| Hot News |

1: [The U.S. Senate will review the cryptocurrency market structure bill this week (January 15), which may become an important turning point for regulation]

2: [South Korea ends 9-year corporate cryptocurrency ban, listed companies can invest 5% of their capital to purchase cryptocurrencies]

How to view Bitcoin and Ethereum today? Many people have been confused by the fluctuating market in recent days. Tommy mentioned the range position of 90400-91500 yesterday, which successfully captured a 1000-point move, and the Ethereum range of 3080-3180 also captured a 100-point move. Recently, the incremental funds in the Bitcoin and Ethereum markets are limited, coupled with the surge in A-shares and small yellow croaker, the speculative funds in the entire market have been withdrawn. The A-share market has already seen 17 consecutive days of gains, with daily trading volume breaking 30 trillion again. Currently, Bitcoin is in a range consolidation after a pullback confirmation; structurally, it is neither a casual chase for gains nor a mindless panic sell-off.

BTC: Bitcoin has been fluctuating in the range of 90000-91000 since yesterday, and is now in a second pullback confirmation. The signs of a morning rally indicate that although the entire market is moving slowly, the bullish support below is still effective. The current operational range is 90400-92100; for intraday operations, we still focus on the support pullback below, and as long as it does not break, we can enter long positions. If the pressure above does not achieve a breakthrough with both volume and price, we should take profits in a timely manner.

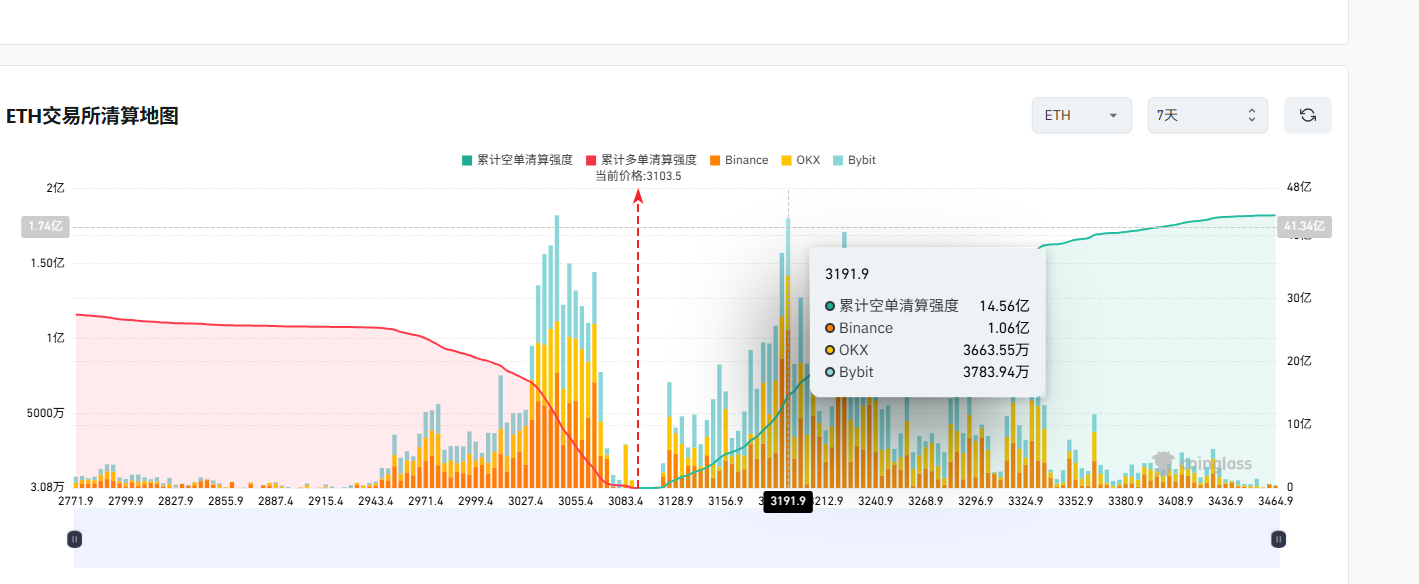

ETH: From the trading volume of Ethereum this week, the overall market is weaker than Bitcoin. The range position still focuses on the support at 3080-3180 and the breakout situation above. As long as the structure does not deteriorate, every pullback that does not break support indicates that the bullish strength is still present. After the pullback, if it does not break effective support but instead oscillates repeatedly at important support levels, our core strategy is to primarily buy on pullbacks. The premise is that this sideways consolidation allows the main force to repeatedly test our patience and emotions. Currently, the entire market is characterized by typical technical and price movement logic. As long as we do not break our range operation model, we can primarily focus on buying on pullbacks.

In summary, today's intraday operation: The daytime lacks liquidity, waiting for the U.S. stock market to open. The daytime is in a narrow range of fluctuations; take a little profit and leave, don’t be greedy. Avoid being washed back and forth by this sideways movement; we won’t panic when the new trend direction erupts.

So, buying on pullback support and shorting on rebounds to take a little profit is the most stable rhythm for today.

In this round of the bull market, I have repeatedly emphasized that I believe the underlying logic of the cryptocurrency market has changed. The factors determining market trends will be more complex than before, and this complexity is something investors have not experienced in previous bull and bear markets. I am Tommy, a companion in the B-circle who trades while cultivating. If you want real-time entry points and personalized strategies, click on my homepage to join the community. We have professional real trading teachers accompanying you around the clock to help you maintain your mindset; don’t bear it alone.

Points are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Finally, everyone should remember the two key points I mentioned in my last article this week: focus on trial positions in the short term, and once we deviate from our target range, it will be the last opportunity to make significant profits before the end of the year. I am K-line Life Tommy, your real-time cryptocurrency steward, mainly focusing on spot, contracts, BTC/ETH/ETC.

Specializing in style: K-line trading

Original volume trading strategy.

Short-term wave highs and lows, medium to long-term trend trades, daily extreme pullbacks, weekly K-top predictions, monthly head predictions.

WeChat public account QR code (K-line Life Tommy)

Warm reminder: The only WeChat public account at the end of the article is created by the author!!

Please be cautious in distinguishing between true and false, thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。