Today is another day where U.S. stocks are down and Bitcoin is up. The decline in U.S. stocks seems to be multifaceted. If the drop a couple of days ago was primarily due to bank stocks, today both Visa and MasterCard have shown signs of rebound. If we were to identify the first tier of credit card companies affected, it would certainly be these two. Additionally, the banks that reported earnings had profits below expectations, leading the financial sector to lead the decline. Technology stocks were not idle either, with Amazon, Tesla, Microsoft, and Meta all experiencing a 2% drop.

Finance and technology often share a pattern of mutual prosperity and decline. The inflated valuations of tech stocks drive the overall market, while financial stocks benefit from increased lending and investment banking activities. However, I personally believe that this decline is not fundamentally about AI narratives, nor is it the beginning of an AI bubble. It seems more like a balancing act based on earnings expectations. The drop in financial stocks reflects concerns about interest spreads, bad debts, and capital efficiency, while the pullback in tech stocks is a natural response to the shrinking risk appetite for overvalued assets.

The strength of Bitcoin, on the other hand, indicates that the market has not entered a phase of widespread risk aversion. As the market begins to reassess bank profits, credit expansion, and corporate earnings uncertainty, assets like $BTC, which do not rely on cash flow, do not require credit backing, and possess liquidity, naturally become a temporary refuge for capital.

This situation last occurred during the bankruptcy of Silicon Valley Bank in 2023, when the U.S. financial sector was under pressure, and tech stocks experienced amplified volatility, yet Bitcoin became a safe haven for capital hedging against systemic credit uncertainty. However, such divergence may not be long-lasting.

Looking at Bitcoin's data, the price increase has led to a rise in turnover rate, which was expected. From Coinbase's trading volume, it has seen a significant increase for two consecutive days. Today's trading volume is even higher than yesterday's, and in the past year, there have been fewer than 20 instances of such high trading volume. However, it is uncertain how long this phenomenon can be sustained.

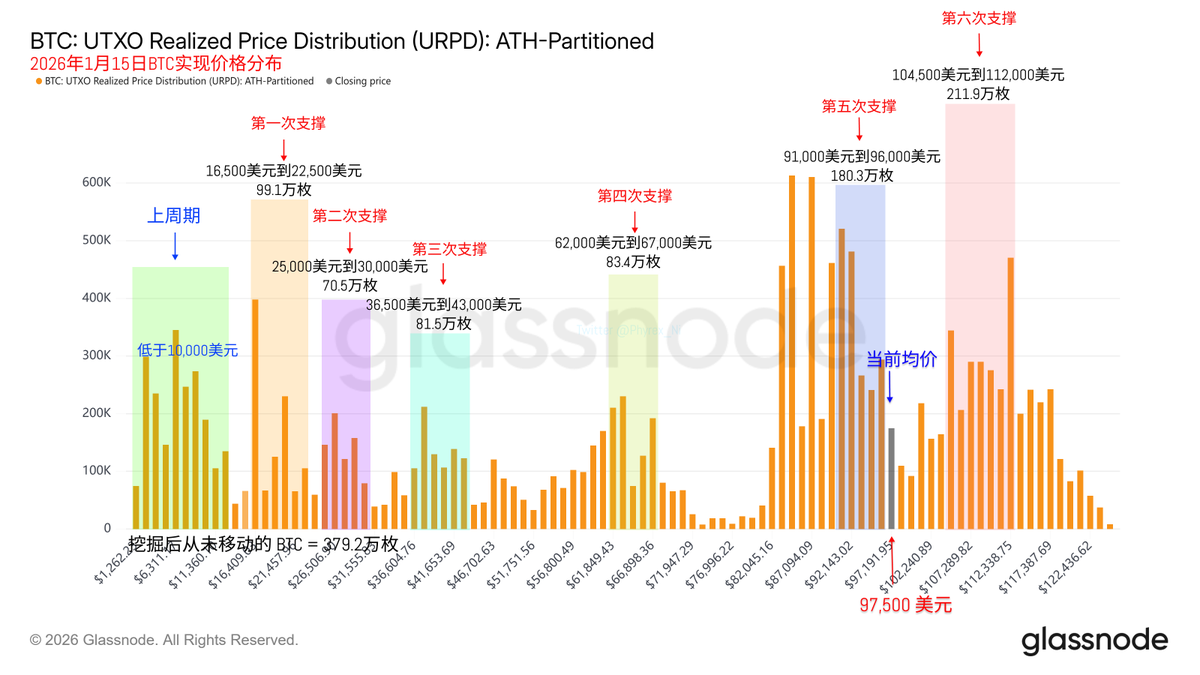

From the perspective of chip structure, it remains very stable, with strong absorption at high levels. However, there is not much turnover below $90,000, leading to a dense range between $85,000 and $95,000. Currently, most changes are from short-term investors, and some time is needed for consolidation.

Nonetheless, the overall narrative and monetary policy have not undergone a qualitative change.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。