Written by: Lawyer Liu Honglin

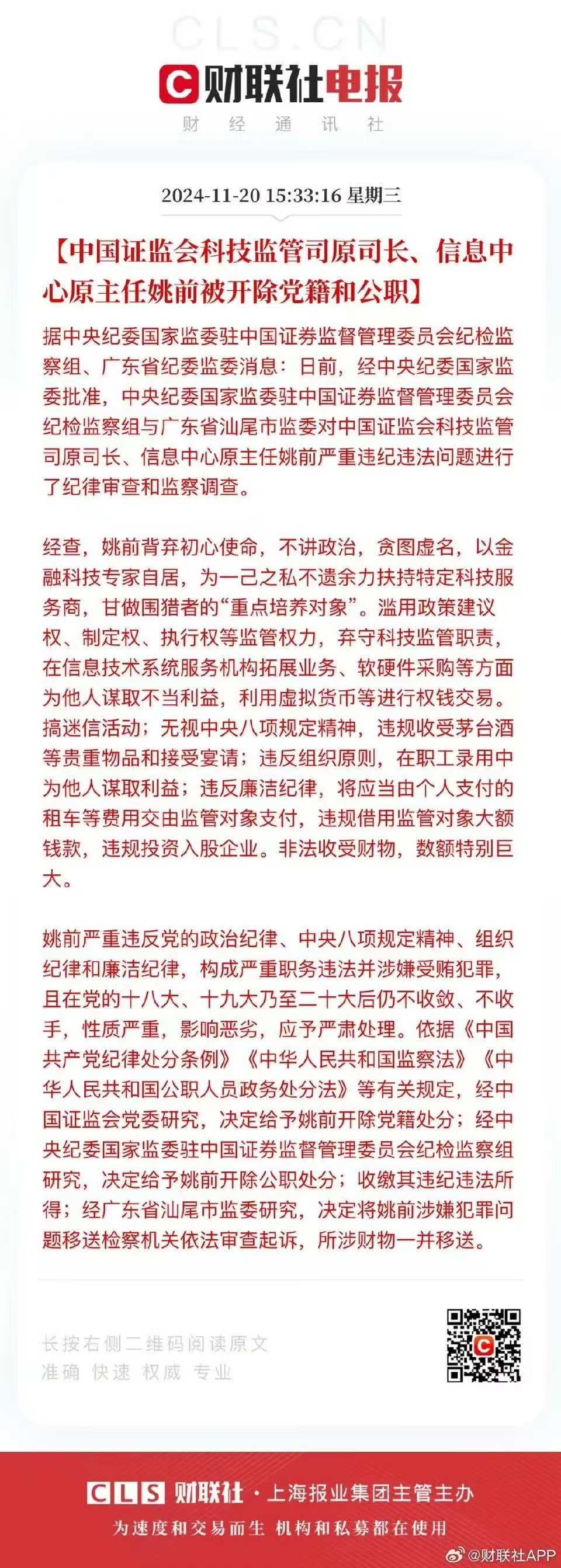

In November 2024, Beijing Daily reported that according to the Central Commission for Discipline Inspection and the National Supervisory Commission stationed at the China Securities Regulatory Commission (CSRC) and the Guangdong Provincial Commission for Discipline Inspection and Supervision: Recently, with the approval of the Central Commission for Discipline Inspection and the National Supervisory Commission, the discipline inspection and supervision team stationed at the CSRC and the Shantou Municipal Supervisory Commission in Guangdong Province conducted a disciplinary review and supervisory investigation into Yao Qian, the former director of the Technology Supervision Department of the CSRC and the former director of the Information Center, for serious violations of discipline and law. After research by the CSRC Party Committee, it was decided to expel Yao Qian from the Party; after research by the discipline inspection and supervision team stationed at the CSRC, it was decided to dismiss Yao Qian from public office; confiscate his illegal gains; and after research by the Shantou Municipal Supervisory Commission in Guangdong Province, it was decided to transfer Yao Qian's suspected criminal issues to the procuratorial organs for legal review and prosecution, along with the related property.

The news of Yao Qian being "double expelled" for serious violations of discipline and law made headlines. This former director of the CSRC's Technology Supervision Department was once regarded as an "expert" in the field of financial technology, but is now under investigation for suspected corruption. There is a detail here: according to the report, Yao Qian abused his regulatory power, not only seeking personal benefits for specific enterprises but also being accused of using virtual currency for power and money transactions.

Virtual currency, due to its decentralization and cross-border liquidity, has been endowed with a lot of "mystical aura" in recent years. In many previous media reports on bribery cases involving government officials, virtual currency has frequently appeared. So the question arises, is bribery with virtual currency really safer than traditional methods?

From a technical perspective, virtual currency does possess a certain level of concealment, which is one of the key reasons it attracts attention. Privacy coins like Monero and Zcash use encryption technology to hide the addresses and amounts of both parties in a transaction, significantly increasing the difficulty of on-chain data analysis. Additionally, tools like mixers can disperse a transaction into multiple payments and then re-output them, seemingly disrupting the flow of funds completely. However, are these methods truly "flawless"?

The answer is, far from it.

The public transparency of public chains is a fundamental attribute of blockchain; all transaction records are permanently stored on the chain. Once a wallet address is linked to identity information, past transaction records can be thoroughly reviewed. In recent years, law enforcement agencies have solved multiple similar cases using on-chain analysis tools, such as the FBI's sting operations against dark web crimes. Simply put, the concealment of virtual currency is not a true "invisibility cloak," but more like a thin veil; no matter how sophisticated the disguise, it may be torn apart by advancements in law enforcement technology.

Of course, one significant advantage of bribery with virtual currency compared to traditional methods is its decentralization and the convenience of cross-border payments. For instance, in countries with strict foreign exchange controls, using virtual currency to bypass traditional financial systems can indeed reduce some regulatory risks. However, on the other hand, this advantage also comes with a higher operational threshold. If both parties in a bribery scheme want to completely hide transaction traces, they must be proficient in cold wallet operations, mixing techniques, and even use offline trading tools to complete asset transfers. Any oversight in the process, such as accidentally exposing an IP address or using a real-name account when withdrawing from a centralized exchange, could expose the entire chain of funds to law enforcement. More complex is the need for both parties to have a high level of trust in each other. In the high-risk area of bribery, trust is already a scarce resource, and the non-physical nature of virtual currency makes this even more challenging.

Additionally, an important change brought about by bribery with virtual currency is that the evidence of power and money transactions has shifted from traditional physical forms to digital assets. This digital transaction method can indeed be difficult to detect in certain aspects. For example, if both parties complete asset transfers using offline devices and do not use the funds for a long time, it can indeed increase the difficulty of tracking. However, this "long-term lurking" strategy may not be cost-effective for the briber, as the price of virtual currency is highly volatile, and holding it may lead to significant losses. For instance, if a bribe is made in the form of Bitcoin and the briber encounters a market crash after the transaction, they may not only fail to achieve the expected value but also risk being investigated for improper holding. In other words, the price volatility of virtual currency may make such transactions even more unstable.

Price volatility is not the only challenge faced by bribery with virtual currency. Globally, the regulation of virtual currency trading is gradually strengthening. Whether it is the FATF guidelines in the United States or the MiCA regulations in Europe, strict requirements have been imposed on the use of virtual currency, especially in the KYC (Know Your Customer) process at exchanges. For bribers, if the transaction funds need to be withdrawn through a centralized exchange, regulatory records become an important clue for law enforcement. Recent cases have shown that even if mixers or privacy coins are used for concealment, the ultimate flow direction of the funds can still be traced. This makes bribery actions very difficult to achieve true "trace-free" status, and they may even leave more evidence than cash transactions from a technical standpoint.

Another noteworthy aspect of the Yao Qian case is the special environment of bribery with virtual currency in China. China's comprehensive restrictions on virtual currency trading make the flow of virtual currency funds more likely to attract the attention of law enforcement agencies. Although some bribers may bypass domestic regulations through cross-border transactions, such operations also bring more uncertainties. For example, if the bribed party withdraws or spends money domestically, the transaction records will directly enter the view of law enforcement agencies. Moreover, the legal status of virtual currency in China is not clear; once bribery funds involve overseas accounts, they may also be deemed illegal asset transfers or foreign exchange violations, bringing additional legal risks. For some cross-border cases, the decentralization and borderless nature of virtual currency indeed provide new possibilities. For instance, transferring funds through distributed wallets avoids the scrutiny of traditional banking systems for cross-border remittances. However, implementing such strategies requires high technical support, and with the strengthening of international law enforcement cooperation, virtual currency transactions have become a key area of monitoring for law enforcement agencies. Recent cooperative cases between the FBI and European law enforcement agencies indicate that virtual currency is not as "safe" as imagined; rather, its global liquidity has become a larger regulatory target.

In summary, bribery with virtual currency does offer some conveniences that traditional methods find hard to match, especially in cross-border transactions and evading the banking system. However, it also comes with higher operational complexity, greater trust risks, and more legal and technical tracking pressures. From the public details of the Yao Qian case, bribery with virtual currency did not spare him from investigation; rather, it may have become important evidence due to on-chain records. This indicates that the so-called "safety" of virtual currency is more of a temporary advantage of technical means rather than an absolute barrier.

Finally, Lawyer Honglin wants to emphasize again that the technical attributes of virtual currency itself are neutral; the potential for bribers to use this tool and the ability of law enforcement agencies to use the same tool are inversely proportional. With technological advancements, the transparency and permanent storage of on-chain data may actually make bribery behaviors easier to leave traces. In this sense, bribery with virtual currency resembles a "technological game." The outcome of the Yao Qian case illustrates that the winner of this game is not necessarily the briber. Virtual currency is not a get-out-of-jail-free card; it is a double-edged sword, and with a slight misstep, one can be exposed to the light of law enforcement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。