Introduction

Recently, a dispute surrounding the freezing of accounts on the OKX platform and the ownership of 40,000 USDT has continued to escalate within the Chinese crypto community. On the surface, this appears to be a conflict between a user and the platform; however, at a deeper level, it exposes an unavoidable reality conflict in the crypto industry during its comprehensive compliance process—personal narratives are colliding head-on with institutional logic.

This is not the first controversy triggered by risk control freezes, but it may be the first time that it has so clearly presented: when trading platforms truly prioritize "compliance," the familiar set of rules that users are accustomed to no longer works.

Figure 1: Platform OKX

I. From "Personal Appeal" to Public Incident: How Did It Escalate?

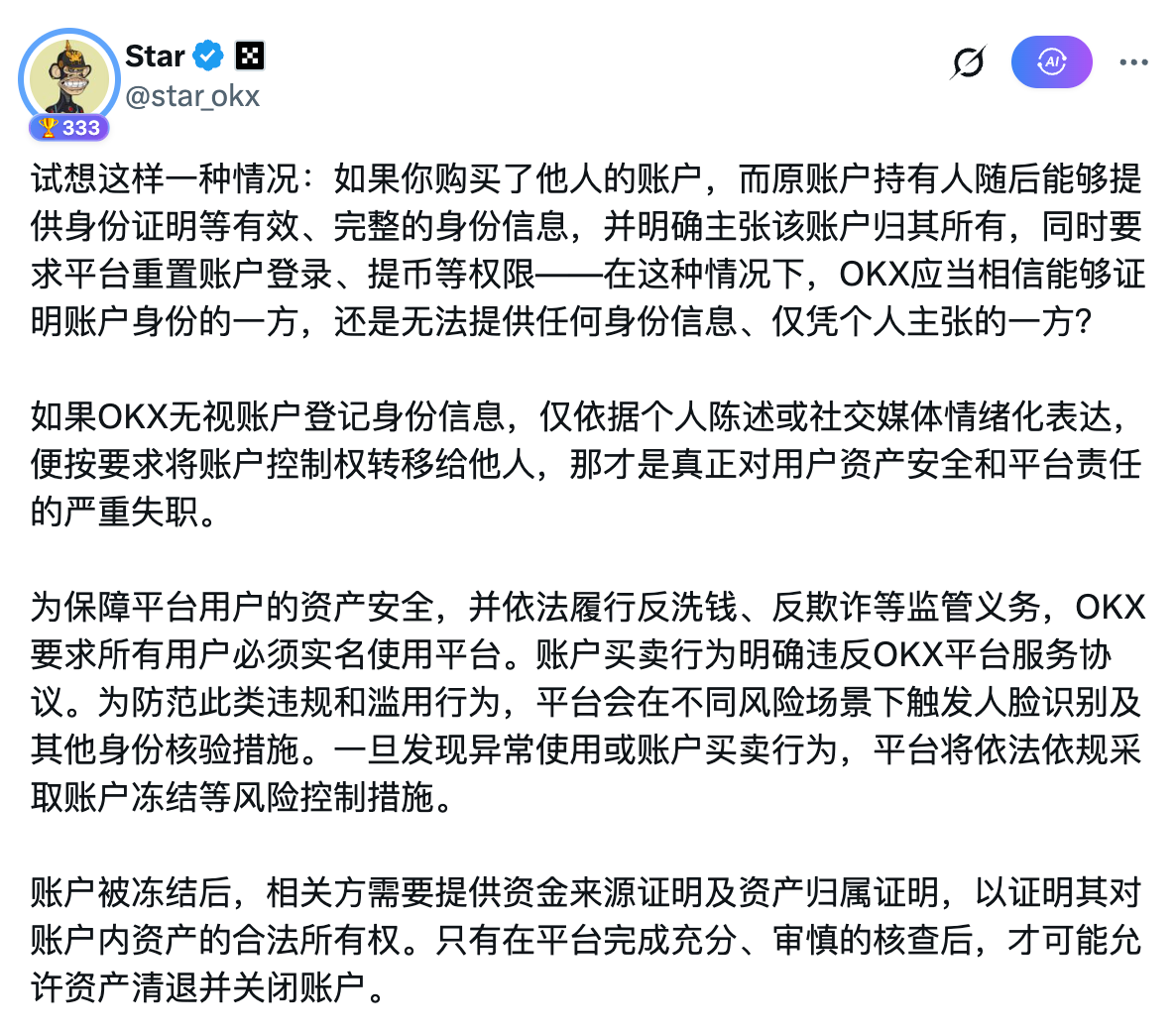

The incident initially stemmed from a user's public appeal on social media. They stated that due to their account being frozen by risk control, approximately 40,000 USDT could not be withdrawn, and the funds were urgently needed. This statement quickly garnered sympathy, leading to widespread sharing and discussions spilling over.

In the early narrative, the issue was simplified into a familiar opposing structure:

"Ordinary users facing difficulties vs. the cold, hard platform rules."

However, as information gradually emerged, the background of the incident began to complicate— the account in question was not registered under the user's real name but involved a third-party KYC situation, which directly triggered the platform's high-risk risk control mechanism.

This step marked a turning point in the entire matter.

Figure 2: User's original complaint post (https://x.com/captain0bunny/status/2010357857947152768)

II. The Platform's Position: Accounts Only Belong to "Those Who Can Prove Their Identity"

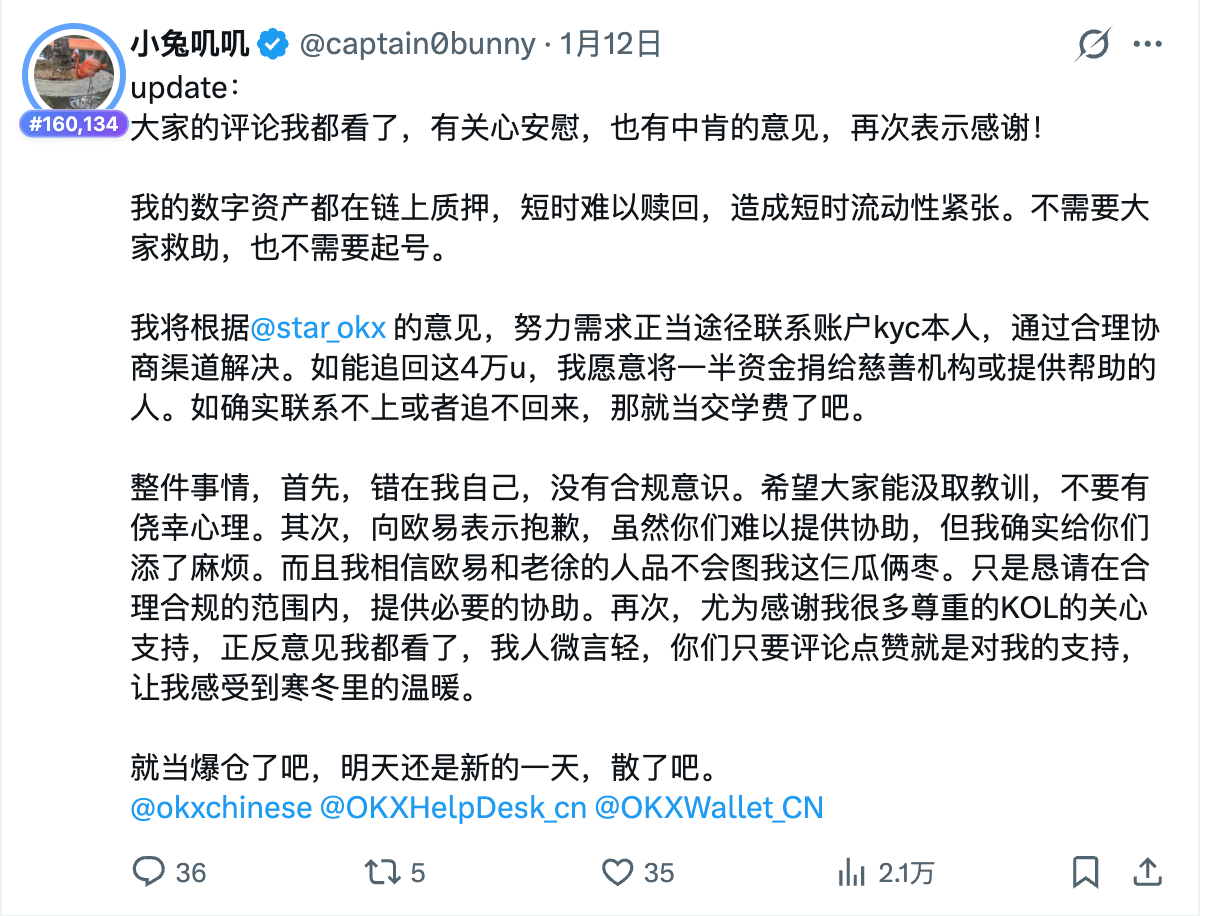

In response to public scrutiny, OKX founder Star subsequently made a public statement, the core logic of which is not complex but very resolute:

Under any circumstances, the platform can only recognize account registrants who can provide complete and valid identity information.

If the original account holder can assert ownership through identification, KYC information, etc., the platform has no right, nor is it possible, to transfer account control based solely on others' statements or public pressure.

This response clearly sends a signal:

The platform's basis for determining account ownership is not emotional intensity but legal responsibility.

From the platform's perspective, ignoring registered identity information and disposing of assets based solely on social media expressions would pose a systemic risk to the safety of all users' assets.

Figure 3: Part of OKX founder Star's response (https://x.com/star_okx/status/2010519743690883183)

III. When Emotional Narratives Meet Factual Supplements

As discussions deepened, the community began to dig into the past public information of the involved party. Some historical content showed that they still held a considerable amount of digital assets on-chain, but these were in a state of collateral, staking, or lock-up, limiting liquidity in the short term.

Figure 4: The involved party's past information revealed (https://x.com/riba2534/status/2010385714115199030)

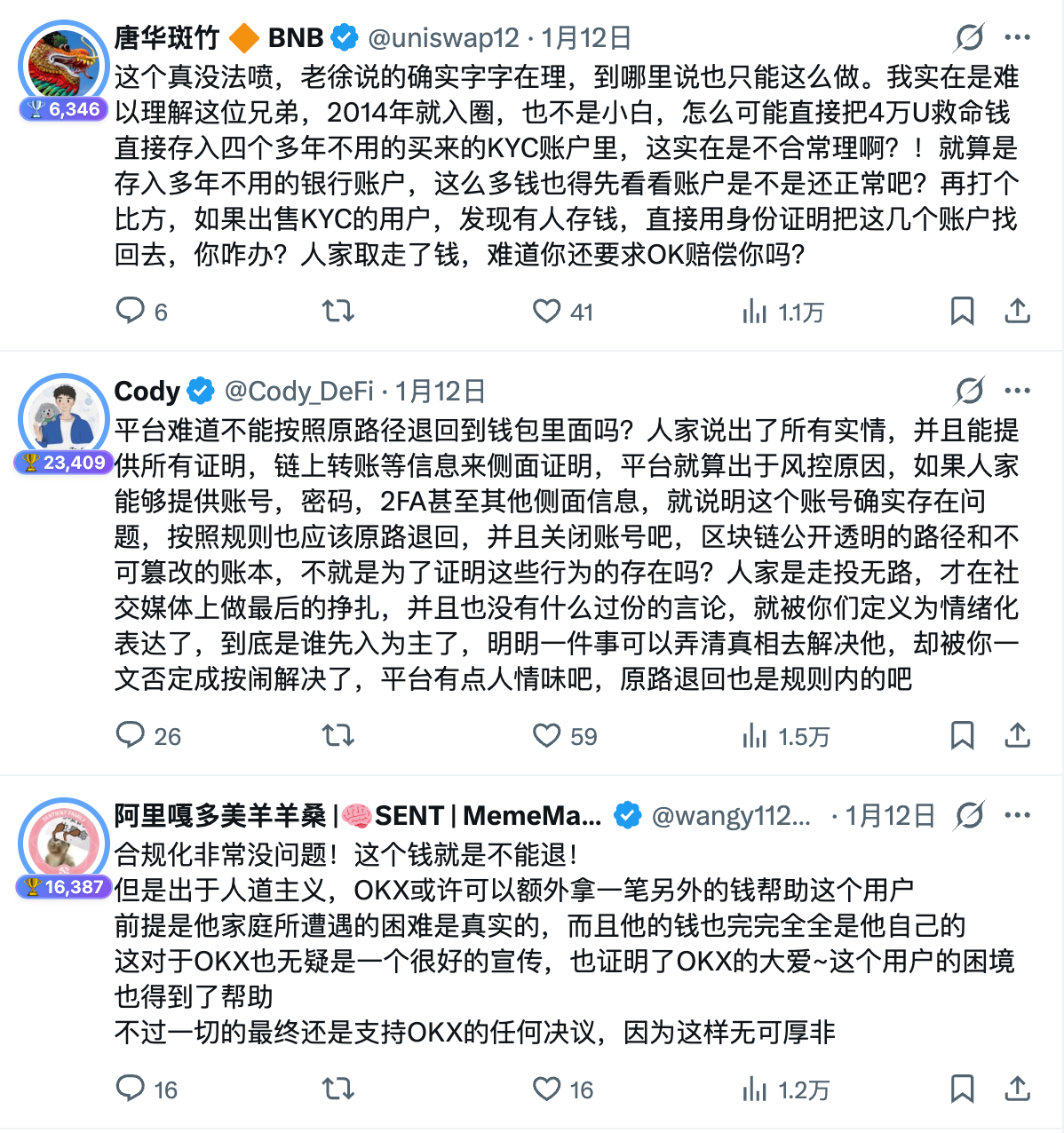

In response, the involved party proactively de-escalated in their latest update, acknowledging that the essence of the problem was not "asset disappearance," but rather that short-term liquidity was compressed by their own structural configuration. They also clearly stated that they would no longer seek public pressure and accepted their own shortcomings in compliance awareness.

Figure 5: The involved party's proactive clarification (https://x.com/captain0bunny/status/2010562397854204375)

This update shifted the incident from "emotion-driven" back to "realistic discussion," also making the outside world begin to realize:

This is not a simple good vs. evil judgment, but a systemic conflict.

IV. The Community's Mainstream Attitude: Rules Cannot Be Broken, but Lives Cannot Be Ignored

As the details of the incident gradually emerged, market discussions shifted from initial emotional alignments to more rational judgments. Overall, the community formed a relatively clear, though not extreme, mainstream consensus.

The first layer of consensus is: Violation is violation and should not be glamorized.

Many users candidly stated that purchasing third-party KYC accounts is essentially a form of "exploiting loopholes." In the early days of the industry, such practices were indeed not uncommon, and some profited from them, but this does not change their violation nature. Once the platform's risk control is triggered and the account is frozen, the operator must bear the consequences of their choices.

The second layer of consensus is: From a rules perspective, OKX's refusal to unfreeze is not problematic.

Many voices clearly expressed support for the platform's "hardline stance." If a precedent of "distributing based on noise" is established, future risk controls will be coerced by public opinion, ultimately harming the asset safety of all normal users.

However, the discussion did not stop at a simple binary of "right and wrong."

The third layer, which is more noteworthy, is: Is there still room for humane handling without breaking the rules?

Some users pointed out that the current 40,000 USDT is in an awkward state:

The involved party cannot withdraw it, and the platform cannot use it; the funds have effectively "settled." If, after strict verification, it can be confirmed that the related medical situation is genuine, could this portion of funds be converted into some form of public welfare assistance or targeted aid within the compliance framework?

This suggestion does not require the platform to break the system but attempts to find supplementary solutions outside the system—

without changing account ownership and risk control principles, and without allowing an event that was originally destined to be deadlocked to be reduced to a cold judgment of right and wrong.

As a highly upvoted comment stated:

Sticking to the rules is being responsible, but lending a hand outside the rules is the true big picture.

Figure 6: Some community comments

V. The Real Contradiction: Compliance Does Not Care About Your Situation

In this incident, what is most concerning is not who is right or wrong, but a fact that is being repeatedly validated:

The compliance system essentially lacks "flexibility."

For the platform, whether there is a personal dilemma does not constitute a legitimate reason to change the rules.

Anti-money laundering, anti-fraud, and account real-name systems are not moral choices but regulatory obligations.

This is also why, when the industry enters a phase of stock game and strong regulation, platforms are even less likely to make exceptions for individual cases—because once an exception is made, the risk they bear is not public opinion risk but legal risk.

Figure 7: The collision of crypto and compliance

Conclusion: The Era of Informal Rules is Coming to an End

This OKX account risk control incident will not be the last.

Its symbolic significance lies in the fact that the crypto industry is undergoing an identity transformation—from a period of gray expansion to a period of institutional absorption.

At this stage, platforms no longer act as "mediators" but more like nodes executing rules.

Emotions can be understood, and situations deserve sympathy, but the rules will not change because of this.

What truly needs to be re-recognized is not a specific exchange but the reality of the entire industry—

When order arrives, everyone must learn to survive within the rules.

AiCoin user exclusive OKX registration benefits: Permanent 20% rebate

Registration link:

https://jump.do/zh-Hans/xlink?checkProxy=true&proxyId=2

Join our community, let's discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group:

https://aicoin.com/link/chat?cid=l61eM4owQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。