Written by: Zack Pokorny, Researcher at Galaxy Research

Translated by: Yangz, Techub News

The prediction market is expected to achieve a "breakthrough from 0 to 1" by the end of 2024 to 2025, establishing its position as a mechanism that aggregates decentralized information into probabilistic signals. The upcoming application scenarios may extend this capability, not only answering whether events will occur but also further revealing what these events mean for asset prices and organizational decisions.

We anticipate that this expansion will take two forms: Impact Markets and Decision Markets. Impact Markets present the collective view of the market on the conditional valuation of assets (for example, what the trading price of Bitcoin would be if the Federal Reserve cuts rates by 75 basis points; or what Nvidia's valuation would be if a specific candidate wins the election). Decision Markets go a step further, utilizing these conditional valuations to automate organizational governance, allowing the market to directly determine the actions an organization should take based on expected economic outcomes. A few projects are already dedicated to realizing these concepts, and we expect the number of such projects to increase in the coming year and beyond, as the products and user ecosystems surrounding them flourish.

Both mechanisms are built on the ability of prediction markets to aggregate information through the market, but they shift the output from event probabilities to actionable intelligent information. These markets no longer stop at "there is a 65% chance of this happening," but instead answer: "what does this specifically mean for your portfolio" and "what actions should your organization take in response." While the infrastructure and incentive structures are similar, the potential range of questions these markets can clearly reveal is much broader.

Limitations: Event Probabilities and Economic Outcomes

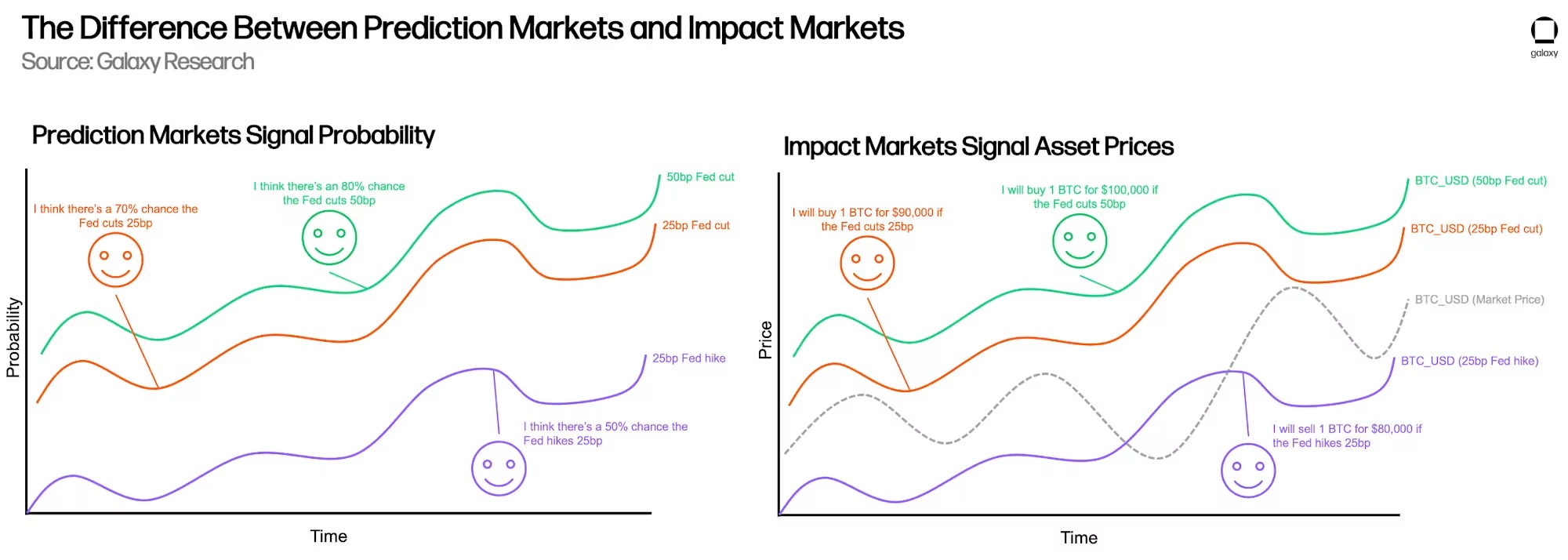

The current key constraint is that prediction markets only provide binary returns for discrete events, and are separated from asset price outcomes. For example, users can bet on the likelihood of the Federal Reserve lowering the benchmark interest rate by 25, 50, or 75 basis points, with each possibility having its corresponding "yes/no" market and a range of probability outcomes. However, they cannot directly trade or clearly communicate signals indicating how bonds, Bitcoin, or any other asset would be affected if these rate cuts occur. Prediction markets capture event probabilities but do not reveal how these events will impact asset prices. Such conditional pricing information is not only valuable for hedging but can also inform strategic decision-making.

The existing utility of prediction markets as hedging tools and information dissemination mediums should not be underestimated. Prediction markets provide a direct mechanism to hedge against any discrete event risk (for example, the timing of the release of the next generation of ChatGPT models, or whether military action will occur before a specific date), risks that are often difficult or impossible to hedge separately in traditional markets. Additionally, by aggregating the decentralized knowledge of real capital participants, prediction markets can quickly synthesize scattered information into continuously updated probabilities with capital bias, a performance that has historically outperformed expert forecasts and polls.

Impact Markets

Impact Markets will address a fundamental information gap. Current prediction markets cannot tell you what the value of an asset will be under the condition of a specific event occurring. Such information does not exist in a clearly discoverable form. While prediction markets reveal event probabilities and spot markets reveal prices, there is no mechanism to present the market's collective view on the conditional valuation of assets tied to specific events, such as: what price Bitcoin will trade at if the Federal Reserve cuts rates by 75 or 50 basis points; or how Nvidia's stock will perform if a candidate with a cautious stance on AI wins a significant election.

Users of Impact Markets do not trade probability odds through "yes/no" tokens but instead directly trade the asset itself under conditional states. An expression of such a position might be: "I am willing to buy Bitcoin at a unit price of $110,000 (10% above market price) if and only if the Federal Reserve cuts rates by 75 basis points." This fundamentally enhances the information revealed by the market. We no longer need to maintain separate markets for "the probability of a Federal Reserve rate cut" and "the price of Bitcoin," but can directly discover prices for "Bitcoin price | Federal Reserve cuts by 75 basis points." This concept can be extended to any "asset | event" pairing, such as "GOOGL (Google) | GPT 6 released before Gemini Series 4" or "gold | asteroid mining achieved before 2030," and so on.

The key distinction is that events are one thing, while the impact of these events on companies and assets is another; the two are fundamentally different. Prediction markets aggregate the probability of whether an event will occur. Impact Markets answer the next question: "If this event occurs, what will happen to this company or asset?" This separation allows each market type to operate in a specialized manner while creating a more complete set of information.

This framework addresses the multi-step reasoning problem that plagues markets: traders must collect probability odds from prediction markets, input them into proprietary models to estimate asset impacts, and then execute independent trades on exchanges. When traders see a 25% probability of a 75 basis point rate cut and a 65% probability of a 25 basis point cut, they must independently assess what these probabilities mean for their Bitcoin positions and then pray that their correlation assumptions hold true when executing (or hope that the Federal Reserve does not unexpectedly raise rates and cause their positions to liquidate). Impact Markets simplify the entire workflow into direct price discovery for conditional valuations, with trades only settling when the given event actually occurs. The benefits are substantial:

Directly reveals hidden information. Currently, there is no mechanism to present the market's collective view on the conditional valuation of assets tied to specific events. While prediction markets reveal event probabilities and spot markets reveal current prices, Impact Markets answer the question that neither can directly address: if the event occurs, at what price will the asset trade?

True economic hedging. Bitcoin holders concerned about election impacts can directly lock in a conditional price for their assets under specific concern scenarios. This is fundamentally different from the "hedging" of prediction markets. They do not need to manage asset positions separately while betting on event probabilities; instead, they execute a trade that secures their economic outcome when a specific event occurs. This minimizes the basis risk between their event views and asset exposure.

Reduces model risk. Users do not need to build correlation models or estimate how events will affect prices. The market automatically aggregates these views through demonstrable preferences. The reasoning problem is resolved by allowing market participants to directly express conditional valuations.

The most impactful insight is that Impact Markets reveal the market's implied joint distribution between events and asset prices, information that is hidden under the current prediction market framework or requires complex model assumptions to extract. This is not only valuable for hedging but is crucial for any decision that relies on understanding how events affect economic outcomes.

Following this, organizations can effectively leverage this model to glimpse conditional futures and act accordingly. We call this Decision Markets.

Decision Markets

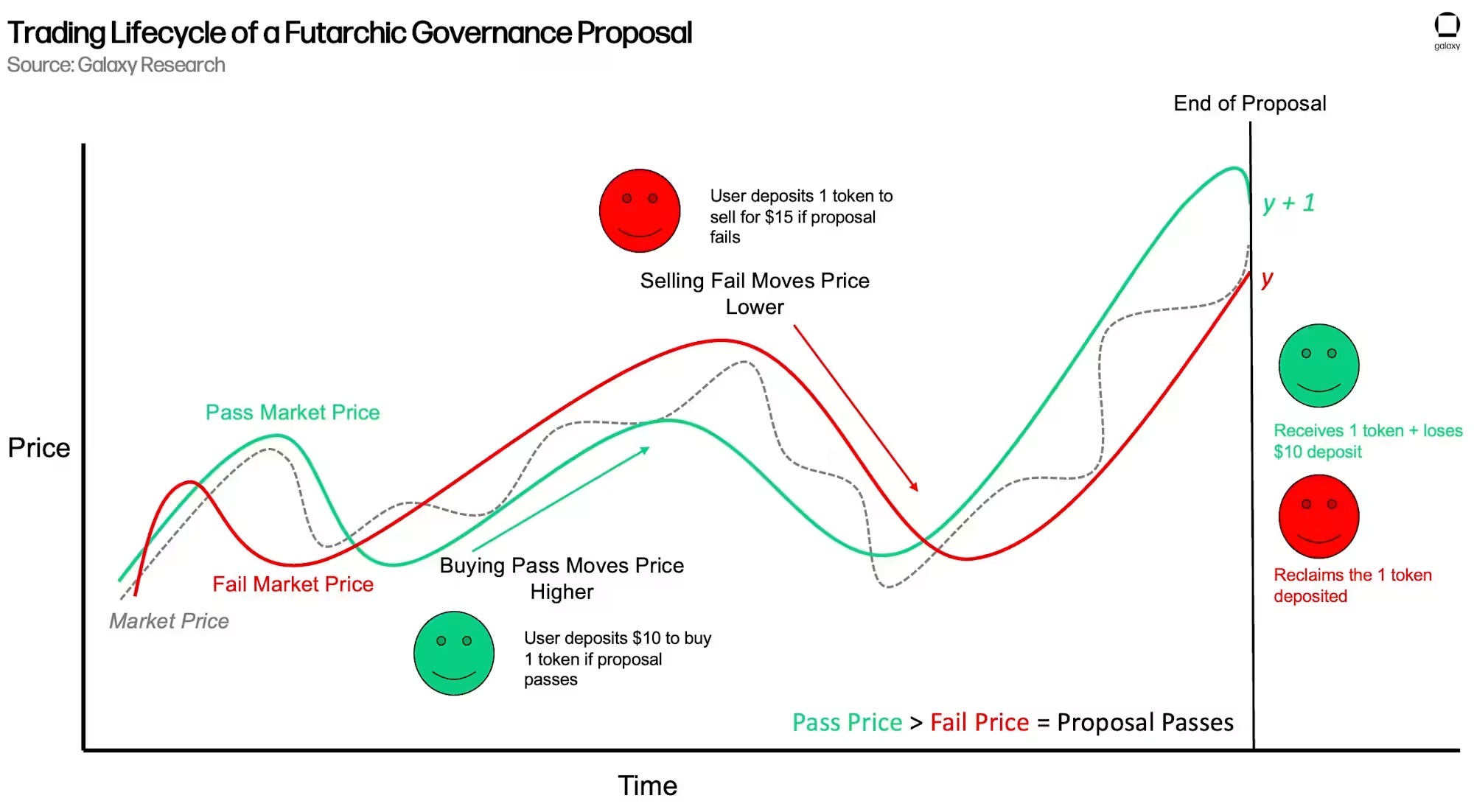

Decision Markets originated from economist Robin Hanson's 2000 working paper “Shall We Vote on Values, But Bet on Beliefs?”, extending the mechanism of Impact Markets from information revelation to governance automation. They are not merely revealing conditional valuations for individual decision-making reference but directly and bindingly determining whether an organization should take a specific action based on which outcome the market prices higher. This mechanism has been practiced in the "futarchy" DAO, where the total trading volume of its decision markets has reached millions of dollars. In a typical setup, an organization proposes a decision (for example, whether to dilute its token supply by 5% to fund a new product line), and the market trades two conditional "states": "pass" and "fail." Each state assigns its own value to the organization's tokens, with the price serving as the market's objective function—the object the market seeks to optimize. If the market prices the tokens higher in the "pass" state, the organization executes the decision. If the trading price of tokens is higher in the "fail" state, the proposal is rejected, and no action is taken. Market participants collectively decide which action maximizes expected value, and their trades will be executed conditionally based on the winning outcome. Galaxy Research has reported on these markets and their application organizations in reports on futarchy and its on-chain implementation, as well as in our annual predictions for 2025 and 2026.

However, this structure reveals a key constraint: the effectiveness of the objective function. For decision markets to generate meaningful signals, the traded assets must have a causal relationship with the outcomes the decisions aim to optimize; ideally, holders should have substantial ownership claims to the economic value generated by the relevant applications. However, many (and possibly most) crypto tokens fail this test. When the value of a governance token for a chain is structurally decoupled from the growth of on-chain applications, or when token holders do not substantially enjoy the economic benefits generated by the chain, it cannot effectively guide ecosystem grant allocations. If "performance" (or damage) cannot flow back to the traded asset, the market cannot reveal whether a grant will be successful. Worse, rational traders may completely refuse to participate. When the success of an application does not accumulate value for the token, why would anyone buy governance tokens (thereby increasing their economic exposure) to express support for application grants? When the objective function is inconsistent with the decision domain, the market's ability to accurately predict the best decision collapses.

This effectiveness issue makes it very difficult to retrofit decision markets into existing organizations.

Mature DAOs have established specific governance processes, social norms, informal power structures, and (most critically) token and ownership structures that may not align token value with organizational outcomes. Introducing binding decision markets requires fundamental restructuring, such as how proposals are formed, how rights are exercised, and how contributors act after decisions are made. Additionally, it often necessitates changes to the organization’s own structure, as token ownership may need to be reorganized to fully link economic outcomes with governance decisions. The human, coordination, and capital/legal costs required to achieve this may be burdensome for some organizations.

Newly established organizations, however, are not subject to such constraints. They can design their architecture from the outset with decision markets as the default coordination mechanism, specifically designing token economics and governance processes to ensure that the objective function and expectations regarding the governance process (how governance is conducted and its content) remain effective. Tokens can be designed to ensure that the organization’s success inevitably flows into token value, thereby avoiding the disconnection issues that plague existing organizations restructured for decision markets. Therefore, decision markets are more likely to gain adoption through the establishment of new types of organizations that are inherently designed for market governance, rather than attempting to graft markets onto legacy structures.

This points to a pathway for the broader development of decision markets. They do not replace existing organizational coordination mechanisms but rather make previously impossible new forms of organization feasible. These entities can aggregate information, coordinate incentives and ownership, and execute decisions through direct market mechanisms rather than political processes.

This brings both advantages and constraints. Decision markets should excel at measuring risk and return, maximizing the return on the deployment of unit resources, and pricing decisions under high uncertainty. They are particularly powerful for capital allocation, resource deployment, and strategic choices where economic impact is the primary consideration. However, they are less suited for decisions where established goals include qualitative factors, such as value alignment, community social capital, or standards that cannot be simplified to token prices. In decision markets, the market mechanism must optimize for economic value to generate meaningful signals. This is a feature, not a flaw. The strength of decision markets lies precisely in their ability to compress complex trade-offs into a single dimension of economic value. Therefore, organizations relying on this structure may self-govern in ways that differ from today’s typical on-chain organizations. They may not micromanage application details but instead focus governance on monthly contributor allowances and burn rates, treasury expenditures, and asset control (including intellectual property), while operators retain autonomy over creativity and daily operations.

Summary

Prediction markets have demonstrated that markets can aggregate information about whether events will occur. Impact markets and decision markets are expected to expand this understanding, revealing the value of these events and, in some cases, allowing the market to directly determine what actions organizations should take. Impact markets can fill critical information gaps by presenting conditional asset valuations, enabling true economic hedging and event-driven price discovery. Decision markets will further leverage these valuations to dominate capital allocation and strategic decision-making. Together, they signify a shift from merely predicting events to pricing the consequences of events and acting accordingly.

While these next-generation markets are still in their infancy, the groundbreaking success of prediction markets over the past two years suggests a bright future for the next chapter of information finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。