Powell, facing a subpoena from the U.S. Department of Justice for a criminal investigation, chose to publicly accuse it of being an excuse for the Trump administration to pressure for interest rate cuts, igniting a constitutional crisis concerning the independence of the U.S. central bank.

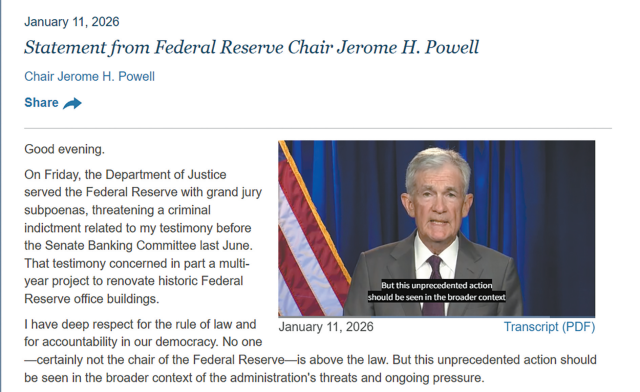

On the evening of January 11, Beijing time, Powell released a video statement confirming that the U.S. Department of Justice had issued a grand jury subpoena to the Federal Reserve on January 9, threatening criminal charges regarding his testimony before the Senate Banking Committee about the renovation of the Federal Reserve building in June 2025.

"This unprecedented action is occurring against the backdrop of government threats and ongoing pressure," Powell sharply pointed out in his statement, emphasizing that the true reason for the investigation was not the renovation project itself, but rather because the Federal Reserve "sets interest rates based on the best assessment of public interest, rather than following the president's wishes."

1. The Outbreak of the Incident

● On January 9, 2026, the U.S. Department of Justice issued a grand jury subpoena to the Federal Reserve, officially launching a criminal investigation against Federal Reserve Chairman Powell. The investigation primarily revolves around the renovation project of the Federal Reserve's Washington headquarters, focusing on whether Powell made false statements to Congress regarding the scale of the project.

● The renovation project began in 2022 and is expected to be completed in 2027, with an initial budget of $1.9 billion, which later increased to nearly $2.5 billion due to rising construction material costs. In July 2025, Trump inspected the construction site of the Federal Reserve headquarters and publicly criticized the project for costing $3.1 billion, far exceeding the budget.

2. Public Counterattack

● In the face of the Department of Justice's threat of a criminal investigation, Powell did not choose silence. After careful consideration over the weekend, he released a video statement of about two minutes on the evening of January 11 through the Federal Reserve's website, making the investigation public.

● The usually cautious central bank president, who has a legal background, used unusually harsh language in his statement, bluntly calling the investigation an "excuse" and warning: "The core issue is: Can the Federal Reserve continue to formulate monetary policy based on evidence and economic conditions? Or will monetary policy be swayed by political pressure or intimidation?"

● Powell emphasized that he has served under four administrations, both Republican and Democratic, but "in every term, I have not been influenced by political fear or favoritism."

3. Political Background

● This criminal investigation is not an isolated incident but a culmination of the long-standing tense relationship between the Trump administration and the Federal Reserve. Since beginning his second term in January 2025, Trump has repeatedly urged the Federal Reserve to cut interest rates, criticizing Powell for acting too slowly and calling him "Mr. Too Late."

● In August 2025, the Trump administration attempted to remove Federal Reserve Governor Lisa Cook on "justifiable grounds," but this was later rejected by the courts. This incident was seen as an important attempt by the White House to "reshuffle" the Federal Reserve Board.

● Analysts point out that the Trump administration is trying to influence the direction of the Federal Reserve's monetary policy through multiple means, including "placing loyalists" and "legal pressure."

4. Power Struggle

Powell's term as Federal Reserve Chairman will end in May 2026, but his term as a Federal Reserve Governor will continue until early 2028.

● Trump has recently indicated that he has finalized a candidate to succeed Powell. White House National Economic Council Director Hassett and former Federal Reserve Governor Kevin Walsh are seen as leading candidates.

● Some of Trump's allies had anticipated that the pressure campaign might force Powell to resign before the end of his chairmanship. Powell's strong response this time clearly sends a signal of "not backing down."

● Senate Banking Committee member and Republican Senator Tillis stated: "There should be no doubt now about whether advisors from the Trump administration are actively pushing to end the independence of the Federal Reserve."

5. Market Impact

● The news of Powell being under criminal investigation triggered severe fluctuations in global financial markets. Following the news, the dollar plummeted, U.S. stock futures fell, and spot gold and silver prices briefly hit record highs. Analysts warned that the sentiment of "selling America" is sweeping the market, and concerns that the independence of the Federal Reserve in formulating monetary policy may be compromised could lead investors to reduce their reliance on dollar assets.

● "This development has reignited concerns about the damage to the independence of the Federal Reserve, which could undermine global investors' confidence in U.S. Treasuries," commented the Associated Press.

● In the long term, a weakening of the Federal Reserve's independence could affect the dollar's status as the global reserve currency and accelerate the process of "de-dollarization."

6. Future Direction

● The current U.S. economy is in a delicate phase: inflation indicators remain above long-term targets, while signs of cooling in the labor market have emerged. Under Powell's leadership, the Federal Reserve has cut interest rates three times in 2025, totaling 75 basis points.

● The intervention of the investigation has put monetary policy formulation in a dilemma. If Powell compromises on interest rate cuts to alleviate political pressure, it could lead to a rebound in inflation; if he insists on making decisions based on economic data, it will exacerbate tensions with the government.

● Analytical institutions have developed serious divergences regarding the monetary policy path for 2026, ranging from ICBC International's prediction of a 50-75 basis point cut to JPMorgan's belief that there may only be one rate cut, showing significant differences in forecasts.

● Regardless of the investigation's outcome, this public conflict has already shaken market confidence in the independence of the Federal Reserve, and its long-term impact will far exceed the issue of Powell's personal tenure.

Faced with the threat of a criminal investigation from the Trump administration, Powell did not back down. He chose to characterize the Department of Justice's investigation as a "direct challenge to the Federal Reserve's ability to operate independently from political control."

This struggle has transcended personal disputes and evolved into a challenge to the core institutional foundations of the Federal Reserve. From a legal perspective, the Department of Justice's investigation must provide sufficient evidence for a grand jury to decide on prosecution.

Political resistance is increasing, with Senator Tillis stating he will obstruct any new Federal Reserve official nominations until the investigation results are released. This development will have far-reaching implications for U.S. monetary policy, global financial markets, and the status of the dollar.

"The true reason for the criminal charges is that 'the Federal Reserve did not cater to the president's preferences but set interest rates based on the best judgment of public interest,'" Powell firmly stated at the end of his statement.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。