Original Title: Solana DEX Winners: All About Order Flow

Original Author: Carlos Gonzalez Campo, Blockworks Research

Original Translation: BitpushNews

Core Insights

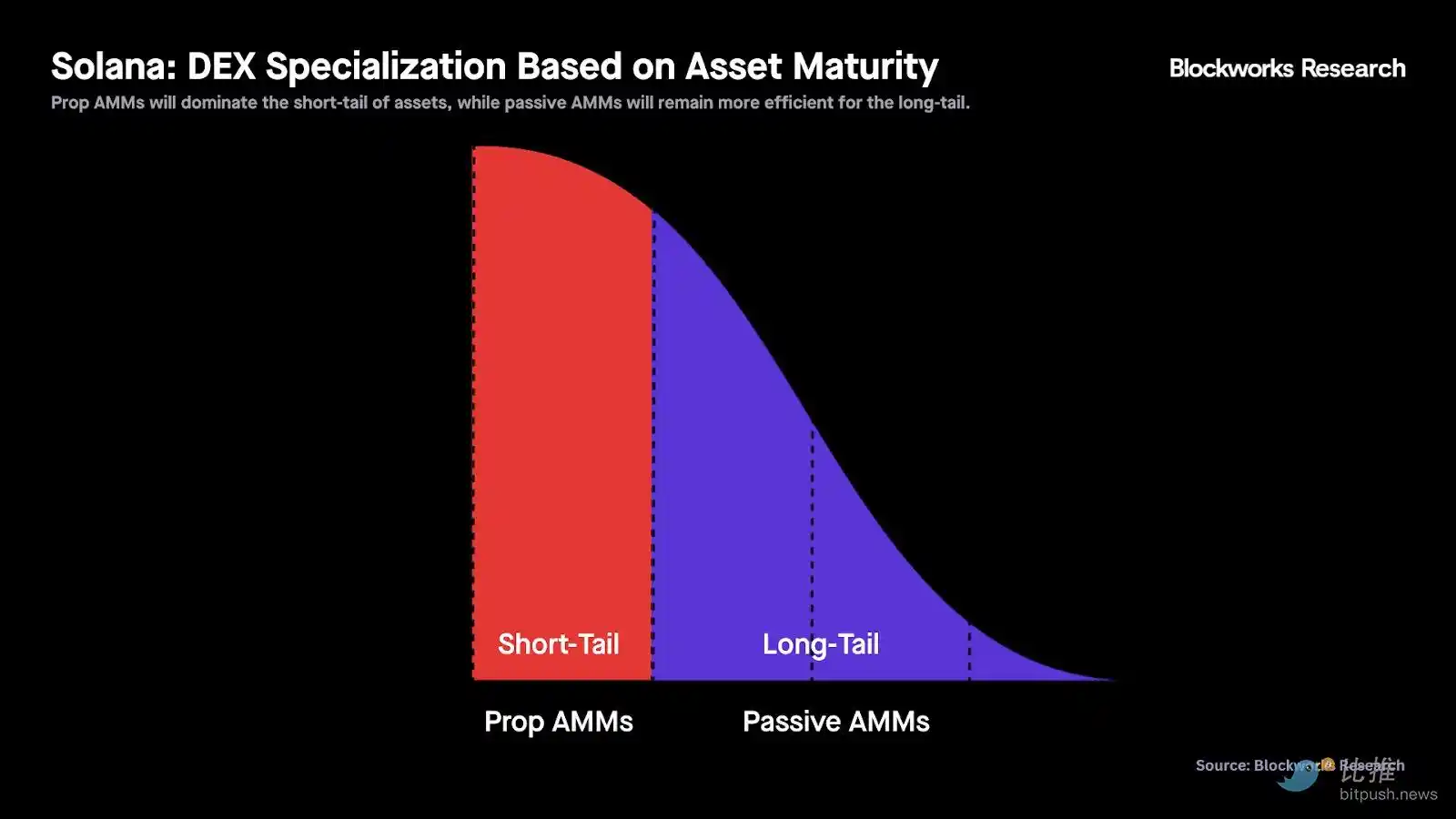

- The dominant landscape of Solana DEX will differentiate based on asset maturity: Active market-making AMMs will continue to dominate short-tail high liquidity markets, while passive AMMs will increasingly focus on long-tail assets and new token issuances.

- The winning strategies of the two types of AMMs are completely different: Both can benefit from vertical integration, but in opposite directions. Passive AMMs are getting closer to users through token issuance platforms (like Pump-PumpSwap, MetaDAO-Futarchy AMM), while active market-making AMMs are extending downstream, focusing on trade execution services (like HumidiFi-Nozomi).

- HumidiFi leads the active market-making AMM category, capturing about 65% of the market share, with most of its trading volume concentrated in the SOL-USDC and SOL-USDT trading pairs. Its oracle update instruction costs are the best among peers, showing superior mark price spread performance compared to competitors like SolFi and Tessera, as well as passive AMMs.

- Independent passive AMM models are outdated. Future winning "passive AMMs" will no longer be seen as pure AMMs but will become token issuance platforms that vertically integrate AMMs as a profit layer—like becoming a launchpad like Pump or an ICO platform like MetaDAO.

- DEXs that do not belong to either category will face structural growth decline. Protocols that are neither active market-making AMMs nor vertically integrated issuance platforms (most notably Raydium and Orca) are at a structural disadvantage and may become losers in this trend.

- Valuations should reflect both business quality and token value accumulation. Multiples like price-to-sales (P/S) only make sense in the context of growth prospects and credible token holder value capture. WET is a case in point: it appears undervalued compared to peers, but due to long-term token empowerment uncertainties, its trading price still faces discounts.

Introduction

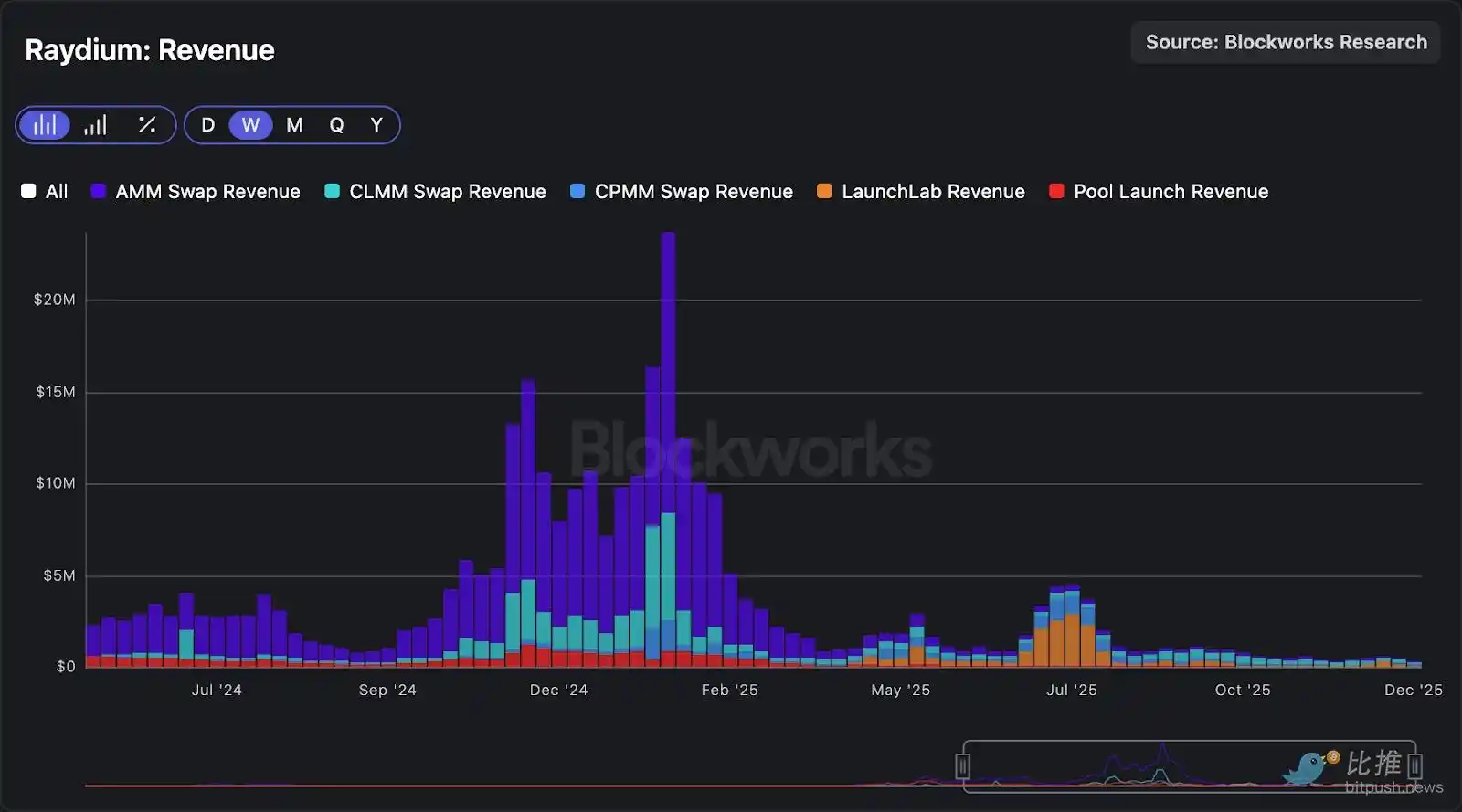

In February 2025, we published a report on the competitive landscape of Solana DEXs. At that time, DEX trading volume was at historical highs, and we (in hindsight) anchored too much on a 90-day rolling window that included an exceptionally frenzied period: the rebound after the U.S. elections in Q4 2024, the TRUMP meme coin craze in January, and the active period driven by LIBRA in February. At that time, Raydium was the leading DEX, holding about 50% of the market share, and most DEX trading volume on Solana came from meme coins.

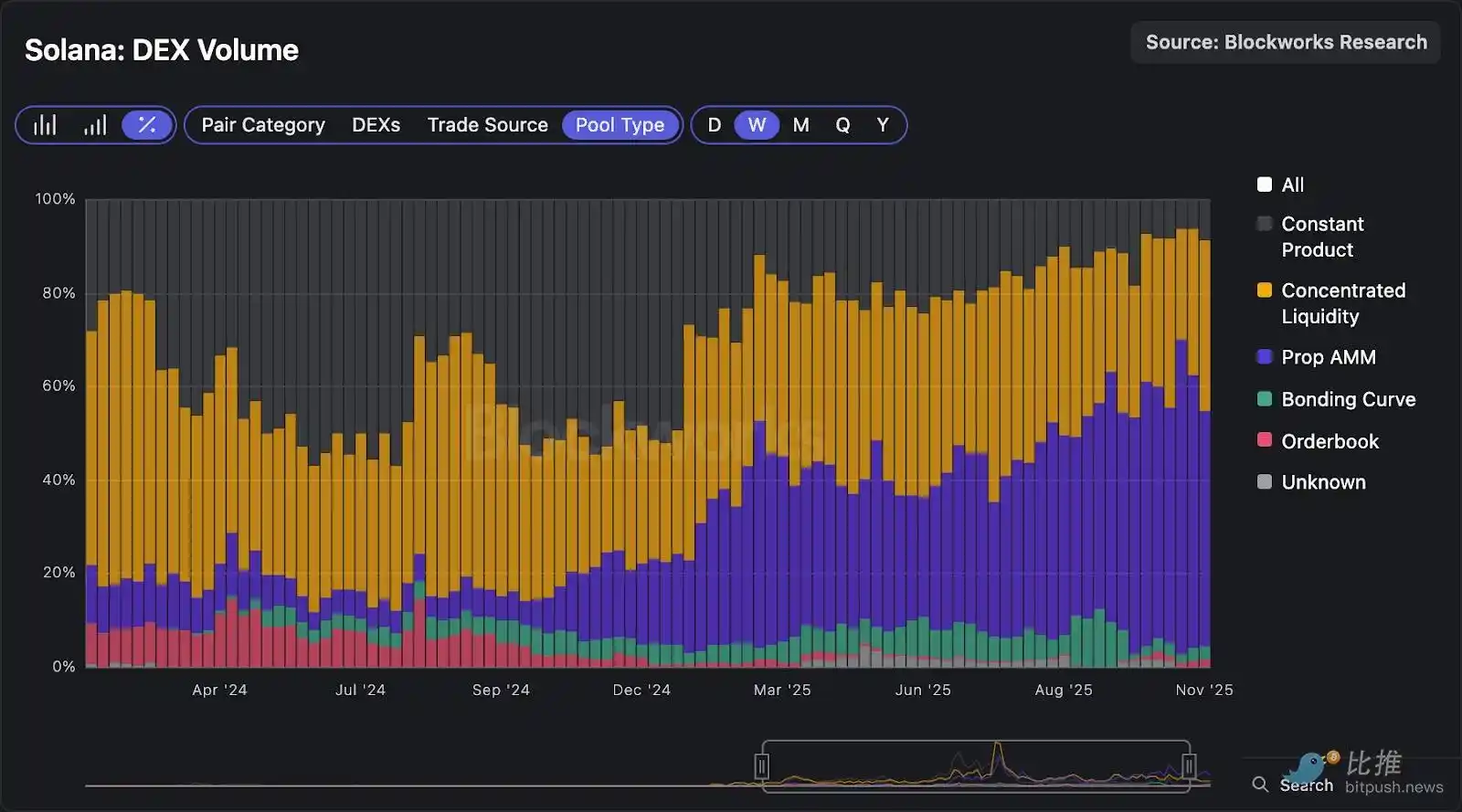

Now, the landscape has fundamentally changed. The rise of active market-making AMMs has reshaped market structure, with trading volume concentration shifting from meme coins to SOL-USD trading pairs. Although Lifinity pioneered the active market-making AMM model, it wasn't until the launch of SolFi at the end of October 2024 that active market-making AMMs began to surge, capturing significant shares of trading volume in high liquidity trading pairs.

As active market-making AMMs continue to dominate the capital flow of short-tail assets, passive AMMs are struggling, increasingly pushed towards long-tail assets and volume reliant on issuance. The launch of AMM by Pump in March 2025 demonstrated this dependency: once Pump directed graduation tokens to its own AMM, Raydium lost its largest source of trading volume and revenue, leading to a continuous decline in market share. As the liquidity of passive AMMs has largely been commoditized, the AMMs most likely to survive will be those that control issuance and order flow.

This report re-examines the DEX landscape of Solana based on this new market structure, updating competitive positioning, valuations, and articulating our views on the protocols most likely to emerge victorious.

Specialization: Short-tail Assets vs. Long-tail Assets

The dominant position of Solana's DEX will continue to differentiate based on asset maturity.

Active market-making AMMs will dominate short-tail assets (i.e., high liquidity markets), including SOL-stablecoin and stablecoin trading pairs.

In contrast, passive AMMs like Meteora and Raydium will still be more efficient in managing liquidity for long-tail assets. There is almost no active market-making AMM in this vertical, as actively managing liquidity for new assets without real-time oracle prices is too risky for them.

Order Flow: Execution vs. Issuance

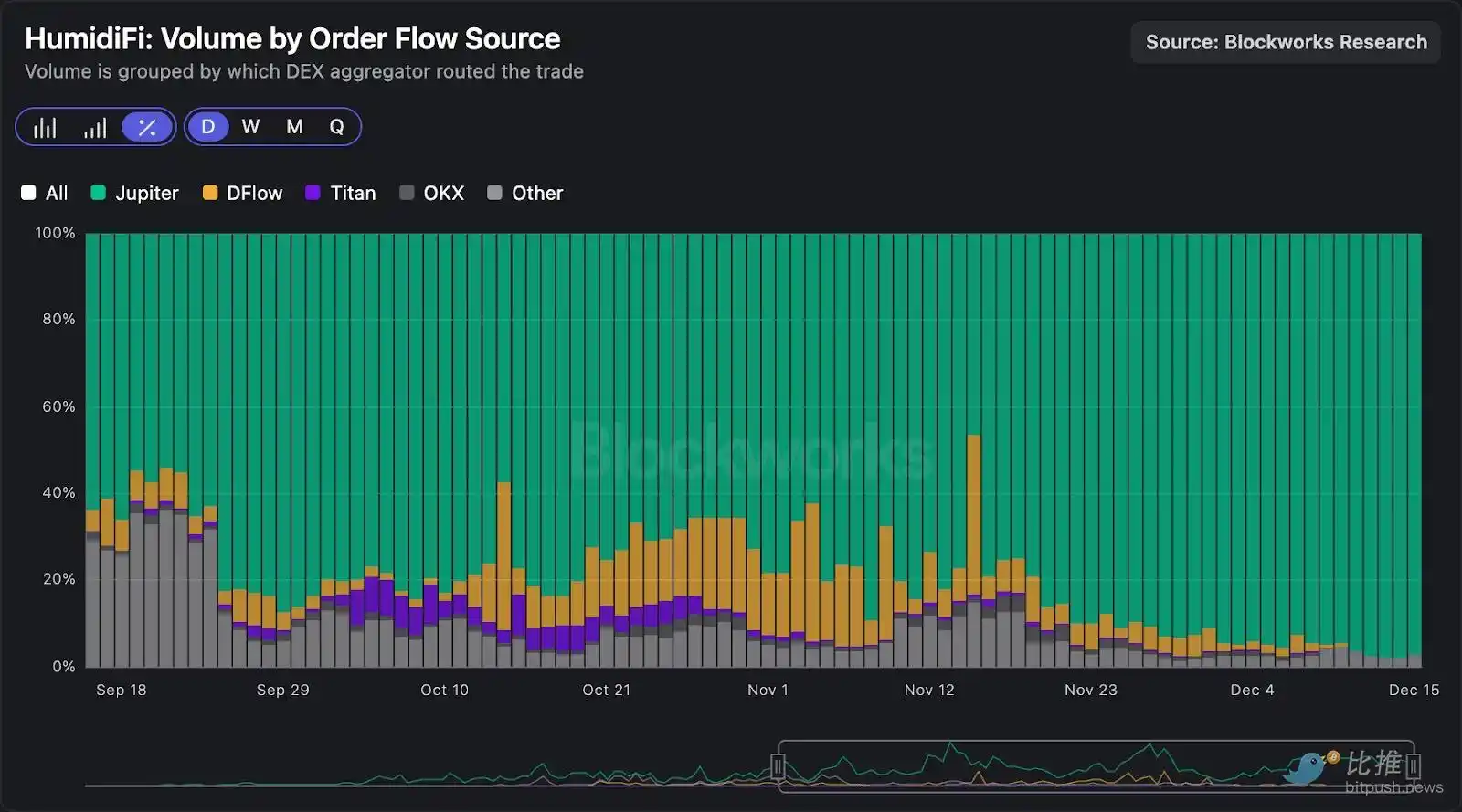

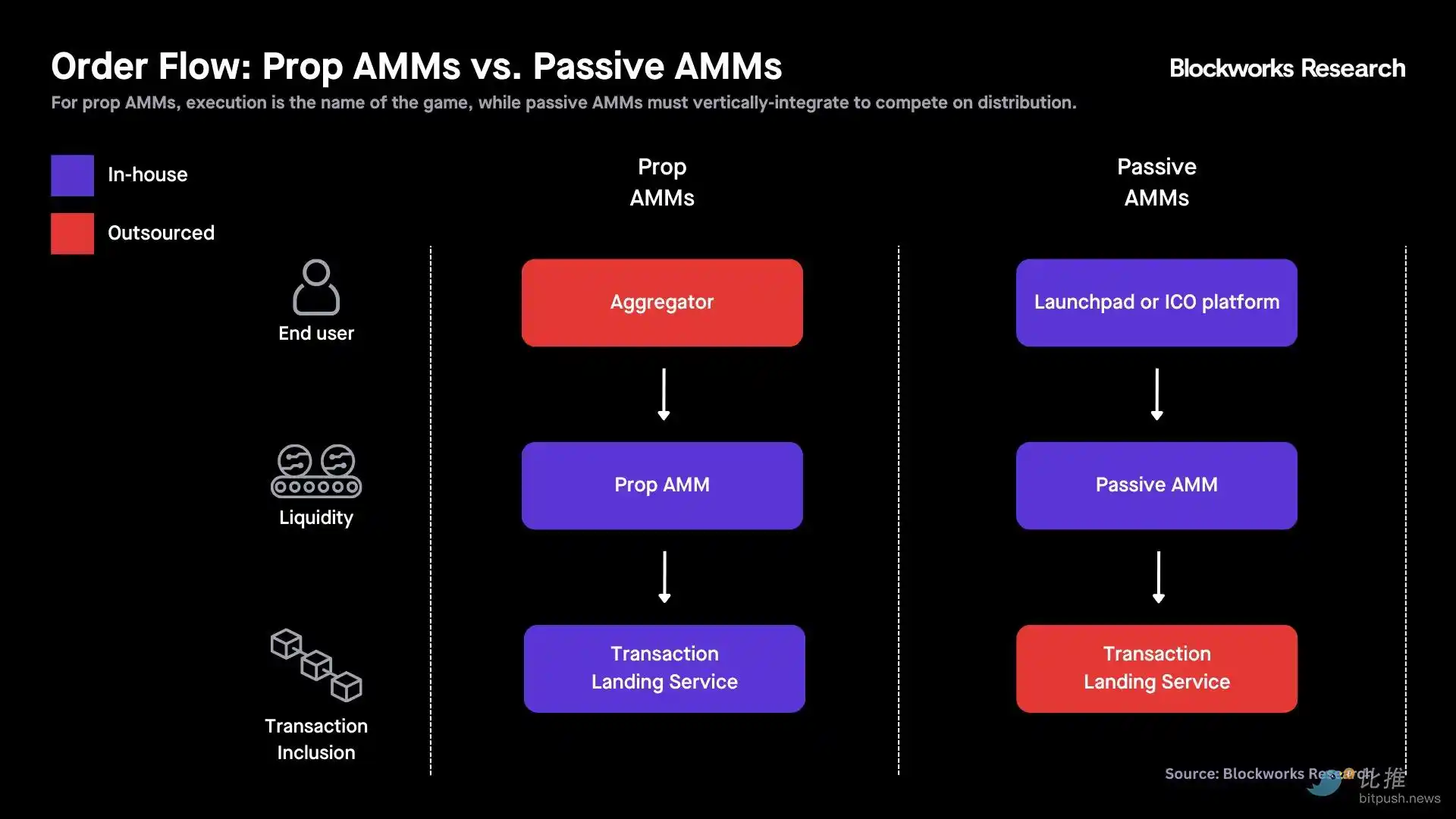

Active market-making AMMs do not have a front end, so they rely on aggregators like Jupiter and DFlow to interact with their contracts and execute trades through their liquidity pools. In other words, active market-making AMMs need aggregators to obtain order flow.

The following chart shows that over 95% of HumidiFi's trading volume comes from DEX aggregators, and other active market-making AMMs like Tessera, GoonFi, and SolFi exhibit similar patterns.

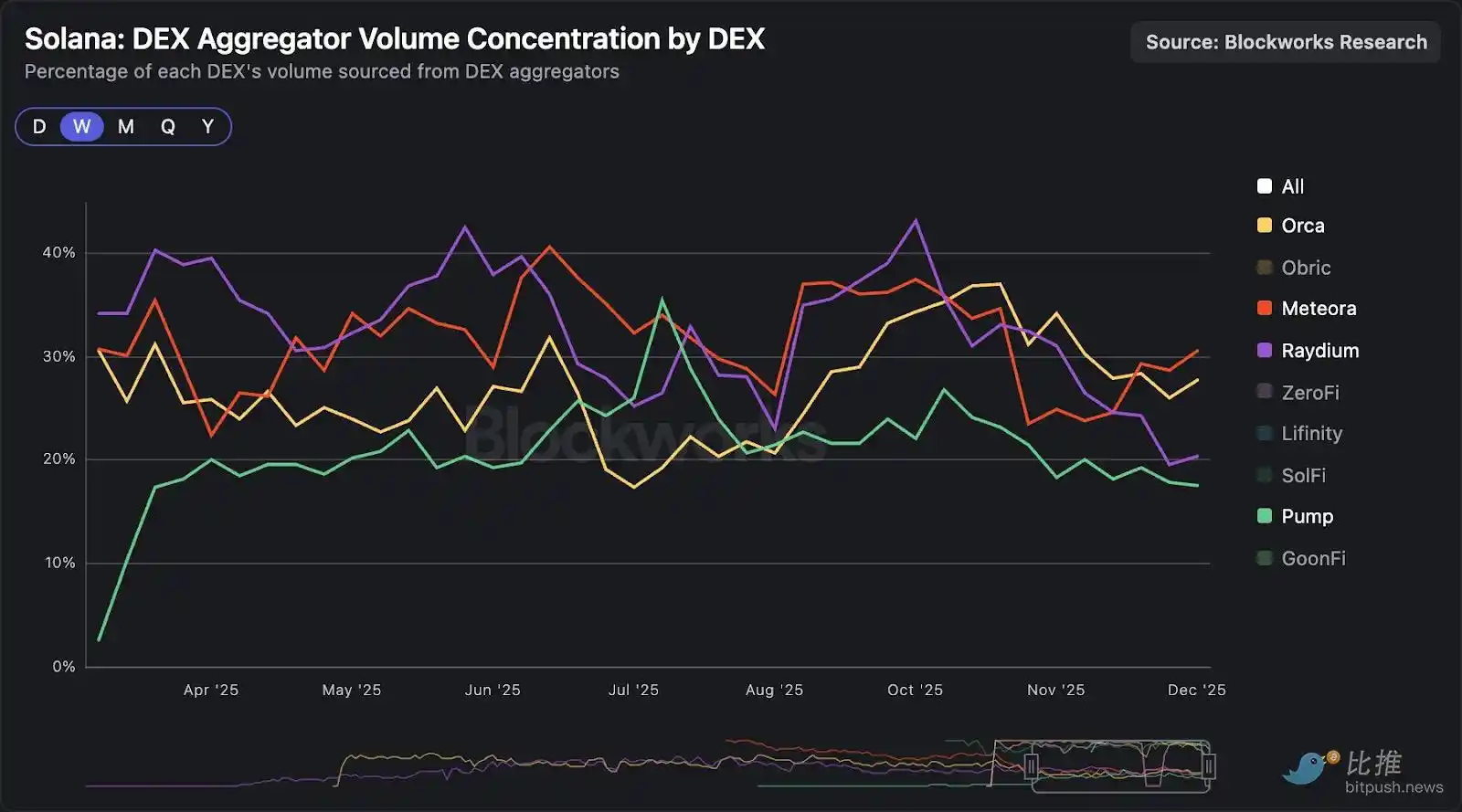

On the other hand, the trading volume from aggregators accounts for less than one-third of passive AMMs.

Passive AMMs cannot compete with active market-making AMMs in price execution for major assets, and since the liquidity of long-tail assets has largely been commoditized, they must compete on issuance channels.

In summary:

- Active market-making AMMs must compete on price execution, as aggregators will route orders to the places offering the lowest slippage. As will be detailed later in the report, trade ordering is crucial for active market-making AMMs (which can be seen as market makers) because they need to race to update quotes before arbitrageurs take advantage. Therefore, active market-making AMMs can benefit from moving downstream and focusing on trade execution services.

- Passive AMMs must compete on issuance channels, meaning they need to vertically integrate, or they will gradually lose relevance. Unlike active market-making AMMs, passive AMMs need to get closer to users through token issuance platforms (like Pump-PumpSwap, MetaDAO-Futarchy AMM).

We believe that the passive AMMs that can survive in the long run will no longer be seen as pure AMMs. Their primary function will shift to token issuance platforms—like launchpads or ICO platforms—while the AMM itself will merely serve as an underlying tool for monetizing token issuance. Meteora is a possible exception, but its success largely depends on the traffic distribution brought by Jupiter. Here are some of the most typical examples of this trend:

- Pump (Launchpad) — PumpSwap

- MetaDAO (ICO Platform) — Futarchy AMM

- Jupiter's DTF (ICO Platform) — Meteora

HumidiFi is the clearest example of a vertically integrated active market-making AMM, benefiting from the trade execution service Nozomi built by the same core team (Temporal).

The fundamental differences between active market-making AMMs and traditional AMMs require independent competitive analysis.

Active Market-making AMM: HumidiFi's Dominance

Active market-making AMMs are spot exchanges that manage liquidity actively through oracle updates. Each active market-making AMM is operated by an independent market maker (without external liquidity providers), which uses highly optimized trades to update oracle prices, allowing for multiple quote adjustments per second. With over ten active market-making AMMs now launched on Solana, they have captured more than 50% of all spot trading volume on the chain.

As mentioned earlier, Lifinity was the first active market-making AMM, pioneering the concept of proprietary liquidity and adjusting quotes based on oracle prices. However, after Ellipsis Labs (the team behind Phoenix) launched SolFi at the end of October 2024, Lifinity rapidly lost market share and saw a continuous decline in trading volume. Lifinity ceased operations on November 20, 2025, a decision that highlights how fierce the competition is in the active market-making AMM space.

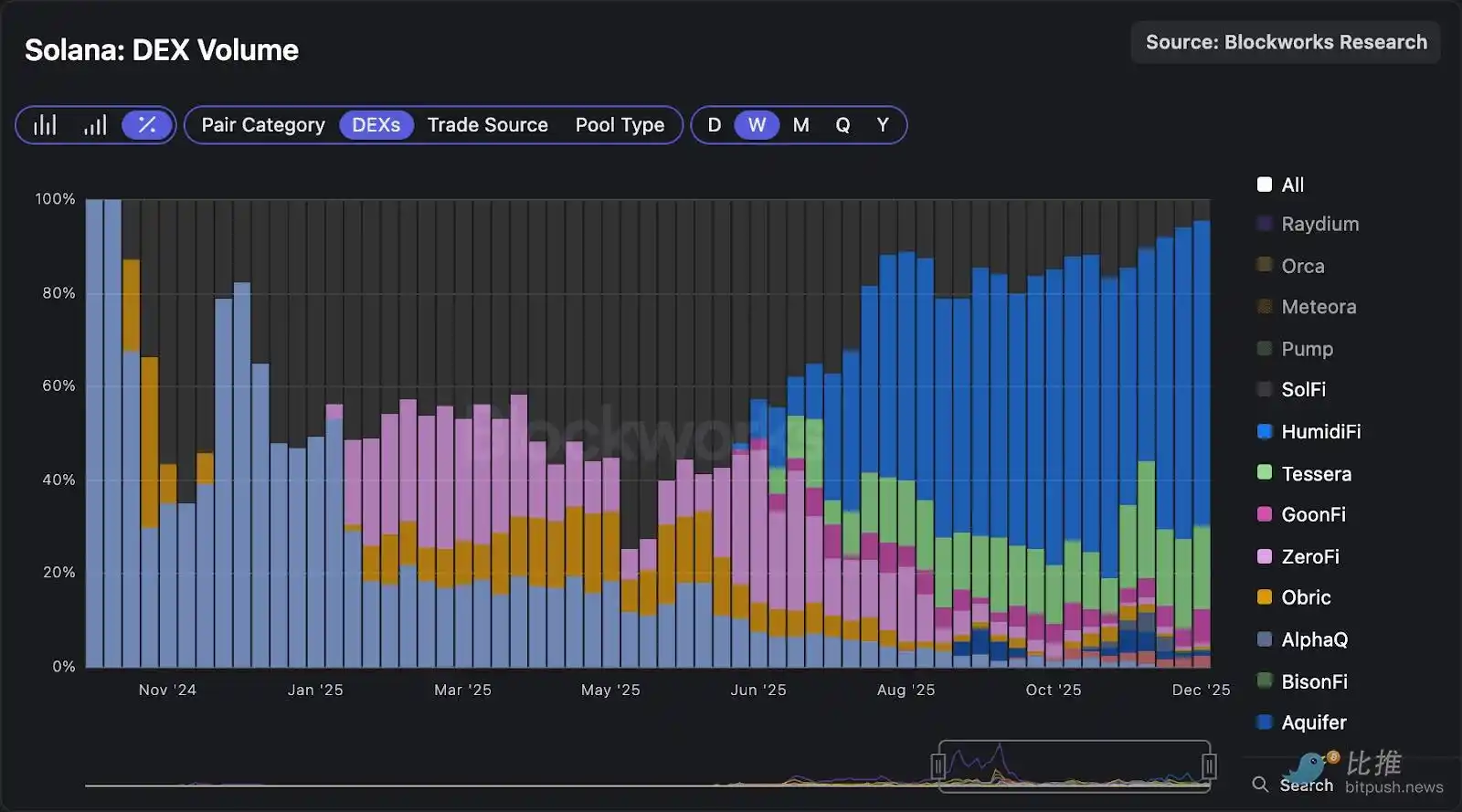

As shown in the chart above, SolFi captured nearly half of the active market-making AMM trading volume in the first and second quarters of 2025, but HumidiFi quickly rose to the top after its launch in June 2025. HumidiFi currently leads active market-making AMM trading volume with 65% market share, followed by Tessera (18%) and GoonFi (7%).

The core engineering team behind HumidiFi is Temporal, one of the most technically proficient teams on Solana.

Temporal also operates other products at the infrastructure level, including Nozomi (trade execution service) and Harmonic (a regional block building system aimed at competing with Jito). In addition to Temporal's contributions, HumidiFi's co-founder Kevin Pang has worked at Jump, Paradigm, and Symbolic Capital Partners, bringing indispensable high-frequency trading expertise to this active market-making AMM.

HumidiFi exemplifies our point: unlike passive AMMs that need to move downstream and control end users to capture order flow, active market-making AMMs are better suited to move downstream into the trade packaging and sorting infrastructure space. Temporal's infrastructure stack is highly complementary to HumidiFi, enhancing its ability to optimize computation for oracle updates and trade execution.

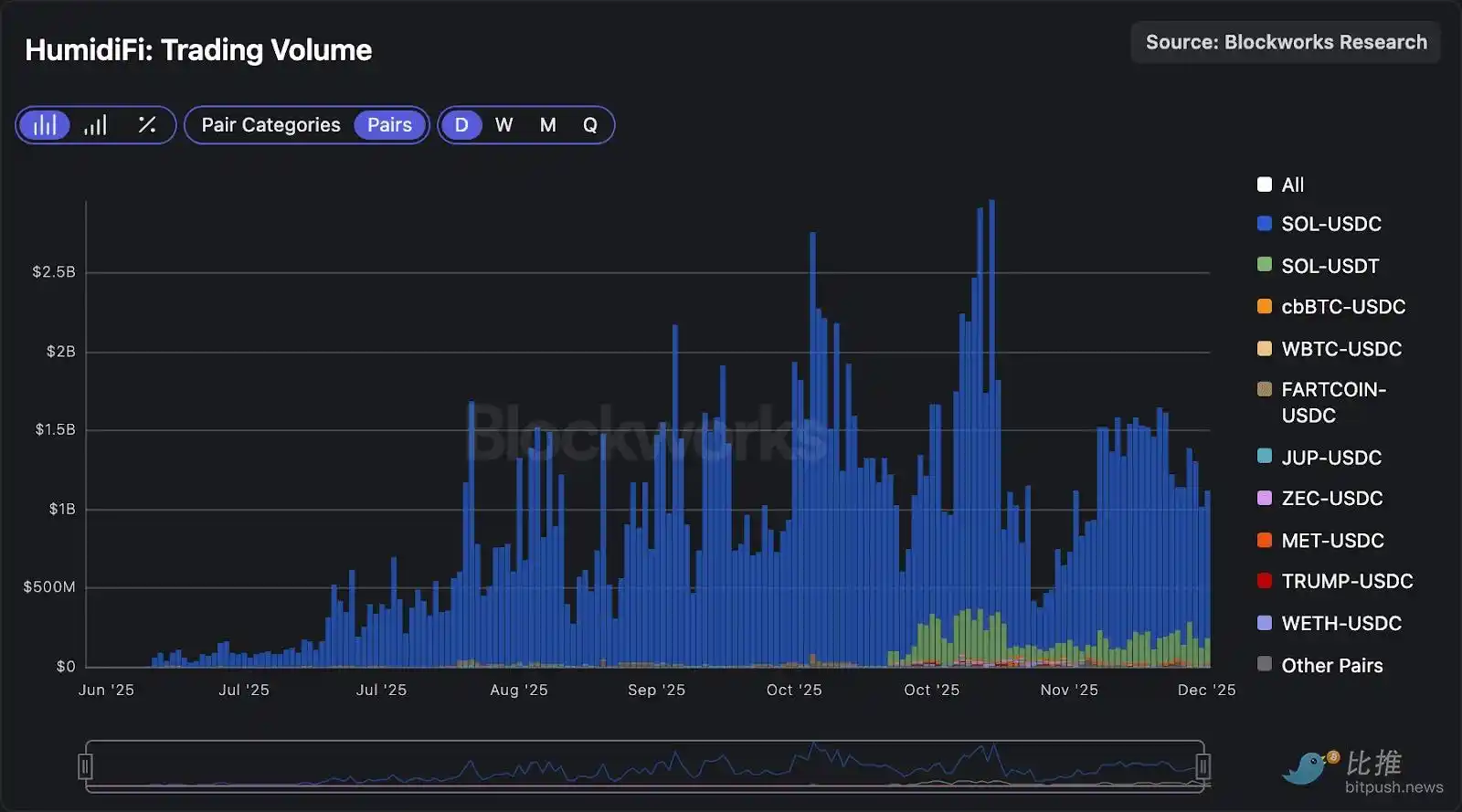

Although HumidiFi has 18 active liquidity pools, about 98% of its trading volume comes from the SOL-USDC (83.3%) and SOL-USDT (14.4%) trading pairs.

CEX>DEX Arbitrage is Shifting On-Chain

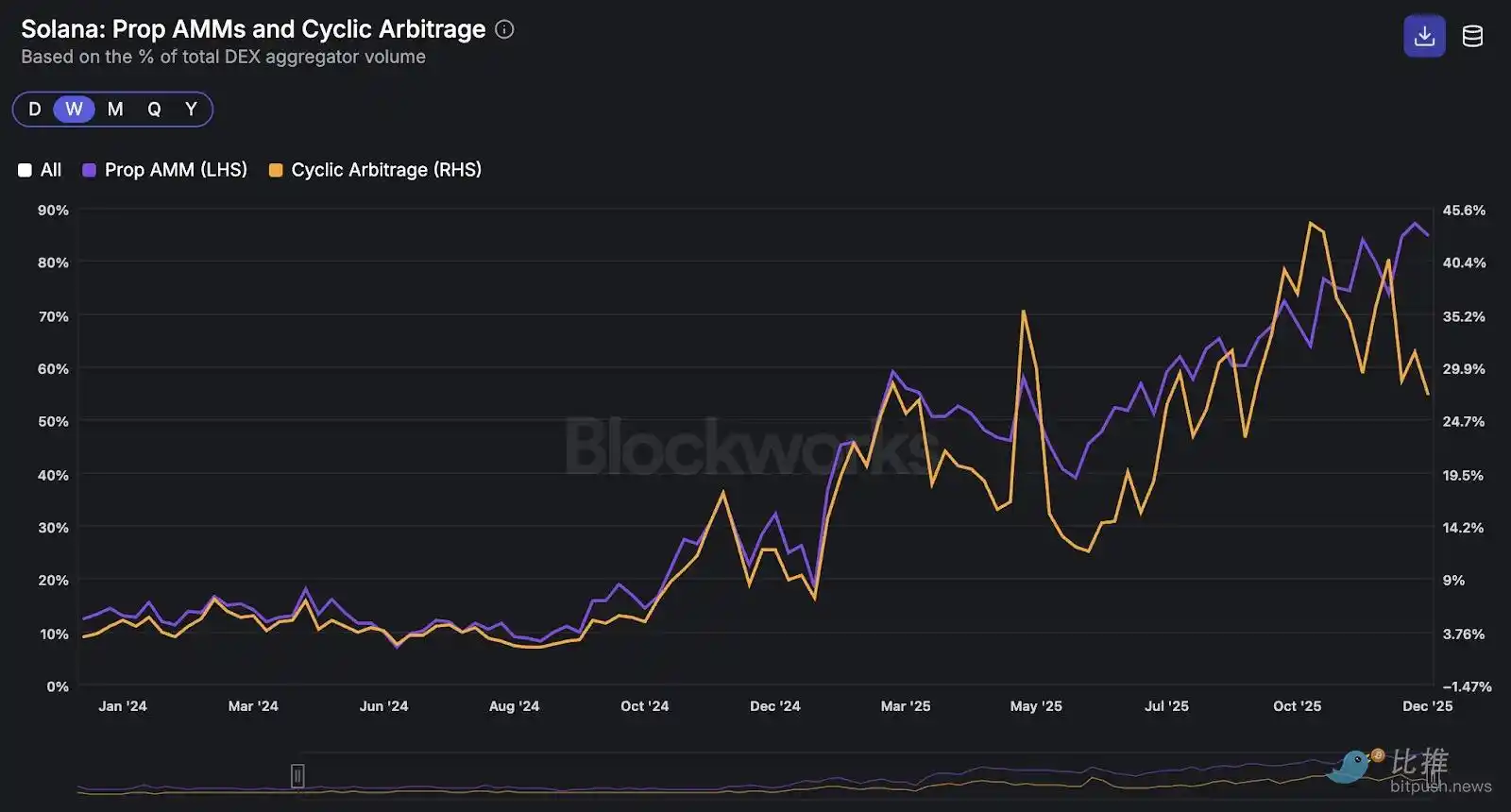

According to Dan Smith, Head of Data at Blockworks, one of the most interesting second-order effects of active market-making AMMs dominating SOL-USD trading volume is that the CEX>DEX arbitrage segment is shifting on-chain.

In the past, the situation was:

- On-chain price is $120, Binance price spikes to $125.

- CEX>DEX arbitrage bots would buy on-chain and sell on Binance.

- The arbitrage bot captures a $5 spread.

Now, the situation is:

- On-chain price is $120, Binance price spikes to $125.

- Active market-making AMMs quickly update their quotes to reflect Binance's $125 price.

- Arbitrage bots can now buy from the on-chain venue with lagging quotes and sell to the active market-making AMM.

- The arbitrage bot captures a $5 spread.

Since both the lagging on-chain venues and active market-making AMMs are on-chain, arbitrage can now be executed atomically in a single transaction, reducing the risk faced by traders. As a result, the number of arbitrage bots utilizing flash loans to capture these opportunities has increased.

The chart below shows a very close relationship between the percentage of trading volume through DEX aggregators of active market-making AMMs (left axis) and the percentage of trading volume belonging to circular arbitrage (right axis). Here, we define circular arbitrage as trades where the input and output tokens are the same, capturing the aforementioned arbitrage trades.

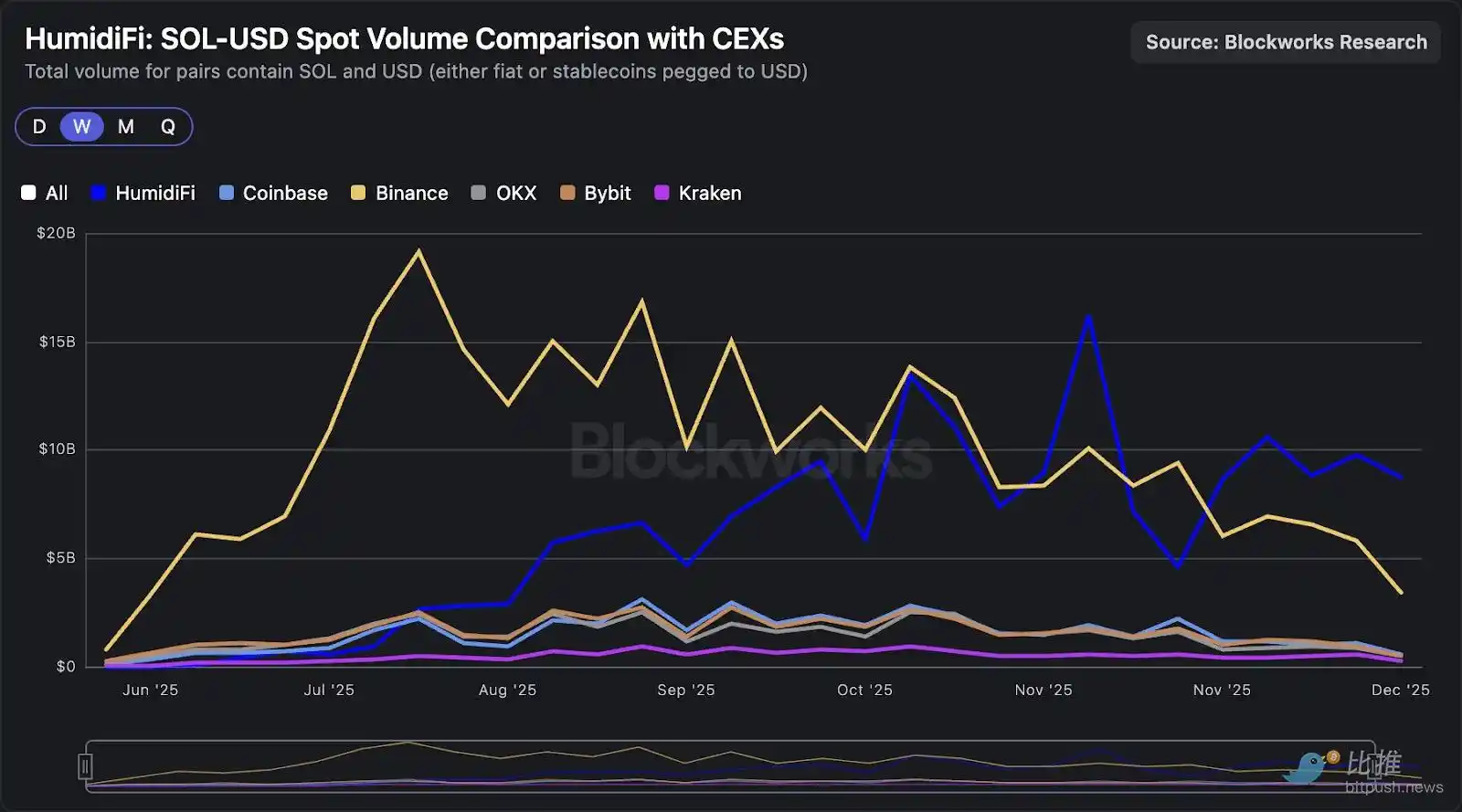

From this trend, active market-making AMMs currently have trading volume on SOL-USD pairs that exceeds CEXs. The chart below shows that over the past four weeks, HumidiFi's average weekly SOL-USD trading volume exceeded $9 billion, surpassing Binance and becoming the largest trading venue.

Oracle Progress

Active market-making AMMs adjust their pricing curves through oracle updates, making their quotes "fresher" than those of passive AMMs. Since the computational intensity of oracle updates is about 100 times lower than that of swaps, market makers in active market-making AMMs can quickly update their internal liquidity pool parameters multiple times per second, allowing them to offer narrower spreads than passive AMMs with aggregated liquidity.

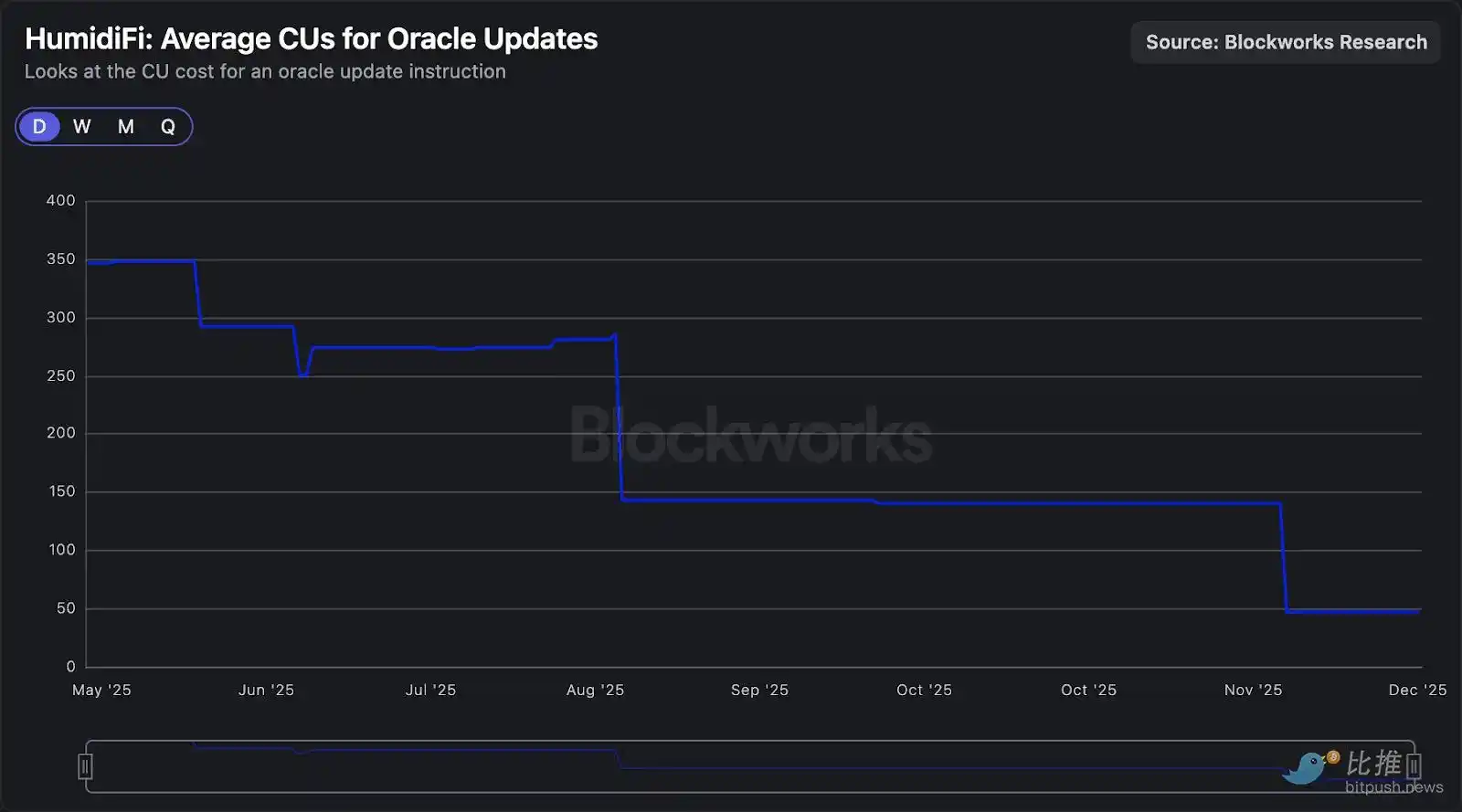

These oracle update transactions are highly optimized to consume as few computational units as possible. Since transactions in a block are prioritized based on the fees paid per CU, lighter oracle updates can achieve higher prioritization in a block at a lower total transaction cost. Transaction ordering is crucial because there is a race to update quotes before arbitrageurs take advantage. The chart below shows that HumidiFi has actively optimized its oracle update instructions, reducing the computational load to 47 CUs, a decrease of over 85% since its launch in June.

However, the above chart only considers the CUs consumed by the oracle update instructions themselves. A more relevant metric is the total CUs for transactions, as active market-making AMMs rely on complete transactions to update oracles, which includes any additional program calls and account processing overhead required for executing updates.

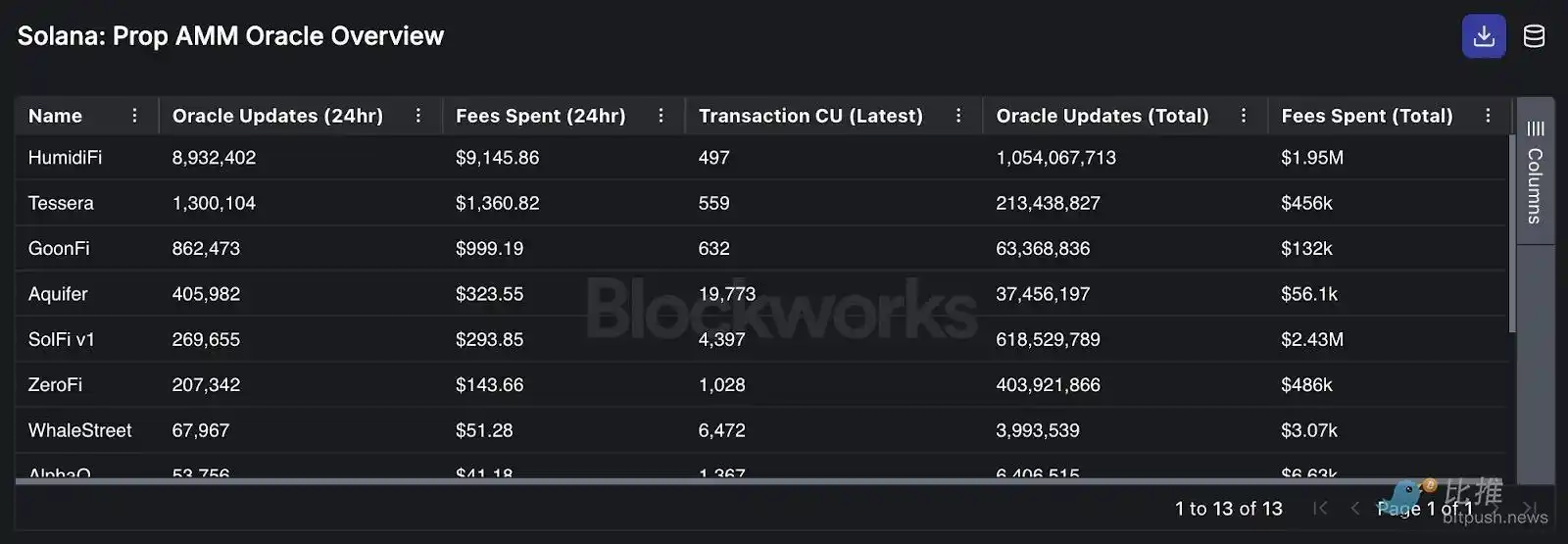

The table below shows that HumidiFi has reduced its oracle update transactions to 500 CUs, the lowest among its peers. Besides HumidiFi, only Tessera and GoonFi are below 1000 CUs.

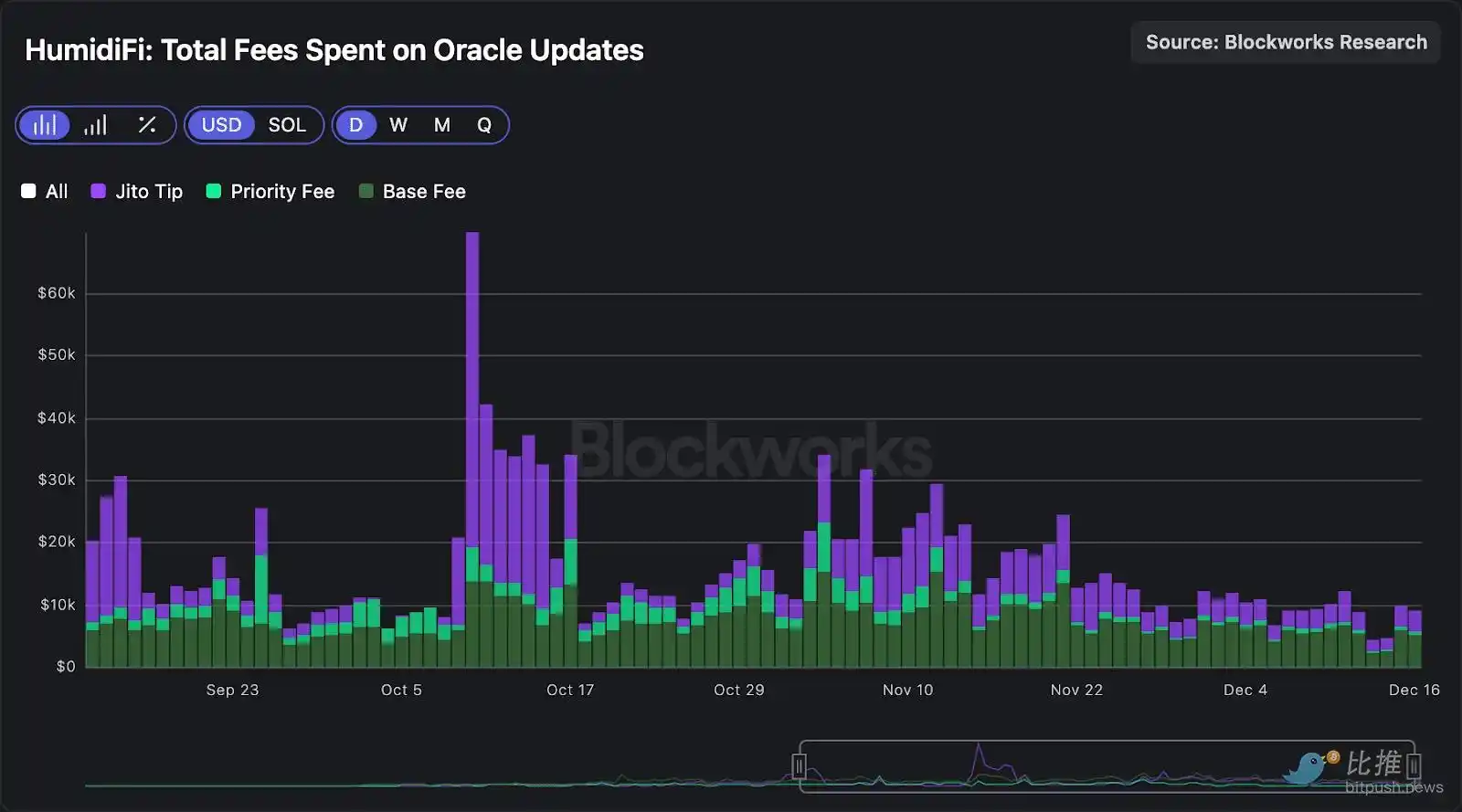

Although each oracle update transaction costs about $0.0016, since reducing the total computational load to below 500 CUs, HumidiFi has averaged about 6 million updates per day (approximately 70 times per second!). At this rate, HumidiFi spends about $9,000 to $10,000 daily on transaction packaging fees (base fees + priority fees + Jito tips).

HumidiFi's Revenue

While HumidiFi's revenue is not publicly disclosed, we can estimate it by observing the incremental token inventory since its inception. The core idea is that since HumidiFi essentially acts as a market-making counter (with only one LP in active market-making AMMs), every trade with it has a winner and a loser. Over time, the net inventory change of the market maker reflects trading profits and losses. Therefore, we can track the cumulative net trading flow of various tokens from HumidiFi's perspective as a proxy for its revenue.

The chart below shows the cumulative net trading flow of HumidiFi in SOL (from which 98% of its trading volume originates), amounting to approximately 25,000 SOL as of December 2, 2025. By measuring the daily changes in HumidiFi's SOL inventory and multiplying these balances by the daily SOL price, we estimate that from its establishment in June 2025 to December 2, its cumulative trading revenue is approximately $4.1 million, equivalent to an average daily gross revenue of about $24,000.

The above method estimates on-chain trading profits and losses, but if HumidiFi hedges its inventory on CEXs, and funding rates, fees, and hedging profits and losses occur off-chain, there may be discrepancies with the actual net income.

Another important caveat is that the above estimate reflects gross revenue. After deducting the daily oracle update costs of $9,000 to $10,000, HumidiFi's implied net income is approximately $14,000 to $15,000 per day. Again, this is just an estimate based on existing on-chain data. A more accurate revenue estimate would need to incorporate any off-chain hedging activities, as mentioned earlier.

Mark Price Spread Analysis: Active Liquidity vs. Passive Liquidity

Mark price spread is an indicator of execution quality and market maker adverse selection, and it serves as a useful assessment tool for active market-making AMMs competing with the same strategy (providing delta-neutral order book top liquidity).

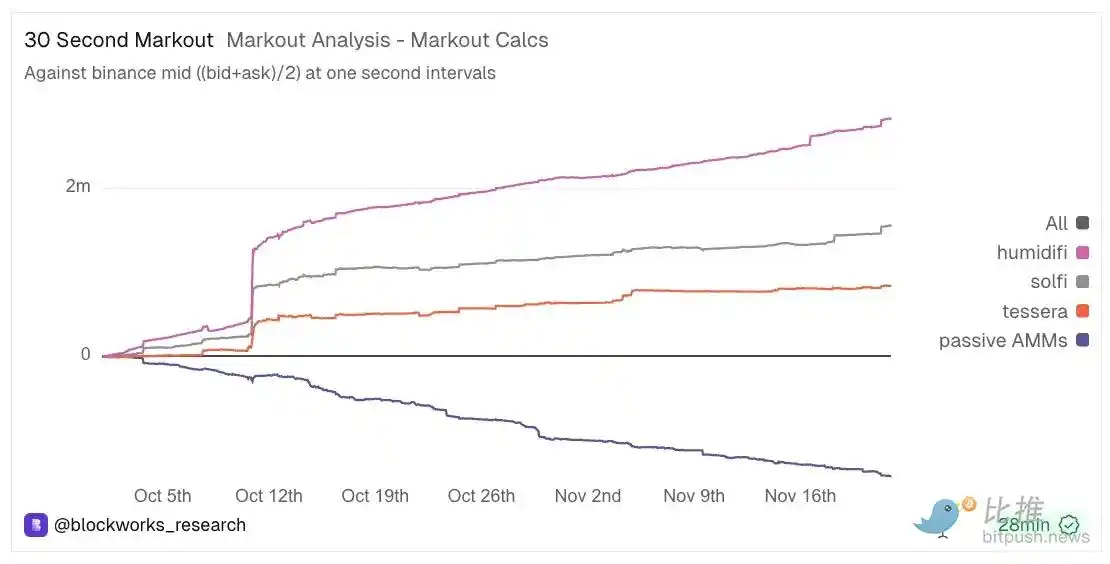

In this analysis, our data team focused solely on the SOL-USDC trading pair traded on HumidiFi, SolFi, and Tessera. Using a 30-second interval after execution, we compared the on-chain transaction price with the mid-price of SOL-USDC on Binance.

The profit and loss calculation formula is: `((Binance future mid-price – execution price) / execution price) * market maker direction * trading volume in USD`.

Here, the market maker direction is defined from the market maker's perspective: when the active market-making AMM buys SOL (the taker sells SOL to it), it is +1; when the active market-making AMM sells SOL (the taker buys SOL from it), it is -1. Additionally, it should be noted that using the Binance mid-price as a reference may introduce cross-venue basis and timing mismatches with on-chain execution, so the mark price spread should be interpreted directionally rather than as an exact breakdown of realized profits and losses.

The analysis period is from October 1, 2025, to November 22, 2025.

Cumulative positive profits indicate that market makers are executing soft/non-toxic flow, and the price moves in a direction favorable to the market maker within 30 seconds after the trade. Conversely, cumulative negative profits indicate adverse selection, meaning the price moves in a direction unfavorable to the active market-making AMM after the trade.

The chart below shows that during this period, the 30-second profit and loss for active market-making AMMs was positive, indicating that these active market-making AMMs successfully avoided toxic flow and captured spreads from benign users. We also included aggregated data from passive AMMs on Solana, showing that the mark price spread performance of active market-making AMMs significantly outperformed their predecessors.

SOL-USD Passive Liquidity: A Losing Game

Our mark price spread analysis indicates that active liquidity management can protect funds from toxic takers attempting to profit from mispriced assets.

The ensuing conclusion is that most of the SOL-USD trading volume on traditional passive AMMs is not "organic" user flow but rather arbitrage targeting outdated quotes. The curves of passive AMMs will always lag behind the rapidly changing reference prices in active market-making AMMs. This lag creates a mechanical opportunity for arbitrage bots to intervene and trade with passive liquidity pools when mispricing occurs.

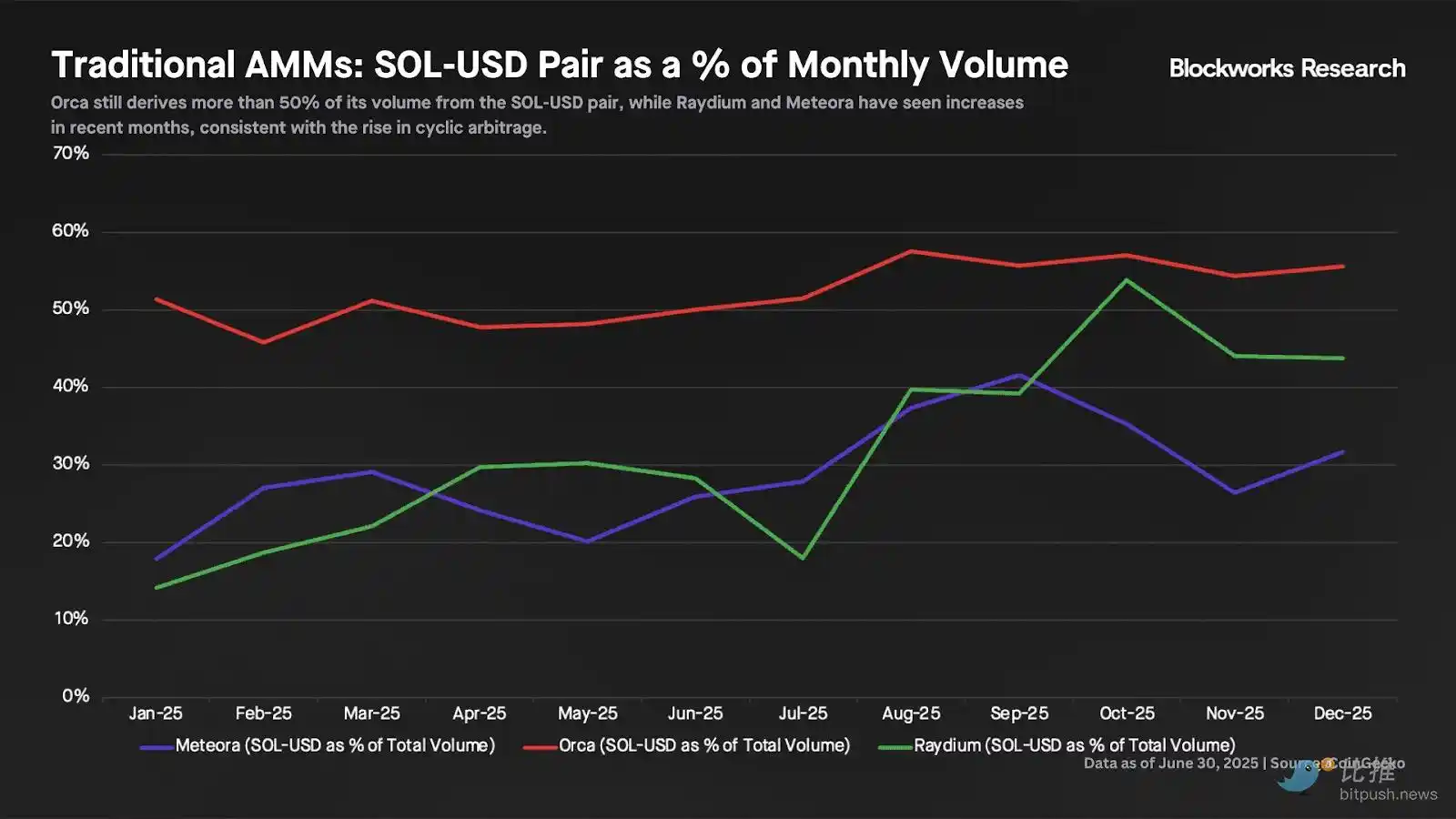

Observing the trading volume composition of traditional AMMs, Orca still has over 50% of its trading volume coming from SOL-stablecoin trading pairs. Meanwhile, the SOL-stablecoin trading volumes of Meteora and Raydium (which had previously been heavily skewed towards meme coins) have increased in recent months, consistent with the aforementioned trend of rising circular arbitrage shares.

Notably, newer AMMs like Pump's PumpSwap or MetaDAO's Futarchy AMM have not set up any active liquidity pools for high liquidity trading pairs like SOL-stablecoins.

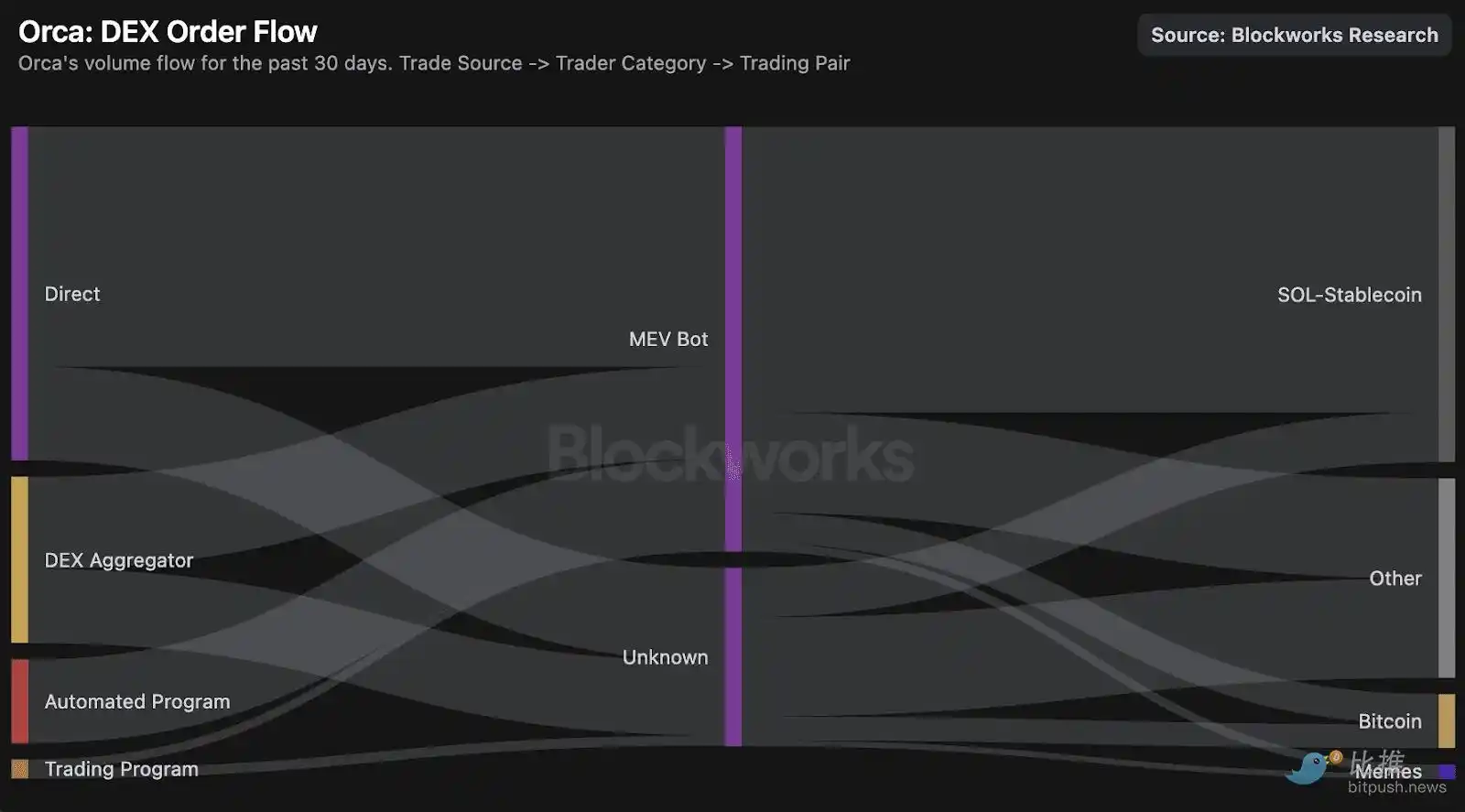

At a more granular level, the order flow chart shown below indicates that at least 85% of Orca's SOL-stablecoin trading volume can be attributed to "MEV bot" activity. However, most of the flow appears to come from Wintermute's public market-making bots rather than purely speculative arbitrage targeting outdated quotes.

In the absence of incentives and assuming participants rationally seek profits, LP capital on traditional AMMs for high liquidity trading pairs (SOL-stablecoin, stablecoin pairs, BTC-stablecoin, etc.) will naturally contract in the coming months.

Nevertheless, traditional AMMs can still play an important role in short-tail assets. In particular, they serve as a backup liquidity source that remains available even when active market-making AMMs withdraw liquidity during times of stress.

The End of Independent DEXs

Although this is a report about DEXs, one of the core points we want to convey is that the independent DEX model has already perished, except for active market-making AMMs. Cryptocurrency investors have historically tended to analyze protocols in isolation, partly because Ethereum has produced clear category winners: Aave in lending, Uniswap in DEXs, Lido in LSTs, and so on.

It is natural to apply the same mindset to Solana, but it does not work. First, the level of competition in Solana far exceeds that of Ethereum, and it is rare to see a protocol maintain a dominant position in its vertical for an extended period. Second, as we have shown throughout the report, Solana's market structure has pushed traditional passive AMMs toward long-tail assets, where they can support first-day liquidity and achieve on-chain price discovery.

The problem is that DEXs lack a moat, or at least they do not have one on their own. AMM liquidity is increasingly commoditized, and launching a new AMM with constant or concentrated liquidity pools is trivial. To win order flow as a traditional DEX, you must be closest to the end users, which means you must control the issuance channels and become the token issuance layer.

Following this logic, we will no longer view "winner-takes-all DEXs" as DEXs but rather as token issuance platforms. This model can take two forms:

- High-velocity launchpads for meme coins (e.g., Pump).

- ICO platforms for more legitimate projects to achieve on-chain capital formation (e.g., MetaDAO, Jupiter's DTF).

Launchpads

We have extensively reported on launchpads in the past, emphasizing the importance of controlling user relationships through a consumer-centric, mobile-first front end. However, one point we have not explicitly made is that the surge of launchpads disrupts passive AMMs almost as much as active market-making AMMs, but through different avenues.

Active market-making AMMs have captured market share in short-tail assets. Meanwhile, launchpads have become the token issuance layer for long-tail assets, controlling the issuance and order flow of these assets. Evidence of this disruption is that the three major passive AMMs on Solana (Raydium, Orca, Meteora) have all launched products related to launchpads in the past year.

Raydium:

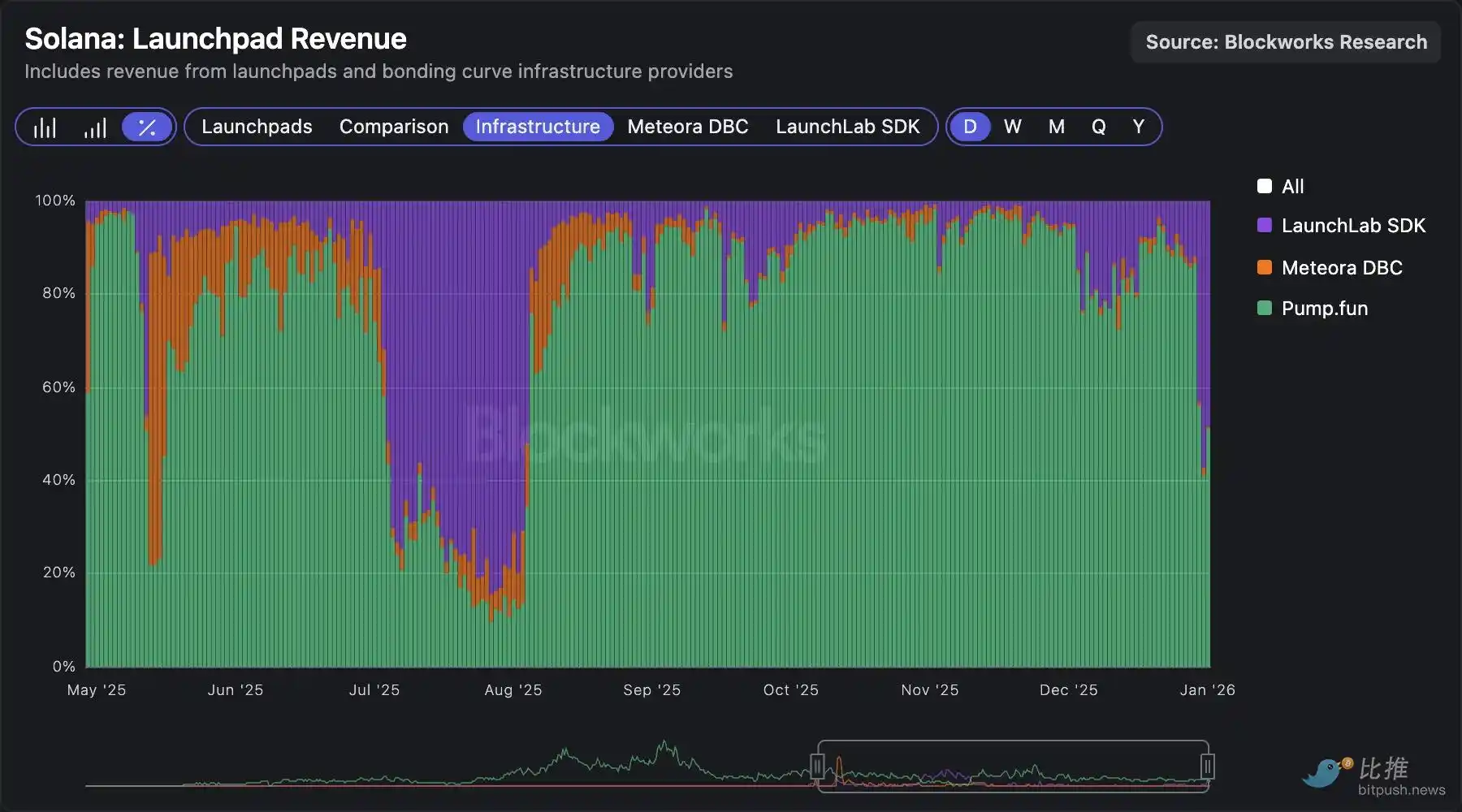

After Pump launched PumpSwap AMM and cut off Raydium's graduation token flow, Raydium responded with LaunchLab, a white-label solution that allows integrators to easily create their own launchpads. Raydium charges a 25 basis point protocol fee on the trading volume of any third-party launchpad built using LaunchLab, with graduation tokens redirected to Raydium's AMM.

Raydium's most famous client is Bonk. Although LaunchLab briefly regained some market share through Bonkfun in July 2025, Pump still maintains dominance, consistently capturing over 90% of the market share. LaunchLab has recently regained some share, but in the absence of clear structural catalysts, historical patterns suggest that these gains are more likely to be sporadic rather than sustainable.

Orca:

Orca has historically struggled to capture significant share in meme coin trading volume.

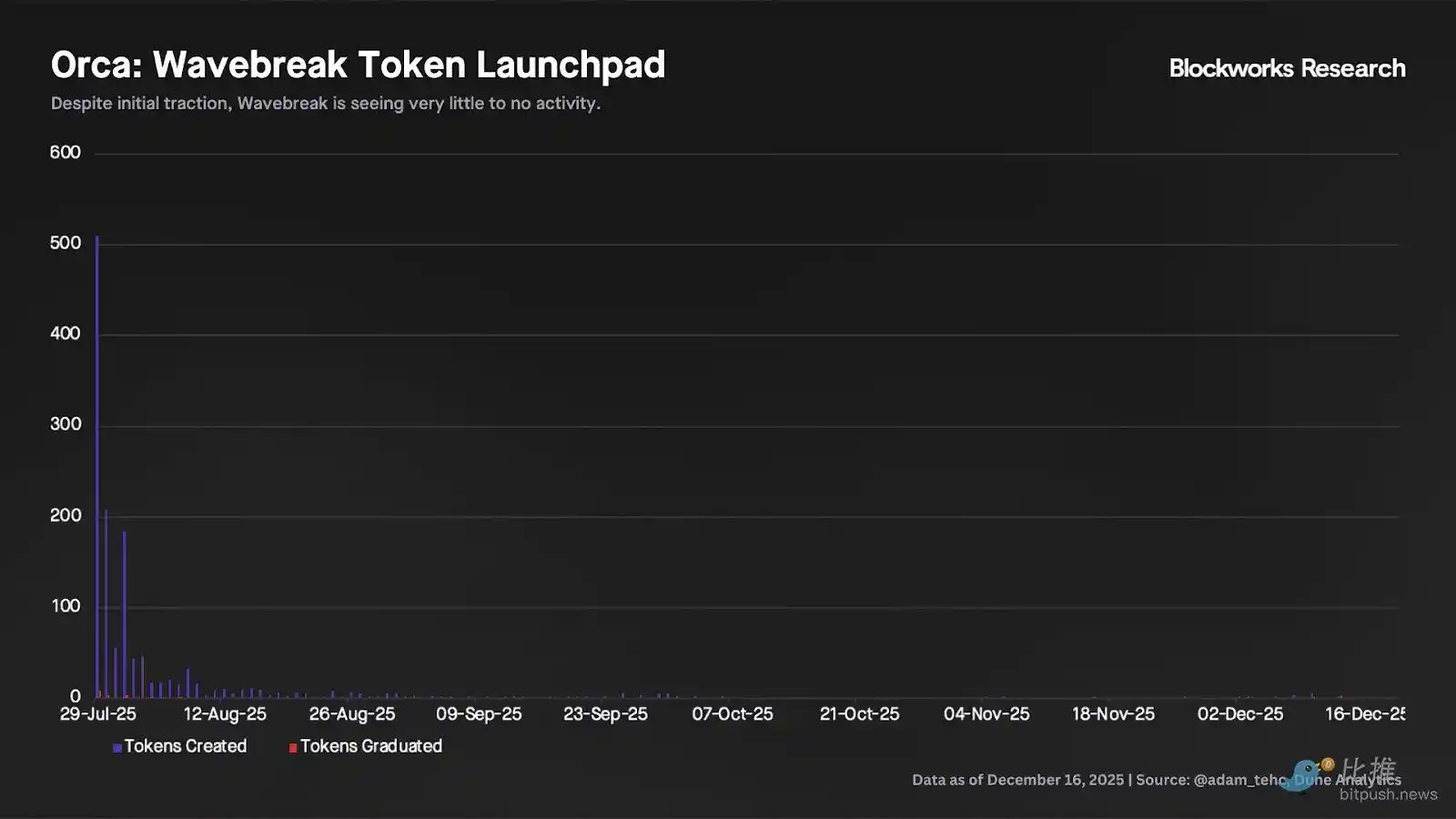

Since 2023, over 50% of its monthly trading volume has come from the SOL-USD trading pair, with the remainder increasingly dispersed among project tokens, stablecoin swaps, BTC-USD, and composite tokens. This positioning has put Orca in a difficult situation for over a year: as Pump-driven meme coin issuance accelerated in Q1 2024, it ceded ground to Raydium; and as active market-making AMMs took over all short-tail liquidity, the primary bullish argument for the protocol (its dominance in SOL-USD and other high liquidity trading pairs) was also undermined. In July 2025, Orca launched the Wavebreak launchpad, marketing it with "proprietary anti-bot technology," with DeFiTuna's TUNA as the first issuance. However, aside from initial post-launch attention, Wavebreak has seen almost no activity since late August 2025.

Meteora:

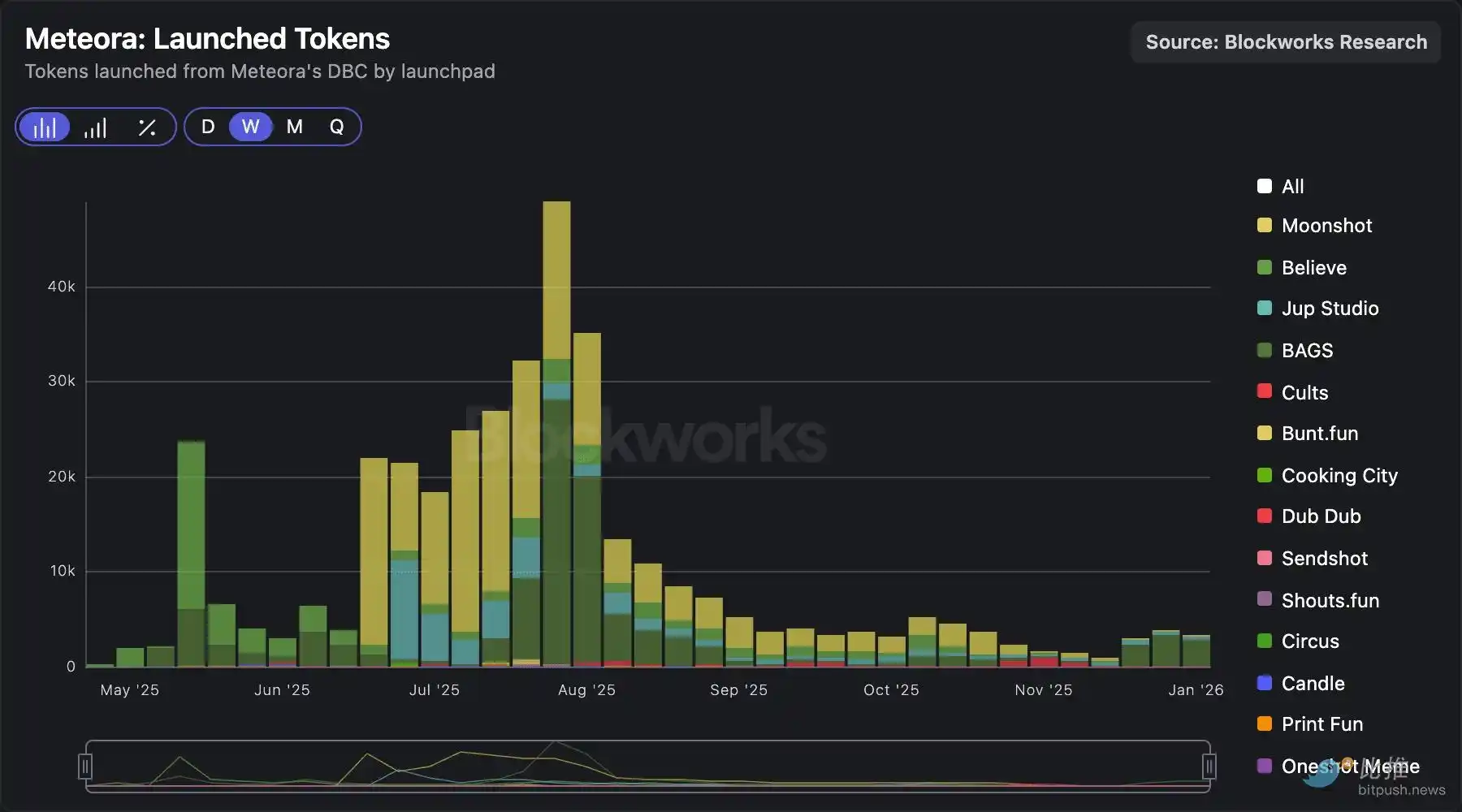

Meteora operates closely with the Jupiter team, which has become the entry point for most retail users conducting on-chain transactions. To expand its product range, Meteora partnered with Moonshot to introduce a launchpad in August 2024.

In April 2025, Meteora launched a dynamic bonding curve, capturing 20% of trading fees from launchpad activity. Since then, the team has introduced new partners, including Believe, BAGS, and Jup Studio. Nevertheless, Meteora's launchpad activity also seems to follow the same pattern as LaunchLab and Wavebreak. Despite a rebound through token issuance in Q2 and Q3 of 2025, usage has sharply declined since September.

Pump:

As mentioned above, Pump remains the dominant launchpad with a significant advantage.

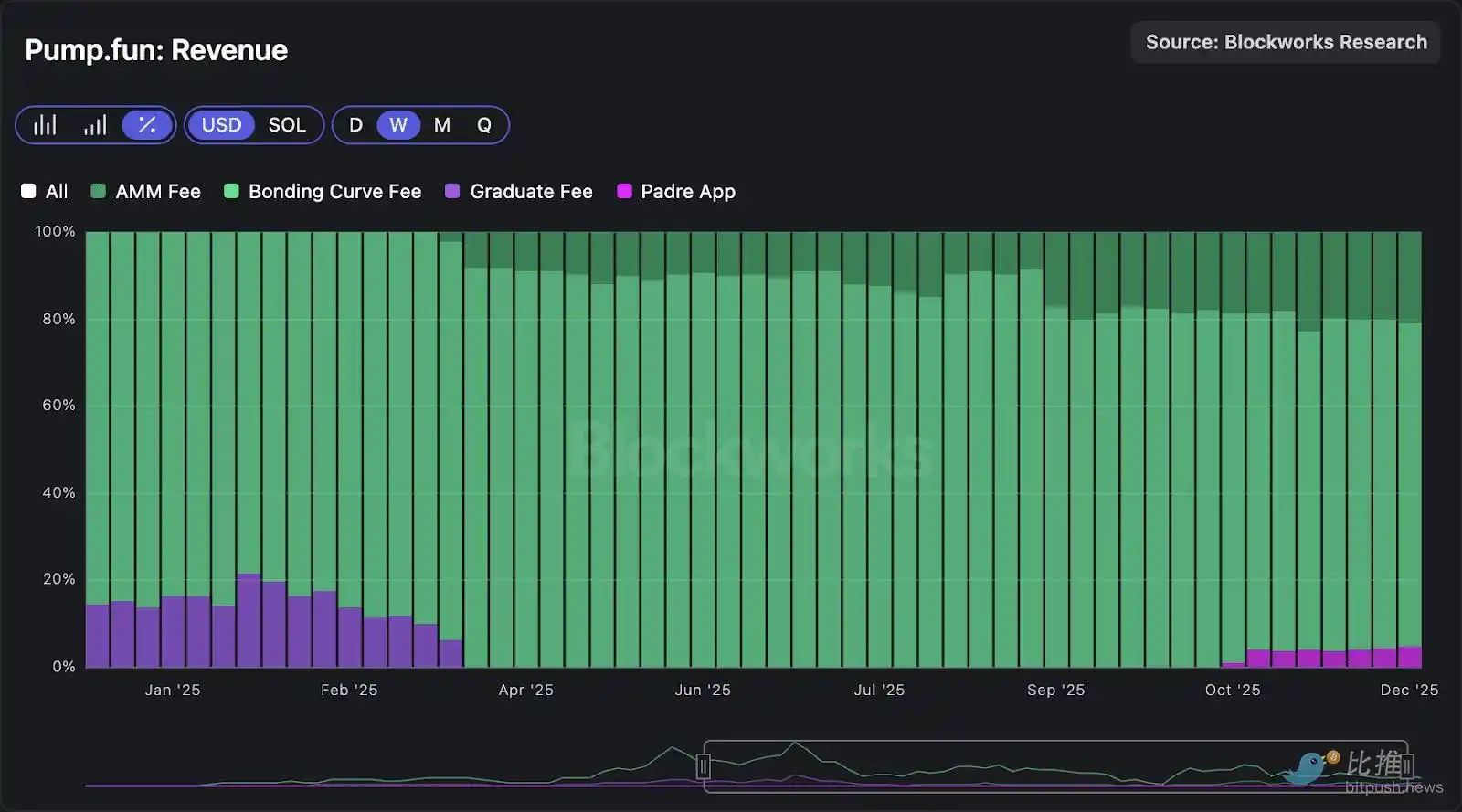

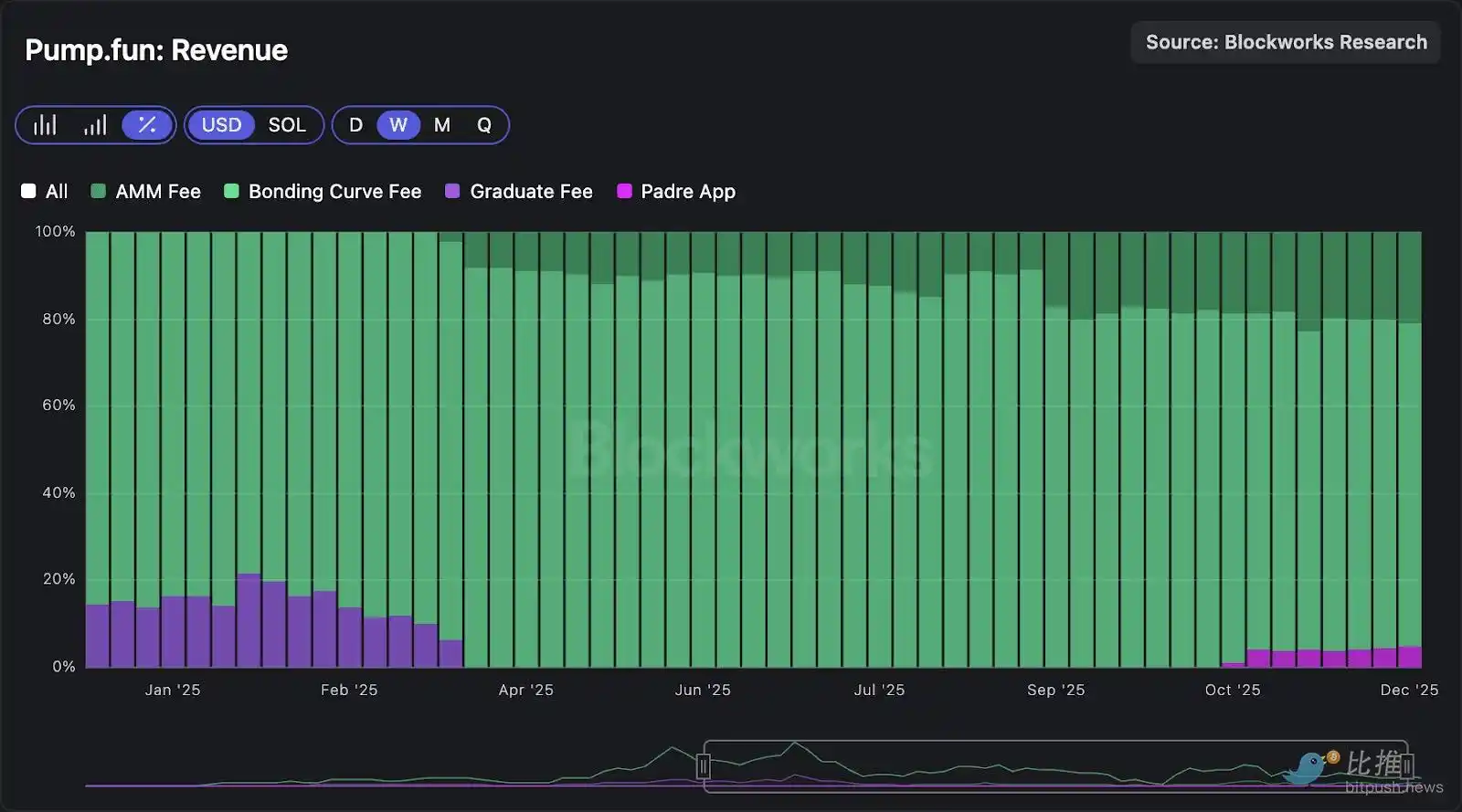

We have discussed this in detail in previous research, so here we will focus on the most interesting aspects. Pump can be seen as the first embodiment of vertically integrated DEX theory, built from the top down starting with issuance rather than the other way around. After securing issuance channels and order flow through its launchpad, Pump introduced its passive AMM to capture downstream trading activity. This integration has significantly diversified Pump's revenue sources, no longer relying solely on bonding curve mechanisms. The chart below shows that Pump is now monetizing activity across the entire token lifecycle, with AMM fees contributing over 20% of its total revenue.

ICO Platforms

In the past year, low-circulation tokens have been penalized in the liquidity market, and a more favorable regulatory environment has jointly driven the revival of ICOs. Unlike meme coin launchpads driven by high turnover of token issuance, curated ICO platforms, while also hoping for sustained issuance, place greater emphasis on the quality and reputation of founders, as well as the long-term retention of founders and investors.

MetaDAO:

We continue to stand by our argument that MetaDAO is the best-positioned protocol to win this market. As we summarized in our September report: "MetaDAO is built from first principles and is significantly different from other solutions in the market. Notably, MetaDAO aims to address one of the most important issues in today's industry: executable rights for token holders."

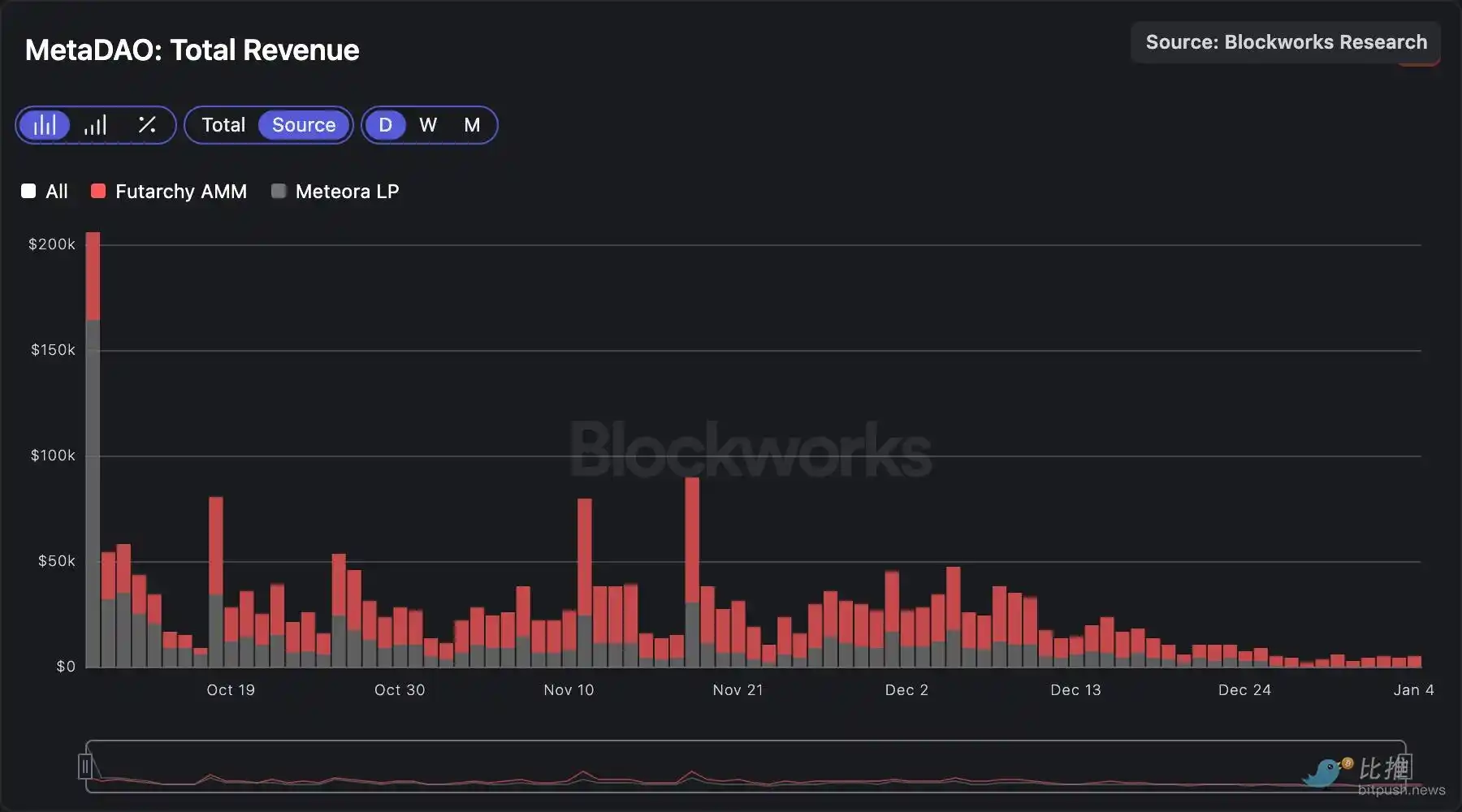

Unlike launchpads, MetaDAO does not have a bonding curve. Instead, it monetizes ICOs through swap fees on its Futarchy AMM and its LP positions on Meteora. The Futarchy AMM charges a 0.5% fee on trading volume, initially split evenly between MetaDAO and fundraising projects (e.g., 0.25% to MetaDAO, 0.25% to Avici). On December 28, the revenue-sharing ratio was retrospectively adjusted by agreement with the team, so that the entire 0.5% now belongs to MetaDAO.

Since the Futarchy AMM launched on October 10, MetaDAO has generated $2.4 million in revenue, with approximately 60% coming from the Futarchy AMM and 40% from its Meteora LP positions. MetaDAO may be the clearest embodiment of our "independent AMM extinction theory." No one views MetaDAO as an AMM. Nevertheless, the Futarchy AMM operates as the primary profit layer of the protocol, thanks to MetaDAO's control over the token issuance layer and its subsequent issuance channels.

Jupiter and Meteora:

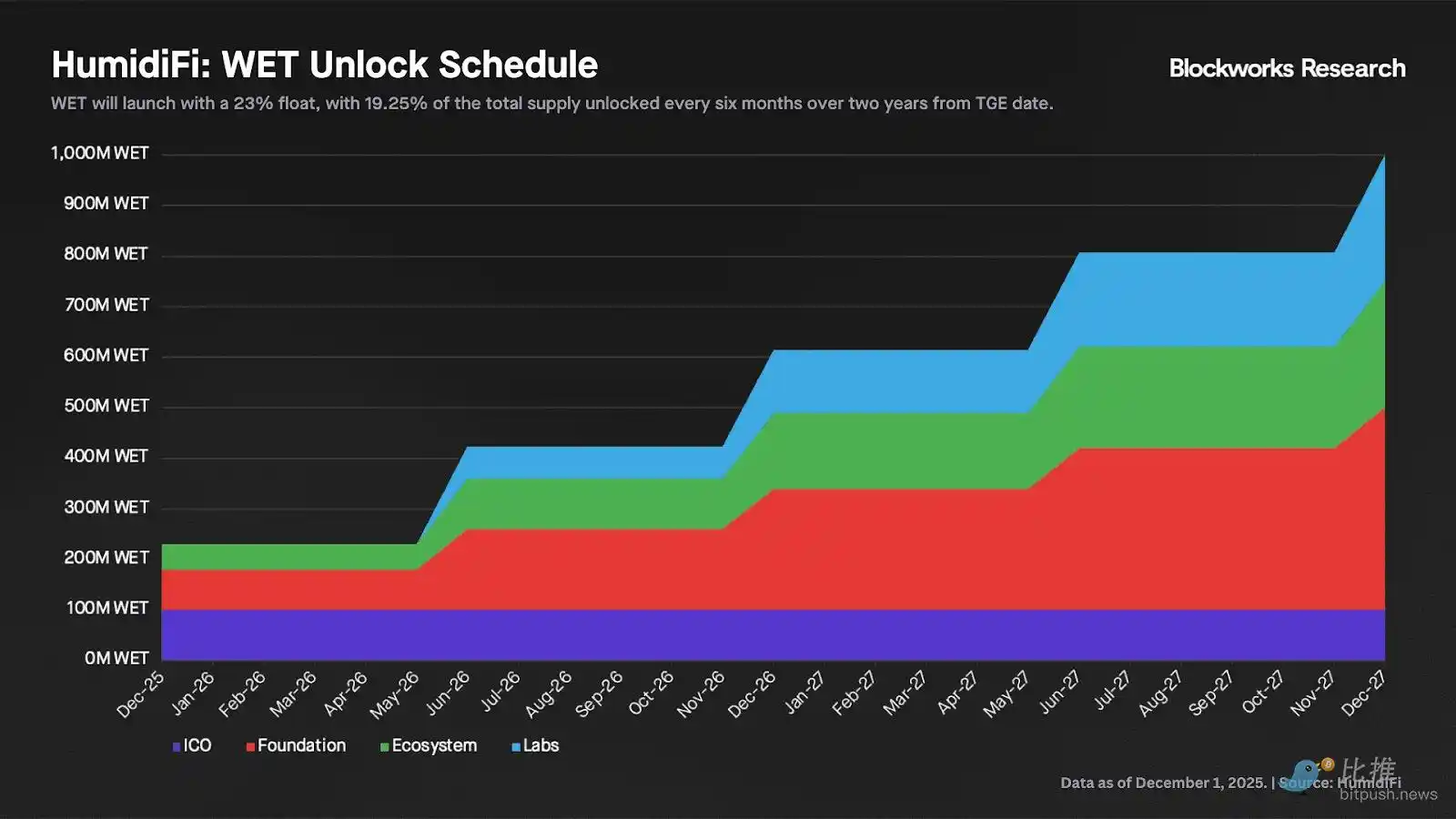

On December 3, Jupiter launched its decentralized token formation platform, with the first project being HumidiFi's WET. Projects issued through DTF must undergo a review and screening process by the Jupiter team, highlighting the methodological differences between high-velocity launchpads and curated ICO platforms.

The sale of WET is conducted in multiple phases on a first-come, first-served basis, with the first two phases priced at a fully diluted valuation of $50 million, and the public offering at a fully diluted valuation of $69 million. Notably, Jupiter has indicated that future issuances may attempt other sales mechanisms. After the sale concludes, any remaining allocation shares will be transparently locked using Jup Lock, and a liquidity pool will be established on Meteora immediately from a portion of the sale proceeds to ensure the token's liquidity.

Although Meteora's efforts in the launchpad space have not yielded results, we believe its positioning is better than Raydium and Orca due to its relationship with Jupiter, possessing superior issuance channels and business development capabilities. For example, Meteora has been chosen as the preferred venue for high-profile token issuances such as TRUMP or WLFI, despite the highly cyclical nature of the trading volume and revenue generated by such tokens.

Valuation Framework

While it is easy to value Solana DEX tokens based on historical price-to-sales ratios, the practical value of making such comparisons in isolation is limited. Simply labeling an asset as the "cheapest" among peers ignores the fact that the Solana spot trading landscape is still rapidly evolving, and future growth will be determined by where trading volume consolidates, not where it has historically accumulated. Therefore, understanding the direction of market structure is a prerequisite for any meaningful valuation analysis. Moreover, not all tokens are equal; some tokens provide stronger protections for token holders than others.

For investors looking to capture upside potential from the Solana spot trading landscape, we see two main paths:

1. Active market-making AMMs, which should continue to consolidate their share in short-tail assets. Although the SOL-USD trading pair currently drives most of the trading volume, we expect active market-making AMMs to also dominate other categories that will become important for Solana in the coming months, such as tokenized stocks.

2. Token issuance platforms with vertically integrated AMMs, where the AMM primarily serves as a profit layer for issuance. Depending on the risk exposure expected by investors, this bet can be expressed through high-velocity launchpads (like Pump) or ICO platforms that achieve on-chain capital formation (like MetaDAO). Given the current market environment, we are more optimistic about the growth prospects of ICO platforms for legitimate projects.

In this context, we find it increasingly difficult to justify a long-term bullish view for DEXs that do not fall into either of the above categories (the most obvious examples being Raydium and Orca).

Price-to-Sales Ratio

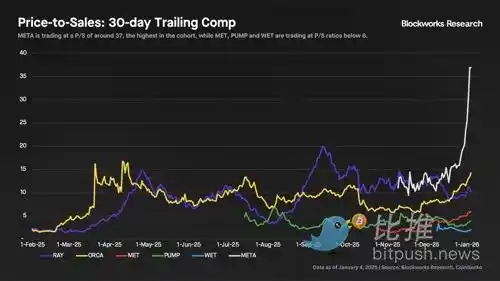

The chart below shows the circulating market cap price-to-sales multiples for the tokens discussed in this report. The first notable conclusion is that RAY and ORCA have become more expensive over time (with revenue declining faster than valuations), leading to their current P/S ratios of 10x and 14x, respectively. In contrast, PUMP and MET are trading at approximately 4x and 6x P/S, despite being better positioned in terms of issuance and growth prospects.

When estimating the price-to-sales ratio (P/S) for WET, we derive HumidiFi's revenue by applying a 0.5 basis point (0.005%) take rate to the trading volume. While this assumption provides directional reference value in peer comparisons, the estimate is not entirely precise due to the potential for HumidiFi's actual spreads to fluctuate significantly with market conditions. Within this framework, HumidiFi's price-to-sales ratio is approximately around 2x.

Meanwhile, META stands out as the "most expensive" token among its peers with a price-to-sales ratio of about 36x—this reinforces our view that decisions should not be made solely based on historical multiples. We believe that given META's clear protections for token holder rights and its forward-looking growth prospects, its premium relative to non-ownership tokens is justified. We have previously published a forward-looking valuation model for META.

However, META's current price-to-sales ratio of approximately 36x is significantly higher than its historical average (around 15x), indicating that the market is pricing in a series of recent catalysts in advance. Over the past week, META has risen by about 40%, driving the expansion of valuation multiples, while its recent revenue has actually declined due to a temporary slowdown in ICO activity over the past month. Looking ahead, the following developments are expected to drive a rebound in its revenue:

- The fee-sharing ratio for the Futarchy AMM has been increased from 0.25% to 0.50%;

- According to the Omnibus proposal, approximately 90% of META liquidity is migrating from Meteora DAMM v1 to Futarchy AMM;

- The upcoming Ranger ICO (scheduled to launch on January 6, 2026).

These catalysts, along with the upcoming permissionless issuance and mechanisms like STAMP, are expected to help its price-to-sales ratio gradually return to a more stable range as revenue returns to a growth trajectory in the coming months.

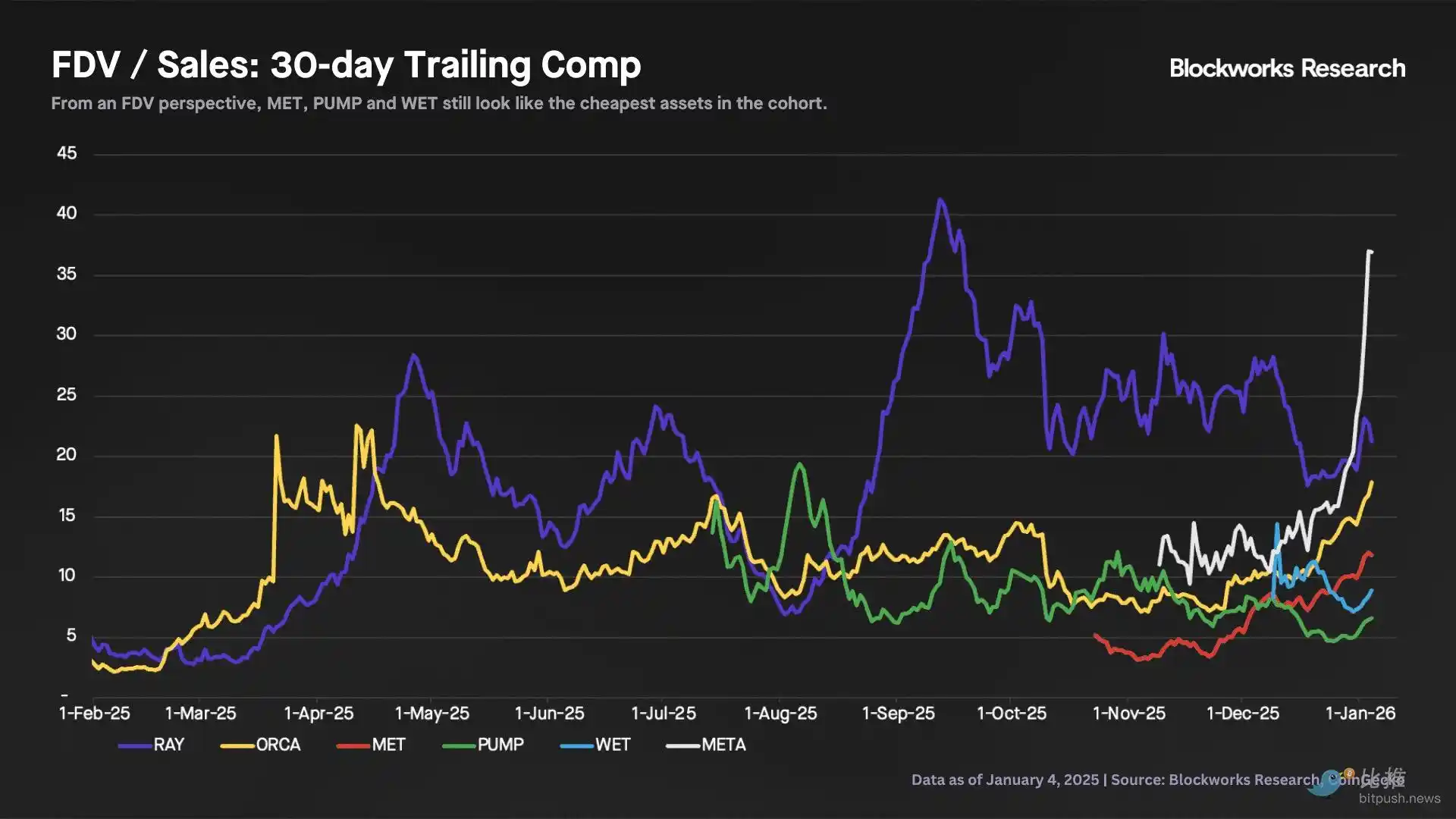

Fully Diluted Valuation (FDV) and Revenue Ratios

Based on fully diluted P/S, META and RAY are the most expensive among their peers. For Raydium, given its more challenging future trading volume trajectory and lack of lasting control over the issuance layer, we find it difficult to justify its premium. In contrast, MET, WET, and PUMP have the lowest multiples among their peers, at 12x, 9x, and 7x, respectively.

Adverse Selection of Liquidity Tokens

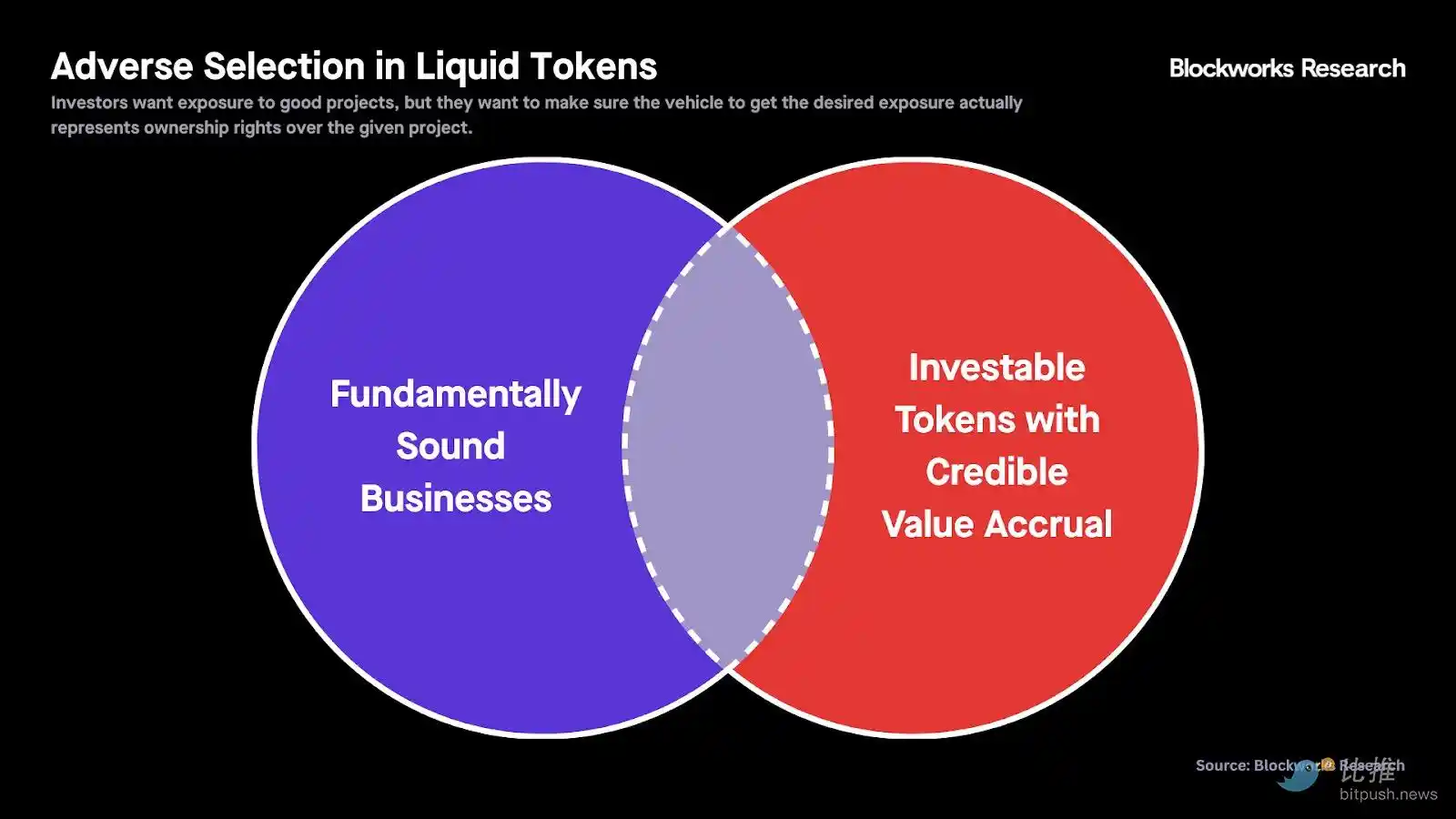

Overall, we observe a median P/S of 8x, with fully diluted valuation/revenue at 15x. While these multiples may appear low on the surface, the primary reason for the discount lies in the uncertainty surrounding token holder rights and supply dynamics.

Investors want to invest in fundamentally sound businesses but also want to be assured that holding the token provides ownership of that business. Specifically, they want to ensure that the team will act in the best interests of the project and token holders, and that the token has a credible claim to residual cash flows, assets, and legitimate recourse.

We believe that META enjoys a premium relative to its peers because it is one of the few assets that meets both criteria: a fundamentally sound business and an investable token with credible value accumulation. However, we expect that as revenue accelerates again in the coming weeks, the current ~36x P/S will converge towards ~20x. Otherwise, the recent price increase will be harder to justify based solely on fundamentals.

RAY is also an investable token. Raydium scores 38/40 in the token transparency framework, indicating that the project has fully disclosed its revenue sources, equity and token holder rights, advisory service providers, and core team members. It also has high trading volume, and the team programmatically uses 12% of the swap fees to repurchase RAY.

The issue with Raydium is that its high multiple relative to peers fundamentally diverges from its growth prospects. Revenue is declining faster than its valuation, and in the absence of clear structural catalysts, it is difficult to explain why this trend would reverse. Notably, Orca faces similar structural issues as Raydium; while one can argue for ORCA as an investable token, its growth prospects are similarly constrained.

An interesting observation is that, aside from ownership tokens, the only credible signal the team has communicated to the market that they care about the token has been buybacks (RAY, PUMP, ORCA, MET)—even though this is not the optimal use of capital. Pump has spent approximately $230 million to repurchase about 17% of the circulating supply of PUMP, yet the token's trading price remains about 3 times its historical P/S. Meanwhile, Meteora has spent about $12 million to repurchase nearly 3% of the total supply of MET, with a slightly higher trading P/S ratio of 5x.

Even if you present compelling reasons for the growth prospects of Pump and Meteora as businesses, both tokens face challenges in justifying their discounted trading. Regarding Pump, it remains unclear how value is allocated between the token and equity for public market participants, and whether token holders have rights to Pump's treasury. Regarding Meteora, as part of the team's and ecosystem's reserve allocation, approximately 7.2 million MET tokens are unlocked each month, which could translate into selling pressure. For example, at the current valuation of $280 million, these unlocks could translate into $2 million of potential selling pressure each month.

Nevertheless, while the challenges faced by both tokens may justify their discounted trading, RAY and ORCA trade at multiples more than twice that of PUMP and MET, while having lower growth prospects, which may indicate a mispricing in the market and provide attractive opportunities for relative value pair trading.

Finally, HumidiFi's WET also faces similar issues. HumidiFi is the dominant and fastest-growing DEX on Solana, and theoretically, WET is the only liquidity avenue to gain exposure to active market-making AMMs. However, investors have to (to some extent blindly) trust that the team will not abandon the token.

In terms of token utility, users will be able to stake WET to receive fee rebates, and the team has explicitly stated that "WET is not and should not be viewed as an investment." If the team aligns its interests with the token in the long term, it is easy to argue that WET is currently undervalued, despite its low circulation. However, the problem is that public market participants cannot determine whether WET is a meme coin or an investable token with credible value accumulation. Therefore, its trading price is below what it could potentially be.

Nonetheless, considering the quality and track record of Temporal as a long-term builder in the Solana ecosystem, we believe the team is more likely to pursue growth and value accumulation consistent with WET. This is ultimately a subjective judgment and should be approached with appropriate caution. Even so, on a risk/reward basis, we believe that before the unlock begins in June 2026, WET has greater upside potential than RAY, ORCA, PUMP, and MET, at least in the short term.

Risks

Each project for which we hold a constructive view has a unique set of risks, outlined as follows:

- HumidiFi: As mentioned earlier, the primary investment risk remains the lack of clarity regarding WET's value accumulation. Beyond the token design, there are risks associated with HumidiFi's competitive position in the active market-making AMM space. So far, HumidiFi has benefited from Temporal's deep technical expertise and vertical integration at the infrastructure layer. However, a decisive advantage of today's active market-making AMMs is on-chain composability: since both the venues with delayed quotes and active market-making AMMs are on-chain, arbitrage can be executed atomically in a single transaction, significantly reducing execution risk. In this regard, the recently introduced composable RFQ product by Titan may narrow the gap between RFQ and active market-making AMMs, potentially putting pressure on the market share of active market-making AMMs in the coming months.

- Pump: Setting aside the previously discussed token issues, Pump's dominance in the high-velocity launchpad category is indisputable. A more relevant concern is the sustainability of its revenue, with a common worry being that meme coins may be in a long-term decline. On-chain data shows that despite the overall market weakness, revenue has remained resilient in recent days, hovering around $900,000 per day. However, this has also raised questions about data quality and sustainability. Current bonding curve activity appears to remain healthy, with approximately 1 to 2 million transactions per day. Nevertheless, there is growing skepticism about whether this demand might be externally subsidized; while this claim remains speculative, it undoubtedly increases uncertainty surrounding long-term revenue prospects.

- MetaDAO: While we remain optimistic about META and believe that MetaDAO is the most differentiated ICO platform, execution risk still exists, particularly regarding the pace of issuance. In our September base case, we anticipated about 5 ICOs per month. As of now, it has been over a month since the last issuance, and there are no ICOs scheduled for December 2025. Nevertheless, the Ranger ICO should be able to accelerate revenue growth again. There has been ongoing internal and public discussion within MetaDAO about whether to maintain a fully curated model or attempt permissionless issuance. We believe that while the latter carries the risk of lower project quality, it is a necessary experiment to increase throughput and validate the platform's scalability, and it is likely the direction the team will ultimately choose. We also believe that Colosseum's STAMP will bring sustained, high-quality issuance to MetaDAO, complementing the permissionless issuance.

- Meteora: While Meteora clearly benefits from Jupiter's issuance channels, an important nuance is that the two protocols maintain independent tokens. Therefore, how much of the growth driven by Jupiter's front end ultimately belongs to MET rather than JUP is not clear. Even if the team's interests are highly aligned, if Meteora continues to primarily position itself as a back-end liquidity infrastructure while Jupiter captures most of the user traffic and interface-level value, then MET's lower multiple may also be justified.

Final Conclusion

This report has outlined the current landscape of spot trading on Solana. The core conclusion is that we expect the market to continue to differentiate: active market-making AMMs will continue to dominate the short-tail high liquidity market, while passive AMMs will increasingly focus on long-tail assets and new token issuances.

Both active market-making AMMs and passive AMMs can benefit from vertical integration, but in opposite directions.

Passive AMMs are moving closer to the user end through token issuance platforms (such as Pump-PumpSwap, MetaDAO-Futarchy AMM); while active market-making AMMs are extending upstream in the supply chain, focusing on trade execution services (such as HumidiFi-Nozomi). The losers in this trend will be traditional AMMs that have limited control over end users and lack persistent issuance-driven order flow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。