This Monday, the price of gold almost "burst out."

Spot gold quickly surged after opening, approaching the historical high of $4,600 per ounce; in just the first month of the new year, the cumulative increase has nearly reached $280. Silver's performance was even more aggressive, rising by 5% during the day, breaking through $84 and setting a new historical record.

In terms of news, everything seems "logical":

Geopolitical tensions, weakening employment data, and rising expectations for interest rate cuts have led to a concentrated influx of safe-haven funds into precious metals. However, it is precisely because the "logic is too complete" that it is worth a calm look from ordinary people.

Central Banks Increasing Gold Holdings Surpass U.S. Treasuries as the World's Largest Reserve Asset

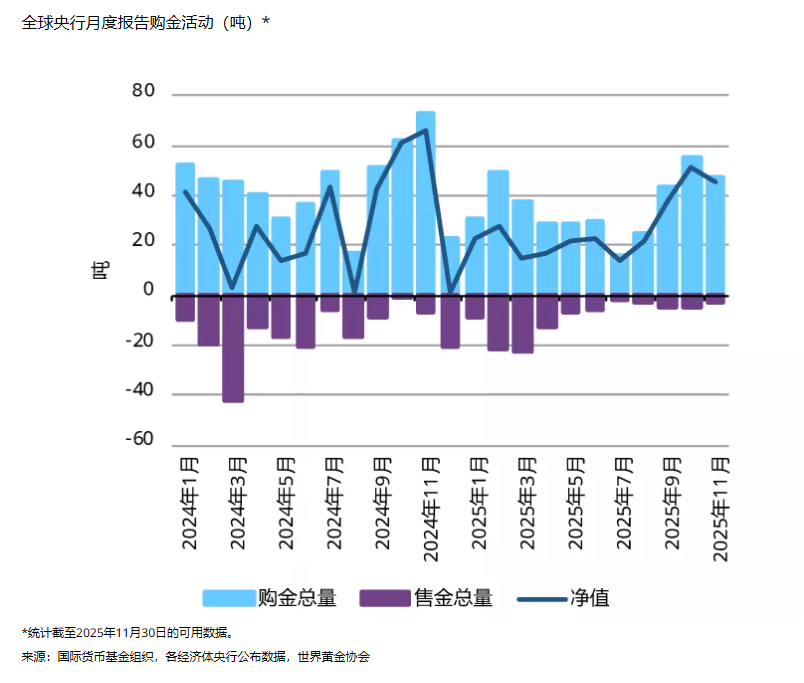

Globally, gold has long been regarded as a core asset in the reserves of sovereign nations. According to the latest international data, central banks around the world continue to hold large amounts of gold as an important component of foreign exchange reserves:

- The United States ranks first globally with over 8,100 tons of gold, serving as the "last trump card" of its credit system.

- Germany, Italy, Russia, and France all hold between 2,000 and 3,400 tons, with gold generally accounting for a high proportion of their foreign exchange reserves.

- China: By the end of 2025, gold reserves are expected to be approximately 74.15 million ounces, having increased for 14 consecutive months, accounting for about 9.5% of the country's official international reserves.

Three Core Reasons for Countries to Buy Gold:

To hedge against long-term risks of the dollar and U.S. Treasuries ("I dare not bet on just one").

To combat inflation and the decline of fiat currency credibility ("Money will depreciate, but gold cannot be printed").

To guard against extreme sanctions and asset freezes ("I cannot put all my assets in someone else's system").

But there is one key point that is often overlooked:

Gold does not generate interest, dividends, or cash flow.

Countries buy gold for decades of stability and security, not for short-term price fluctuations, and they are even less concerned about temporary pullbacks.

What Does the Surge in Gold Prices Mean for Ordinary People?

The impact of soaring gold prices on daily life, from "national gold hoarding" to individuals, translates to currency depreciation + increased consumption pressure. The more gold prices soar, the easier it is to create a dangerous illusion:

"I seem to have become wealthy."

However, from a more practical perspective, this may not be the case. The rapid rise in gold reflects a more realistic issue:

People's confidence in fiat currency is declining.

In other words, gold has not suddenly become more "valuable"; rather, money itself is becoming less valuable. This is also why, recently, in addition to physical gold, more funds are starting to allocate digital assets or diversify through exchanges.

👉 OKX (new/old return 20%): https://www.firgrouxywebb.com/join/AICOIN520

If we pull this "paper profit" back into real life for comparison, we will find:

- Mortgage payments have not become easier.

- Expenses for education, healthcare, and retirement are still rising.

- Daily consumption pressure does not disappear just because gold prices are rising.

Many times, the role of rising gold prices is merely to shield you from a portion of inflation. But the feeling of "prices are rising" may make people more prone to relax their vigilance and spend more. This is what is referred to as "paper wealth."

Why "consider selling a little" instead of "not touching gold"?

Gold is not the problem; the real issue is that ordinary people easily regard it as a form of "universal security," neglecting the real need for cash flow and flexibility in life.

From two perspectives, this risk is particularly evident:

First, the price aspect.

Many people buy gold jewelry or branded gold bars, and the processing fees and brand premiums often add up to over ten percent. When it comes time to sell, based on the pure gold price, after deducting losses and discounts—if gold prices have risen significantly, you may only just break even.

Second, the life aspect.

Mortgage payments are deducted monthly, tuition fees must be paid on time, and illness will not wait for you to slowly find a recycling shop to compare prices. Gold hanging around your neck or locked in a cabinet cannot be instantly converted into cash when needed. Therefore, rather than asking "should I liquidate all my gold," it is more practical to think differently:

At this point, when everyone is excited and prices are not low, sell a small portion of gold in several transactions to turn paper profits into:

- Emergency funds that can last 3–6 months;

- Paying off high-interest debt;

- Or investing in areas that can truly enhance quality of life and earning capacity.

The benefits of doing this are simple: if prices rise, you still have a large portion of your position intact; if they fall, you have already secured a "safety cushion" for your family.

This is not about being bearish on gold, but rather prioritizing life over market trends.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。