Original Title: "Hong Kong RWA Regulatory Practices and Representative Projects | A Series of Articles on RWA from Traditional Finance - by W Labs Brian"

Original Source: Guatian Laboratory Wlabs

This article will detail Hong Kong's RWA regulatory practices and representative projects

In early August 2025, Hong Kong's RWA and stablecoin sectors reached their hottest peak in nearly five years. At that moment, the entire city was filled with a passion not seen since 2017-2018: executives from traditional financial institutions, AI entrepreneurs, and even leaders of industrial capital flocked to Hong Kong in search of Web3 integration paths, with discussions on tokenized government bonds, cash management tools, and stablecoin legislation filling dining rooms and hotel lobbies. A Wall Street banker who had just moved from New York to Hong Kong candidly stated: in terms of the density of crypto topics and breadth of participation, Hong Kong has replaced New York as the hottest blockchain city in the world.

However, just over two months later, market temperatures plummeted sharply. There were clear signs of tightening policies from mainland regulators regarding the RWA transformation of mainland financial institutions and assets heading to Hong Kong. Several mainland physical asset tokenization projects that were poised to launch were postponed or shelved, and trading volumes for some RWA platforms with Chinese backgrounds dropped by 70%-90%. Once regarded as the "global leader," the heat of Hong Kong's RWA seemed to slide from the height of summer into the depths of autumn, raising temporary doubts about Hong Kong's status as an international Web3 hub. On November 28, 2025, the People's Bank of China led a meeting with 13 national-level departments, including the Central Financial Office, the National Development and Reform Commission, and the Ministry of Justice, to establish a "Coordination Mechanism for Combating Virtual Currency Trading Speculation." For the first time, the meeting included stablecoins in the regulatory scope of virtual currencies, clarifying that activities related to virtual currencies are illegal financial activities, emphasizing that they do not possess legal tender status and cannot be used for currency circulation.

The tightening of mainland regulations, while affecting mainland clients to some extent in the short term, with restrictions on capital outflow, led some mainland institutions to suspend their Hong Kong RWA businesses. However, Hong Kong's unique "one country, two systems" framework, with its independent regulatory framework, theoretically should not be influenced by mainland policies. This does not represent a fundamental shift in Hong Kong's RWA policies but rather another manifestation of the "high-temperature cooling - structural repositioning" cycle that has repeatedly occurred in Hong Kong's RWA sector over the past two years. Looking back at 2023-2025, three stages of evolution can be clearly outlined:

2023 - H1 2024: Regulatory Opening and Sandbox Testing Period

The HKMA launched Project Ensemble, and the SFC continuously approved multiple tokenized money market ETFs and bond funds. Local licensed platforms like HashKey and OSL obtained virtual asset VA licenses, officially establishing Hong Kong as a "regulated RWA testing ground."

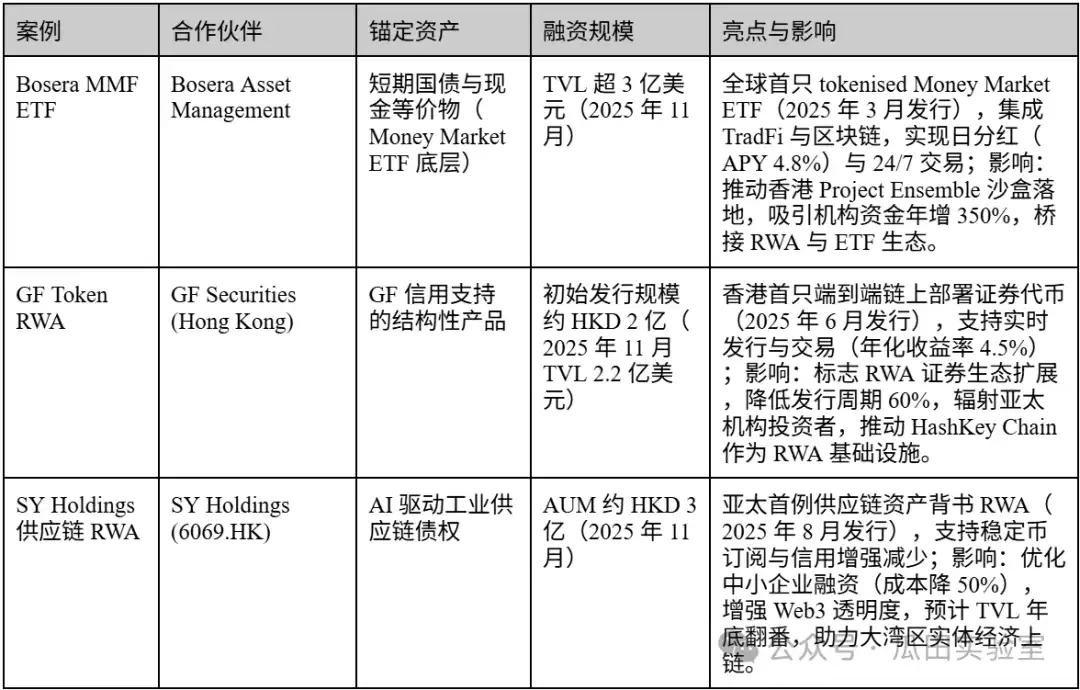

H2 2024 - July 2025: Explosive Growth Period of Internal and External Resonance

The passage of the U.S. "GENIUS Stablecoin Act," the onset of the Federal Reserve's interest rate cut cycle, and the Trump administration's clear pro-crypto stance, combined with the release of Hong Kong's local stablecoin legislative consultation document, triggered a surge of global funds and projects. The Bosera - HashKey tokenized money market ETF, XSGD, and several tokenized private credit funds saw their AUM soar from tens of millions of dollars to the billion-dollar level within just a few months, making Hong Kong briefly the fastest-growing market for RWA globally.

From August 2025 to Present: Limited Participation and Risk Isolation Period

Mainland regulators adopted a more cautious attitude towards cross-border asset tokenization, clearly restricting the deep involvement of mainland institutions and individuals in the Hong Kong RWA ecosystem, objectively cutting off the previously main sources of incremental funds and assets. Local and international capital in Hong Kong continued to be allowed to participate fully, but the growth momentum shifted from "mainland assets on-chain" to "local + global compliant funds allocated to U.S.-led on-chain assets."

The underlying logic of this cyclical cooling is the dynamic balance that decision-makers maintain between "participating in the new order of the global digital economy" and "preventing systemic financial risks." Hong Kong's role has been redefined as: limited by local resources, fully connecting with the U.S.-led blockchain economic network while building a firewall to prevent risk transmission to the mainland.

This means that the Hong Kong RWA market has not entered a recession but has entered a clearer and more sustainable third phase: shifting from the previous "barbaric growth" to a new pattern of "compliance-led, DeFi integration, and global funds connecting to U.S. on-chain assets." Purely on-chain, high transparency, low-risk cash management-type RWAs (money market funds, tokenized government bonds) will continue to grow rapidly, while the path of physical RWA that heavily relies on mainland assets and funds will be significantly compressed.

For practitioners, the short-term pain brought about by policy fluctuations is inevitable, but the compliance space remains ample. Especially, the brief window of U.S. regulatory tolerance towards DeFi, combined with the legal on-chain services that licensed platforms in Hong Kong can provide, creates a rare overlapping advantage, offering a valuable strategic runway for further deepening on-chain liquidity, structured products, and cross-chain asset allocation within a regulated framework.

The story of Hong Kong RWA is far from over; it has simply transitioned from a noisy and passionate phase into a more calm and professional deepening period. This article will further elaborate on the Hong Kong RWA market and related representative projects.

Hong Kong RWA Market Landscape

As a frontier in the integration of global blockchain and traditional finance, Hong Kong's RWA (Real World Assets) market has established itself as the most regulatory mature ecological hub in Asia by 2025. This market is driven by the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC), focusing on tokenized money market instruments, government bonds, green bonds, and emerging physical assets (such as charging station revenues and international shipping rents) through the Project Ensemble sandbox project and the "Digital Asset Policy 2.0" framework. The overall landscape presents characteristics of "institution-led, compliance-first, and gradual DeFi integration": shifting from experimental issuance in 2024 to large-scale infrastructure construction in 2025, emphasizing cross-chain settlement, stablecoin integration, and global liquidity connection. The Hong Kong RWA ecosystem has transformed from a "financing window" to an "innovation platform," deeply connecting with the U.S.-led on-chain network while solidifying risk isolation walls to prevent cross-border transmission.

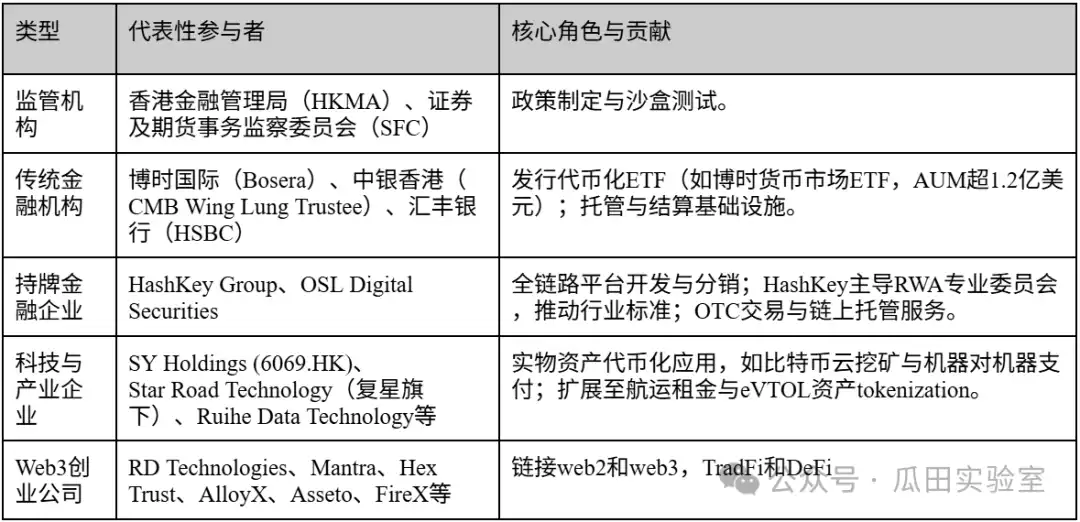

Types of Participants: Institutional Capital Dominates, with Tech Companies and Startups Coexisting

Participants in the Hong Kong RWA market are highly stratified, dominated by institutional capital, supplemented by local tech companies and emerging Web3 startups, forming a closed-loop ecosystem. The following table summarizes the main types (based on active entities in 2025):

It can be seen that the Hong Kong market is primarily composed of institutional players, accounting for about 70%, dominating the issuance of high-threshold products; enterprises and startups fill the technical and application gaps, benefiting from the SFC's expansion of VA licenses.

Overall Scale and Growth Trends

In 2025, the Hong Kong RWA market size is embedded within the global $26.59B - $35.8B on-chain TVL framework, with AUM soaring from tens of millions of dollars at the beginning of the year to the billion-dollar level. The growth momentum stems from the policy overlay effect—the 2025 policy report calls for RWA infrastructure investment, and stablecoin regulations are set to take effect in 2026, expected to reduce cross-border payment costs by 90% and settlement times to 10 seconds. With an annual growth rate exceeding 200% and a 58-fold expansion of TVL within three years, high compliance costs (over $820,000 for single product issuance) limit retail penetration, with institutional inflows accounting for over 80%.

Future Development Potential Assessment

Hong Kong's RWA potential is vast, with the market size expected to reach trillions of dollars from 2025 to 2030, ranking among the top three globally (only behind the U.S. and Singapore). The advantages lie in the iterative speed of the regulatory sandbox and alignment with international standards: the SFC is about to open global order book sharing to enhance liquidity; the Ensemble project will build a tokenized deposit settlement system, radiating to emerging trade chains in Brazil/Thailand. The DeFi tolerance window and the integration of AI + blockchain (such as shipping rent tokenization, unlocking a $200 billion market) will drive diversified scenarios, with the startup ecosystem expected to add over 50 new projects. Challenges include cost barriers and isolation from mainland funds, but this instead reinforces Hong Kong's positioning as a "global neutral hub": attracting European and American institutions to allocate U.S. Treasuries / MMFs while local enterprises deepen their engagement with Asian physical assets. Overall, Hong Kong RWA is transitioning from "heat-driven" to "sustainable growth," with the key being policy continuity and infrastructure maturity.

Hong Kong RWA Related Platforms

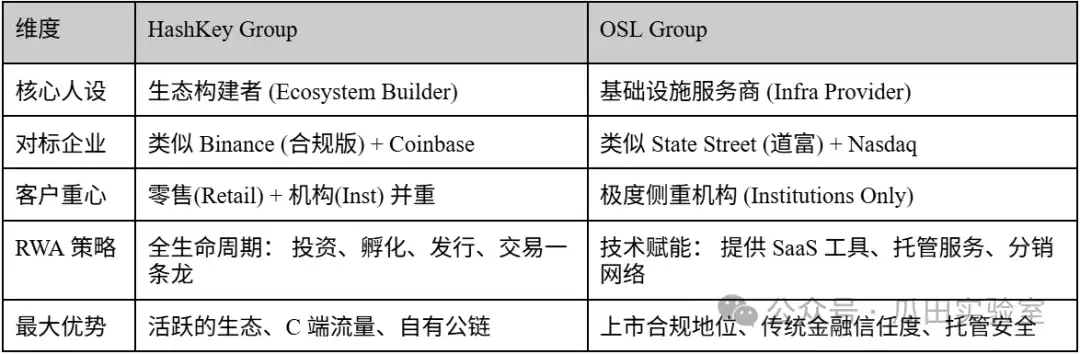

HashKey Group - The "Full-Stack" Cornerstone of the Compliant Ecosystem

In the grand narrative of Hong Kong's ambition to become a global Web3 hub, HashKey Group is undoubtedly the most representative "flagship" entity at present. As Asia's leading end-to-end digital asset financial services group, HashKey is not only a pioneer in Hong Kong's compliant trading market but also a key builder of the infrastructure for RWA (Real World Asset) issuance and trading. Its strategic layout spans from the underlying blockchain technology to the upper-level asset management and trading, forming a complete compliance loop.

Founded in 2018 and headquartered in Hong Kong, HashKey has deep ties with Wanxiang Blockchain Labs. At the outset of the SFC's implementation of the virtual asset trading platform licensing system, HashKey established a route of embracing regulation.

In August 2023, HashKey Exchange became one of the first exchanges in Hong Kong to upgrade to Class 1 (securities trading) and Class 7 (providing automated trading services) licenses, allowing it to provide services to retail investors. This milestone not only established its legal monopoly advantage in the Hong Kong market (one of the two oligopolies) but also provided an effective channel for the future secondary market circulation of compliant RWA products (such as STOs, security token offerings).

On December 1, 2025, HashKey Group passed the Hong Kong Stock Exchange hearing and is set to list on the main board of Hong Kong, expected to become the "first licensed virtual asset stock in Hong Kong." There are several industry experts analyzing Hashkey's prospectus and listing outlook; I believe Hashkey's listing is a landmark event that will help Hong Kong compete for pricing power and discourse in the Web3 field globally (especially compared to Singapore and the U.S.), establishing Hong Kong's position as a "compliant digital asset center."

HashKey's structure is not a single exchange model but rather builds an ecosystem that serves the entire lifecycle of RWA:

HashKey Exchange (Trading Layer): The largest licensed virtual asset exchange in Hong Kong, providing fiat (HKD/USD) deposit and withdrawal channels. For RWA, this is the future liquidity destination after asset tokenization.

HashKey Tokenization (Issuance Service Layer): This is the core engine of its RWA business. This department focuses on assisting institutions in tokenizing physical assets (such as bonds, real estate, artworks, etc.), providing a one-stop STO solution from consulting, technical implementation to legal compliance.

HashKey Capital (Asset Management Layer): A top global blockchain investment institution with an asset management scale (AUM) exceeding $1 billion. Its role in the RWA field is more about supporting the funding side and product construction (such as ETFs).

HashKey Cloud (Infrastructure Layer): Provides node validation and underlying blockchain technology support, ensuring the security and stability of asset tokenization.

In the Hong Kong RWA market, HashKey's core competitiveness is reflected in two dimensions: "compliance" and "ecological linkage":

1. Regulatory Moat: The core of RWA lies in mapping regulated offline assets onto the blockchain. HashKey possesses complete compliance licenses, allowing it to legally handle tokens that are classified as "securities" (Security Tokens), which is a threshold that most unlicensed DeFi platforms cannot surpass.

2. Consolidated Ecological Capability: It can connect the asset side (Tokenization), funding side (Capital), and trading side (Exchange). For example, a real estate project can be tokenized by HashKey Tokenization, with early subscriptions from HashKey Capital, and finally listed and traded on HashKey Exchange.

3. Institutional-Level Connector: HashKey has established fiat settlement collaborations with traditional financial institutions such as ZA Bank and Bank of Communications (Hong Kong), solving the most critical issues of "fund inflow and outflow" and fiat settlement in RWA.

HashKey's practices in the RWA field mainly reflect two directions: "traditional financial assets on-chain" and "compliant issuance." Here are its typical case summaries:

HashKey Group is not just an exchange; it is the operating system of the Hong Kong RWA market. By holding scarce compliance licenses and building a full-stack technical infrastructure, HashKey is transforming "asset tokenization" from a concept into executable financial business. For any institution wishing to issue or invest in RWA in Hong Kong, HashKey is currently an indispensable partner.

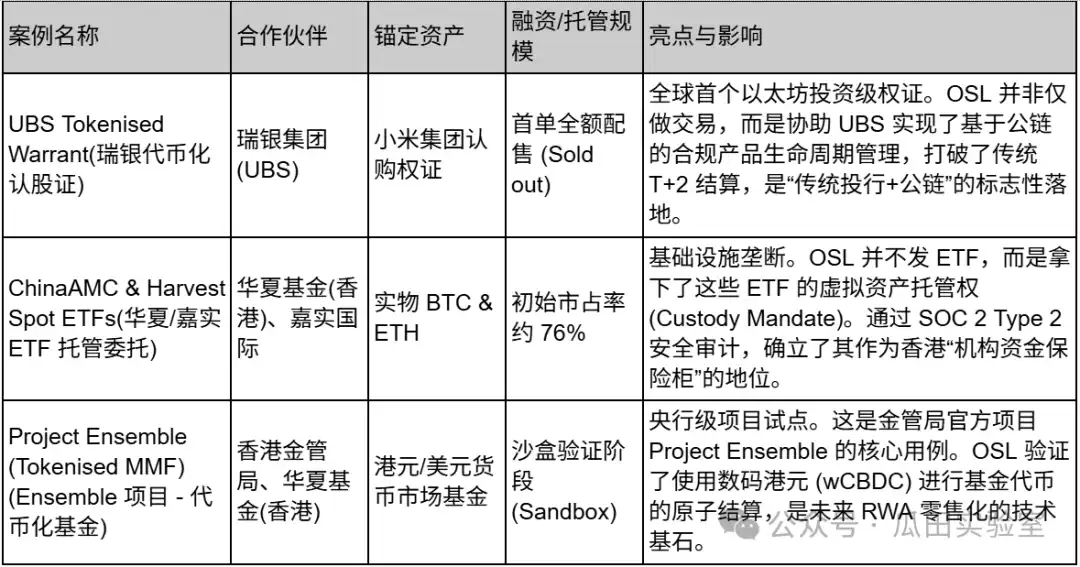

OSL Exchange - The "Digital Arms Dealer" and Infrastructure Expert of Traditional Finance

In the chess game of Hong Kong RWA, if HashKey is the "flagship" leading the charge and building a complete ecosystem, then OSL Group (formerly BC Technology Group, 863.HK) is the "arms dealer" working behind the scenes, providing technology for traditional financial institutions.

As the only publicly listed company in Hong Kong focused on digital assets, OSL enjoys the financial transparency and auditing standards of a public company. This makes OSL the preferred "safe passage" for traditional banks and sovereign funds that are extremely risk-averse to enter the RWA market.

Unlike HashKey, which actively expands retail users and builds a public chain ecosystem, OSL's strategic focus is extremely concentrated on institutional business. Its structure is not designed to "build an exchange," but to "help banks build their products":

Unique "Public Company" Moat:

The core of RWA lies in compliance review through traditional finance (TradFi). For large banks, the compliance costs of collaborating with a public company are far lower than with private enterprises. OSL's financial statements are audited by the Big Four, and this "institutional trust" is its biggest trump card in the B-end market.

Technology Provider (SaaS Model):

OSL is not fixated on having all assets traded on the OSL platform but is willing to provide technology (OSL Tokenworks) to help banks build their own tokenization platforms. This is a "selling shovels" strategy—whoever issues RWA, as long as they use OSL's underlying technology or liquidity pool, OSL can profit.

Monopolistic Position in Custody:

In the issuance of Hong Kong's first Bitcoin/Ethereum spot ETFs, Harvest and ChinaAMC both chose OSL as the virtual asset custodian. This means that over half of the underlying assets in the Hong Kong ETF market are secured by OSL. For RWA, "whoever controls custody controls the lifeblood of the assets."

In the RWA industry chain, OSL defines itself as a precise pipeline connecting traditional assets with the Web3 world:

RWA Structuring and Distribution (Structurer & Distributor):

Leveraging its identity as a licensed broker, OSL excels at handling complex financial product structuring. It is not just about simple "asset on-chain" but focuses on the tokenization of investment-grade products, such as bank notes and structured products.

Cross-Border Compliance Liquidity Network:

OSL has deep collaborations with Zodia Markets, a subsidiary of Standard Chartered Bank, and financial giants in Japan. In terms of RWA liquidity, OSL follows an "institution-to-institution" dark pool and OTC route, rather than a retail order book model.

OSL's cases are often not limited to Hong Kong but have strong international demonstration effects, with partners being top TradFi giants. Due to its B2B characteristics, financing scales are generally not disclosed:

To better understand the differences between the two, a comparison table of HashKey vs. OSL has been summarized:

If HashKey is building a prosperous "Web3 commercial metropolis" in Hong Kong, then OSL is like the chief engineer responsible for the underground pipelines, vault security, and power supply of this city. In the RWA market, OSL does not pursue the loudest "issuance" but is committed to becoming the safest "warehouse" and the most compliant "channel" for all RWA assets.

Ant Digital - The "Trusted Bridge" for Physical Asset Tokenization

In the landscape of Hong Kong RWA, Ant Digital (and its Web3 brand ZAN) represents a dimensional strike from internet giants. Unlike financial institutions that focus on "licenses" and "trading," Ant Digital's core competitiveness lies in solving the fundamental pain point of RWA: how to prove that the tokens on the blockchain correspond to the physical assets off-chain?

Ant Digital's strategic path is very clear: leveraging the high-performance technology of AntChain, which has been deeply cultivated in China for many years, combined with Trusted IoT, to provide "asset digitization" technical standards and verification services for global RWA projects in Hong Kong, this international window.

Ant Digital does not exist as a "trading venue" in the Hong Kong RWA market but is positioned as a Web3 technology service provider. Its business logic can be summarized as "two ends and one cloud":

Asset Side: By implanting IoT modules (Trusted Modules) into physical devices such as solar panels, charging piles, and construction machinery, real-time data is collected and directly put on-chain. This transforms RWA from "credit based on the issuer" (trusting the issuer) to "credit based on the asset" (trusting the real-time cash flow generated by the device).

Capital Side: Through the ZAN brand, it provides KYC/KYT (Know Your Customer/Know Your Transaction) services, smart contract audits, and node services for institutional investors, ensuring compliance for fund inflows and outflows.

Privacy Protection: It is one of the few vendors capable of providing zero-knowledge proof (ZKP) technology in the Hong Kong Monetary Authority's Project Ensemble (sandbox), solving the deadlock for banks in asset settlement on public chains, where they need to "verify transactions without disclosing commercial secrets."

While HashKey and OSL handle "securitized assets" (such as bonds and funds), Ant Digital excels at handling "non-standardized physical assets":

Source Credibility: Traditional RWA relies on auditors to inventory warehouses, while Ant Digital uses implanted chips to allow real-time on-chain operation data (such as power generation and mileage) for new energy vehicles, batteries, and even biological assets (like cattle).

Large-Scale Concurrent Processing: Inheriting the technical genes of Alipay's "Double Eleven" level, Ant Digital's blockchain can support concurrent on-chain processing of hundreds of millions of asset data, which is difficult for most public chains to achieve.

Internationalization of the ZAN Brand: From 2024 to 2025, ZAN rapidly rose in Hong Kong, becoming a key middleware platform connecting Web2 developers and the Web3 world, especially occupying a place in the RegTech field.

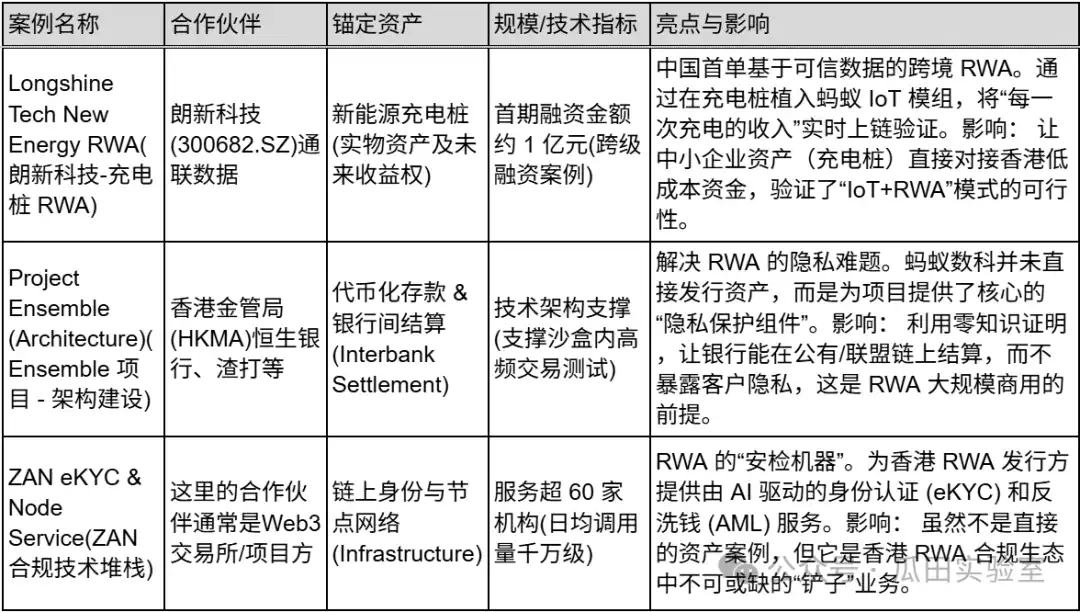

Ant Digital's cases mainly reflect "physical economy on-chain" and "interbank settlement architecture."

If HashKey is "Taobao," building a platform for everyone to buy and sell RWA products; OSL is the "vault," providing the safest storage for institutions to safeguard RWA assets, then Ant Digital is the "smart factory + quality inspector," delving into the production process (charging piles, batteries), tagging each asset with a "qualified label" (IoT verification), and providing technology to ensure smooth circulation of these assets. Ant Digital focuses on data in the Hong Kong RWA market, aiming to become the "customs" and "translator" for physical world assets transitioning to the Web3 world.

Conflux Network - The "Compliant Public Chain" Base Connecting the Mainland and Hong Kong

In the Hong Kong RWA market, the vast majority of platforms (such as HashKey and OSL) mainly address the issue of "how assets are traded locally in Hong Kong," while Conflux addresses the questions of "how mainland assets can comply and come out" and "what currency to use for settlement."

As "China's only compliant public chain," Conflux leverages its background from the Shanghai Tree-Graph Blockchain Research Institute, deeply binding itself with "national team" resources such as China Telecom and the Belt and Road Initiative. In the Hong Kong market of 2025, Conflux has evolved from merely a technical public chain to the core issuance layer of offshore RMB/HKD stablecoins.

Conflux's RWA strategy is distinctly different from others; it avoids the crowded asset management track and focuses on the foundational infrastructure:

The Lifeblood of RWA (Stablecoins): Conflux has incubated and supported AnchorX (with major investment from Hony Capital), dedicated to issuing compliant HKD stablecoins (AxHKD). In RWA transactions, asset tokenization is the first step, but "what to buy with" is the second step. Conflux aims to make AxHKD the settlement currency for the Hong Kong RWA market, comparable to USDT/USDC.

Physical Entry (BSIM Card): The BSIM card launched in collaboration with China Telecom embeds blockchain private keys directly into mobile SIM cards. For RWA, this means that future asset rights confirmation (for example, if you buy a tokenized property on your phone) can be linked to the real-name identity of the telecom operator, solving the most challenging "identity verification (DID)" issue in RWA.

Mainland-Hong Kong Connector: Utilizing its R&D center in Shanghai (Tree-Graph), Conflux can meet the overseas needs of mainland enterprises, enabling the compliant mapping of mainland physical assets (such as photovoltaics and supply chains) onto the Conflux public chain in Hong Kong for financing.

In the RWA space, Conflux's moat lies in its geopolitical advantages:

"Desensitized" Interoperability: Conflux has achieved a unique technical architecture that complies with mainland regulations (non-coin blockchain technology applications) while enabling tokenized transactions in Hong Kong through cross-chain bridges. This makes it the most "politically correct" choice for state-owned and central enterprises in mainland China attempting to venture into RWA.

Payment and Settlement Closed Loop: Through the AnchorX project, Conflux is effectively participating in the Hong Kong Monetary Authority's "sandbox regulation." Once the HKD stablecoin is launched, Conflux will transform from a mere "road" into a financial network with "toll fee" pricing power.

High-Performance Throughput: RWA (especially high-frequency notes or retail assets) requires extremely high TPS (transactions per second). Conflux's Tree-Graph structure claims to achieve 3000-6000 TPS, which offers advantages over Ethereum's mainnet when processing high-concurrency transactions in traditional finance.

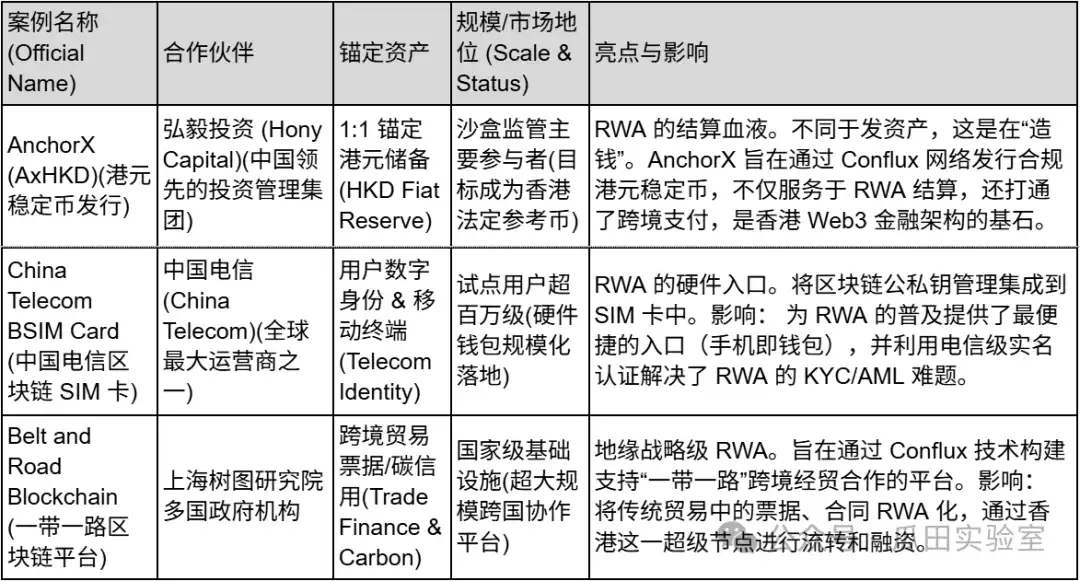

Conflux's cases focus on "currency infrastructure" and "national-level cooperation."

Conflux Network is the only "public chain-level" player in the Hong Kong RWA market. It does not directly profit from transaction fees but aims to become the "digital silk road" connecting Chinese manufacturing with global capital by setting underlying standards (stablecoin standards, SIM card standards).

Star Road Technology - A Customized First-Class Cabin for "Old Money" to Web3

In the cacophony of the Hong Kong RWA market, Star Road Technology (Star Road Technology, with some overseas promotional brands as Finloop) may not be the loudest "disruptor," but it is likely the most stable "successor."

Rather than viewing Star Road as an independent Web3 startup, it is better seen as an "official landing craft" sent by a large comprehensive private enterprise—Fosun International—into the digital asset world. Independently incubated by Fosun Wealth, the birth of Star Road carries a distinct group will: it is not committed to building a new financial order from scratch but aims to smoothly and compliantly "ferry" the vast stock assets and high-net-worth clients of traditional finance into the blockchain world.

Strategically, Star Road has proposed a unique "Web5" concept. Unlike the purely decentralized idealism of Web3, Star Road's Web5 strategy resembles a pragmatic compromise—it seeks to integrate the mature user experience and traffic entry of the Web2 era (Fosun Wealth's client base) with the value interconnection technology of the Web3 era.

In this narrative, Star Road has built its core infrastructure—the FinRWA Platform (FRP). This is an enterprise-level RWA issuance engine, but its design is not intended to serve anonymous on-chain geeks; rather, it is meant to serve institutions and high-net-worth individuals within the Fosun system. It acts as a precise converter, connecting the real estate, consumer, and cultural tourism assets that Fosun has cultivated for years on one end, and a compliant digital asset distribution network on the other. For Star Road, RWA is not the goal but a means to activate the liquidity of the group's stock assets.

Unlike other platforms that are keen to explore high-risk, high-return DeFi plays, Star Road has chosen the most stable entry path: currency fund tokenization.

Through deep alliances with China Asset Management (Hong Kong) and its parent company Fosun Wealth, Star Road's flagship product focuses on the tokenization of currency market funds in HKD, USD, and RMB. This choice is strategically insightful—currency funds are the most familiar and lowest-threshold financial products for traditional investors. By tokenizing these funds with its technology, Star Road is effectively providing the safest entry ticket for "old money" that is cautious about crypto.

More importantly, Star Road has opened up the RWA channel for RMB. Against the backdrop of Hong Kong as an offshore RMB center, this capability allows Star Road to precisely capture mainland capital that holds large amounts of offshore RMB and seeks compliant overseas value enhancement.

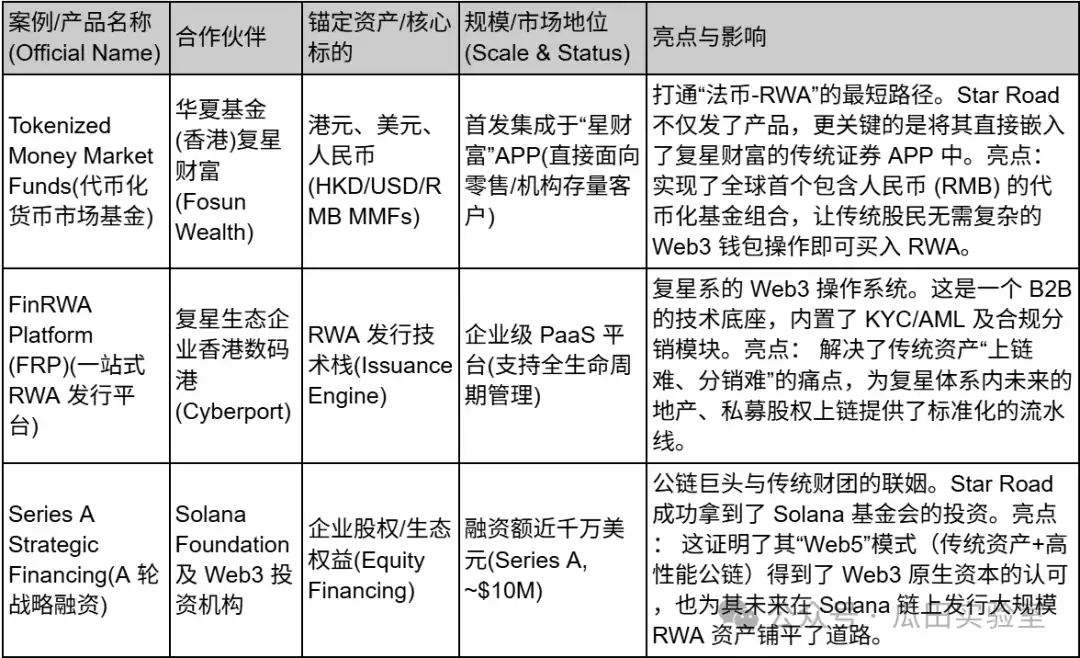

Star Road's business landscape resembles a "boutique digital investment bank" rather than an exchange. Its cases demonstrate a complete closed loop from "underlying technology" to "asset issuance" to "ecological capital":

Star Road Technology represents the understanding and transformation of Web3 by the elite class of traditional finance: not pursuing radical decentralization but striving for extreme compliance, security, and experience. For institutions and high-net-worth individuals looking to allocate digital assets while retaining the traditional financial service experience, Star Road is the most harmonious and convenient entry point.

MANTRA - The RWA "Compliance Highway" Connecting the Middle East and Asia

In the Warring States era of RWA, MANTRA represents the rise of the "infrastructure faction." It is not satisfied with merely issuing a certain type of asset but attempts to define the underlying standards for RWA assets operating on-chain.

MANTRA's predecessor was MANTRA DAO, which has evolved over several years into a public chain focused on regulatory compliance for RWA. Its strategic focus is quite unique—it avoids the fiercely competitive U.S. market and does not fully rely on Hong Kong but instead heavily invests in the UAE, utilizing Dubai's very friendly virtual asset regulatory framework (VARA) to build a corridor connecting Middle Eastern capital with Asian liquidity.

MANTRA addresses a core pain point at the strategic level: the contradiction between the "permissionless" nature of public chains and the "strong regulation" of finance.

Native Compliance Layer: MANTRA Chain has built-in identity verification (DID), KYC/AML modules, and compliance whitelist mechanisms in its underlying protocol. This means that developers do not need to write complex compliance code themselves; they can directly call MANTRA's modules to issue real estate tokens or bonds that meet regulatory requirements.

Connecting Middle Eastern "Oil Capital": MANTRA has secured investment from top Middle Eastern venture capital Shorooq Partners and established deep cooperation with Dubai real estate giant MAG. This not only brings funding but, more importantly, opens up the vast real estate and sovereign wealth resources in the Middle East, a unique advantage that other platforms relying on USD or HKD assets do not possess.

Mainnet Incentives and Token Economy: MANTRA has constructed a tight economic closed loop through its native token $OM's buyback and staking mechanism. It uses token incentives to attract institutional validators and asset issuers, attempting to leverage Web3's incentive model to drive the on-chain movement of TradFi assets.

On the asset side, MANTRA has chosen a heavy but also attractive track: real estate. Unlike government bond RWA (which is also a strong point for platforms like Star Road), real estate RWA requires handling complex offline rights confirmation and legal structures. MANTRA is directly collaborating with Dubai developer MAG to plan the tokenization of a $500 million luxury real estate portfolio. This approach is highly ambitious—if it can turn Dubai's luxury homes into on-chain liquid tokens, then MANTRA will have proven its ability to handle "non-standard, large-scale, physical assets," which is a much deeper moat than simple government bond tokenization.

Additionally, MANTRA launched a large-scale $OM token buyback plan in 2025 (committing at least $25 million), a behavior similar to a public company's "stock buyback," which greatly enhances institutional investors' confidence in its token economic model.

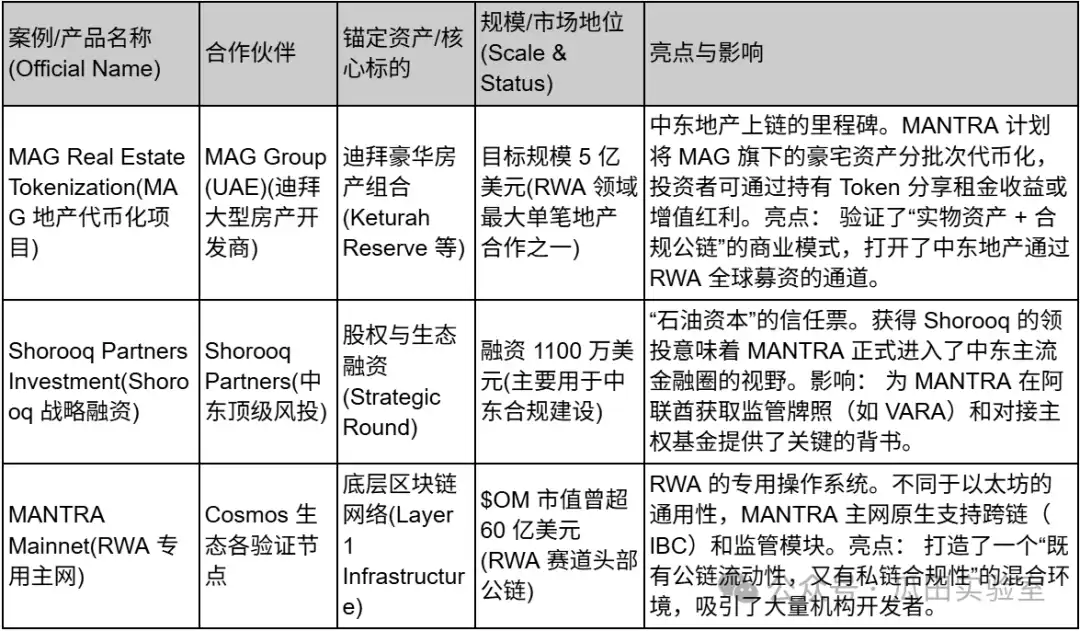

MANTRA's business landscape exhibits distinct characteristics of "Middle Eastern assets + Asian technology + global compliance":

Although MANTRA started in Hong Kong, it has shifted its focus to the Middle East to align with its RWA compliance strategy. MANTRA represents another possibility in the RWA market: not just moving assets on-chain but specifically building a chain for assets. For investors optimistic about the rise of Middle Eastern capital and the prospects of real estate tokenization, MANTRA is currently the most representative infrastructure target.

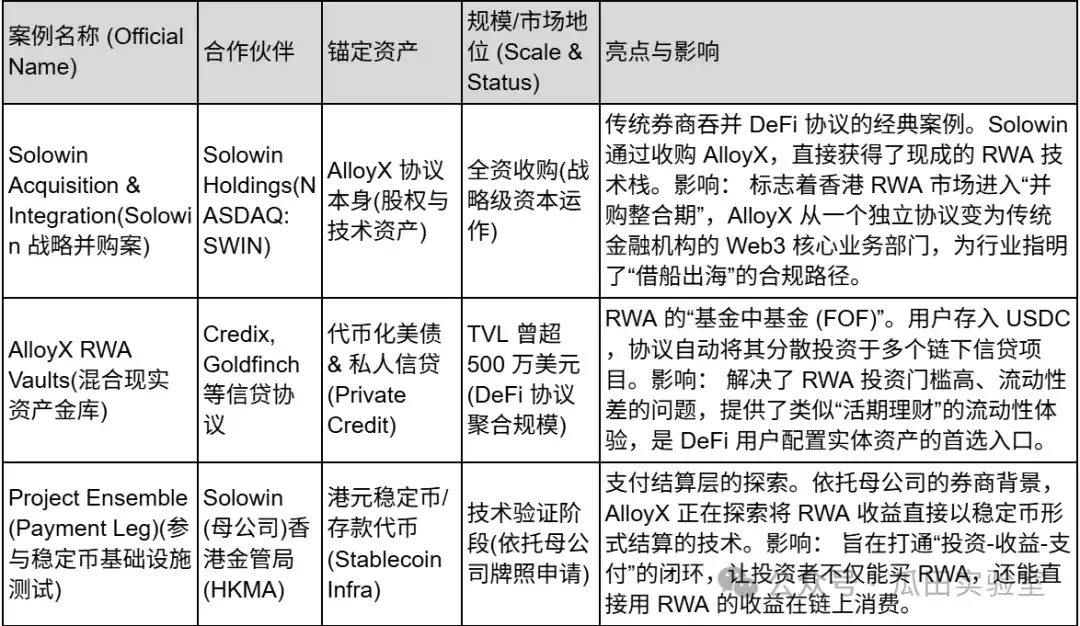

AlloyX - A "Hybrid Aggregator" Linking DeFi Liquidity with Physical Assets

In the grand narrative of the Hong Kong RWA market, if HashKey and OSL are building "heavy asset" infrastructures akin to Nasdaq or bank vaults, then AlloyX represents another agile force in the RWA market—the "DeFi-native aggregator."

As a Web3 fintech company originating from San Francisco and later fully acquired by the Hong Kong-listed brokerage Solowin Holdings (NASDAQ: SWIN), AlloyX plays a unique role as a "CeDeFi (Centralized and Decentralized Hybrid Finance) connector" in the Hong Kong RWA landscape. It does not directly hold heavy physical assets but instead uses smart contract technology to "bundle" credit assets scattered across different chains and protocols into highly liquid financial products, directly delivering them to investors in the crypto world.

AlloyX's business logic is fundamentally different from traditional exchanges. It is essentially an RWA asset aggregation protocol (Aggregator Protocol).

In the early RWA market, assets were fragmented: investors wanting to buy U.S. Treasuries might have to go to one platform, while those looking to invest in private credit would need to go to another, with extremely high thresholds. The emergence of AlloyX addresses this pain point. It has built a modular "vault" system that can connect to multiple upstream credit protocols such as Centrifuge, Goldfinch, and Credix. By standardizing these into unified tokenized products, AlloyX allows users to easily allocate stablecoins like USDC into real-world credit assets, much like depositing into a money market fund.

With its official integration into Solowin Holdings in 2025, AlloyX has completed a stunning transformation from a "pure DeFi protocol" to a "compliant fintech flagship." Today, AlloyX acts more like a tentacle of Solowin, a traditional brokerage reaching into the Web3 world, leveraging Hong Kong's regulatory license advantages to distribute traditional securities, funds, and other assets in token form to global investors, achieving true "asset rights confirmation in the traditional world, liquidity release in the blockchain world."

In the fiercely competitive Hong Kong market, AlloyX's moat primarily lies in the combination of its unique shareholder background and technological architecture.

First, the endorsement and resource injection from a listed company is its greatest differentiating advantage. As a wholly-owned subsidiary of Nasdaq-listed Solowin, AlloyX has stepped out of the compliance dilemmas faced by ordinary DeFi projects. It can directly utilize the Class 1, 4, and 9 license resources held by its parent company from the Hong Kong Securities and Futures Commission (SFC) to legally design and distribute tokenized products involving securities. This "front-end DeFi experience + back-end licensed brokerage risk control" model perfectly aligns with the CeDeFi regulatory direction promoted in Hong Kong.

Secondly, AlloyX possesses strong "composability" technical capabilities. Unlike single asset issuers, AlloyX excels at algorithmically mixing and packaging RWA assets of different risk levels (such as low-risk U.S. Treasuries and high-risk trade financing) to create on-chain products similar to structured notes. This capability allows institutional investors to customize RWA investment portfolios on-chain according to their risk preferences, greatly enriching the profit strategies in the RWA market.

AlloyX's business practices mainly focus on "asset aggregation" and "compliant issuance," with the following being its most representative business cases:

Looking back at AlloyX's development path, we can clearly see that it does not pursue a large and comprehensive platform traffic but instead focuses on refined operations on the asset side. Through Solowin's acquisition, AlloyX has effectively become the "technical engine" for traditional financial institutions to undergo digital transformation in RWA. For the market, AlloyX proves that RWA is not just a game for giants; technical protocols can also find their core ecological niche within the high walls of compliance through deep binding with licensed institutions.

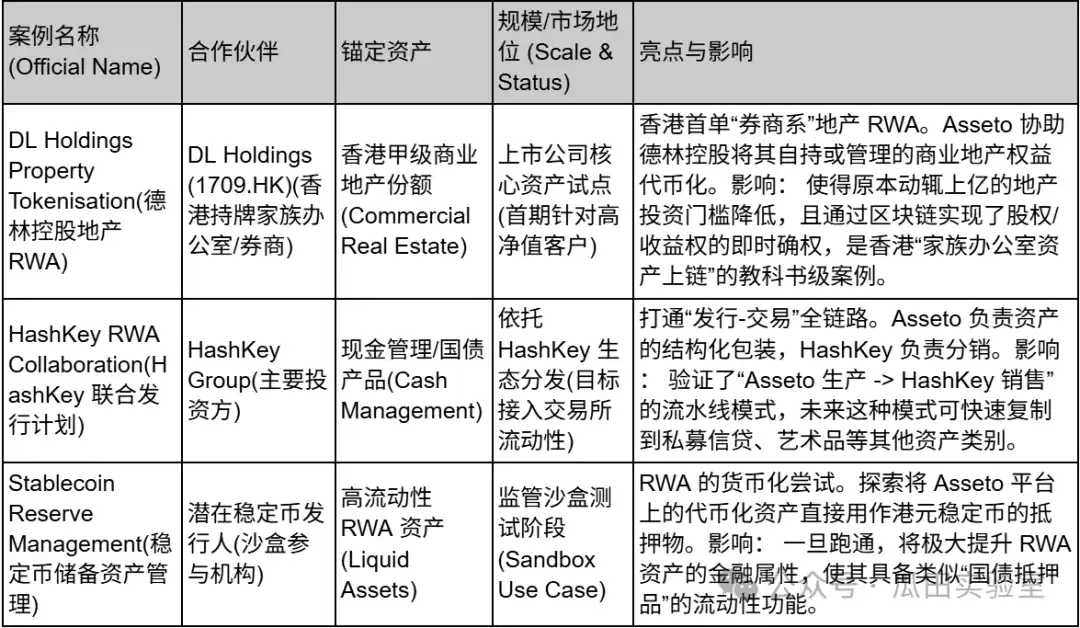

Asseto—The RWA "Asset Packaging Factory" Tailored for Institutions

In the Hong Kong RWA industry chain, Asseto plays a key role as the "originator" of assets. It is positioned at the very top of the industry chain, directly connecting with the real economy.

As the flagship RWA infrastructure project strategically invested by HashKey Group, Asseto boasts a strong "noble lineage." It does not deal directly with retail investors but focuses on solving the most challenging "first-mile" problem of RWA: how to "transform" a building or a fund into a compliant token from legal structure, technical standards, and compliance processes?

Asseto's business model is highly vertical and has high barriers to entry, primarily serving Traditional Finance (TradFi) giants with billions in assets:

RWA Asset Issuance Gateway: Asseto provides a standardized technology stack that allows institutions to "on-chain" cash management products, real estate, private credit, and other assets with one click. It not only offers smart contracts but, more importantly, provides "legal wrapper" services to ensure that the tokens on-chain have real claims to the underlying assets under Hong Kong law.

Asset Conveyor Belt of the HashKey Ecosystem: As a portfolio company of HashKey, Asseto is an important source of potential RWA assets for HashKey Exchange. Asseto is responsible for organizing assets off-chain (cleaning, rights confirmation, tokenization) and then distributing them to secondary market investors through HashKey's compliance channels.

Application Scenario Provider for Stablecoin Sandbox: Asseto collaborates closely with several institutions applying for Hong Kong stablecoin licenses, aiming to use RWA assets as reserve assets for stablecoins and exploring high-end strategies like "issuing stablecoins using tokenized government bonds/cash."

Asseto's core advantage in the Hong Kong market lies in the top-tier resources brought by its shareholder structure:

HashKey's technical and channel support: HashKey not only provides funding but also opens up HashKey Chain (L2 public chain) to Asseto as the preferred issuance platform. This means that the assets issued by Asseto inherently possess the largest compliant liquidity exit in Hong Kong.

DL Holdings' asset injection: The Hong Kong main board-listed company DL Holdings (1709.HK) has not only invested in Asseto but also signed a strategic agreement to plan the tokenization of family office assets (such as commercial real estate and fund shares) managed by it through Asseto. This addresses the most troublesome "asset scarcity" issue for RWA projects—Asseto enters the market with high-quality assets from a listed company.

Asseto's cases are highly "institutionally customized," primarily revolving around real estate and cash management:

Asseto is the "asset alchemist" of the Hong Kong RWA market. It does not directly shout at retail investors but hides behind the scenes, using precise legal and technical molds to melt down the vast and cumbersome assets of traditional financial institutions into gold coins suitable for circulation in the Web3 world.

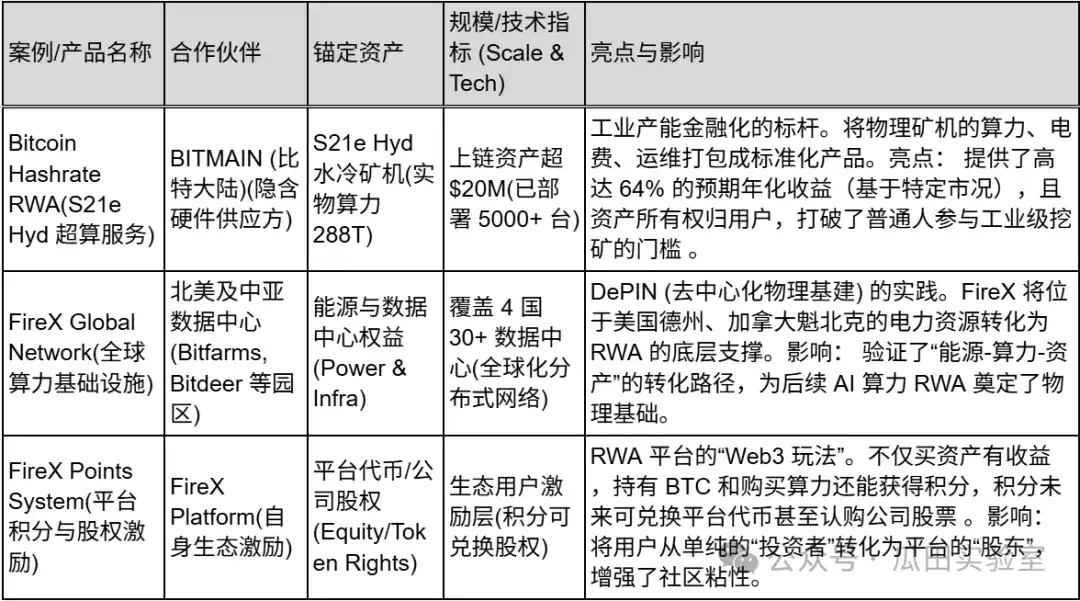

FireX—An "Industrial-Grade" RWA Platform for Releasing Computing Power Liquidity

In the Hong Kong RWA market, the vast majority of platforms deal with "paper assets" (such as bonds and equities), while FireX focuses on "productive assets."

FireX is an institutional-level RWA trading platform, with its core narrative centered on "financializing the source capacity (computing power) of Bitcoin." It collaborates with top infrastructure providers like Bitmain to package data centers and mining entities located globally (in the U.S., Canada, Kazakhstan, etc.) into on-chain tradable RWA tokens. For investors, purchasing FireX's RWA products essentially means buying the "future cash flow rights" of a running supercomputer.

FireX's business logic is very vertical; it addresses the mismatch between the "poor liquidity" of traditional mining and the "lack of stable physical returns" in Web3 funding:

Assetization of Computing Power (Hashrate as an Asset): FireX transforms the "S21e Hyd miner" and its generated computing power (288 TH/s), which originally belonged only to the physical world, into on-chain assets. This means users do not need to build mining farms or maintain machines themselves; they can hold computing power and earn Bitcoin mining rewards.

Global Energy Arbitrage Network: FireX is not just a trading platform; it is backed by a vast physical infrastructure network. It owns or collaborates with over 30 data centers in locations such as Texas, Quebec, and Ethiopia. It is essentially engaging in global energy arbitrage—seeking the cheapest electricity, converting it into Bitcoin, and then distributing the returns through RWA.

Diverse Asset Allocation Entry: In addition to core Bitcoin computing power, FireX's vision also includes RWA for global quality stocks (such as NVDA, MSFT), Pre-IPO equity, and AI computing power assets. It aims to create a comprehensive asset allocation basket that encompasses both the digital and physical worlds.

Unlike pure software protocols, FireX's moat is built on heavy "hardware" and "ecological relationships":

Verifiable Physical Scale: FireX has currently deployed over 5,000 supercomputing servers, managing computing power exceeding 1,000 PH/s, with on-chain asset value exceeding $20 million. This "tangible" physical scale provides the most fundamental credit endorsement for RWA—property rights belong to customers, and assets operate genuinely.

Top-tier Ecological Network: According to disclosures, FireX's partner network includes mining giants BITMAIN, mining pool Antpool, and leading institutions like Binance, Coinbase, and Tether. This resource integration capability that spans the entire industry chain from "mining machine production - mining - exchanges - stablecoins" ensures the stability and low-cost advantages of its asset supply (such as zero machine position fees and zero service fees).

High Yield Expectation Product Design: During the Bitcoin bull market cycle, FireX's computing power RWA demonstrates extremely high yield elasticity. According to calculations for its S21e Hyd product, under the optimistic assumption of Bitcoin reaching $150,000, the ROI (Return on Investment) could even approach 100%. This is more attractive than traditional Treasury RWA.

FireX's business is highly focused on "financializing computing power" and "global asset allocation":

FireX is the "hardcore industrial faction" in the RWA track. It moves beyond the simple "old wine in new bottles" model of traditional financial assets (like Treasuries) and instead provides a foundational yield layer supported by the real roar of machines and energy consumption through the "securitization packaging" of Bitcoin computing power, a native digital asset.

Bipolar Narrative: Deep Benchmarking of the RWA Markets in Hong Kong and the U.S.

If 2024 is the year of concept validation for RWA, then 2025 will be the year of "bipolarization" in the global RWA market landscape. In the global RWA map, the U.S. and Hong Kong represent two distinctly different yet mirror-like evolutionary paths.

The U.S. has become the "super factory" for RWA assets, relying on its native DeFi innovation and dollar hegemony; while Hong Kong, leveraging its unique institutional advantages and geopolitical positioning, has become the "super boutique" and "distribution hub" for RWA assets.

1. Regulatory Philosophy: "Enforcement-based Tolerance" vs. "Sandbox-style Access"

U.S.: Bottom-up Jungle Law

The U.S. RWA market has grown wildly in the cracks of regulation. Although the regulatory environment softened somewhat after the Trump administration took office in 2025, its core logic remains a game of "Regulation by Enforcement" and "DeFi First."

Characteristics: U.S. projects (like Ondo, Centrifuge) often start as DAOs or decentralized protocols, first pursuing scale and technological innovation, then using complex legal structures (like SPV offshore isolation) to evade SEC's securities classification.

Advantages: Innovation is rapid, allowing asset combinations to be realized through smart contracts without the need for licensing approval, leading to the emergence of phenomenon-level products with strong scale effects like BlackRock BUIDL.

Disadvantages: There is significant legal gray area; once cross-border distribution or non-qualified investors (retail) are involved, there is a high compliance risk.

Hong Kong: Top-down Design

Hong Kong has taken a completely opposite path—"Licensing Regime." From obtaining an exchange license from HashKey to Star Road (Star Road Technology) relying on the 1, 4, and 9 licenses held by Fosun Wealth, every step of Hong Kong RWA is within the visible range of the SFC and HKMA.

Characteristics: "No license, no RWA." All projects (like OSL, HashKey) must operate within the Project Ensemble sandbox or existing securities framework. Regulators are not only referees but also "product managers" (like guiding the design of tokenized deposits).

Advantages: There is a high degree of certainty. Once a product is approved (like the tokenized products from Huaxia Fund), it can legally connect to the banking system and retail funds, possessing the trust endorsement of traditional financial institutions.

Disadvantages: The entry threshold and compliance costs are extremely high (over $800,000 per project), stifling grassroots innovation and leading to market participants being mostly "big names" or "consortia."

2. Market Structure: "Fundamentalist DeFi" vs. "Traditional Consortium"

U.S.: The Home of DeFi-native Capital

The structure of the U.S. RWA market is "DeFi downward compatible with TradFi." The main sources of capital come from on-chain USDC/USDT whales, DAO treasuries, and crypto hedge funds. Project teams are usually led by tech geeks who disdain cumbersome offline processes, aiming to turn everything (including Treasuries) into ERC-20 tokens and then use them for collateral lending on Uniswap or Aave.

Typical Profile: Protocols like MakerDAO or Compound purchase U.S. Treasuries through RWA modules to provide yield support for stablecoins.

Hong Kong: Digital Transformation of Traditional Consortiums

The structure of the Hong Kong RWA market is "TradFi upward adapting to Web3." The main sources of capital come from family offices, high-net-worth individuals (HNWI), and corporate treasuries seeking diversified wealth management. Project teams often have deep industrial backgrounds (like the mining computing power resources behind FireX, the Fosun industrial capital behind Star Road, and the real estate funds behind Asseto).

Typical Profile: The "Web5" strategy proposed by Star Road Technology is the most typical—using Web3 technology to serve existing Web2 customers. Hong Kong RWA is not about creating new assets but about making "old money" feel trendy and secure.

3. Asset and Project Spectrum: "Standardized Treasuries" vs. "Non-standard Structured Assets"

U.S.: The Unilateral Hegemony of U.S. Treasuries

About 80% of the TVL in the U.S. RWA market is concentrated in "tokenized U.S. Treasuries." This is the most standardized, liquid, and easily accepted collateral by DeFi protocols. Most U.S. RWA projects operate on roll rates and T+0 settlements.

Hong Kong: A Testing Ground for Diverse Assets

Due to market size limitations, Hong Kong cannot compete with the U.S. purely on the U.S. Treasury track, so it has moved towards "differentiation" and "physicalization."

Physical and Industrial RWA: FireX packages Bitcoin computing power and energy into RWA, a unique "hardcore industrial" innovation in Hong Kong that leverages Asia's advantages in the global mining supply chain.

Real Estate and Alternative Assets: Mantra (though headquartered in Dubai, deeply rooted in Asia) and Asseto focus on structuring non-standard assets like real estate and private credit. Hong Kong is better at handling complex offline rights confirmation (like the Fosun system assets handled by Star Road).

Infrastructure Development: OSL and HashKey are not just dealing with assets; they are building a complete infrastructure of "exchanges + custody + SaaS," reflecting Hong Kong's service provider gene as a financial center.

Advice for Mainland Assets and Enterprises Going to Hong Kong for RWA

Given the recent tightening of regulations, for enterprises with a mainland background (shareholders, teams, operating entities), the window for issuing RWA through the "Mainland Assets/Team + Hong Kong Shell" model has essentially closed. This is not just a matter of increased compliance difficulty but a shift from a "gray area" to a "high-risk criminal involvement."

On November 28, 2025, a meeting of 13 departments, including the central bank, clearly stated that stablecoins are virtual currencies and do not possess legal repayment status, categorizing related businesses as illegal financial activities. This essentially cuts off the most critical "payment settlement" leg of RWA. RWA yields are typically settled in stablecoins (USDT/USDC), which have been classified as illegal. On December 5, 2025, seven major industry associations issued risk warnings, explicitly listing RWA investment and financing as illegal activities, akin to illegal public financing.

In this policy environment, mainland enterprises face three dimensions of blockage when issuing RWA in Hong Kong:

A. The "Long Arm" Extension of Legal Jurisdiction (Penetrative Regulation)

The past operational model was to establish an SPV (Special Purpose Vehicle) in Hong Kong, with the mainland parent company only providing technical support or consulting. Now, this "isolation wall" has become ineffective.

Personal Jurisdiction: Even if the issuing entity is in Hong Kong, if the actual controllers, executives, or technical teams are in mainland China, they are considered to be "cooperating with illegal financial activities" under the new regulations.

Accomplice Risk: The December policy particularly emphasizes a crackdown on the entire industry chain. Mainland entities (and individuals) providing technical development, marketing, payment settlement, or even market-making services for overseas RWA projects may violate the illegal business operation laws or the laws against aiding information network crime.

B. "Supply Cut" on the Asset Side

The Hong Kong RWA market is most eager for high-quality physical assets from the mainland (like photovoltaic power station revenue rights, commercial real estate rents).

Asset Outbound Lockdown: Since RWA has been classified as illegal financial activity, packaging domestic assets for outbound financing through RWA is suspected of illegal foreign exchange trading and capital flight.

Rights Confirmation Dilemma: Domestic law does not recognize on-chain tokens as ownership of domestic assets. If a project defaults, foreign investors holding tokens to sue in mainland courts for asset enforcement will not receive support (due to violations of public order and mandatory regulations).

C. "Blockade" on the Funding Side

Funding Repatriation Blocked: Even if you raise USDT/USDC in Hong Kong, these funds cannot flow back to mainland entities through regular banking channels for real economic construction (as banks will refuse to accept funds related to "virtual currency businesses").

Marketing Red Lines for Mainland Investors: It is strictly prohibited to market to Chinese citizens. If your RWA product offering memorandum (PPM) has a Chinese version, or if your roadshow activities involve mainland IP, it will directly trigger regulatory red lines.

According to market feedback, since November 28, the Hong Kong RWA market has reacted sharply. About 90% of RWA consulting projects with mainland backgrounds have been suspended or canceled, and the stock prices of Hong Kong-listed companies related to RWA concepts (especially those with parent companies in mainland China, such as Meitu, New Huo Technology, and Boyaa Interactive) have seen significant declines.

Therefore, for enterprises with a pure mainland background (Team in China, Assets in China) that still wish to participate in RWA token issuance, the risks are extremely high; not only is compliance impossible, but they also face criminal liability. It is recommended to abandon the RWA tokenization narrative and return to traditional ABS (Asset-Backed Securities) or issue traditional bonds in Hong Kong.

For enterprises that are completely going overseas (Global Team, Global Assets), it is theoretically still feasible, but they need to cut ties, including physical and legal separations, such as:

Personnel Separation: Core team members and private key controllers cannot be within mainland China.

Asset Separation: The underlying assets must be overseas assets (like U.S. Treasuries, overseas real estate) and cannot be domestic assets.

Market Separation: Strict KYC, using technical means to block mainland IPs, and not conducting any publicity in the simplified Chinese internet.

Conclusion and Outlook: Returning from "Fervor" to "Essence" in Hong Kong's Path

Looking back at 2025, the Hong Kong RWA market underwent an almost brutal stress test. From the initial spotlight on Project Ensemble at the beginning of the year, to the frenzy of capital inflow mid-year, and finally to the freeze and reconstruction triggered by tightening regulations from the mainland at the end of the year, this painful process completed a deep reshuffling of the market.

After the waves have washed away the sand, the naked swimmers have exited, leaving behind the seven pillars we deeply analyzed in the text:

HashKey and OSL have maintained the baseline of compliant trading and custody, becoming the "water, electricity, and gas" of Hong Kong Web3;

Star Road and Asseto have proven the feasibility of traditional consortia revitalizing existing assets using RWA;

FireX has showcased Hong Kong's unique ability to connect physical industries (computing power/energy) with digital finance;

Mantra and AlloyX have provided the necessary underlying public chain infrastructure and DeFi aggregated liquidity for the market.

Looking ahead to 2026, the Hong Kong RWA market will present the following three major trends:

1. Transition from "Internal Circulation" to "External Circulation": With the tightening of capital channels from the mainland, Hong Kong will completely bid farewell to the gray fantasy of "helping mainland capital go overseas." Future increments will mainly come from "global assets, Hong Kong distribution." This means utilizing Hong Kong's compliant channels to package U.S. Treasuries, Dubai real estate (as in the Mantra case), or global computing power (as in the FireX case) to sell to institutional investors in Southeast Asia, the Middle East, and Japan and South Korea. Hong Kong will become a true "offshore financial router."

2. The Blurring of Boundaries between RWA and DeFi (CeDeFi): Purely "asset tokenization" is no longer profitable. The core of competition in the next phase will be "composability." We will see more aggregators like AlloyX using tokenized funds issued by Star Road as collateral to generate stablecoins or conduct leveraged operations on-chain. Compliant CeFi assets will become the highest quality underlying "LEGO bricks" for DeFi protocols.

3. Stablecoins as the Final Battlefield for RWA: All transactions and settlements of RWA ultimately point to currency. With the implementation of Hong Kong's stablecoin regulations, "yield-bearing stablecoins" (stablecoins backed by RWA assets) will become the largest single RWA product. Whoever can master the issuance scenarios of RWA (such as FireX's mining revenue settlement or Asseto's real estate rent distribution) will control the minting rights of HKD/USD stablecoins.

The story of Hong Kong RWA is not over; it has merely turned the page on the "grassroots entrepreneurship" prologue and entered the main text of "institutional games." In this new phase, compliance is no longer a burden but the greatest asset; technology is no longer a gimmick but a carrier of credit. Hong Kong, a city that continually evolves in crisis, is redefining the financial center of the digital age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。