Original | Odaily Planet Daily (@OdailyChina)

On January 13, Polygon Labs announced that it has completed the acquisition of cryptocurrency startups Coinme and Sequence, with a total acquisition price exceeding $250 million. However, Polygon Labs declined to disclose the specific acquisition prices for each company and did not specify whether the transaction was conducted in cash, equity, or a combination of both. From the information currently disclosed, the transaction will proceed in a phased manner: the Sequence-related transaction is expected to be completed within this month, while the acquisition of Coinme will require regulatory approval, and the earliest it can be finalized is in the second quarter of 2026.

"Counter-Cyclical Actions" During a Low Period

Polygon Labs CEO Marc Boiron and Polygon Foundation founder Sandeep Nailwal stated that this acquisition aims to support the network's stablecoin strategy. Specifically, Polygon is currently promoting the adoption of stablecoins but lacks localized regulatory infrastructure. The acquisition of Coinme is intended to fill this gap. As a cryptocurrency financial company headquartered in the United States, Coinme holds remittance licenses covering multiple states and operates a Bitcoin ATM network, which means Polygon can leverage Coinme's existing compliance framework to bypass lengthy approval processes and directly enter the highly regulated U.S. market. Coinme will continue to operate its existing business, including cryptocurrency exchanges, wallets, and Crypto-as-a-Service services, as a wholly-owned subsidiary of Polygon Labs.

The value of Sequence lies more in the blockchain wallet and developer infrastructure aspect. In the context of Web3, wallets are not only tools for asset storage but also gateways for users to enter the entire on-chain world. Their security, ease of use, and scalability directly determine whether the network can accommodate a larger scale of users and funds. Polygon's acquisition of Sequence is, to some extent, an early construction of the "user-side" infrastructure for its stablecoin strategy.

From this perspective, Polygon's two acquisitions are part of a upstream and downstream layout centered around the same goal: one end is the compliance channel, and the other end is the user entry point.

Bringing the focus back to the overall industry, in a context where the L2 ecosystem continues to shrink and market conditions are sluggish, Polygon has chosen to be proactive and actively rescue itself, continuously investing resources for integration and expansion. This counter-cyclical action is driven by a core principle of "compliance first," attempting to complete the transformation from "cryptocurrency infrastructure" to "financial infrastructure" in a global regulatory environment that is tightening, thereby attracting more traditional capital and institutional users and solidifying its own competitive moat.

On-Chain Data: Not All L2s Are in Decline

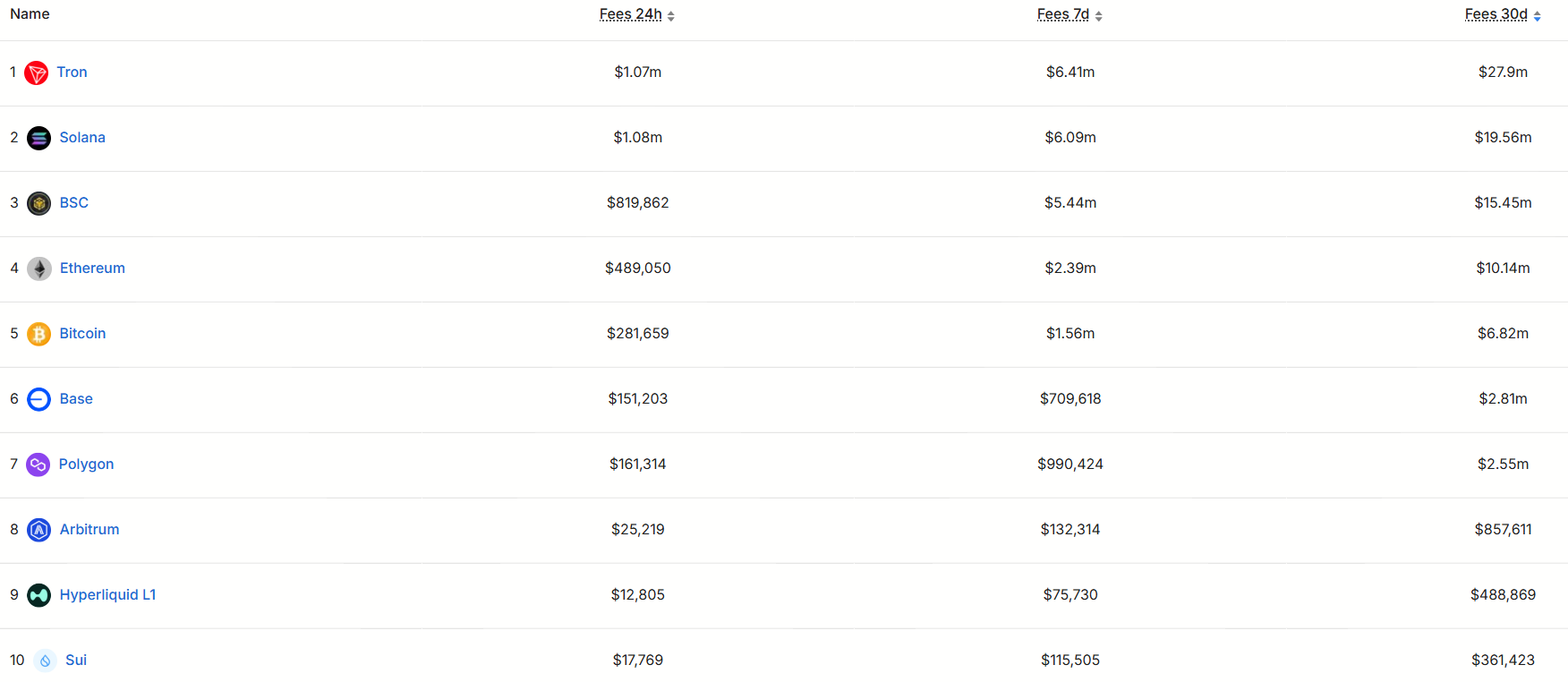

In addition to strategic layouts, Polygon's on-chain data performance is also impressive. According to defillama.com data on public chain revenue over the past 30 days, Polygon ranks seventh, still maintaining a certain resilience in the fiercely competitive public chain arena.

Of course, the overall gap remains quite significant. The top-ranked Tron has a monthly revenue of up to $27.9 million, while the tenth-ranked Sui only has $360,000, a difference of over 77 times. Reality is quickly eliminating public chain projects that "tell stories but lack real demand," and even the L2 network Zero Network, incubated by the Web3 wallet company Zerion, which once raised $22.5 million, has stopped block production for over three weeks.

In this comparison, Polygon at least remains "active at the table."

The Truth Behind the Revenue Surge: Short-Term Push from Polymarket

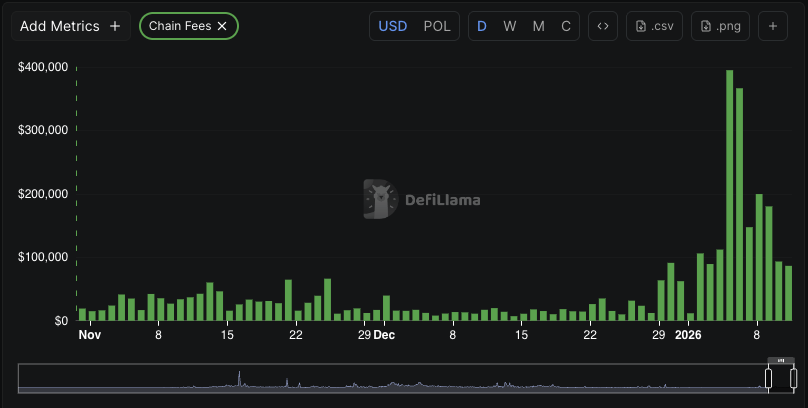

However, it should be noted that the significant increase in Polygon's fee revenue actually began to manifest only in early 2026. According to data disclosed by Castle Labs on January 13, Polygon's current monthly revenue is approaching $1.7 million.

The main driver of this revenue growth comes from Polymarket. Since its 15-minute price prediction market started charging (where users bet on whether the prices of mainstream coins like BTC, ETH, SOL, XRP will rise or fall in the next 15 minutes, settling every 15 minutes), Polygon's daily revenue on the network once reached $100,000.

More importantly, Polygon employs a fee-burning mechanism in its PoS network, meaning that the higher the transaction volume, the more tokens are burned, creating a deflationary effect. Since the beginning of the year, Polygon has cumulatively burned about 12.5 million POL, worth approximately $1.5 million, accounting for about 0.12% of the total supply.

Based on the current pace, if this trend continues, the burn rate by 2026 could reach about 3.5%, significantly higher than the staking reward's annual issuance rate of about 1.5%. The amount burned has exceeded more than twice the amount of staking rewards distributed, resulting in a net supply reduction.

Although Polymarket has confirmed through its Discord community that it will migrate to its own Ethereum Layer 2 (named POL) by late December 2025, the migration will not be completed immediately. In the short term, Polygon will still benefit from Polymarket's high activity, accelerating the deflationary effect, which is favorable for POL prices.

For more analysis on the correlation between the two, see: The Economic Account Behind Polymarket's Departure from Polygon.

Conclusion

In summary, Polygon's current surge in transaction fees and token burning largely relies on the temporary prosperity brought by Polymarket; at the same time, its long-term strategy focused on stablecoin payments and real-world financial infrastructure is gradually being implemented.

This may be the most noteworthy aspect of Polygon at this moment: short-term data provides confidence to the market, while long-term layouts determine whether it can remain in the next round of competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。