At the beginning of 2026, the correlation between cryptocurrencies and traditional stock markets has become more pronounced. Several publicly listed companies in the U.S. continue to increase their allocation to crypto assets, while Wall Street giants accelerate their layout in the fields of tokenization and stablecoins. Local governments in the U.S. are also frequently releasing positive signals, indicating a clear acceleration in the integration of traditional finance and the crypto world.

Here are some of today's key highlights:

U.S. State-Level Crypto Holdings Expand: West Virginia Proposes Legislation to Allocate Up to 10% of Funds to Bitcoin and Other Assets

West Virginia Senator Chris Rose has officially submitted the "Inflation Protection Act," which aims to allow the state finance committee to invest up to 10% of its funds in precious metals, digital assets with a market cap exceeding $750 billion (currently only Bitcoin meets this criterion), and regulated stablecoins. Digital assets can be held through qualified custodians or ETFs.

If the bill passes, West Virginia will become the latest state, following Texas, Arizona, and New Hampshire, to officially allow state-level holdings of crypto assets. The bill is currently under review by the Banking and Insurance Committee.

Here are some related visual representations:

(Image: Conceptual image of West Virginia's integration with crypto assets)

Corporate Treasury Continues "Hoarding" Trend: Bitcoin + Ethereum + Sui All Gaining Momentum

U.S. publicly listed company DDC Enterprise announced it will increase its holdings by 200 Bitcoins in 2026, raising its total holdings to 1,383 Bitcoins, with Bitcoin returns reaching 16.9%.

BitMine has made a significant purchase of 24,068 Ethereum (approximately $80.57 million) through FalconX, currently staking over 1.7 million ETH (valued at about $5.65 billion), ranking first in the network for physical holdings.

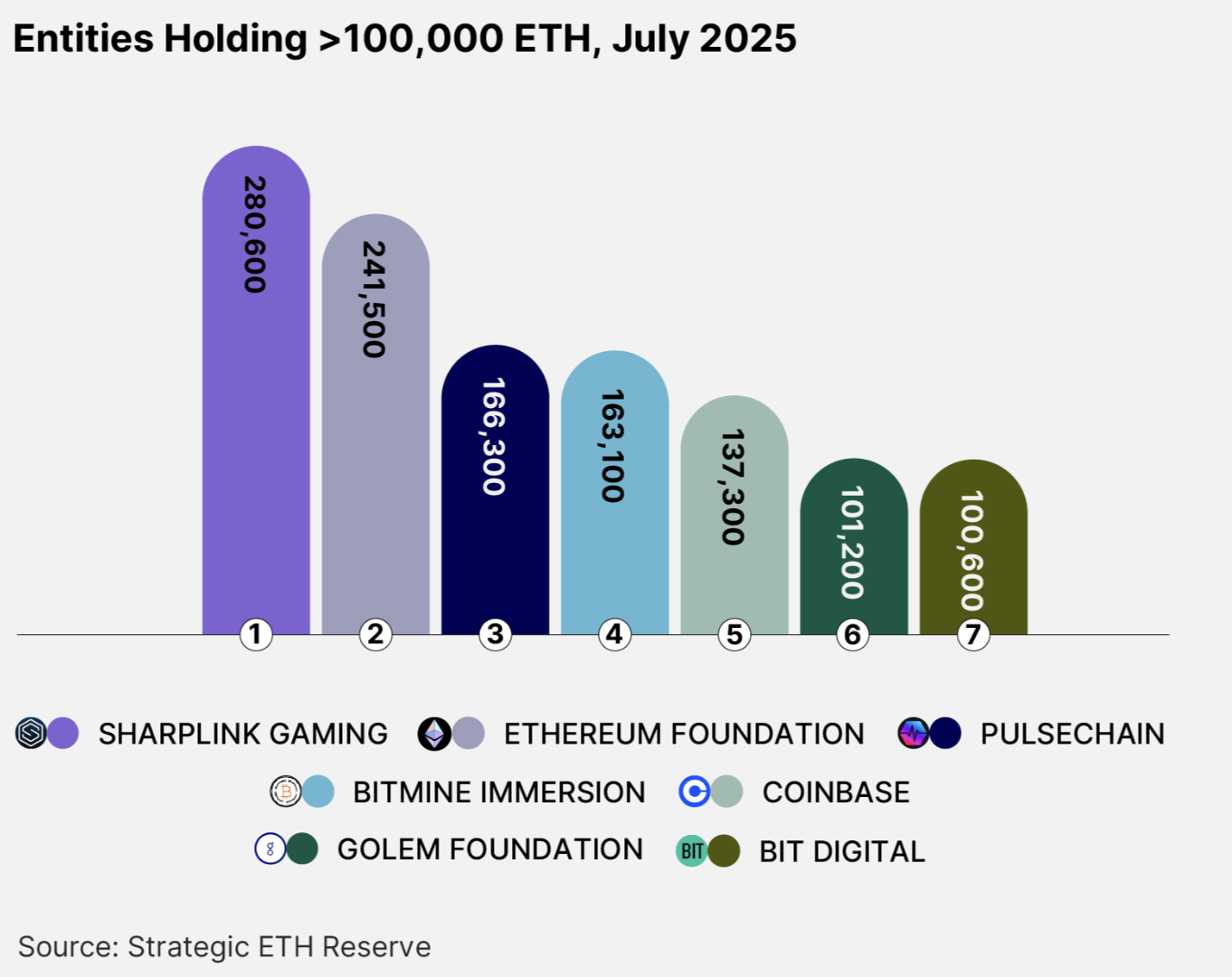

Data from StrategicEthReserve shows that 67 entities currently hold approximately 6.61 million ETH (accounting for 5.47% of the circulating supply), with a total value exceeding $20.5 billion.

SOL treasury company Upexi has reached a $36 million convertible bond agreement with Hivemind, using SOL as collateral. After the transaction, SOL holdings will increase by 12%, exceeding 2.4 million, making it the second-largest corporate SOL holder after Forward Industries.

These companies' "crypto treasury" strategies are becoming one of the most significant investment trends of 2026.

Let's take a look at the trend of companies incorporating Bitcoin and Ethereum into their balance sheets:

(Image: Trend chart of crypto treasury companies from 2025-2026 and corporate ETH allocation illustration)

Wall Street Giants Accelerate: Tokenization, Stablecoins, and Prediction Markets Become Key Focus

Goldman Sachs CEO David Solomon stated that the company is heavily investing in research on tokenization, prediction markets, and stablecoins, having formed a large team and met with senior executives from related platforms.

State Street (with over $51.7 trillion in global regulated assets) announced the launch of a tokenization platform, planning to develop products such as tokenized money market funds, ETFs, tokenized deposits, and stablecoins. They previously collaborated with Galaxy Digital to launch a tokenized fund.

Bank of America CEO Brian Moynihan issued a warning: if interest-bearing stablecoins are allowed to develop on a large scale, they could siphon off up to $6 trillion in deposits from the traditional banking system, impacting credit supply, especially for small and medium-sized enterprises.

Traditional financial giants are embracing blockchain technology at an unprecedented pace, with the tokenization track becoming the biggest highlight of 2026.

Visual representation of Wall Street's tokenization layout:

(Image: Illustration of banking institutions' tokenized assets and RWA track)

Other Noteworthy Developments

Hong Kong's Derlin Securities has received approval from the Securities and Futures Commission to upgrade to a Type 4 license, planning to launch virtual asset consulting and trading services, expected to go live in February 2026.

Short-term liquidity pressure: Recently, several projects are set to unlock, including Cronos (CRO) with 1.17 billion tokens (approximately $118 million), deBridge, etc. Some tokens have already shown significant corrections, necessitating caution regarding short-term volatility.

Summary: At the start of 2026, the correlation between cryptocurrencies and stocks has entered a new phase—from corporate treasuries increasing their holdings with "real money," to local governments legislating to open the gates, and Wall Street giants fully embracing tokenization. Crypto assets are accelerating from the margins to the core of mainstream financial infrastructure. In the coming months, institutional capital movements and regulatory developments will remain the biggest driving forces in the market. Investors should focus on structural opportunities related to Bitcoin, Ethereum, the SOL ecosystem, and RWA/tokenization-related targets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。