Author: Liang Yu

Editor: Zhao Yidan

On the evening of January 14, 2026, a television documentary titled "Technology Empowering Anti-Corruption" brought a highly digital-age characteristic corruption case to the public's attention. The film revealed that Yao Qian, the former director of the Technology Supervision Department of the China Securities Regulatory Commission and former head of the Central Bank's Digital Currency Research Institute, had key evidence of his disciplinary violations locked by blockchain technology. Investigations showed that as early as 2018, Yao Qian accepted a request from cryptocurrency businessman Zhang to use his influence to "give a heads-up" to a virtual currency exchange, helping Zhang's company successfully issue tokens and raise 20,000 Ethereum (ETH). Subsequently, he secretly accepted 2,000 ETH as "digital remuneration" through his trusted subordinate Jiang Guoqing as an intermediary. Ironically, the special investigation team later found a hardware wallet containing the bribe money directly in his office drawer.

However, the drama of the case goes far beyond this. What truly made this virtual bribe "visible" was its attempt to integrate into the real world. Investigators painstakingly traced back through about four layers of "shell accounts" disguised by others and discovered that one payment of 10 million yuan for a house came from a virtual currency trader's fund account. This money ultimately flowed into a villa in Beijing worth over 20 million yuan, completing a thrilling leap from "on-chain keys" to "offline luxury homes."

This raises a thought-provoking question: When corruption dons a "technological invisibility cloak," does it really become safer and more concealed? The Yao Qian case provides a sharp negative answer. It reveals a key paradox: virtual currency is not a "get-out-of-jail-free card" for corruption, but rather a sharp double-edged sword. On one hand, its aura of decentralization and anonymity easily creates a false sense of "technological superiority" for both parties involved in bribery; on the other hand, the permanent, public, and traceable transaction records on the blockchain act like an unalterable global ledger. Once a certain address is linked to a real identity, the entire chain of funds may be fully exposed. Moreover, this method of bribery is far from "low-threshold" — it adds multiple layers of technical, market, and trust risks, such as private key management, price volatility, cross-border cashing, and off-chain money laundering, essentially reconstructing the cost and risk structure of corruption, making it a complex and fragile dangerous game.

Especially in the context of China's regulatory environment, the strict control over virtual currency transactions makes the movement of related large funds highly "anomalous." When digital assets attempt to land as real-name assets like real estate and luxury cars through layers of "shells," the scrutiny and penetration risks they face only increase. The thin veil of technology cannot hide the sunlight of the system and the evolving penetration power of law enforcement. The closed loop of the Yao Qian case, from "hardware wallet" to "Beijing villa," serves as a profound footnote in this dynamic game. This article will use this case as a sample to deeply analyze the operational chain, inherent risks, and institutional dilemmas of virtual currency bribery, questioning whether technology is indeed empowering the concealment of corruption or providing sharper weapons for anti-corruption.

I. From Giving a Heads-Up to Buying a Villa: The Complete Chain of the Yao Qian Case

In 2018, cryptocurrency businessman Zhang, through Yao Qian's subordinate Jiang Guoqing, requested Yao Qian's assistance for his token issuance financing project. According to the case disclosure, Yao Qian subsequently gave a heads-up to a virtual currency exchange, and Zhang's company successfully issued tokens and raised 20,000 Ether. As a token of gratitude, Zhang sent 2,000 Ether to Yao Qian through a transfer address set up by Jiang Guoqing as a reward.

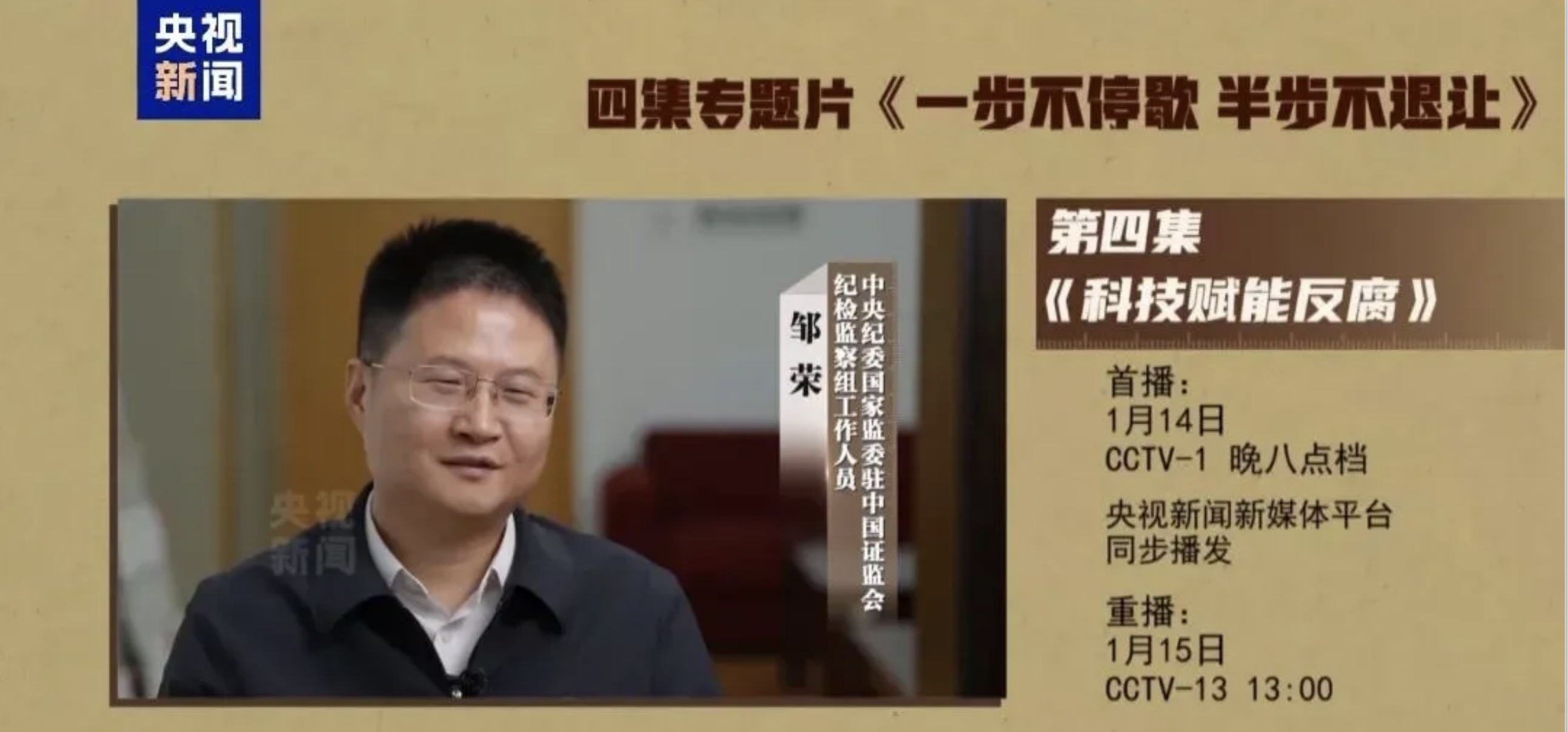

The market value of these 2,000 Ether fluctuated with market changes, at one point exceeding 60 million yuan at its highest assessed value. Yao Qian did not directly cash out these virtual assets but stored them in a hardware wallet. According to the television documentary "Step Forward Without Stopping, Half Step Back Without Compromise," aired on the evening of January 14, 2026, the special investigation team seized the hardware wallet storing these assets from a drawer in Yao Qian's office.

Another key clue in the case is that investigators found Yao Qian controlled multiple bank accounts opened under other people's identities. One payment of 10 million yuan was confirmed to come from a virtual currency trader's fund account after penetrating about four layers. After entering Yao Qian's "shell account," this money, along with funds from other sources, was ultimately used to purchase a villa in Beijing worth over 20 million yuan. This villa was registered under the name of Yao Qian's relative but was actually owned by Yao Qian.

II. Hardware Wallets and Shell Accounts: How Do Dual Concealments Operate?

In the Yao Qian case, hardware wallets and "shell accounts" constitute two key barriers to the concealment of corruption. A hardware wallet, as an offline storage device, theoretically allows for the physical isolation of private keys from the internet, thereby reducing the risk of being hacked or tracked online. Meanwhile, "shell accounts" attempt to obscure the direct connection between the ultimate beneficiary and the source of funds through multi-layered, multi-person fund transfers.

Yao Qian later admitted, "To be honest, I knew this was a sneaky behavior; how could you do it? It just seemed like it would be hard to find evidence before." This mindset reflects some corrupt individuals' excessive trust in technological concealment methods. Investigating such cases typically requires mastering two key items: the hardware wallet itself and the paper recording the private key mnemonic. These technical details indicate that the investigators have gained a deep understanding of the storage and management of virtual currencies.

From an operational perspective, virtual currency bribery is more complex than traditional cash transactions. Both parties in the transaction need to possess a certain level of technical knowledge to securely generate and safeguard private keys, complete on-chain transfers, and plan subsequent cashing paths. This increase in operational thresholds effectively changes the cost structure of corrupt transactions, combining legal risks with technical risks to form a high-complexity choice.

III. Price Volatility and Trust Crisis: New Risks of Virtual Bribery

While virtual currency bribery appears to offer greater concealment, from a risk management perspective, this method is not a low-risk alternative to traditional corruption. Corrupt individuals utilizing virtual currencies actually bear multiple new risks, including technical operation risks, asset price volatility risks, and trust risks arising from complex processes.

The price volatility of Ether involved in the Yao Qian case exemplifies this risk. From receiving 2,000 Ether in 2018 to partially cashing out in 2021, the price of Ether experienced dramatic fluctuations. This means the actual value of the bribe assets was unstable, and the bribing party effectively bore the unique price risks of the cryptocurrency market. Unlike traditional assets such as cash or real estate, the value of virtual currencies can plummet overnight or surge dramatically in a short period, increasing the instability of corrupt transactions.

Moreover, virtual currency transactions heavily rely on the correctness of technical operations. If a private key is lost or leaked, the corresponding assets will be permanently unrecoverable or controlled by others. Unlike cash transactions, which confirm instantly, both parties in virtual currency bribery must maintain a high degree of consistency in technical operations, increasing the risk of transaction failure or interception by intermediaries. In an environment where bribery lacks legal protection and trust is low, the complexity of technology may exacerbate the trust crisis between both parties.

IV. The Double-Edged Sword of Blockchain: Public Ledger and Law Enforcement Tracking

The concealment of virtual currencies and their openness constitute two sides of the same coin. Staff from the special investigation team pointed out that while virtual currencies have concealment features, they are also a "double-edged sword" due to their publicly accessible nature. Anyone can check the virtual currency inflow and outflow records of any blockchain address at any time, which is determined by the decentralized nature of blockchain.

In the Yao Qian case, the special investigation team successfully traced the flow of 2,000 Ether from Zhang's wallet address to Yao Qian's wallet address in 2018, as well as the complete record of Yao Qian transferring 370 Ether in 2021 to exchange for 10 million yuan. By conducting electronic evidence collection in accordance with regulations and laws, the special investigation team achieved mutual verification of various pieces of evidence, forming a closed loop.

However, the transparency of blockchain is not a panacea. Techniques such as mixers and privacy coins can indeed increase tracking difficulty and raise law enforcement costs. If a private key is physically lost, even with clear on-chain records, the corresponding assets may become "digitally irretrievable relics." In judicial practice, the recognition of on-chain evidence still needs to be combined with traditional evidence to form a complete chain of evidence. These practical limitations mean that the realization of blockchain transparency requires the collaborative evolution of systems and technology, rather than relying solely on the technical characteristics themselves.

V. The Specificity of the Chinese Market: Why Are Virtual Currency Transactions More Conspicuous?

Against the backdrop of China's comprehensive restrictions on virtual currency transactions, large transactions involving virtual currencies are inherently highly anomalous, which actually increases the likelihood of such corrupt behaviors being discovered. In the Yao Qian case, it was precisely through the large fund flow into real estate purchases that the source of the virtual currency was ultimately traced back.

The highly real-name system characteristic of China's financial system means that when virtual currencies ultimately "land," they must face strict scrutiny. Whether it is real estate purchases, large expenditures, or bank transfers, these processes require identity verification, forming a stark contrast to the anonymity of virtual currencies. This environmental difference means that the key vulnerability of virtual currency corruption often appears in the "off-chain landing" phase.

It is worth noting that cross-border transactions are not a channel free from regulation. With the improvement of international anti-money laundering cooperation mechanisms and the global promotion of FATF (Financial Action Task Force) rules, major virtual currency exchanges have implemented strict KYC (Know Your Customer) policies. These institutional arrangements mean that even if corrupt individuals attempt to conceal assets through cross-border transactions, their fund flows may still be tracked and revealed within the framework of international cooperation.

VI. The Cat-and-Mouse Game Upgrade: How Regulation Catches Up with Technological Evolution

In the face of new challenges posed by virtual currency corruption, regulatory technology is rapidly evolving. Law enforcement agencies are no longer passively responding to technological changes but are actively learning about blockchain and virtual currency-related knowledge to master their operational mechanisms. In the Yao Qian case, the special investigation team identified key points for review and investigation by learning a large amount of specialized knowledge, marking a new stage in anti-corruption work characterized by "using technology to counter technology."

The evolution of regulatory technology is reflected not only in the application of technical tools but also in the innovation of institutional design. The use of big data, artificial intelligence, and other technologies enables regulatory agencies to more effectively identify anomalous transaction patterns and discover corruption clues. At the same time, regulatory agencies are also exploring how to transform the transparency of blockchain into regulatory advantages, such as predicting and preventing financial risks through on-chain data analysis.

This dynamic evolution of the game between regulation and concealment is an ongoing process. As technology advances, new concealment methods may emerge, while regulatory tools continue to upgrade. The essence of this game is not a simple technological confrontation but a continuous adaptation between institutional capabilities and the technological environment. In this process, maintaining the flexibility and learning ability of the regulatory framework is more important than merely mastering specific technical tools.

From the details disclosed in the case, it is evident that during Yao Qian's tenure in financial technology regulation, his actions objectively weakened the neutrality of regulation and had a substantial impact on market fairness expectations. When regulators themselves become market participants, regulatory rules may transform from public goods into tools for private rent-seeking.

Yao Qian's actions of facilitating specific companies in listing tokens on exchanges through "giving a heads-up" and other means have disrupted the fair competitive environment of the ICO market. In this case, a project's market access no longer solely depends on technological advantages, business models, or team capabilities, but may be influenced by non-market factors. In the long term, this distorted resource allocation will hinder genuinely valuable innovative projects from gaining development opportunities, while inadequately qualified projects may gain market advantages through rent-seeking behavior.

This deviation from the role of regulators may also trigger a broader trust crisis. When market participants begin to doubt the neutrality and fairness of regulation, the overall compliance willingness of the industry may decline, and regulatory efficiency may be affected. For the early-stage financial technology industry, this erosion of the trust foundation could have far-reaching impacts on the long-term healthy development of the sector.

When the special investigation team opened the hardware wallet in Yao Qian's office drawer, this case had evolved from a simple power-money transaction into a complex sample interwoven with technology, finance, and institutions. The Yao Qian case shows that virtual currency has not changed the essence of corruption; it has merely altered its form of expression.

When power, technology, and capital intertwine, corrupt behavior often presents a more complex chain, but it inevitably leaves traces during the processes of asset landing, identity binding, and cross-system conversion. For regulators, this is not a one-way technological chase, but a continuously evolving institutional game.

In this game, while technology may change constantly, the core task of the institution remains clear: to ensure that any form of power operation is effectively constrained, regardless of the technological disguise in which that power is hidden.

Sources of some materials:

· "Former CSRC Director Yao Qian Expelled; Is Virtual Currency Bribery Really Safer?"

· "Did 'Father of Digital Currency Yao Qian' Fall Because of 2,000 ETH?? A Warning on New Corruption!"

· "Annual Anti-Corruption Blockbuster | Yao Qian's 2,000 ETH Bribery Chain, From Receiving Coins to Buying a Villa"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。