Written by: Max.S

The past 2025 is often regarded as the "great selection era" of the derivatives track. As we stand before the current power landscape of Perp DEX, it is clear that the vast majority of once-prominent fork projects have fallen silent, while the surviving ones are reshaping the financial order with a brand new posture.

The survival of Perp DEX does not stem from being faster or cheaper than centralized exchanges (CEX), but rather from addressing the most fundamental cost in the financial system—trust. After experiencing several black box crises of liquidation in second-tier exchanges (the Double Ten collapse left all market makers heartbroken!), the market has reached a consensus: transparency is not optional, but the underlying logic of infrastructure.

Early Perp DEXs were often seen as "low-spec versions" of CEXs, but with the popularization of Chain Abstraction technology, users in 2026 can achieve seamless cross-chain transactions. User assets no longer need to be held by intermediaries but can be locked in smart contracts. This return of "asset sovereignty" gives Perp DEX the confidence to carve out a share of the CEX market.

Currently, on-chain derivatives trading volume has stabilized at over 25% of the entire network. This is not just a numerical increase but a shift in user behavior patterns. When liquidation logic, funding rates, and order matching are all recorded on an immutable ledger, Perp DEX has evolved from an experimental DApp into a necessary infrastructure in the crypto market.

The Demise of Most Perp DEXs: Mediocrity is the Original Sin

Behind the prosperity lies an extremely brutal elimination race. In the past two years, over 90% of Perp DEXs have fallen silent. The "cause of death" for these failures is highly consistent: product homogeneity, liquidity dependence on subsidies, and lack of technical depth.

From the "Points" wave, many projects attracted users through inflated liquidity mining. However, when points were redeemed and airdrops materialized, these platforms fell into a "liquidity zero" death spiral. This model, which relies on rented liquidity, will gradually disappear from the professional market in 2026.

Note: Rented liquidity refers to the model where DEXs incentivize users to provide funds to support trading depth through the issuance of points or token subsidies. In simple terms, the protocol does not truly "own" this liquidity but temporarily rents users' funds by paying high "rents" (token or point rewards).

Another reason for DEXs "going bust" is the skyrocketing customer acquisition cost (CAC). In the absence of an independent ecological niche, merely changing a UI or forking GMX's code can no longer sustain survival in this highly competitive market. Projects without the advantage of a core order matching engine or strong ecological backing are essentially just expensive liquidity pools, not true exchanges.

The existing four DEX models are worth learning from for future entrants:

Hyperliquid Model: Vertical Integration of Technical Hegemony

Among all the DEX survivors, Hyperliquid is an unavoidable monument. It proves that if a general-purpose public chain cannot support high-frequency trading, the best solution is to create a chain of its own.

Hyperliquid attracts a large amount of quantitative capital because it solves the order book latency issue through L1 underlying optimization. It no longer relies on Arbitrum or other Layer 2s but has built a consensus mechanism specifically designed for derivatives. This "vertical integration" allows it to achieve matching performance close to CEX while maintaining on-chain transparency.

More importantly, Hyperliquid has successfully built a "quant-friendly" ecosystem. When third-party market makers discover that the API latency here is extremely low and slippage is controllable, endogenous liquidity begins to grow organically. This "performance barrier" built on technical hard power allows it to navigate the competition from generic DEXs lacking distinctive features with ease.

Aster Model: Ecological Premium and Asset Management Layer

If Hyperliquid relies on hardcore technology, Aster and its backing from the Binance ecosystem represent another survival logic: extreme resource efficiency and asset gains—essentially, holding onto a good "big leg."

Aster is not just a trading venue; it is more like a "leveraged layer of interest-bearing assets." By deeply binding with the Binance ecosystem, it introduces collateral like asBNB or USDF, allowing users to earn staking or re-staking rewards while holding positions. This optimization of capital efficiency is difficult for standalone DEXs to achieve.

For large capital users, funding costs are a core consideration. When users open a position in Aster, their margin continues to generate annualized returns. This logic of "liquidity assetization" transforms Aster into a highly sticky financial entry point rather than just a speculative tool.

Lighter Model: ZK-Driven Verifiable Financial Infrastructure

The Lighter model represents the pinnacle of "financial infrastructure." It does not seek to become a traffic entry point but instead provides institutions with a mathematically certain trading foundation through self-built application-specific ZK-Rollups.

Lighter's uniqueness lies in its solution to the "mathematically honest" problem. It writes order matching and liquidation logic into "ZK circuits." This means that the matching and liquidation of each transaction no longer rely on the "reputation" of nodes but on verifiable mathematical proofs. This is extremely attractive to institutional investors who are averse to "black box liquidations."

Additionally, Lighter's ZK-Orderbook design inherently possesses anti-MEV properties, protecting the strategy privacy of high-frequency traders. This combination of "verifiability + privacy protection + ultra-low latency" makes it the standard interface linking real-world assets (RWA) with on-chain derivatives, creating a high compliance and technical moat.

Decibel Model: The Unity of Extreme Performance and Full-Chain Composability

In the 2026 market, Decibel represents the third model of evolution for the new generation of Perp DEXs: the combination of "high-performance engines" and "composability" like LEGO. As a full-chain trading engine that has risen in the Aptos ecosystem, Decibel has completely ended the fate of "speed and decentralization cannot coexist."

Decibel's core competitiveness lies in its deeply optimized trading virtual machine (Trading VM). Relying on Aptos's Block-STM parallel execution architecture, it is moving towards sub-20 ms block times and processing capabilities of over 1 million orders per second. This makes on-chain order matching no longer an "illusion" but a reality that can truly compete with top CEXs.

Unlike traditional isolated DEXs, Decibel offers a highly programmable financial platform. It unifies spot, perpetual contracts, margin, and vaults. This "full-stack" design means users can use a single cross-chain margin account to collateralize various assets like APT, USDC, BTC, ETH, greatly enhancing capital efficiency.

Decibel's "X-Chain Accounts" technology further breaks down inter-chain barriers. Users can directly fund using Ethereum or Solana wallets (like MetaMask or Phantom) without configuring complex cross-chain bridges. This "seamless access" capability, combined with 100% on-chain matching logic, may make Decibel the new favorite of on-chain high-frequency traders and institutions in 2026.

New Directions After 2026: Intent, AI, and Dynamic Pricing

From the perspective of practitioners, the future evolution of Perp DEX will focus on the following three dimensions:

Intent-driven trading experience. Future users will no longer need to manually adjust funding rates or slippage but will express an intent. The system will find the optimal execution path across the chain through a solver. This model will greatly lower the barrier for retail investors to enter complex derivatives.

The explosion of AI Agents. With the maturity of on-chain automation tools, DEXs will incorporate AI strategy engines. A significant portion of future positions will be driven by AI. This means DEXs need to provide more powerful computing capabilities and lower data latency to accommodate high-frequency trading by robots.

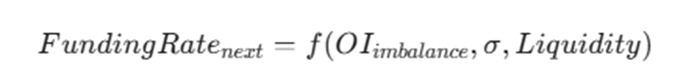

Evolution of pricing models. Current AMMs or simple order books still appear fragile in extreme market conditions. We are seeing more projects introduce complex dynamic risk engines that adjust system parameters in real-time through more scientific formulas:

This automated adjustment based on real-time volatility and position deviation will truly enhance the robustness of Perp DEX systems beyond traditional centralized institutions.

The second half of Perp DEX is a survival competition about "efficiency." Projects that attempt to sustain themselves through mediocre subsidies have long turned to dust. Future winners will either possess impeccable technical foundations like Hyperliquid, or have irreplaceable ecological resources like Aster, or find the perfect balance between performance limits and full-chain composability like Decibel.

In this field, there is only one reason to survive: Do you provide a set of execution efficiency that capital and strategies cannot refuse?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。