Good evening everyone, I am Xin Ya. Last night, the market sentiment faded, and the volatility slowed down. It’s easy to guess that profit-taking has allowed for a peaceful weekend, but it would be great if you were also part of it.

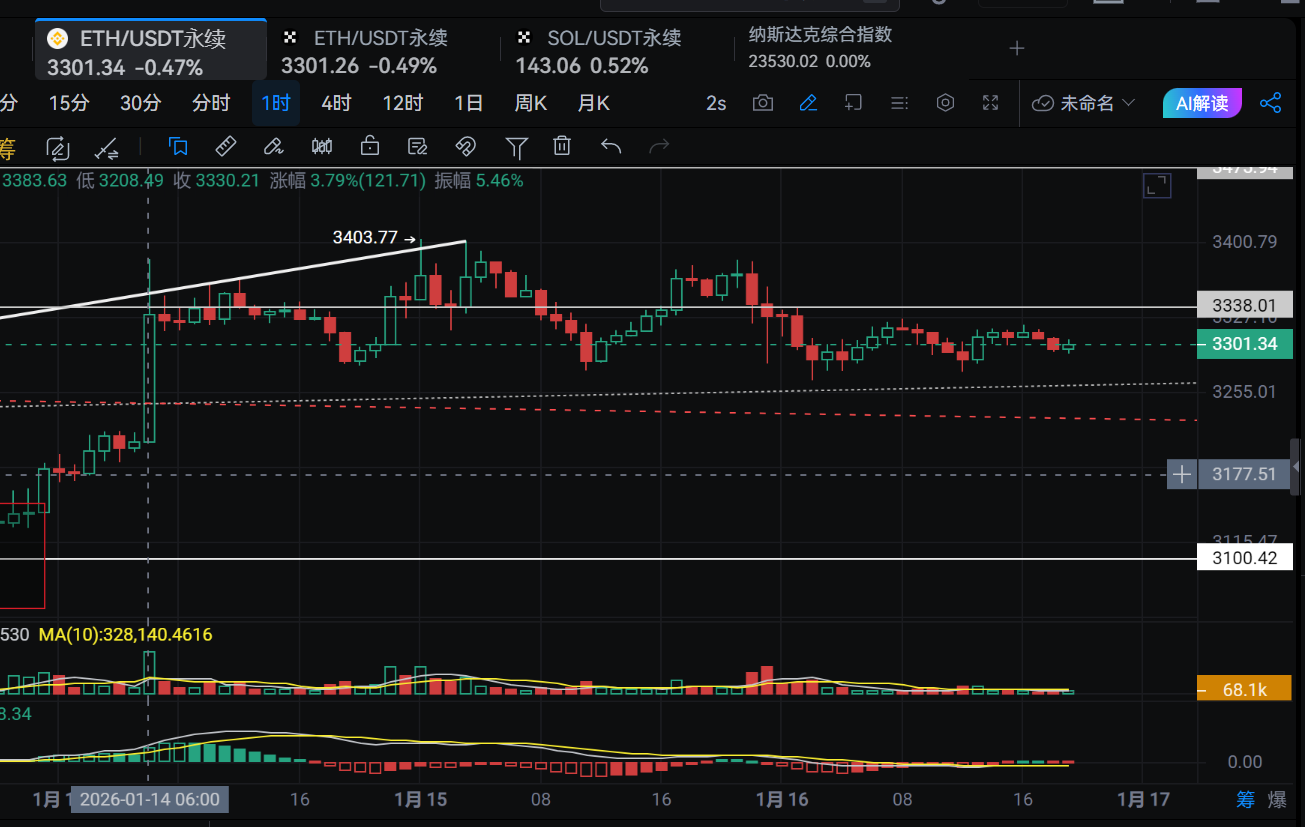

Let’s first look at the trend of Ethereum. After a doji was formed at 9 PM on the 15th, there was a five-hour bearish arrangement. The third candle closed at the midpoint of 3330, where the selling pressure began to decrease sharply. The lowest point tested around 3270, but several subsequent candles closed around 3280, indicating that the bulls are maintaining stability. The 3280-3380 range for Ethereum has been oscillating multiple times, showing signs of building momentum for an upgrade. Currently, the one-hour EMA30 is concentrated around 3320, while the one-hour EMA120 and EMA144 are around 3250. Focus on these two positions. The future trend may either gently recover, consolidating around 3300 with a slow upward movement, or after a test at 3250, break through 3330, reaching 3368-3386 before testing the upper edge.

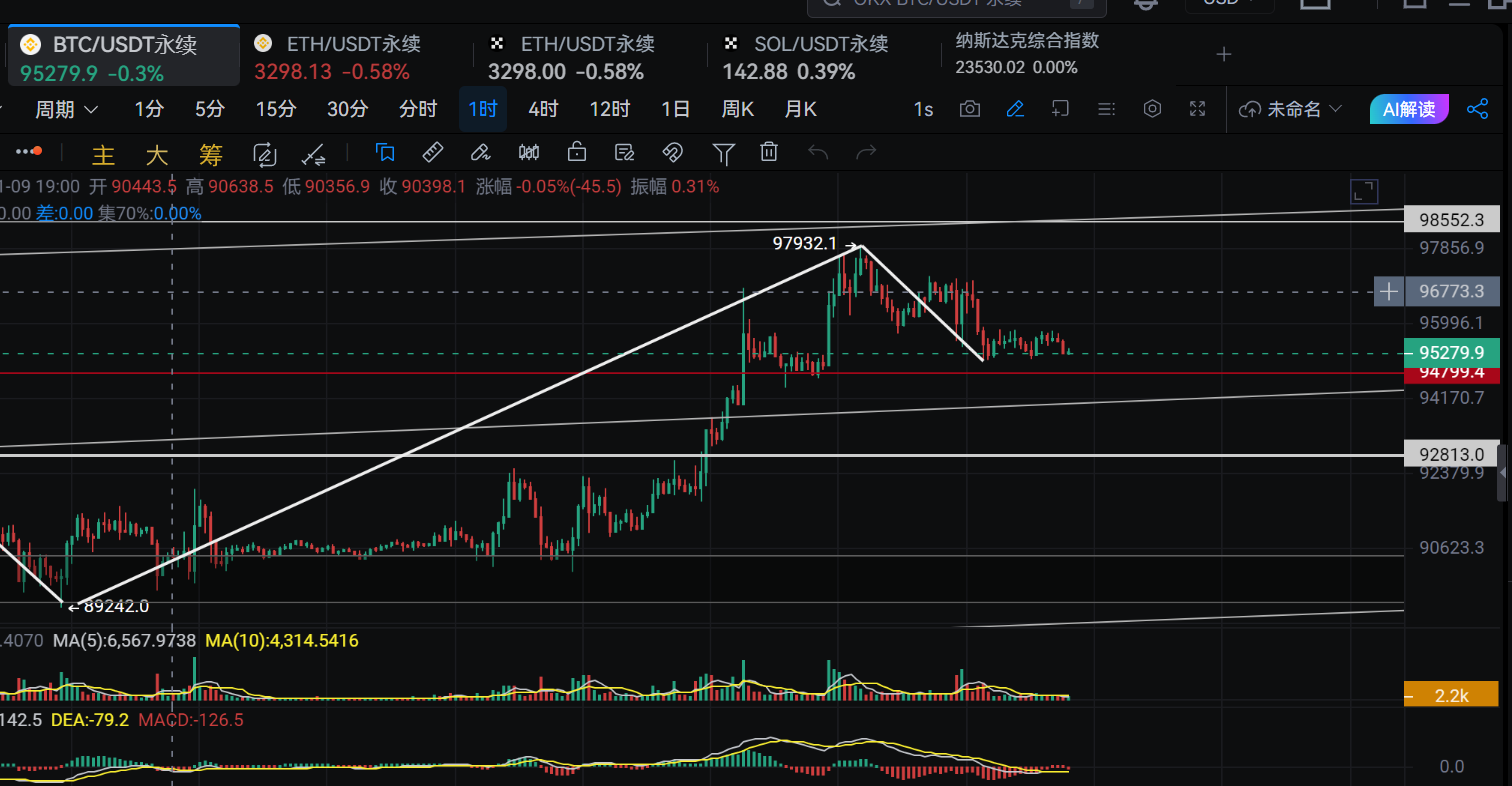

As for Bitcoin, the consolidation range is not large, operating within the 95000-97000 range during the day. The rhythm is like dropping bombs, and during the second drop from 96800, there was a five-hour consecutive bearish trend, with selling pressure and continuity not being too bad. This will attract bears looking for an opportunity to cover their positions, but after the market touched 95200, it began to reduce volume and move towards recovery. In this consolidating market, we can continue with the previous strategy, focusing on building around the central axis.

It is recommended to enter long positions around 95500 when in a flat position, with the replenishment area unchanged at around 94800. Set the worst risk-reward ratio for expectations based on the upper edge of the central axis, with a stop loss at 93750. The consolidation range remains unchanged. For Ethereum, go long around 3280-3300, with a replenishment area at 3250 and a stop loss at 3228. The expected core oscillation range is 3260-3375. Yesterday's layout provided opportunities for profit. Today, we will be a bit more conservative compared to the previous strategy, especially since it’s the weekend.

For synchronized updates, you can contact the public account: Xin Ya Talks About Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。