importance of maintaining independence in monetary policy formulation. Meanwhile, officials generally signaled that the meeting this month may delay interest rate cuts, citing the resilience of the U.S. economy and high inflation levels, indicating that monetary policy needs to remain restrictive;

On January 15, Nikita Bier, head of X products and Solana ecosystem advisor, stated, "We are revising the developer API policy: applications that reward users for posting on X (so-called 'InfoFi') will no longer be allowed. This type of mechanism has already caused a large amount of low-quality AI content and reply spam on the platform;

On January 16, BeInCrypto reported that Polygon has conducted large-scale internal layoffs. Industry insiders indicated that about 30% of employees were laid off this week. This is not the first time Polygon has conducted large-scale layoffs; the company had previously laid off nearly 20% of its workforce in 2024.

Macroeconomics

On January 13, the U.S. December unadjusted core CPI year-on-year rate was 2.6%, expected 2.70%, previous value 2.60%;

On January 15, the number of initial jobless claims in the U.S. for the week ending January 10 was 198,000, lower than the expected 215,000, with the previous value revised from 208,000 to 207,000;

On January 15, according to CME "FedWatch" data, the probability of the Federal Reserve cutting rates by 25 basis points in January is 3.4%, while the probability of maintaining the current rate is 96.6%.

ETF

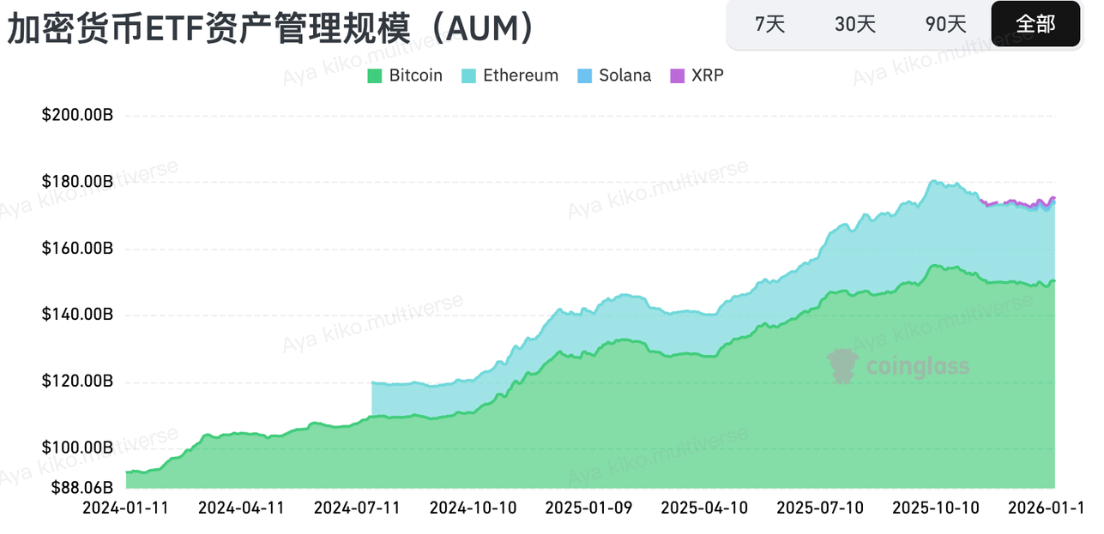

According to statistics, from January 12 to January 16, the net inflow for the U.S. Bitcoin spot ETF was $1.417 billion; as of January 16, GBTC (Grayscale) had a total outflow of $25.367 billion, currently holding $15.634 billion, while IBIT (BlackRock) currently holds $74.697 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $129.177 billion.

The net inflow for the U.S. Ethereum spot ETF was $478 million.

Envisioning the Future

Industry Conferences

Consensus Hong Kong 2026 will be held from February 11 to 12 in Hong Kong, China;

ETHDenver 2026 will be held from February 17 to 21 in Denver, USA;

EthCC 9 will take place from March 30 to April 2, 2026, in Cannes, France. The Ethereum Community Conference (EthCC) is one of the largest and longest-running annual Ethereum events in Europe, focusing on technology and community development.

Project Progress

SBF's ex-girlfriend Caroline Ellison may be released on January 21, 2026. Previously, Caroline Ellison testified as a key witness in SBF's criminal trial in 2023, and her "significant cooperation" was recognized by the judge, but she was still sentenced to prison;

The crypto bug bounty platform Immunefi will launch its token IMU on January 22;

The MET airdrop for Meteora will end on January 23, and any unclaimed tokens will be added to the circulating community reserve for future rewards;

The on-chain film development and funding project Sequel announced that its film THE MUSICAL, funded on Base, has been selected for the competition section of the Sundance Film Festival. The film will premiere on January 25 in the U.S. dramatic competition section.

Important Events

On January 22 at 21:30, the U.S. will report the number of initial jobless claims for the week ending January 17 (in thousands);

On January 23 at 23:00, the U.S. will release the final value of the January University of Michigan Consumer Sentiment Index.

Token Unlocking

Official Trump (TRUMP) will unlock 50 million tokens on January 18, valued at approximately $271 million, accounting for 11.95% of the circulating supply;

Ondo (ONDO) will unlock 1.94 billion tokens on January 18, valued at approximately $772 million, accounting for 57.23% of the circulating supply;

LayerZero (ZRO) will unlock 25.71 million tokens on January 20, valued at approximately $42.68 million, accounting for 6.36% of the circulating supply;

River (RIVER) will unlock 1.5 million tokens on January 22, valued at approximately $29.84 million, accounting for 4.32% of the circulating supply;

Soon (SOON) will unlock 21.88 million tokens on January 23, valued at approximately $7.55 million, accounting for 5.63% of the circulating supply;

Humanity (H) will unlock 105 million tokens on January 25, valued at approximately $19.6 million, accounting for 4.57% of the circulating supply.

About Us

Hotcoin Research is the core research institution of Hotcoin Exchange, dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers will also engage with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。