Written by: Seed.eth

$200 million is the figure just announced today.

BitMine Immersion Technologies (BMNR), chaired by Wall Street renowned analyst Tom Lee, has announced an investment in the holding company behind global top influencer MrBeast (Beast MrBeast). Meanwhile, Beast Industries mentioned in an official statement that the company will explore how to "integrate DeFi into its upcoming financial services platform."

If we only look at the news, this seems like another familiar crossover: traditional, crypto, influencers, entrepreneurship. On one side is the YouTube giant with over 400 million cumulative subscribers, where a single video can cause the algorithm to weight you favorably; on the other side is Wall Street's top analyst who excels at weaving crypto narratives into balance sheets, making everything seem logical.

MrBeast's Journey

Looking back at MrBeast's early videos, it's hard to connect them with today's $5 billion valued Beast Industries.

In 2017, shortly after graduating high school, Jimmy Donaldson uploaded a video of himself counting to 100,000 for 44 hours—"Challenge: Count to 100000!" The content was simple to the point of being childish, with no plot, no editing, just a person repeating numbers in front of the camera, yet it became a turning point in his content career.

At that time, he was not yet 19 years old, and his channel had only about 13,000 subscribers. After the video was released, it quickly surpassed a million views, becoming the world's first viral phenomenon.

Later, he recalled that time in an interview, saying:

"I wasn't actually trying to get famous; I just wanted to see if putting all my time into something no one else wanted to do would yield different results."

Jimmy Donaldson succeeded in building his brand, becoming the MrBeast everyone knows today. But more importantly, from that moment on, he developed an almost obsessive understanding: attention is not a gift of talent, but something earned through investment and endurance.

Running YouTube as a Business, Not a Creative Platform

Many creators, after becoming popular, choose to "play it safe": reduce risks, increase efficiency, and turn content into a stable cash flow.

MrBeast chose the opposite path.

He repeatedly emphasizes one thing in multiple interviews:

"I basically spend all the money I make on the next video."

This is the core of his business model.

By 2024, his main channel's subscriber count had exceeded 460 million, with total video views surpassing 100 billion. But behind this is an extremely high cost:

The production cost of a single top video typically ranges from $3 million to $5 million;

Some large challenges or charity projects can cost over $10 million;

The first season of "Beast Games" on Amazon Prime Video was described by him as "completely out of control" and he admitted in an interview that it lost tens of millions of dollars.

When he said this, he did not express regret:

"If I don't do this, the audience will go watch someone else.

At this level, you can't save money and still expect to win."

This statement can almost serve as a key to understanding Beast Industries.

Beast Industries: $400 Million Annual Revenue, But Slim Profits

By 2024, MrBeast consolidated all his businesses under the name Beast Industries.

From publicly available information, this company has far exceeded the scope of a "creator's side hustle":

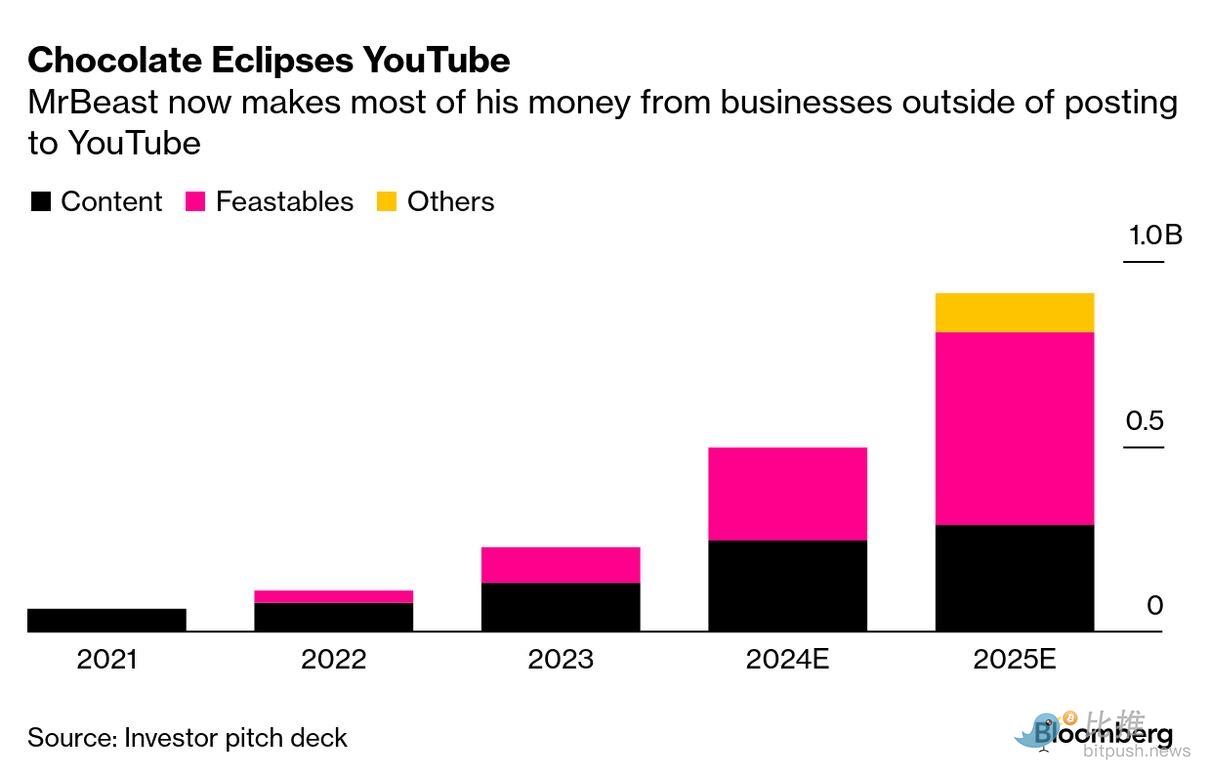

Annual revenue exceeds $400 million;

Business spans content production, fast-moving consumer goods, licensed merchandise, and tool products;

After the latest round of financing, the market generally expects its valuation to be around $5 billion.

But it is not easy.

MrBeast's YouTube main channel and Beast Games bring massive exposure but almost consume all profits.

In stark contrast to the content is his chocolate brand Feastables. Public data shows that in 2024, Feastables' sales were about $250 million, contributing over $20 million in profit. This is the first time Beast Industries has seen a stable, replicable cash flow business. By the end of 2025, Feastables had entered over 30,000 physical retail stores in North America (including Walmart, Target, 7-Eleven, etc.), significantly enhancing the brand's offline sales capabilities.

MrBeast has admitted on several occasions that the cost of video production is getting higher, even "increasingly difficult to break even." But he still insists on investing a large amount of money into content production because, in his view, it is not just about paying for videos, but about buying traffic for the entire business ecosystem.

The core barrier of the chocolate business is not production, but the ability to reach consumers. While other brands need to spend huge sums on advertising exposure, he only needs to release a video. Whether the video itself is profitable is no longer important; as long as Feastables can continue to sell, this business loop can keep running.

"I'm Actually Broke"

In early 2026, MrBeast revealed in an interview with The Wall Street Journal that he is broke, sparking heated discussions:

"I'm basically in a 'negative cash' state right now. They all say I'm a billionaire, but there's not much money in my bank account."

This statement is not "humble bragging," but a natural result of his business model.

MrBeast's wealth is highly concentrated in unlisted equity; although he holds just over 50% of Beast Industries, the company continues to expand and hardly pays dividends; he personally even deliberately does not keep cash.

In June 2025, he admitted on social media that he had put all his savings into video production and even had to borrow money from his mother to pay for his wedding.

As he later explained more directly:

"I don't look at my bank account balance—that would affect my decision-making."

And the fields he invests in have long since expanded beyond content and consumer goods.

In fact, as early as the NFT boom in 2021, on-chain records show that he purchased and traded several CryptoPunks, some of which were sold for 120 ETH each (then worth several hundred thousand dollars).

However, as the market entered a correction phase, his attitude became more cautious.

The real turning point is that MrBeast's own business model has reached a critical edge.

When a person controls a top global traffic entry but remains in a state of high investment, cash tightness, and expansion reliant on financing, finance is no longer just an investment option but a fundamental infrastructure that must be restructured.

The internal discussions at Beast Industries in recent years have gradually clarified the question: how to make users not just "watch content and buy products," but enter into a long-term, stable, and sustainable economic relationship?

This is precisely the direction traditional internet platforms have been trying for years: payment, accounts, credit systems. At this juncture, the emergence of Tom Lee and BitMine Immersion (BMNR) will lead this path toward more structural possibilities.

Partnering with Tom Lee to Build DEFI Infrastructure

On Wall Street, Tom Lee has always played the role of a "narrative architect." From early explanations of Bitcoin's value logic to emphasizing Ethereum's strategic significance on corporate balance sheets, he excels at translating technological trends into financial language. BMNR's investment in Beast Industries is not merely chasing influencer hype but betting on the programmable future of attention gateways.

So, what does DeFi mean here?

Currently, publicly available information is very restrained: no tokens, no profit promises, and no exclusive financial products for fans. But the phrase "integrating DeFi into the financial services platform" points to several possibilities:

- A lower-cost payment and settlement layer;

- A programmable account system for creators and fans;

- Asset records and rights structures based on decentralized mechanisms.

The imaginative space is vast, but the real challenges are also clearly visible. In the current market, whether native DeFi projects or traditional institutions exploring transformation, most have yet to truly establish sustainable models. If they cannot find differentiated paths in this fierce competition, the complexity of financial operations may erode the core capital he has accumulated over the years: fan loyalty and trust. After all, he has publicly stated multiple times:

"If one day what I do harms the audience, I would rather do nothing."

This statement may be repeatedly tested in every future attempt at financialization.

So, when the world's most powerful attention machine begins to seriously build financial infrastructure, will it become a new generation platform or an "overly bold" crossover?

The answer will not be revealed quickly.

But one thing he knows better than anyone else: the greatest capital is not past glory, but the right to "start over."

After all, he is only 27 years old.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。