⚡️Spark has begun to enter the institutional lending business, with Anchorage Digital serving as the third-party compliance custodian—

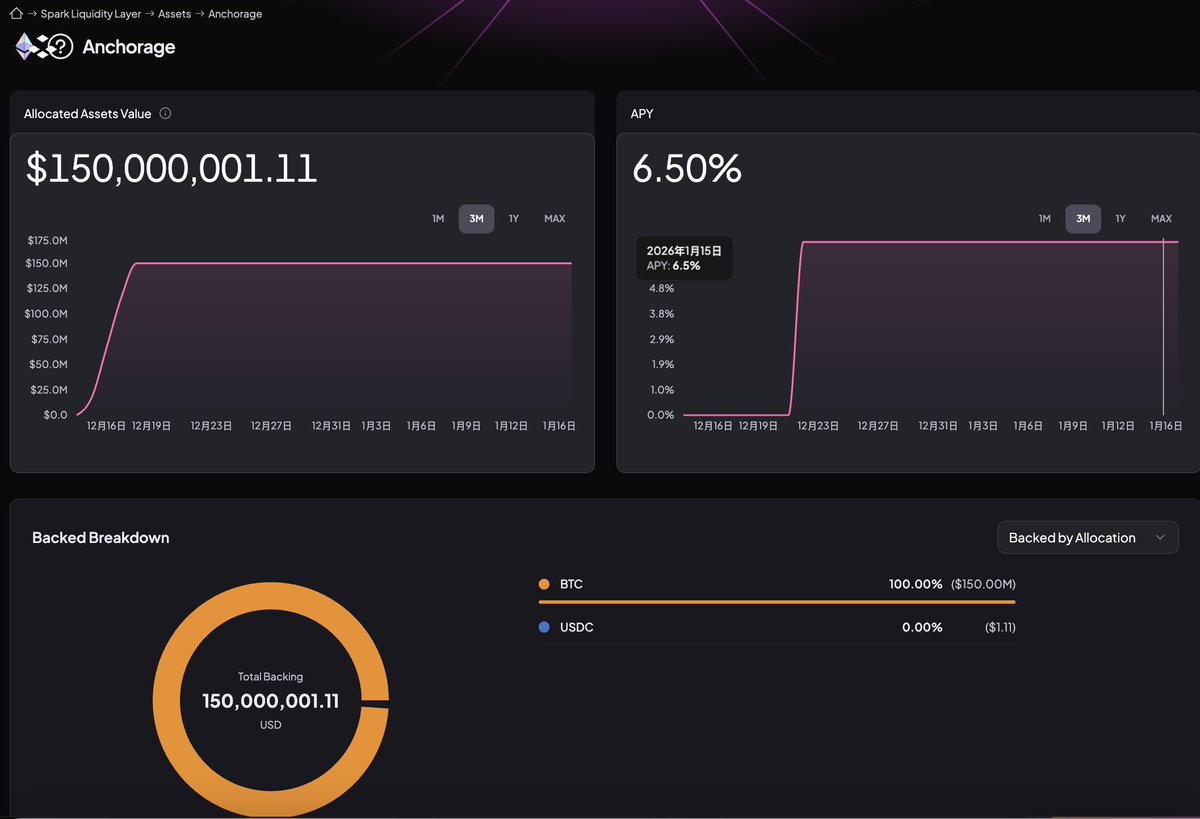

The first loan involves three institutional counterparties pledging $222 million in BTC to borrow $150 million in USDC, representing approximately 148% over-collateralization.

This should be a significant update to Spark's @sparkdotfi business structure;

Institutions have long held the largest and highest quality collateral, $BTC, but this collateral has rarely entered the on-chain credit system, leaving a long-standing gap in institutional collateralized lending.

Many attribute the reason simply to the high risks on-chain, but I believe this perspective is too simplistic. I resonate with @jason_chen998's judgment:

The issue is not in demand, but in the execution method.

Institutional assets often must be placed within a compliant custodial framework, where the control rights, disposal rights, and information disclosure obligations determine that they cannot simply throw their coins into a public lending pool for self-collateralization like retail investors;

Moreover, the sources and destinations of funds in public protocols are extremely difficult to make "counterparty explainable." If institutions step on a landmine in the funding chain, the cost is not something that returns can cover.

Spark's approach essentially acknowledges this reality constraint by stitching together on-chain lending and compliant custody:

Collateral remains in compliant custody, with liquidation and risk management monitored and executed by the custodian, while lending, interest calculation, and fund dispatch are completed on-chain.

Institutions do not need to abandon compliance standards, and on-chain liquidity now has the opportunity to be utilized on a large scale for the first time.

This step will directly change the meaning of interest rates—

In the retail era, interest rates are more a result of competition among homogeneous funds within existing liquidity;

In the institutional context, interest rates are closer to a financing cost paid for stability, certainty, and reusability.

As long as this structure can operate long-term, institutions do not mind paying higher interest rates because what they are purchasing is not cheap funds, but a long-term financing channel that does not require repeated negotiations.

This also means that on-chain lending is beginning to have the potential to attract external demand, providing Spark with a clearer and more sustainable profit path.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。