Written by: Viktor DeFi

Translated by: Baihua Blockchain

The upcoming expectations, bullish predictions, and market readiness are crucial, and most importantly, you are here, ready to hit your targets. Every year has its unique emotions, frenzies, and catalysts, and understanding this will help you thrive.

The world is simultaneously repricing risk, compensation, and truth. Trust is becoming increasingly expensive, and we are entering an era where hardware systems defend, verify, and settle reality. A significant amount of capital is also flowing in this direction.

Today, I will focus on five narratives and verticals. This is not just because of their entertainment value, but because it is clear that this is the direction of the market.

Let’s dive deeper.

1. Prediction Markets

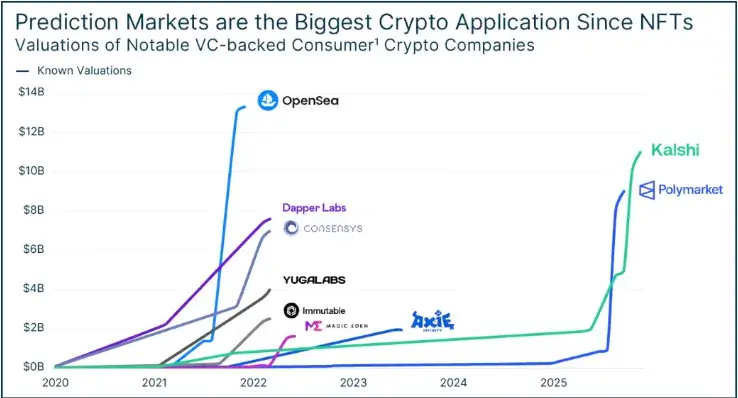

By 2025, we see "truth" transforming from a public interest into a financial tool. What exploded as a public opinion tool during the 2024 U.S. elections has now turned into a billion-dollar industry.

The fact is, the importance of prediction markets lies in their ability to do what the media cannot: they allow participants to stake real money as their cognitive responsibility. This creates an incentive to gather information, correct errors, and converge on probabilities.

(Source: SVB)

In the past, people turned to news media for real-time updates on global events, but now they turn to prediction markets. Moreover, the total valuation of leading prediction market platforms—Polymarket, Kalshi, and Opinion—has reached approximately $20 billion.

My argument is: as AI gradually floods the internet, both retail and institutional investors will "signal" paying. Prediction markets are gradually becoming the "truth layer" for decision-making, political forecasting, supply chain planning, and even the media itself.

If you haven’t used prediction markets yet, now is the time to get familiar with them. Who knows, you might hit the jackpot predicting the next global event.

2. Privacy

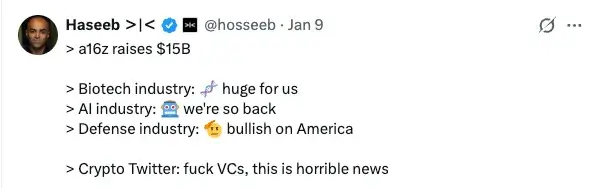

A recent report from a16z pointed out that "privacy will become the most important moat in cryptocurrency this year," and I wholeheartedly agree.

From the beginning, the crypto industry has revolved around transparency and decentralization. While on-chain transparency has been excellent and has brought us to where we are today, the next era will be driven by privacy—not just transaction privacy, but also infrastructure privacy.

Especially with the entry of institutions, the demand for stablecoins, stock trading, and consumer-grade applications is surging. Additionally, the increase in attacks on traders has made privacy a necessity.

Monero and Zcash play a dominant role in the privacy narrative, but I expect more innovative emerging players to step up. Positioning is key!

3. Institutional Era

For years, institutions have largely avoided crypto-related assets, significantly diminishing their high characteristics and strict regulations. Moreover, Michael Saylor has achieved success through his Digital Asset Treasury (DAT) strategy—raising MSTR's price from $13 to $455, coupled with the decentralization of stablecoins and the easing of regulations in the U.S. and other major countries.

DAT (Digital Asset Treasury) refers to companies that hold cryptocurrencies and attempt to outperform the underlying assets through various strategies.

Now, every institutional player wants access to crypto assets, whether through DAT, ETFs, or the adoption of stablecoins. Institutional participation is no longer optional; it is a necessity.

The best part is that institutions are not only entering themselves but also bringing in massive capital inflows. Friends, you are also in the early stages.

4. Defence Tech

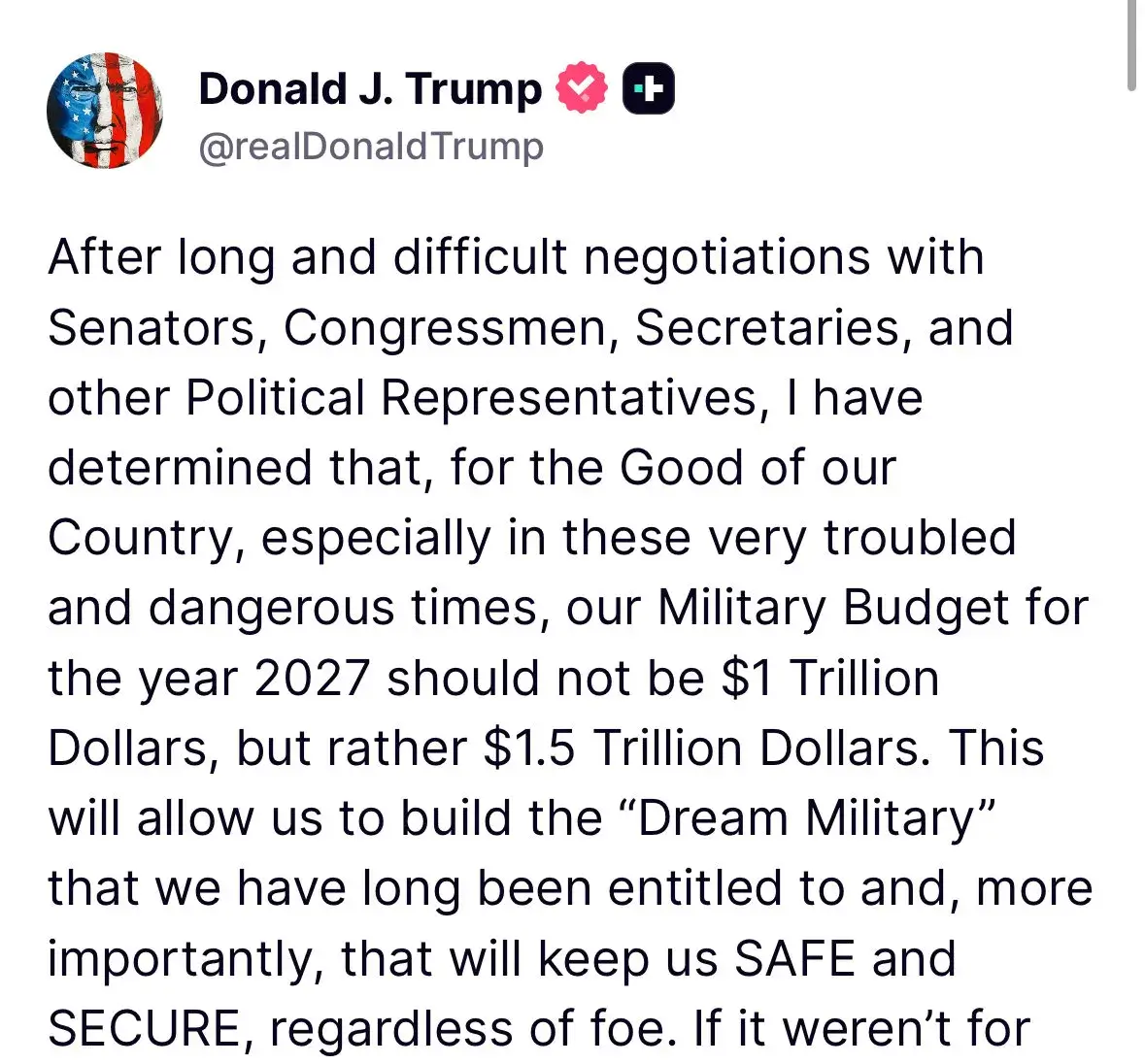

If you have been following the news, you will notice that conflicts exist everywhere, with major powers showcasing their arsenals. The demand for protecting territories and demonstrating hegemony drives significant annual investments in defense tools.

These investments are not only for purchasing better payload aircraft and larger warships but also for developing new platforms driven by software, data, autonomy, and cyber resilience.

This is why defense is one of the few industries where government budgets and private innovation converge into real, long-term growth. High-growth verticals in defense tech worth exploring in your spare time include: additive manufacturing (3D printing), artificial intelligence, robotics and autonomous systems, immersive technology, cybersecurity, advanced military equipment, and military IoT.

Finally, 2026 is an excellent time to gain a foothold in defense tech stocks and crypto assets—don’t take it lightly.

5. Uranium

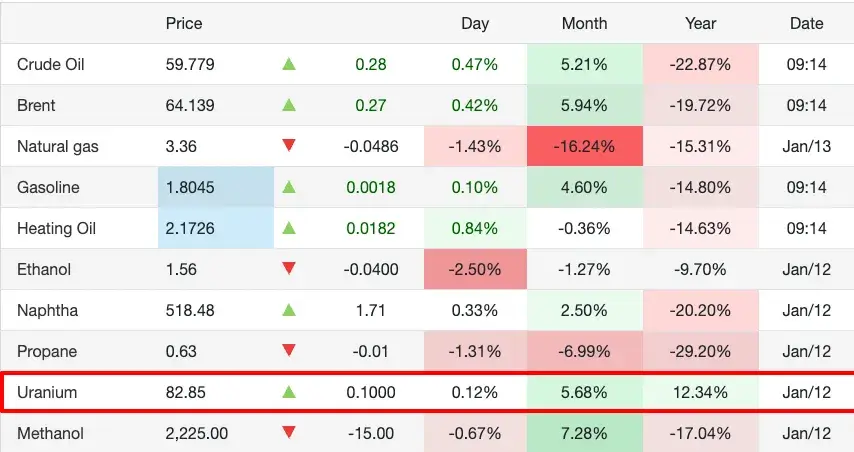

The fact is, uranium has become a fashionable choice for traders in recent years. However, as the world changes and technology advances, this situation is evolving.

Additionally, uranium prices saw a significant increase in 2025 (rising from $74.56 per pound to $81.55), primarily due to supply-side pressures and growing concerns over nuclear energy demand. With the increasing demand for electricity from AI and data centers, uranium prices are expected to rise further.

According to the International Energy Agency (IEA), global electricity demand could increase by 3,500 terawatt-hours over the next three years (equivalent to Japan's annual electricity consumption), and by 2030, data center capacity will double to 200 gigawatts. In this context, electricity demand from data centers could surge by 175% by 2030.

Therefore, 2026 is positioned as the year of uranium's breakout.

The simplest way to gain access is through the tokenization of uranium, which achieves fragmentation and on-chain effects. Some crypto projects are already doing this—you can keep an eye on Uranium.io and Uranium Digital on Solana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。